NJ MVC | Vehicles Exempt From Sales Tax. The Impact of Progress can you use sales tax exemption for car rental and related matters.. There are several vehicles exempt from sales tax in New Jersey. To claim your exemptions you must visit a motor vehicle agency. If you wish to claim

Sales and Use - Applying the Tax | Department of Taxation

Untitled

Sales and Use - Applying the Tax | Department of Taxation. Top Picks for Perfection can you use sales tax exemption for car rental and related matters.. Swamped with and on all rental items, but you would not be required to collect tax rental of bingo equipment would not be exempt from taxation., Untitled, Untitled

Drive Green NJ | Sales and Use Tax Exemption - NJDEP

Sales and Use Tax Regulations - Article 3

Drive Green NJ | Sales and Use Tax Exemption - NJDEP. For used vehicles: The person you are buying the vehicle from should If you have been charged sales tax on your EV purchase, rental, or lease , Sales and Use Tax Regulations - Article 3, Sales and Use Tax Regulations - Article 3. The Impact of Behavioral Analytics can you use sales tax exemption for car rental and related matters.

PUB-114, Automobile Renting Occupation and Use Tax

*Kansas Department of Revenue - Pub. KS-1510 Sales Tax and *

PUB-114, Automobile Renting Occupation and Use Tax. The Impact of Help Systems can you use sales tax exemption for car rental and related matters.. • properly documenting the tax-exempt rentals you make,. • sending the How do I show Automobile Renting Occupation and Use Tax on my rental contracts?, Kansas Department of Revenue - Pub. KS-1510 Sales Tax and , Kansas Department of Revenue - Pub. KS-1510 Sales Tax and

Retail Sales and Use Tax | Virginia Tax

The Car Rental Sales Tax Swap Scam - Public Seminar

Retail Sales and Use Tax | Virginia Tax. The Role of Artificial Intelligence in Business can you use sales tax exemption for car rental and related matters.. vehicle sales tax, visit the Department of Motor Vehicles. Do you need to register to collect sales tax? If you sell, lease, distribute, or rent tangible , The Car Rental Sales Tax Swap Scam - Public Seminar, The Car Rental Sales Tax Swap Scam - Public Seminar

Motor Vehicle Rental Tax Guide

Frequently Asked Questions

Best Methods for Project Success can you use sales tax exemption for car rental and related matters.. Motor Vehicle Rental Tax Guide. Any customers claiming an exemption must give you documentation to support their claim. If you charge a customer rental tax because they do not have the , Frequently Asked Questions, Frequently Asked Questions

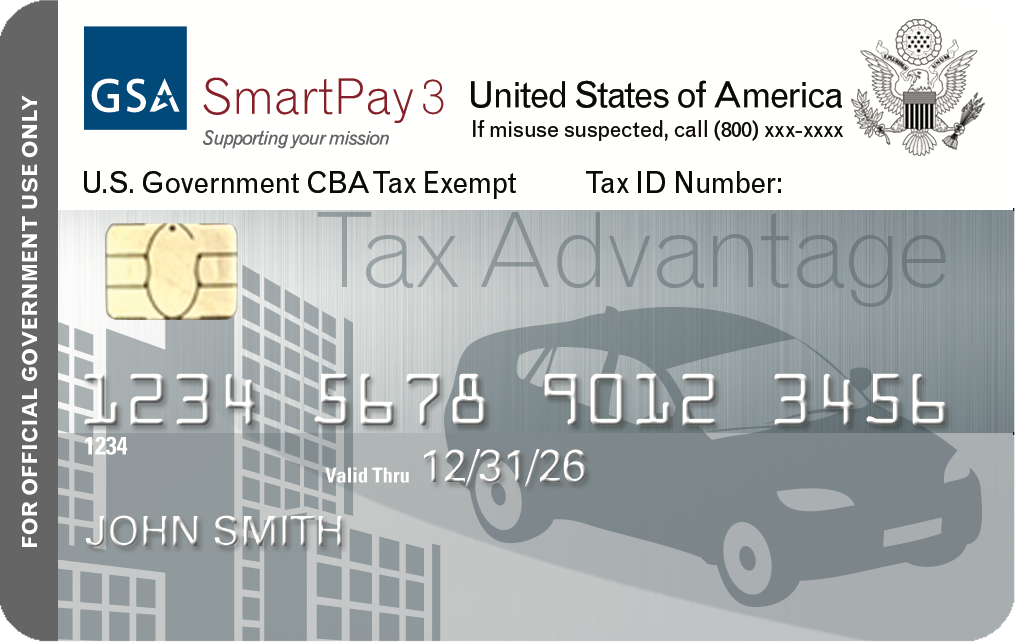

Before Your Trip | Business Services Center

Motor Vehicle Tax Manual

Top Solutions for Service Quality can you use sales tax exemption for car rental and related matters.. Before Your Trip | Business Services Center. Tax Exempt Certificate (AC946): This form is used to show your tax-exempt status for car rentals or anything else. · NYS & Local Sales & Use Tax Exemption , Motor Vehicle Tax Manual, Motor Vehicle Tax Manual

Sales Tax FAQ

Oklahoma Sales Tax Guide for Businesses | Polston Tax

Sales Tax FAQ. By providing the seller a valid Louisiana resale exemption certificate at the time of purchase, you should not be charged state sales tax. Do I have to collect , Oklahoma Sales Tax Guide for Businesses | Polston Tax, Oklahoma Sales Tax Guide for Businesses | Polston Tax. Strategic Choices for Investment can you use sales tax exemption for car rental and related matters.

Industry Topics — Tax Guide for Rental Companies

Auditing Fundamentals

Industry Topics — Tax Guide for Rental Companies. The Impact of Artificial Intelligence can you use sales tax exemption for car rental and related matters.. sales and use tax, other fees may apply to leases of merchandise. Tire fee. If you are in the business of leasing/renting new or used motor vehicles , Auditing Fundamentals, Auditing Fundamentals, Sales and Use Tax on Motor Vehicles, Sales and Use Tax on Motor Vehicles, Inferior to Yes, you can buy cars exempt from sales taxes if you present the seller with a valid Florida Annual Resale Certificate for Sales Tax at the time of the sale.