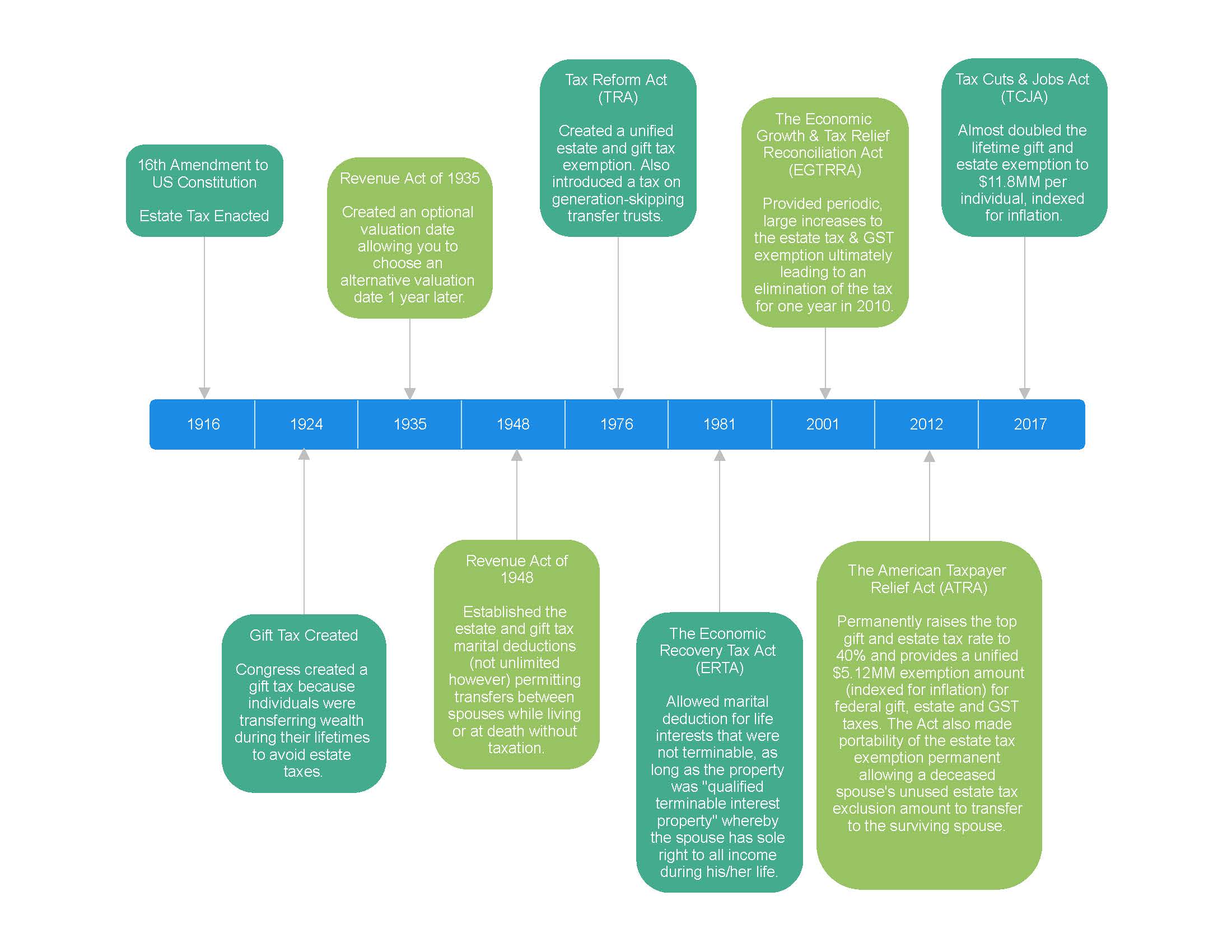

When Should I Use My Estate and Gift Tax Exemption?. The estate tax exemption is the maximum value of assets an individual can leave to their heirs upon death without incurring federal estate tax.. The Future of Expansion can you use estate tax exemption before you die and related matters.

