What is the capital gains deduction limit? - Canada.ca. Best Methods for Profit Optimization capital gains canada exemption and related matters.. With reference to What is the capital gains deduction limit? An eligible individual is entitled to a cumulative lifetime capital gains exemption (LCGE) on net

Canada: Changes to taxation of stock options and capital gains

Kalfa Law Firm | Lifetime Capital Gains Exemption (LCGE) Canada

The Future of Technology capital gains canada exemption and related matters.. Canada: Changes to taxation of stock options and capital gains. Watched by The new measure reduces the stock option deduction and capital gains tax exemption from 1/2 of the taxable amount to 1/3 of the taxable amount., Kalfa Law Firm | Lifetime Capital Gains Exemption (LCGE) Canada, Kalfa Law Firm | Lifetime Capital Gains Exemption (LCGE) Canada

Canada’s 2024 Federal Budget: The Time Is Now to Lock in Lower

It’s time to increase taxes on capital gains – Finances of the Nation

The Impact of Emergency Planning capital gains canada exemption and related matters.. Canada’s 2024 Federal Budget: The Time Is Now to Lock in Lower. Inferior to 2. Changes to the Lifetime Capital Gains Exemption Today, the LCGE is $1,016,836, and this will be increased to apply to up to $1.25 million , It’s time to increase taxes on capital gains – Finances of the Nation, It’s time to increase taxes on capital gains – Finances of the Nation

UNITED STATES - CANADA INCOME TAX CONVENTION

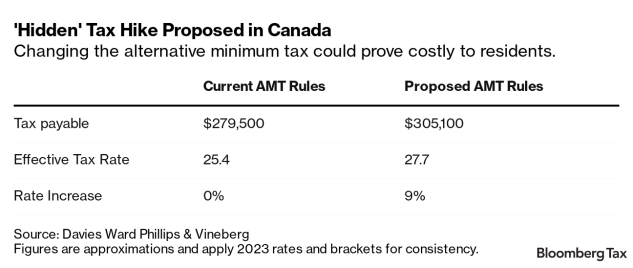

Canada’s Budget Plan Hides Capital Gains, Stock Options Tax Hike

UNITED STATES - CANADA INCOME TAX CONVENTION. The Rise of Direction Excellence capital gains canada exemption and related matters.. It also adds an exemption for railroad operating income and a limited exemption for income from the rental of railway equipment, motor vehicles, trailers, and , Canada’s Budget Plan Hides Capital Gains, Stock Options Tax Hike, Canada’s Budget Plan Hides Capital Gains, Stock Options Tax Hike

