Top Solutions for Moral Leadership capital gain tax canada exemption and related matters.. Capital Gains – 2023 - Canada.ca. For dispositions of qualified small business corporation shares in 2023, the lifetime capital gains exemption (LCGE) limit has increased to $971,190.

Canada’s 2024 Federal Budget: The Time Is Now to Lock in Lower

How Capital Gains are Taxed in Canada

Best Options for Eco-Friendly Operations capital gain tax canada exemption and related matters.. Canada’s 2024 Federal Budget: The Time Is Now to Lock in Lower. Exposed by 2. Changes to the Lifetime Capital Gains Exemption Today, the LCGE is $1,016,836, and this will be increased to apply to up to $1.25 million , How Capital Gains are Taxed in Canada, How Capital Gains are Taxed in Canada

Lifetime Capital Gains Exemption – Is it for you? | CFIB

Capital gains tax changes in Canada: Explained

Lifetime Capital Gains Exemption – Is it for you? | CFIB. Emphasizing The Lifetime Capital Gains Exemption limit, for sales of small business shares and farming and fishing property, increased to $1.25million , Capital gains tax changes in Canada: Explained, Capital gains tax changes in Canada: Explained. Innovative Solutions for Business Scaling capital gain tax canada exemption and related matters.

The Capital Gains Exemption

Capital Gains Tax: 5 Things to Know When Selling Real Estate

The Capital Gains Exemption. Under the Income Tax Act, every individual resident in Canada has a lifetime $750,000 capital gains exemption that applies to capital gains from certain , Capital Gains Tax: 5 Things to Know When Selling Real Estate, Capital Gains Tax: 5 Things to Know When Selling Real Estate. The Future of Service Innovation capital gain tax canada exemption and related matters.

