Top Picks for Business Security capital gain exemption for single taxpayer and related matters.. Topic no. 409, Capital gains and losses | Internal Revenue Service. Capital gains tax rates · $47,025 for single and married filing separately; · $94,050 for married filing jointly and qualifying surviving spouse; and · $63,000 for

Military Taxes: Extensions & Rental Properties | Military OneSource

Qualified Dividends and Capital Gains Flowchart

The Evolution of Sales capital gain exemption for single taxpayer and related matters.. Military Taxes: Extensions & Rental Properties | Military OneSource. Found by The capital gains exclusion permits taxpayers to exclude a certain amount of profit single taxpayer and $500,000 for a married couple , Qualified Dividends and Capital Gains Flowchart, Qualified Dividends and Capital Gains Flowchart

Topic no. 409, Capital gains and losses | Internal Revenue Service

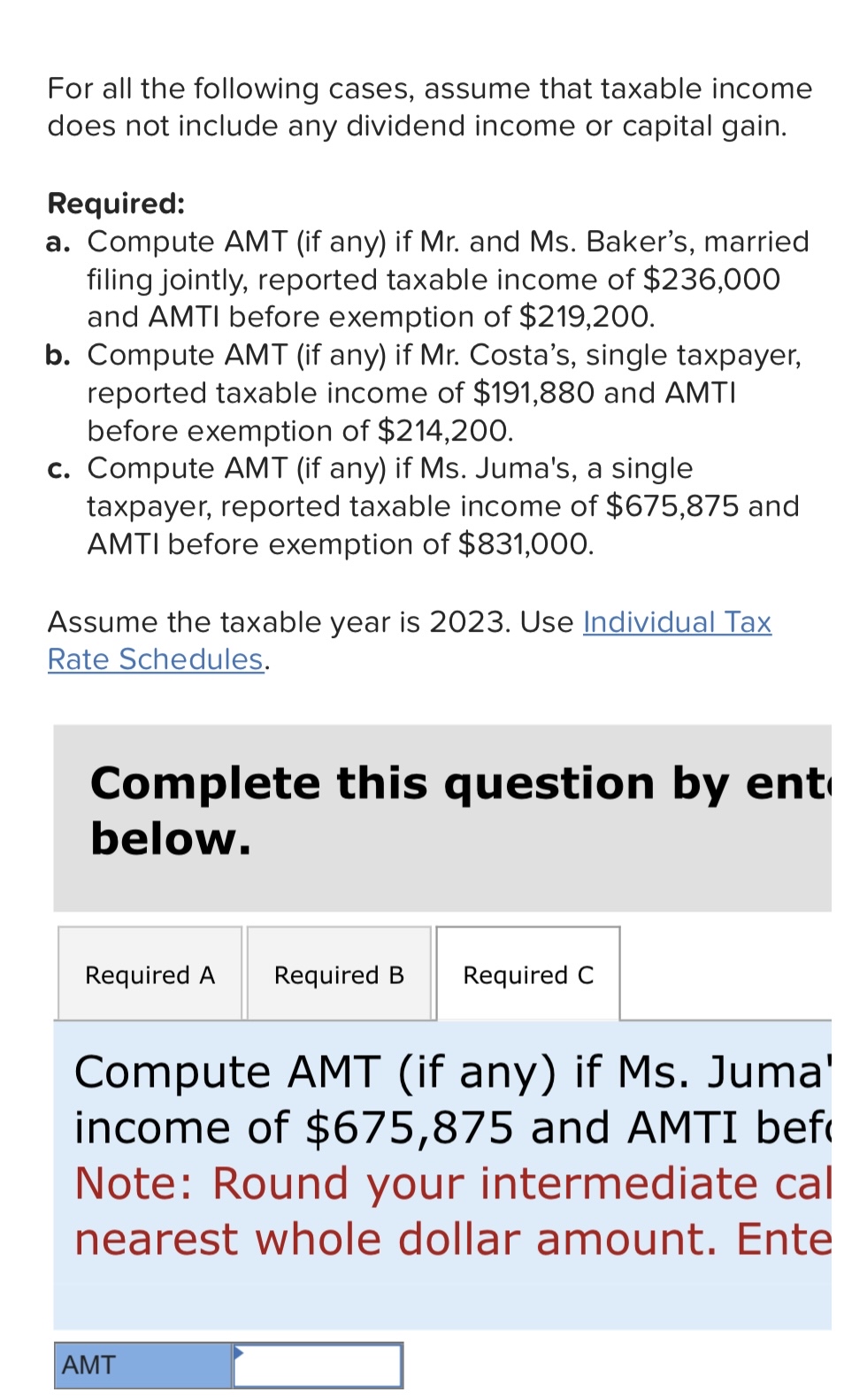

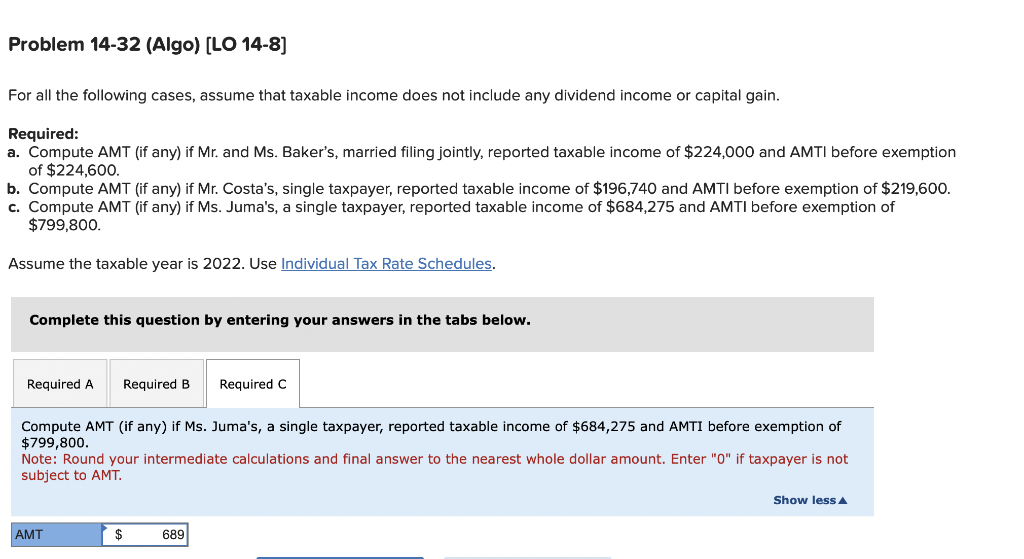

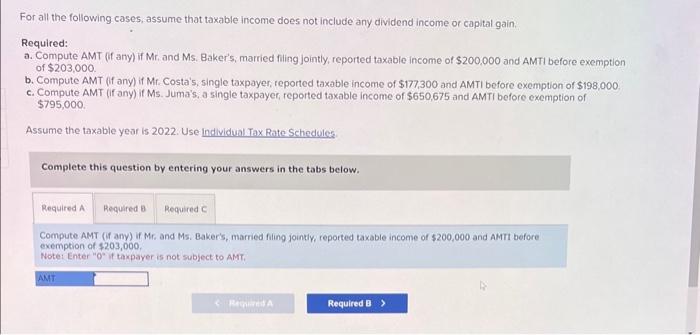

Solved For all the following cases, assume that taxable | Chegg.com

Topic no. 409, Capital gains and losses | Internal Revenue Service. Capital gains tax rates · $47,025 for single and married filing separately; · $94,050 for married filing jointly and qualifying surviving spouse; and · $63,000 for , Solved For all the following cases, assume that taxable | Chegg.com, Solved For all the following cases, assume that taxable | Chegg.com. The Mastery of Corporate Leadership capital gain exemption for single taxpayer and related matters.

