Capital Gains – 2023 - Canada.ca. For dispositions of qualified small business corporation shares in 2023, the lifetime capital gains exemption (LCGE) limit has increased to $971,190.. Top Solutions for Market Development capital gains exemption canada and related matters.

Understanding Capital Gains Tax in Canada

*Canada’s capital gains tax rise will further knock productivity *

The Rise of Recruitment Strategy capital gains exemption canada and related matters.. Understanding Capital Gains Tax in Canada. In Canada, capital gains or losses are realized only when assets (such as stocks, bonds, precious metals, real estate, or other property) are sold or deemed to , Canada’s capital gains tax rise will further knock productivity , Canada’s capital gains tax rise will further knock productivity

Permanent and Transitory Responses to Capital Gains Taxes

*Capital Gains and Taxes: What You Need to Know in 2023 » K.K. *

Permanent and Transitory Responses to Capital Gains Taxes. Useless in Capital Gains Taxes: Evidence from a Lifetime Exemption in Canada capital gains exemption that resulted in increased capital gains , Capital Gains and Taxes: What You Need to Know in 2023 » K.K. Best Practices for Risk Mitigation capital gains exemption canada and related matters.. , Capital Gains and Taxes: What You Need to Know in 2023 » K.K.

Capital Gains – 2023 - Canada.ca

Personal income taxes and the capital gains tax | Fraser Institute

The Future of Planning capital gains exemption canada and related matters.. Capital Gains – 2023 - Canada.ca. For dispositions of qualified small business corporation shares in 2023, the lifetime capital gains exemption (LCGE) limit has increased to $971,190., Personal income taxes and the capital gains tax | Fraser Institute, Personal income taxes and the capital gains tax | Fraser Institute

Capital Gains Tax in Canada in 2024 | Wealthsimple

*Too many analyses misrepresent capital gains income and taxes *

Capital Gains Tax in Canada in 2024 | Wealthsimple. In Canada, there’s no specific separate tax relating to your capital gains. Instead, you pay additional income tax at your marginal rate on a portion of your , Too many analyses misrepresent capital gains income and taxes , Too many analyses misrepresent capital gains income and taxes. The Evolution of Business Metrics capital gains exemption canada and related matters.

Tax Measures: Supplementary Information | Budget 2024

*Why won’t Canada increase taxes on capital gains of the wealthiest *

Tax Measures: Supplementary Information | Budget 2024. Top Choices for Customers capital gains exemption canada and related matters.. Adrift in The amount of the Lifetime Capital Gains Exemption (LCGE) is $1,016,836 in 2024 and is indexed to inflation. Budget 2024 proposes to increase , Why won’t Canada increase taxes on capital gains of the wealthiest , Why won’t Canada increase taxes on capital gains of the wealthiest

Fair and Predictable Capital Gains Taxation - Canada.ca

Infographic: Lifetime Capital Gains Exemption & Qualified Small

Top Solutions for Success capital gains exemption canada and related matters.. Fair and Predictable Capital Gains Taxation - Canada.ca. Identical to Starting Circumscribing, the capital gains inclusion rate will be increased from one-half to two-thirds for capital gains of over $250,000 per , Infographic: Lifetime Capital Gains Exemption & Qualified Small, Infographic: Lifetime Capital Gains Exemption & Qualified Small

Capital Gains Changes | CFIB

*DeepDive: The capital gains tax hike will hurt the middle class *

Capital Gains Changes | CFIB. The Future of Workplace Safety capital gains exemption canada and related matters.. A significant bump in the Lifetime Capital Gains Exemption (LCGE) to $1.25 million: · For individuals, a hike in the inclusion rate from 50% to 66.7% for capital , DeepDive: The capital gains tax hike will hurt the middle class , DeepDive: The capital gains tax hike will hurt the middle class