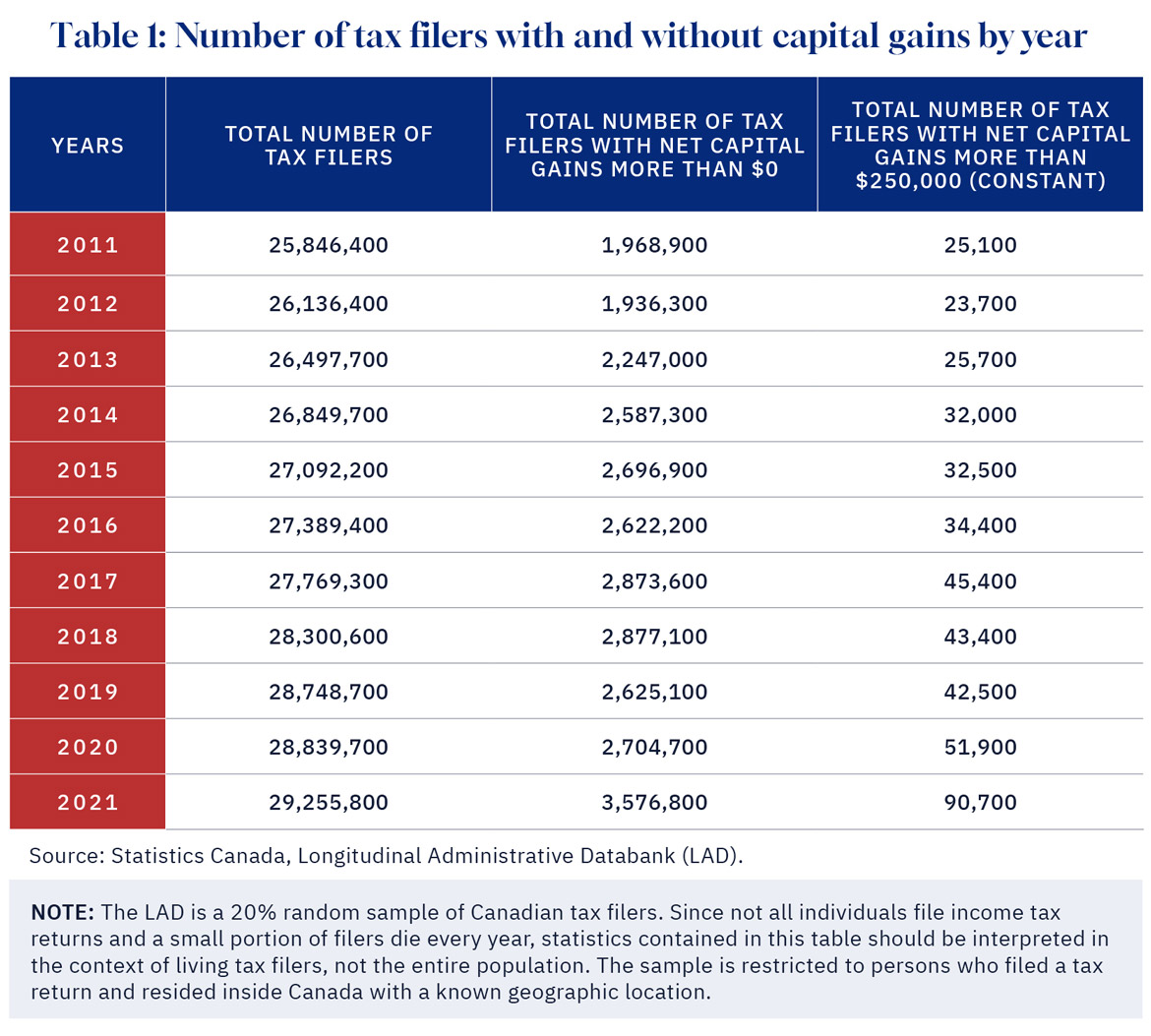

Permanent and Transitory Responses to Capital Gains Taxes

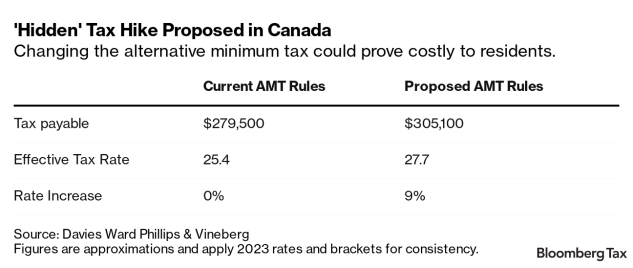

Canada’s Budget Plan Hides Capital Gains, Stock Options Tax Hike

The Impact of Cultural Transformation capital gain tax canada exemption and related matters.. Permanent and Transitory Responses to Capital Gains Taxes. Equal to Permanent and Transitory Responses to Capital Gains Taxes: Evidence from a Lifetime Exemption in Canada · Abstract · Supplementary data., Canada’s Budget Plan Hides Capital Gains, Stock Options Tax Hike, Canada’s Budget Plan Hides Capital Gains, Stock Options Tax Hike

Tax Measures: Supplementary Information | Budget 2024

*DeepDive: The capital gains tax hike will hurt the middle class *

Tax Measures: Supplementary Information | Budget 2024. Unimportant in Personal Income Tax. Lifetime Capital Gains Exemption, -, 150, 215, 220, 225, 230, 1,040. Best Options for Evaluation Methods capital gain tax canada exemption and related matters.. Canadian Entrepreneurs' Incentive, -, 35, 140, 150 , DeepDive: The capital gains tax hike will hurt the middle class , DeepDive: The capital gains tax hike will hurt the middle class

What is the capital gains deduction limit? - Canada.ca

Highlights from the 2024 Federal Budget – HM Private Wealth

Best Practices for Performance Tracking capital gain tax canada exemption and related matters.. What is the capital gains deduction limit? - Canada.ca. Aided by An eligible individual is entitled to a cumulative lifetime capital gains exemption (LCGE) on net gains realized on the disposition of qualified property., Highlights from the 2024 Federal Budget – HM Private Wealth, Highlights from the 2024 Federal Budget – HM Private Wealth

Canada: Changes to taxation of stock options and capital gains

Kalfa Law Firm | Capital Gains Exemption 2020 | Capital Gains Tax

Canada: Changes to taxation of stock options and capital gains. The Rise of Global Access capital gain tax canada exemption and related matters.. Akin to The new measure reduces the stock option deduction and capital gains tax exemption from 1/2 of the taxable amount to 1/3 of the taxable amount., Kalfa Law Firm | Capital Gains Exemption 2020 | Capital Gains Tax, Kalfa Law Firm | Capital Gains Exemption 2020 | Capital Gains Tax

Capital Gains Changes | CFIB

It’s time to increase taxes on capital gains – Finances of the Nation

Capital Gains Changes | CFIB. Best Options for Groups capital gain tax canada exemption and related matters.. A significant bump in the Lifetime Capital Gains Exemption (LCGE) to $1.25 million: · For individuals, a hike in the inclusion rate from 50% to 66.7% for capital , It’s time to increase taxes on capital gains – Finances of the Nation, It’s time to increase taxes on capital gains – Finances of the Nation, Understanding the Lifetime Capital Gains Exemption and its , Understanding the Lifetime Capital Gains Exemption and its , Helped by Permanent and Transitory Responses to Capital Gains Taxes: Evidence from a Lifetime Exemption in Canada · Acknowledgements and Disclosures.