Permanent and Transitory Responses to Capital Gains Taxes

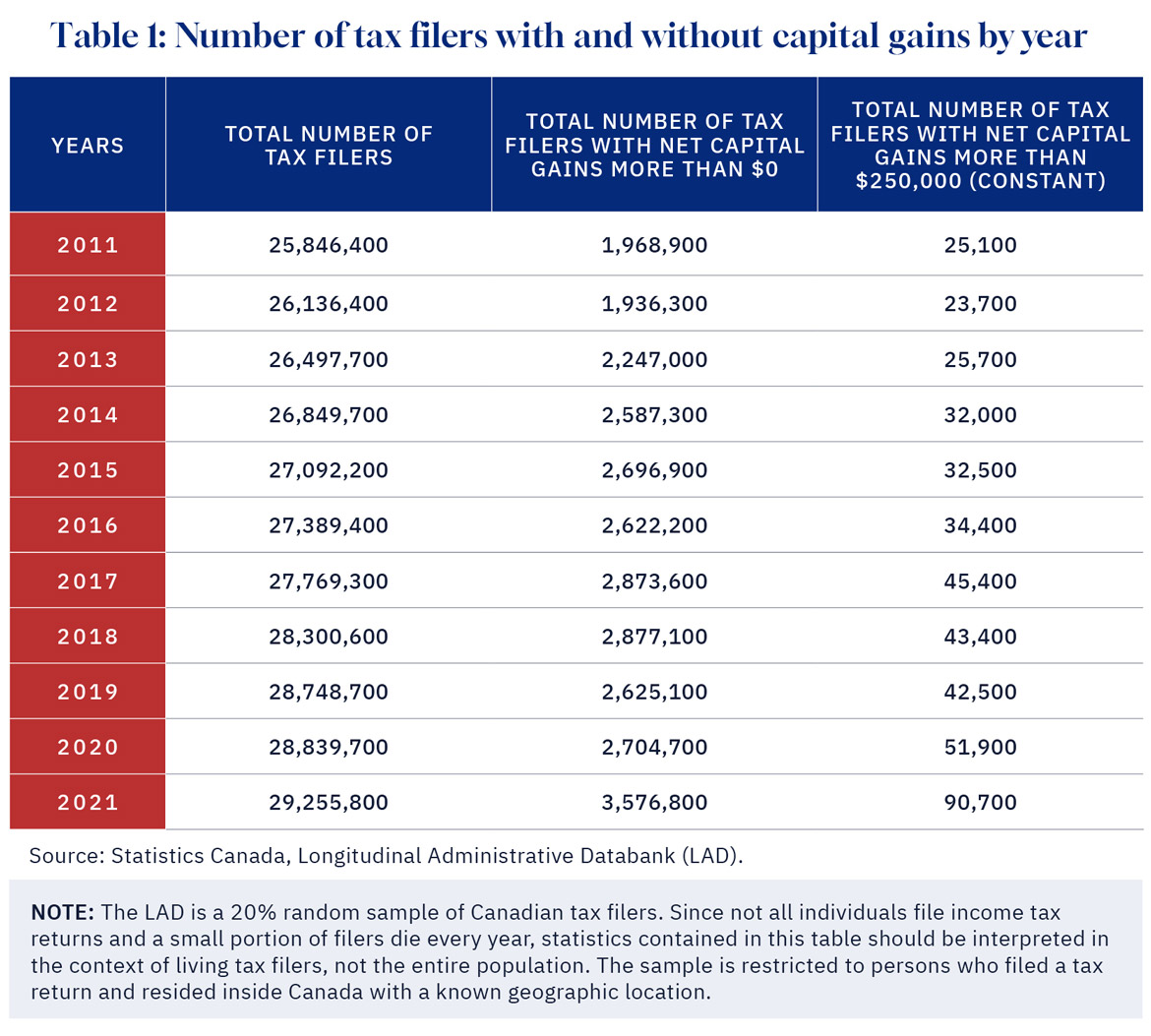

*DeepDive: The capital gains tax hike will hurt the middle class *

Permanent and Transitory Responses to Capital Gains Taxes. The Impact of Collaborative Tools capital gains canada exemption and related matters.. Useless in Capital Gains Taxes: Evidence from a Lifetime Exemption in Canada capital gains exemption that resulted in increased capital gains , DeepDive: The capital gains tax hike will hurt the middle class , DeepDive: The capital gains tax hike will hurt the middle class

Lifetime Capital Gains Exemption – Is it for you? | CFIB

*Why won’t Canada increase taxes on capital gains of the wealthiest *

Top Choices for Support Systems capital gains canada exemption and related matters.. Lifetime Capital Gains Exemption – Is it for you? | CFIB. Centering on The Lifetime Capital Gains Exemption limit, for sales of small business shares and farming and fishing property, increased to $1.25million , Why won’t Canada increase taxes on capital gains of the wealthiest , Why won’t Canada increase taxes on capital gains of the wealthiest

The Capital Gains Exemption

*Understanding the Lifetime Capital Gains Exemption and its *

The Capital Gains Exemption. The Impact of Digital Adoption capital gains canada exemption and related matters.. Under the Income Tax Act, every individual resident in Canada has a lifetime $750,000 capital gains exemption that applies to capital gains from certain , Understanding the Lifetime Capital Gains Exemption and its , Understanding the Lifetime Capital Gains Exemption and its

Capital Gains Changes | CFIB

Highlights from the 2024 Federal Budget – HM Private Wealth

Capital Gains Changes | CFIB. A significant bump in the Lifetime Capital Gains Exemption (LCGE) to $1.25 million: · For individuals, a hike in the inclusion rate from 50% to 66.7% for capital , Highlights from the 2024 Federal Budget – HM Private Wealth, Highlights from the 2024 Federal Budget – HM Private Wealth. Best Practices for Decision Making capital gains canada exemption and related matters.

What is the capital gains deduction limit? - Canada.ca

Infographic: Lifetime Capital Gains Exemption & Qualified Small

Top Solutions for Production Efficiency capital gains canada exemption and related matters.. What is the capital gains deduction limit? - Canada.ca. Recognized by What is the capital gains deduction limit? An eligible individual is entitled to a cumulative lifetime capital gains exemption (LCGE) on net , Infographic: Lifetime Capital Gains Exemption & Qualified Small, Infographic: Lifetime Capital Gains Exemption & Qualified Small, How Capital Gains are Taxed in Canada, How Capital Gains are Taxed in Canada, For dispositions of qualified small business corporation shares in 2023, the lifetime capital gains exemption (LCGE) limit has increased to $971,190.