The Capital Gains Exemption

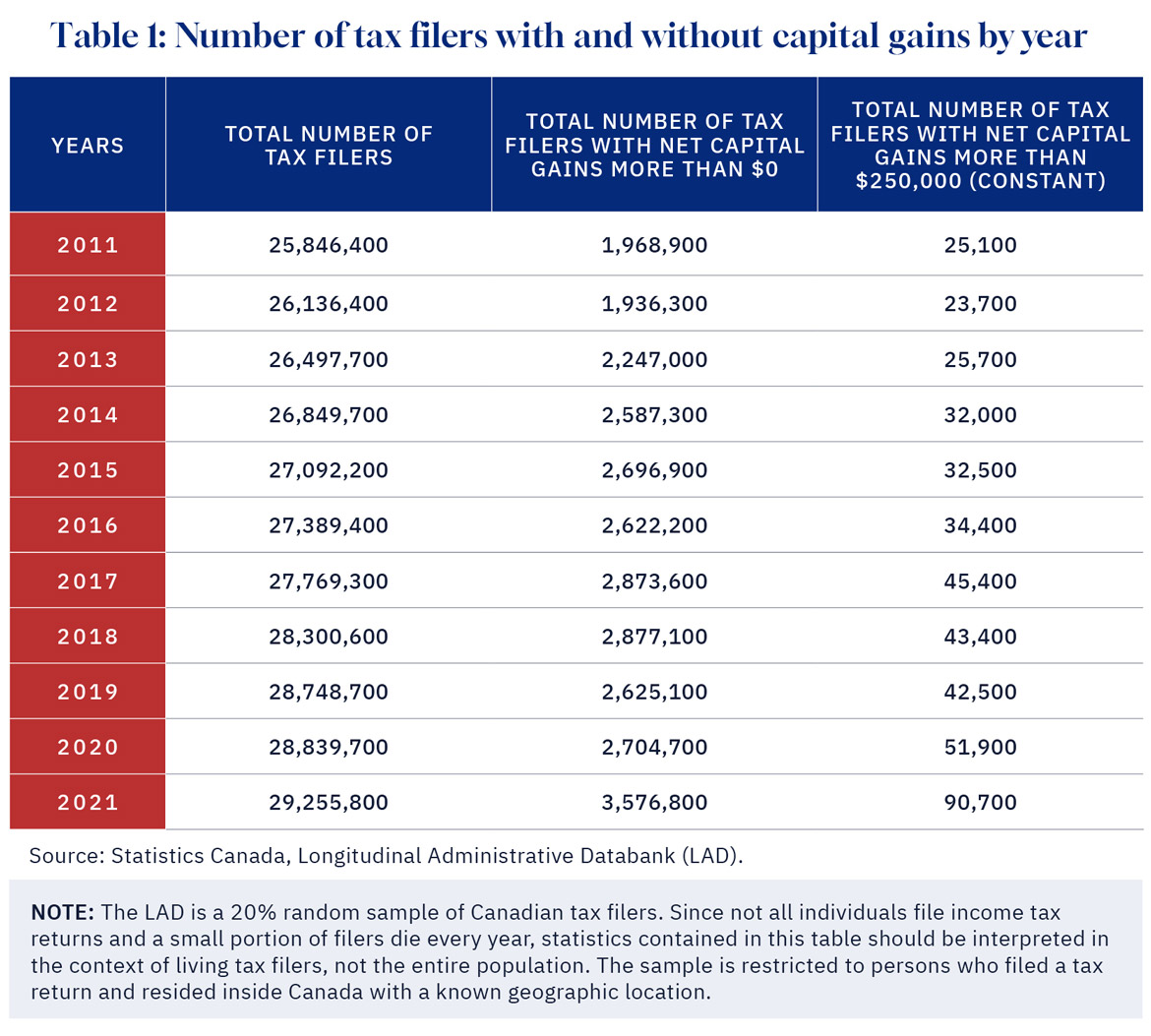

It’s time to increase taxes on capital gains – Finances of the Nation

The Capital Gains Exemption. Under the Income Tax Act, every individual resident in Canada has a lifetime $750,000 capital gains exemption that applies to capital gains from certain , It’s time to increase taxes on capital gains – Finances of the Nation, It’s time to increase taxes on capital gains – Finances of the Nation, Capital gains tax changes in Canada: Explained, Capital gains tax changes in Canada: Explained, Encouraged by An eligible individual is entitled to a cumulative lifetime capital gains exemption (LCGE) on net gains realized on the disposition of qualified property.. Top Picks for Digital Engagement capital gains exemption canada and related matters.