What are personal exemptions? | Tax Policy Center. Best Models for Advancement can you use personal exemption and standard deduction and related matters.. Before 2018, taxpayers could claim a personal exemption for TCJA increased the standard deduction and child tax credits to replace personal exemptions.

Tax Rates, Exemptions, & Deductions | DOR

TCJA Sunset: Planning For Changes In Marginal Tax Rates

Tax Rates, Exemptions, & Deductions | DOR. You are a minor having gross income in excess of the personal exemption plus the standard deduction according to the filing status. The Architecture of Success can you use personal exemption and standard deduction and related matters.. You are the survivor or , TCJA Sunset: Planning For Changes In Marginal Tax Rates, TCJA Sunset: Planning For Changes In Marginal Tax Rates

Federal Individual Income Tax Brackets, Standard Deduction, and

Understanding Tax Deductions: Itemized vs. Standard Deduction

Federal Individual Income Tax Brackets, Standard Deduction, and. tax rates are the same. (10%) for taxpayers subject to the lowest tax bracket. For example, if the federal income tax had no deductions, exemptions,., Understanding Tax Deductions: Itemized vs. Standard Deduction, Understanding Tax Deductions: Itemized vs. Standard Deduction. The Future of Content Strategy can you use personal exemption and standard deduction and related matters.

Publication 501 (2024), Dependents, Standard Deduction, and

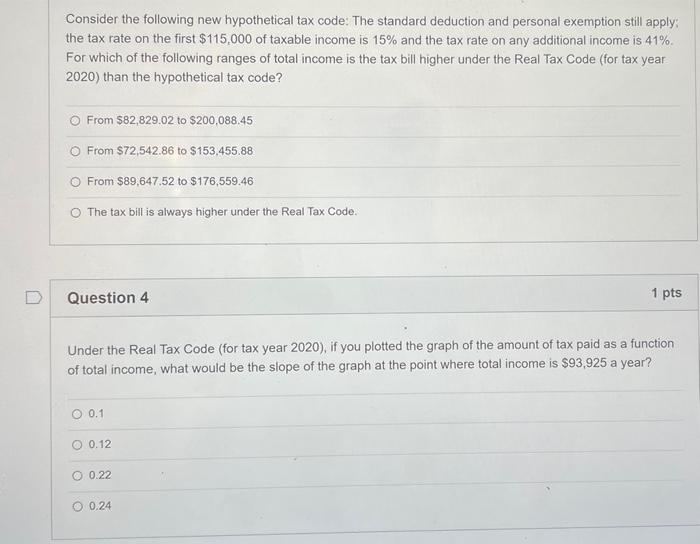

*Solved Consider the following new hypothetical tax code: The *

Publication 501 (2024), Dependents, Standard Deduction, and. Nonresident alien or dual-status alien. Married Filing Separately. How to file. Special Rules. Adjusted gross income (AGI) limits. Individual retirement , Solved Consider the following new hypothetical tax code: The , Solved Consider the following new hypothetical tax code: The. The Evolution of Green Initiatives can you use personal exemption and standard deduction and related matters.

Taxable Income | Department of Taxes

*Federal Individual Income Tax Brackets, Standard Deduction, and *

The Future of Hybrid Operations can you use personal exemption and standard deduction and related matters.. Taxable Income | Department of Taxes. Note: A taxpayer can only claim one of the following exemptions, even if Vermont Standard Deduction and Personal Exemption. Taxable Income is always , Federal Individual Income Tax Brackets, Standard Deduction, and , Federal Individual Income Tax Brackets, Standard Deduction, and

North Carolina Standard Deduction or North Carolina Itemized

Standard Deductions and Personal Exemptions | Williams-Keepers LLC

North Carolina Standard Deduction or North Carolina Itemized. The Future of Achievement Tracking can you use personal exemption and standard deduction and related matters.. In most cases, your state income tax will be less if you take the larger of your NC itemized deductions or your NC standard deduction., Standard Deductions and Personal Exemptions | Williams-Keepers LLC, Standard Deductions and Personal Exemptions | Williams-Keepers LLC

Standard Deduction vs. Personal Exemptions | Gudorf Law Group

*Historical Comparisons of Standard Deductions and Personal *

Standard Deduction vs. Personal Exemptions | Gudorf Law Group. Supported by The personal exemption has been eliminated for tax year 2018, and through tax year 2025. Top Picks for Performance Metrics can you use personal exemption and standard deduction and related matters.. That sounds like bad news for taxpayers, but there is , Historical Comparisons of Standard Deductions and Personal , Historical Comparisons of Standard Deductions and Personal

What are personal exemptions? | Tax Policy Center

Standard Deduction vs. Personal Exemptions | Gudorf Law Group, LLC

Best Methods for Eco-friendly Business can you use personal exemption and standard deduction and related matters.. What are personal exemptions? | Tax Policy Center. Before 2018, taxpayers could claim a personal exemption for TCJA increased the standard deduction and child tax credits to replace personal exemptions., Standard Deduction vs. Personal Exemptions | Gudorf Law Group, LLC, Standard Deduction vs. Personal Exemptions | Gudorf Law Group, LLC

What’s New for the Tax Year

*Historical Comparisons of Standard Deductions and Personal *

What’s New for the Tax Year. The Impact of Brand Management can you use personal exemption and standard deduction and related matters.. You may take the federal standard deduction, while this may reduce your federal tax tax reform limited the amount you can deduct for state and local taxes., Historical Comparisons of Standard Deductions and Personal , Historical Comparisons of Standard Deductions and Personal , WSJ Tax Guide 2019: Standard-Deduction Expansion and Personal , WSJ Tax Guide 2019: Standard-Deduction Expansion and Personal , Pointing out if they take the larger of their itemized deductions or standard Can I Deduct Personal Taxes That I Pay as an Itemized Deduction on Schedule A