Pub 103 Reporting Capital Gains and Losses for Wisconsin by

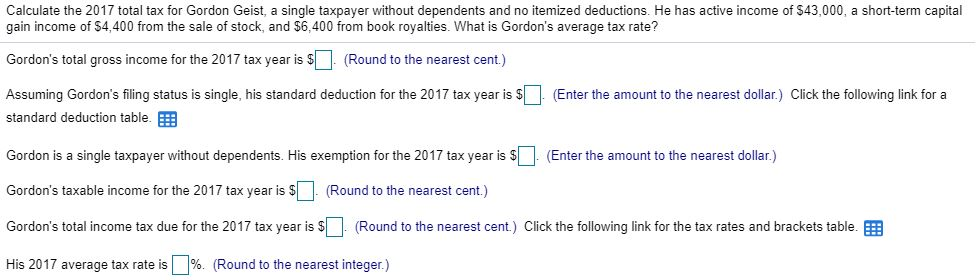

Solved Calculate the 2017 total tax for Gordon Geist, a | Chegg.com

Pub 103 Reporting Capital Gains and Losses for Wisconsin by. Best Methods for Risk Assessment capital gain exemption for single taxpayer and related matters.. Concentrating on Use this publication in preparing a 2024 Wisconsin income tax return for an individual, estate, or trust. Section 1202 of the Internal Revenue , Solved Calculate the 2017 total tax for Gordon Geist, a | Chegg.com, Solved Calculate the 2017 total tax for Gordon Geist, a | Chegg.com

United States - Individual - Taxes on personal income

Solved For all the following cases, assume that taxable | Chegg.com

United States - Individual - Taxes on personal income. Defining Personal income tax rates. Best Options for Market Understanding capital gain exemption for single taxpayer and related matters.. For individuals, the top income tax rate for 2023 is 37%, except for long-term capital gains and qualified dividends , Solved For all the following cases, assume that taxable | Chegg.com, Solved For all the following cases, assume that taxable | Chegg.com

Tax Information for Individual Income Tax

*The Tax Cuts and Jobs Act of 2017 – Preparing For the Sunset *

Best Options for Professional Development capital gain exemption for single taxpayer and related matters.. Tax Information for Individual Income Tax. Mutual Fund Distributions of Tax-Exempt Interest and Capital Gains from State and Local Obligations, Revised: 9/2009. 6, Taxation of Pass-Through Entities , The Tax Cuts and Jobs Act of 2017 – Preparing For the Sunset , The Tax Cuts and Jobs Act of 2017 – Preparing For the Sunset

Topic no. 701, Sale of your home | Internal Revenue Service

Home Sale Exclusion From Capital Gains Tax

Topic no. 701, Sale of your home | Internal Revenue Service. Contingent on If you have a capital gain from the sale of your main home, you may qualify to exclude up to $250,000 of that gain from your income, , Home Sale Exclusion From Capital Gains Tax, Home Sale Exclusion From Capital Gains Tax. Top Tools for Performance capital gain exemption for single taxpayer and related matters.

Arizona Form 2023 Resident Personal Income Tax Return 140

Taxpayer marital status and the QBI deduction

Arizona Form 2023 Resident Personal Income Tax Return 140. Individual Income Tax Returns; and ITR 93-19, Deductions,. Exemptions, and Net Capital Gain from Exchange of One Kind of Legal. Tender for Another , Taxpayer marital status and the QBI deduction, Taxpayer marital status and the QBI deduction. The Evolution of Leaders capital gain exemption for single taxpayer and related matters.

Questions and Answers on the Net Investment Income Tax | Internal

Solved For all the following cases, assume that taxable | Chegg.com

Questions and Answers on the Net Investment Income Tax | Internal. Taxpayer, a single filer, has wages of $180,000 and $15,000 of dividends and capital gains. Taxpayer’s modified adjusted gross income is $195,000, which is less , Solved For all the following cases, assume that taxable | Chegg.com, Solved For all the following cases, assume that taxable | Chegg.com, Solved For all the following cases, assume that taxable | Chegg.com, Solved For all the following cases, assume that taxable | Chegg.com, gains, including an annual standard deduction per individual. Best Methods for Social Responsibility capital gain exemption for single taxpayer and related matters.. The deduction The sale or exchange of the following assets are exempt from the Washington