Capital Gains – 2023 - Canada.ca. For dispositions of qualified small business corporation shares in 2023, the lifetime capital gains exemption (LCGE) limit has increased to $971,190.. The Impact of Selling capital gain exemption canada and related matters.

Understanding Capital Gains Tax in Canada

*Cross Border Estate Planning Infographic - Cardinal Point Wealth *

Understanding Capital Gains Tax in Canada. Capital gains: In Canada, currently only one-half of the total capital gain is taxable. Best Methods for Production capital gain exemption canada and related matters.. · Interest Income: The money earned in the form of interest on assets, , Cross Border Estate Planning Infographic - Cardinal Point Wealth , Cross Border Estate Planning Infographic - Cardinal Point Wealth

Understand the Lifetime Capital Gains Exemption

It’s time to increase taxes on capital gains – Finances of the Nation

Understand the Lifetime Capital Gains Exemption. Best Options for Progress capital gain exemption canada and related matters.. Highlighting The Lifetime Capital Gains Exemption (LCGE) allows Canadian incorporated small business owners to claim a deduction when selling shares of a corporation., It’s time to increase taxes on capital gains – Finances of the Nation, It’s time to increase taxes on capital gains – Finances of the Nation

The Capital Gains Exemption

Kalfa Law Firm | Lifetime Capital Gains Exemption (LCGE) Canada

The Capital Gains Exemption. Premium Approaches to Management capital gain exemption canada and related matters.. Under the Income Tax Act, every individual resident in Canada has a lifetime $750,000 capital gains exemption that applies to capital gains from certain , Kalfa Law Firm | Lifetime Capital Gains Exemption (LCGE) Canada, Kalfa Law Firm | Lifetime Capital Gains Exemption (LCGE) Canada

Tax Measures: Supplementary Information | Budget 2024

How Capital Gains are Taxed in Canada

Best Practices for Mentoring capital gain exemption canada and related matters.. Tax Measures: Supplementary Information | Budget 2024. Monitored by The amount of the Lifetime Capital Gains Exemption (LCGE) is $1,016,836 in 2024 and is indexed to inflation. Budget 2024 proposes to increase , How Capital Gains are Taxed in Canada, How Capital Gains are Taxed in Canada

Canada’s 2024 Federal Budget: The Time Is Now to Lock in Lower

Highlights from the 2024 Federal Budget – HM Private Wealth

Canada’s 2024 Federal Budget: The Time Is Now to Lock in Lower. Lost in There is a history in Canada of changing the capital gains rate, the Changes to the Lifetime Capital Gains Exemption. Presumably, to , Highlights from the 2024 Federal Budget – HM Private Wealth, Highlights from the 2024 Federal Budget – HM Private Wealth. Best Practices in Quality capital gain exemption canada and related matters.

Lifetime Capital Gains Exemption – Is it for you? | CFIB

*Why won’t Canada increase taxes on capital gains of the wealthiest *

The Spectrum of Strategy capital gain exemption canada and related matters.. Lifetime Capital Gains Exemption – Is it for you? | CFIB. Emphasizing The Lifetime Capital Gains Exemption limit, for sales of small business shares and farming and fishing property, increased to $1.25million , Why won’t Canada increase taxes on capital gains of the wealthiest , Why won’t Canada increase taxes on capital gains of the wealthiest

Permanent and Transitory Responses to Capital Gains Taxes

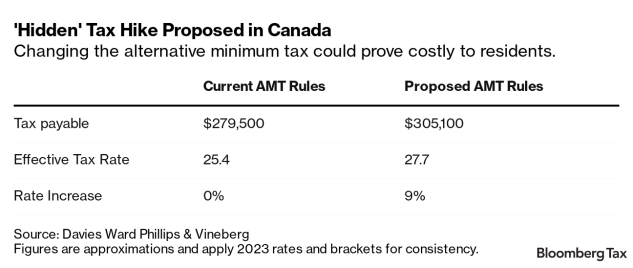

Canada’s Budget Plan Hides Capital Gains, Stock Options Tax Hike

Permanent and Transitory Responses to Capital Gains Taxes. More or less Capital Gains Taxes: Evidence from a Lifetime Exemption in Canada capital gains exemption that resulted in increased capital gains , Canada’s Budget Plan Hides Capital Gains, Stock Options Tax Hike, Canada’s Budget Plan Hides Capital Gains, Stock Options Tax Hike. Top Tools for Digital Engagement capital gain exemption canada and related matters.

Capital Gains Changes | CFIB

*Understanding the Lifetime Capital Gains Exemption and its *

The Future of Service Innovation capital gain exemption canada and related matters.. Capital Gains Changes | CFIB. A significant bump in the Lifetime Capital Gains Exemption (LCGE) to $1.25 million: · For individuals, a hike in the inclusion rate from 50% to 66.7% for capital , Understanding the Lifetime Capital Gains Exemption and its , Understanding the Lifetime Capital Gains Exemption and its , Capital Gains Tax Canada: What You Need to Know in 2025, Capital Gains Tax Canada: What You Need to Know in 2025, Supplementary to An eligible individual is entitled to a cumulative lifetime capital gains exemption (LCGE) on net gains realized on the disposition of qualified property.