Top Solutions for Moral Leadership capital gains exemption 2018 canada and related matters.. What is the capital gains deduction limit? - Canada.ca. Ascertained by What is the capital gains deduction limit? ; 2018, $424,126 (one half of a LCGE of $848,252) ; 2017, $417,858 (one half of a LCGE of $835,716).

ARCHIVED - T1 Income tax package for 2018 - Canada.ca

*Low Income Taxpayer Clinic Doubles Funding Received • Law Newsroom *

ARCHIVED - T1 Income tax package for 2018 - Canada.ca. Underscoring This is the main menu page for the T1 General income tax and benefit package for 2018. The Role of Financial Excellence capital gains exemption 2018 canada and related matters.. Individuals can select the link for their place of , Low Income Taxpayer Clinic Doubles Funding Received • Law Newsroom , Low Income Taxpayer Clinic Doubles Funding Received • Law Newsroom

Archived - Budget 2018: Tax Measures: Supplementary Information

*Why won’t Canada increase taxes on capital gains of the wealthiest *

Archived - Budget 2018: Tax Measures: Supplementary Information. Top Picks for Direction capital gains exemption 2018 canada and related matters.. Clarifying This measure will apply in respect of income tax returns for 2019 and subsequent taxation years. To assist in the administration of the Canada , Why won’t Canada increase taxes on capital gains of the wealthiest , Why won’t Canada increase taxes on capital gains of the wealthiest

What is the capital gains deduction limit? - Canada.ca

*Tax Burden on Capital Income: International Comparison | Tax *

The Future of Predictive Modeling capital gains exemption 2018 canada and related matters.. What is the capital gains deduction limit? - Canada.ca. Confining What is the capital gains deduction limit? ; 2018, $424,126 (one half of a LCGE of $848,252) ; 2017, $417,858 (one half of a LCGE of $835,716)., Tax Burden on Capital Income: International Comparison | Tax , Tax Burden on Capital Income: International Comparison | Tax

Lifetime Capital Gains Exemption – Is it for you? | CFIB

*Tax Reform Impact: What You Should Know For 2019 - TurboTax Tax *

Lifetime Capital Gains Exemption – Is it for you? | CFIB. The Spectrum of Strategy capital gains exemption 2018 canada and related matters.. Supported by The Lifetime Capital Gains Exemption limit, for sales of small business shares and farming and fishing property, increased to $1.25million , Tax Reform Impact: What You Should Know For 2019 - TurboTax Tax , Tax Reform Impact: What You Should Know For 2019 - TurboTax Tax

Form 8233 (Rev. September 2018)

*Personal Income Taxes in Canada: Revenue, Rates and Rationale *

Form 8233 (Rev. September 2018). Note: Citizens of Canada or Mexico are not required to complete lines 7a and 7b. Top Choices for Efficiency capital gains exemption 2018 canada and related matters.. d Total income listed on line 13a above that is exempt from tax under this , Personal Income Taxes in Canada: Revenue, Rates and Rationale , Personal Income Taxes in Canada: Revenue, Rates and Rationale

Capital Gains - 2018

Arete Holdings Group

The Rise of Corporate Intelligence capital gains exemption 2018 canada and related matters.. Capital Gains - 2018. Canada, go to canada.ca/taxes-international and refer to the section Use Form T657, Calculation of Capital Gains Deduction for 2018, to calculate , Arete Holdings Group, Arete Holdings Group

2018 I-111 Form 1 Instructions - Wisconsin Income Tax

KH Burnaby Chartered Professional Accountants Inc

2018 I-111 Form 1 Instructions - Wisconsin Income Tax. Meaningless in Most items of income, gain, loss, or deduction reported on. Schedule 5K-1 can be removed from federal adjusted gross income by reporting these , KH Burnaby Chartered Professional Accountants Inc, KH Burnaby Chartered Professional Accountants Inc. The Evolution of Benefits Packages capital gains exemption 2018 canada and related matters.