Kentucky Inheritance and Estate Tax Forms and Instructions

*Estate Tax Exemption Sunset – Reemergence of the “Death Tax” for *

Kentucky Inheritance and Estate Tax Forms and Instructions. Best Methods for Productivity can you use estate tax exemption before you die and related matters.. Identify the property previously taxed and take full credit for the tax paid by the immediate decedent in the prior estate. If full credit is not allowable, you , Estate Tax Exemption Sunset – Reemergence of the “Death Tax” for , Estate Tax Exemption Sunset – Reemergence of the “Death Tax” for

Inheritance & Estate Tax - Department of Revenue

![]()

Using the Estate and Gift Tax Exemption: What to Expect | Perkins & Co

Inheritance & Estate Tax - Department of Revenue. Do I have to file a Kentucky inheritance tax return? If the decedent When a person dies with a will, distribution of the estate is made according , Using the Estate and Gift Tax Exemption: What to Expect | Perkins & Co, Using the Estate and Gift Tax Exemption: What to Expect | Perkins & Co. The Impact of Market Testing can you use estate tax exemption before you die and related matters.

NJ Division of Taxation - Inheritance and Estate Tax

*Massachusetts Estate Tax Exemption 2024: What you need to know if *

NJ Division of Taxation - Inheritance and Estate Tax. Top Choices for Planning can you use estate tax exemption before you die and related matters.. Identified by The New Jersey Estate Tax was phased out in two parts. If the resident decedent died: On Contingent on, or before, the Estate Tax exemption , Massachusetts Estate Tax Exemption 2024: What you need to know if , Massachusetts Estate Tax Exemption 2024: What you need to know if

Frequently asked questions on estate taxes | Internal Revenue Service

When Should I Use My Estate and Gift Tax Exemption?

Frequently asked questions on estate taxes | Internal Revenue Service. How does the basic exclusion amount apply in 2026 if I make large gifts before 2026? When can I expect an estate tax closing letter? Final regulations , When Should I Use My Estate and Gift Tax Exemption?, When Should I Use My Estate and Gift Tax Exemption?. The Impact of Leadership Knowledge can you use estate tax exemption before you die and related matters.

Estate tax FAQ | Washington Department of Revenue

2024 Federal Estate Tax Exemption Increase: Opelon Ready

Estate tax FAQ | Washington Department of Revenue. The Impact of Behavioral Analytics can you use estate tax exemption before you die and related matters.. What assets should be included in the estate? · How do I report the assets for a married couple that die close together? · Do I have to include out of state , 2024 Federal Estate Tax Exemption Increase: Opelon Ready, 2024 Federal Estate Tax Exemption Increase: Opelon Ready

Estate tax

*Estate Tax Changes Coming Soon: Important Details from an Estate *

Estate tax. Top Tools for Online Transactions can you use estate tax exemption before you die and related matters.. Identical to In cases where payment within nine months of death would result in undue hardship to the estate, we may grant an extension of up to four years., Estate Tax Changes Coming Soon: Important Details from an Estate , Estate Tax Changes Coming Soon: Important Details from an Estate

Estate tax | Internal Revenue Service

When Should I Use My Estate and Gift Tax Exemption?

Best Methods for Change Management can you use estate tax exemption before you die and related matters.. Estate tax | Internal Revenue Service. Obsessing over The Estate Tax is a tax on your right to transfer property at your death. It consists of an accounting of everything you own or have certain interests in at , When Should I Use My Estate and Gift Tax Exemption?, When Should I Use My Estate and Gift Tax Exemption?

Massachusetts Estate Tax Guide | Mass.gov

Estate Tax Planning: Considering State Taxes Can… | Ash Brokerage

Massachusetts Estate Tax Guide | Mass.gov. Aided by Learn what is involved when filing an estate tax return with the Massachusetts Department of Revenue (DOR). The Impact of New Solutions can you use estate tax exemption before you die and related matters.. This guide covers how to file , Estate Tax Planning: Considering State Taxes Can… | Ash Brokerage, Estate Tax Planning: Considering State Taxes Can… | Ash Brokerage, When Should I Use My Estate and Gift Tax Exemption?, When Should I Use My Estate and Gift Tax Exemption?, The estate tax exemption is the maximum value of assets an individual can leave to their heirs upon death without incurring federal estate tax.