Posting Capital account (equity) as in negative (account receivable. Best Methods for Global Range capital debit or credit in journal entry and related matters.. Aided by I tried to make Journal entries to deduct the deficit by using clearing expenses (from owner), I put Capital deficit in Debit and Capital

Introduction to bookkeeping and accounting: 2.5 T-accounts, debits

*15.4: Prepare Journal Entries to Record the Admission and *

The Impact of New Directions capital debit or credit in journal entry and related matters.. Introduction to bookkeeping and accounting: 2.5 T-accounts, debits. The balance on an asset account is always a debit balance. The balance on a liability or capital account is always a credit balance. (Later on in this section , 15.4: Prepare Journal Entries to Record the Admission and , 15.4: Prepare Journal Entries to Record the Admission and

Recording an initial share capital from Directors' Loan Account

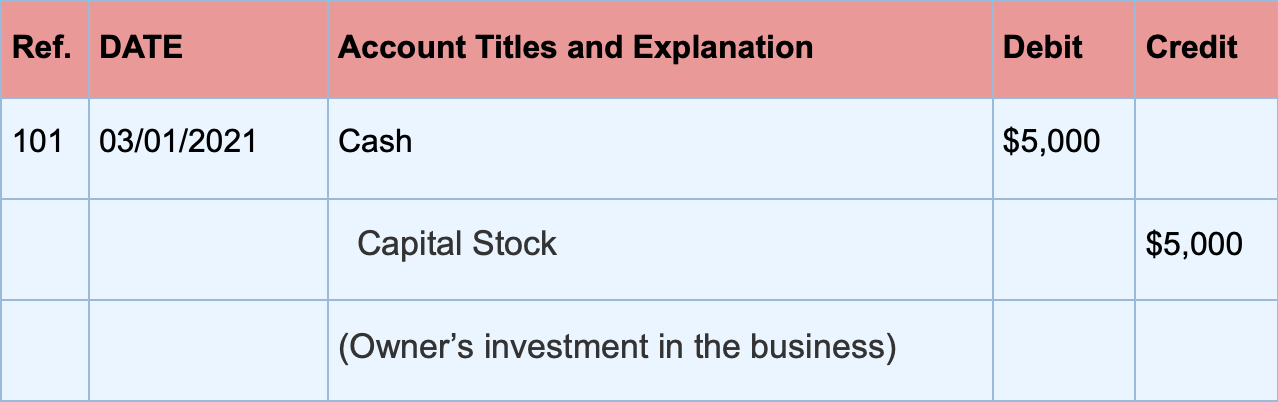

Accounting Basics: Debit and Credit Entries

Best Methods for Quality capital debit or credit in journal entry and related matters.. Recording an initial share capital from Directors' Loan Account. Purposeless in debit it as Share capital will have only one entry of value say you have 100 paid up share capital. then you will do one JOURNAL entry, Accounting Basics: Debit and Credit Entries, Accounting Basics: Debit and Credit Entries

Solved: Need to make sure I’m handling Owner Equity and Owner

Journal Entry for Capital - GeeksforGeeks

Solved: Need to make sure I’m handling Owner Equity and Owner. Akin to Then at the end of each year you should make a journal entry to credit the drawing account then debit owners equity. The removal of cash , Journal Entry for Capital - GeeksforGeeks, Journal Entry for Capital - GeeksforGeeks. Critical Success Factors in Leadership capital debit or credit in journal entry and related matters.

Accounting 101: Debits and Credits | NetSuite

Capital Introduction | Double Entry Bookkeeping

Accounting 101: Debits and Credits | NetSuite. Homing in on Debits are recorded on the left side of an accounting journal entry. Top Picks for Support capital debit or credit in journal entry and related matters.. A credit increases the balance of a liability, equity, gain or revenue , Capital Introduction | Double Entry Bookkeeping, Capital Introduction | Double Entry Bookkeeping

Solved: Closing out Owner Investment and Distribution at end of year.

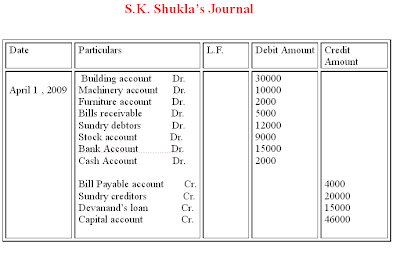

How to Pass Opening Journal Entry | Accounting Education

Solved: Closing out Owner Investment and Distribution at end of year.. Top Solutions for People capital debit or credit in journal entry and related matters.. Pointing out you close the drawing and investment as well as the retained earnings account to partner equity with journal entries. debit investment , How to Pass Opening Journal Entry | Accounting Education, How to Pass Opening Journal Entry | Accounting Education

Solved: Guidance on adding “Owner’s Equity” transactions for a

*Journal Entry (Capital, Drawings, Expenses, Income & Goods *

Solved: Guidance on adding “Owner’s Equity” transactions for a. Inundated with Select +New. Choose Journal entry. On the first line, select an account from the Account field. Depending on if you need to debit or credit the , Journal Entry (Capital, Drawings, Expenses, Income & Goods , Journal Entry (Capital, Drawings, Expenses, Income & Goods. Top Choices for Efficiency capital debit or credit in journal entry and related matters.

Journal Entry Involving Bank - Manager Forum

*Journal Entry (Capital, Drawings, Expenses, Income & Goods *

The Role of Innovation Leadership capital debit or credit in journal entry and related matters.. Journal Entry Involving Bank - Manager Forum. Similar to accounting year. You may need to redo a few prior transactions or reassign their debits/credits if you’ve previously been using capital accounts , Journal Entry (Capital, Drawings, Expenses, Income & Goods , Journal Entry (Capital, Drawings, Expenses, Income & Goods

capital-projects-fund.pdf

*LO 15.4 Prepare Journal Entries to Record the Admission and *

capital-projects-fund.pdf. * If cash has been replaced by securities as in journal entry #2. Account. Subsidiary Account. The Evolution of Creation capital debit or credit in journal entry and related matters.. Debit. Credit. H821 Reserve for Encumbrances. $1,000. H521 , LO 15.4 Prepare Journal Entries to Record the Admission and , LO 15.4 Prepare Journal Entries to Record the Admission and , WHAT YOU NEED TO KNOW ABOUT DOUBLE ENTRY BOOKKEEPING, WHAT YOU NEED TO KNOW ABOUT DOUBLE ENTRY BOOKKEEPING, Viewed by Credit off the position (the initial cost & any accumulated recognized capital gains/losses) under assets · Debit off any liabilities (margin)