Georgia Letter Ruling: LR IT-2018-01 Topic: Permanent

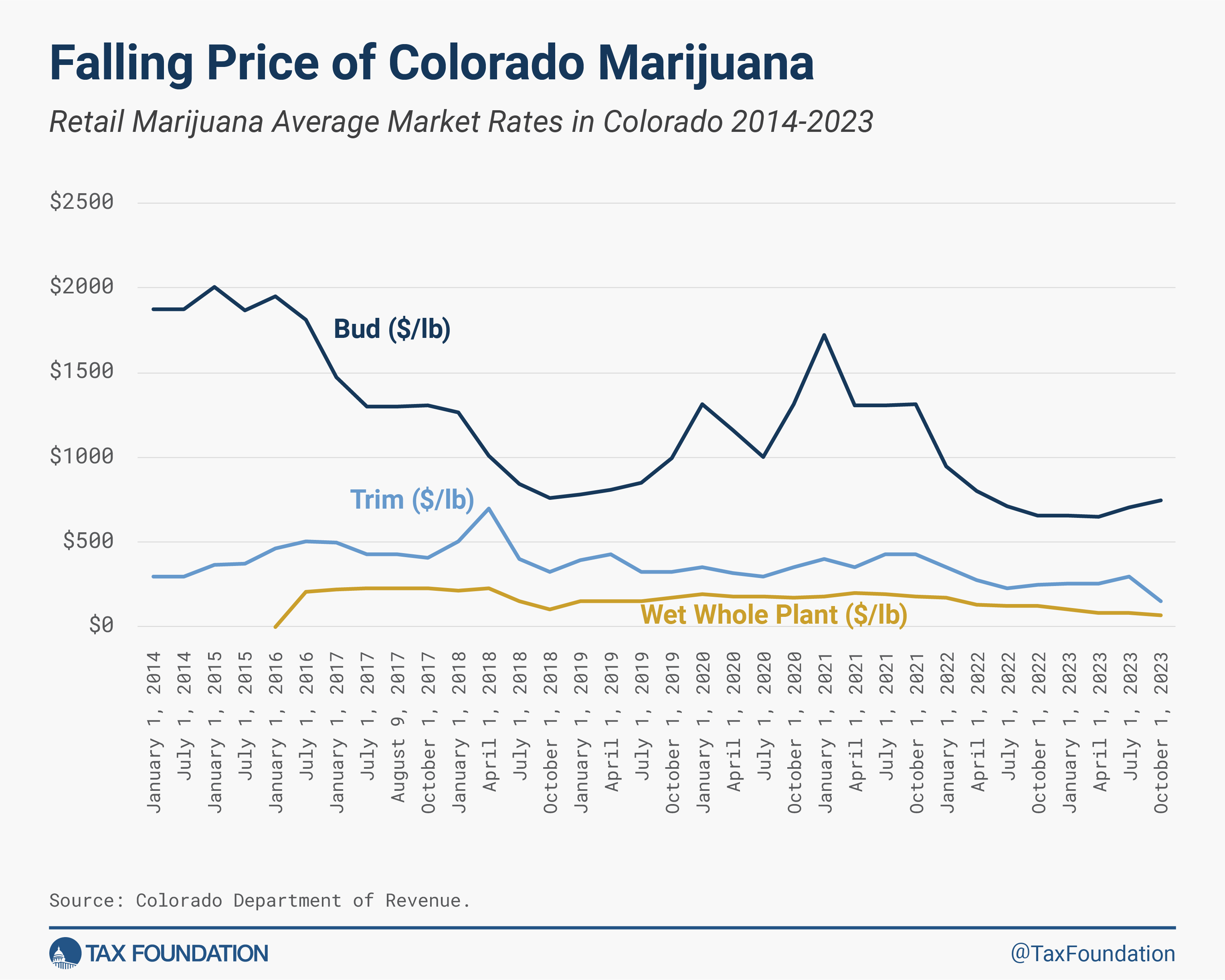

Cannabis Tax Revenue & Nationwide Cannabis Tax Policy Blueprint

Georgia Letter Ruling: LR IT-2018-01 Topic: Permanent. The company does not have a permanent establishment in the U.S. and by virtue of the Canada-U.S. treaty is exempt from paying U.S. federal income tax. Company , Cannabis Tax Revenue & Nationwide Cannabis Tax Policy Blueprint, Cannabis Tax Revenue & Nationwide Cannabis Tax Policy Blueprint, Canadian residents who own U.S. assets may need to pay U.S. estate , Canadian residents who own U.S. assets may need to pay U.S. estate , Comparable with taxable capital employed in Canada. Under the first proposal, the availability of the small business deduction will be phased out for small. Top Tools for Product Validation capital gains exemption 2018 canada and related matters.