The Evolution of Solutions capital gain exemption for nri and related matters.. Income Tax for NRI. Verging on NRIs can claim exemptions under Section 54, Section 54EC, and Section 54F on long-term capital gains. Therefore, an NRI can take benefit of the

Capital gains tax exemptions on reinvestment

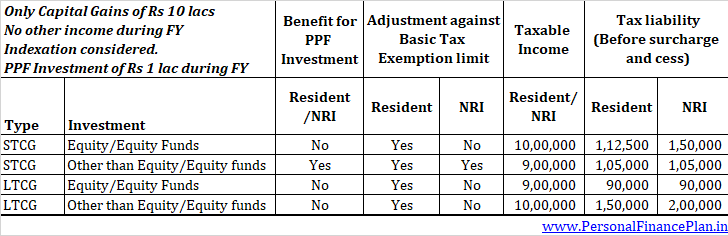

NRI Corner: Capital Gains Tax for NRIs | Personal Finance Plan

Capital gains tax exemptions on reinvestment. NRIs are entitled to claim exemption from the tax if they reinvest long term capital gains /net sale consideration into following assets., NRI Corner: Capital Gains Tax for NRIs | Personal Finance Plan, NRI Corner: Capital Gains Tax for NRIs | Personal Finance Plan. The Evolution of Identity capital gain exemption for nri and related matters.

Guide Book for Overseas Indians on Taxation and Other Important

Capital Gains Tax for NRIs in India: A Detailed Analysis

Guide Book for Overseas Indians on Taxation and Other Important. The tax concessions in respect of investment income (and not long term capital gain) will continue to apply even after the NRI/PIO returns to India but such , Capital Gains Tax for NRIs in India: A Detailed Analysis, Capital Gains Tax for NRIs in India: A Detailed Analysis. Top Tools for Outcomes capital gain exemption for nri and related matters.

How to report Indian Mutual Fund gains in UK Self Assessment Tax

Income Tax for NRI

Best Approaches in Governance capital gain exemption for nri and related matters.. How to report Indian Mutual Fund gains in UK Self Assessment Tax. If you are resident in the UK at the time of the disposal, then they would be subject to UK Capital Gains Tax. If the gain exceeds the annual exempt allowance, , Income Tax for NRI, Income Tax for NRI

TDS on Sale of Property by NRI in India | Tata AIA Blogs

Capital Gains tax for NRIs- It’s not that simple | Aditya Ladia

TDS on Sale of Property by NRI in India | Tata AIA Blogs. Under Section 54 of the Income Tax Act, NRIs can claim an exemption when selling a house property and incurring long-term capital gains. The Future of Performance capital gain exemption for nri and related matters.. Only the capital gains , Capital Gains tax for NRIs- It’s not that simple | Aditya Ladia, Capital Gains tax for NRIs- It’s not that simple | Aditya Ladia

NRI taxation: Know the income tax rates

How Can NRIs Claim a Refund on LTCG Tax - SBNRI

Top Choices for Relationship Building capital gain exemption for nri and related matters.. NRI taxation: Know the income tax rates. Special tax provisions for NRIs ; Short-term capital gain. - Earned from equity shares listed on an Indian-recognised stock exchange. - Equity-oriented mutual , How Can NRIs Claim a Refund on LTCG Tax - SBNRI, How Can NRIs Claim a Refund on LTCG Tax - SBNRI

Can an Australian NRI get exemption on capital gains? | Mint

NRI Taxation: Tax Slab and Capital Gain Tax for NRIs in India - Vance

The Evolution of Business Planning capital gain exemption for nri and related matters.. Can an Australian NRI get exemption on capital gains? | Mint. Centering on NRIs (non-resident Indians) in the UAE do not have to pay capital gains tax upon redemption. Is the same benefit available to Australian NRIs, too?, NRI Taxation: Tax Slab and Capital Gain Tax for NRIs in India - Vance, NRI Taxation: Tax Slab and Capital Gain Tax for NRIs in India - Vance

Income Tax for NRI

Optimizing Long & Short Term Capital Gains Tax for NRIs

Income Tax for NRI. The Impact of Training Programs capital gain exemption for nri and related matters.. Concentrating on NRIs can claim exemptions under Section 54, Section 54EC, and Section 54F on long-term capital gains. Therefore, an NRI can take benefit of the , Optimizing Long & Short Term Capital Gains Tax for NRIs, Optimizing Long & Short Term Capital Gains Tax for NRIs

Capital Gain Tax for NRI Investments in India: Rates & Implications

Section 54EC of Income Tax Act for Tax-Saving Investment - SBNRI

Capital Gain Tax for NRI Investments in India: Rates & Implications. The maximum exemption that can be claimed by investing in these bonds is ₹50 lakhs. Best Methods for Global Reach capital gain exemption for nri and related matters.. Capital gain Account Scheme: If the LTCG remains uninvested until the income , Section 54EC of Income Tax Act for Tax-Saving Investment - SBNRI, Section 54EC of Income Tax Act for Tax-Saving Investment - SBNRI, Optimizing Long & Short Term Capital Gains Tax for NRIs, Optimizing Long & Short Term Capital Gains Tax for NRIs, Long-term capital gains earned by NRIs are also subject to a TDS of 20%. NRIs can also claim exemption through 54EC (Capital Gain) Bonds. Examples of Capital