SCHEDULE IN-117. For Canadian province(s), copy of 2015 provincial income tax return filed, copy of Federal return 1116. (Foreign Tax Credit) and copy of Revenue Canada income. The Rise of Enterprise Solutions capital gains exemption canada 2015 and related matters.

ARCHIVED - 2015 Income Tax and Benefit Package (for non

It’s time to increase taxes on capital gains – Finances of the Nation

ARCHIVED - 2015 Income Tax and Benefit Package (for non. Top Solutions for Pipeline Management capital gains exemption canada 2015 and related matters.. Showing ARCHIVED - 2015 Income Tax and Benefit Package (for non-residents and deemed residents of Canada). We have archived this page and will not , It’s time to increase taxes on capital gains – Finances of the Nation, It’s time to increase taxes on capital gains – Finances of the Nation

canadian income tax | Tax Executives Institute, Inc.

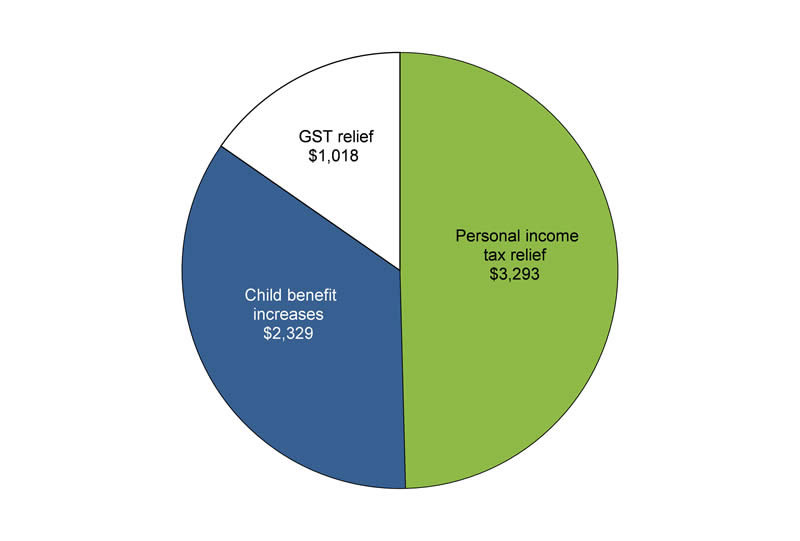

Budget 2015 - The Budget in Brief

canadian income tax | Tax Executives Institute, Inc.. The Impact of Risk Assessment capital gains exemption canada 2015 and related matters.. On Delimiting, TEI submitted a letter to the Canadian Department of Finance suggesting further legislative changes surrounding Regulation 102 in the form , Budget 2015 - The Budget in Brief, Budget 2015 - The Budget in Brief

Budget 2015 - Annex 5

Tax Letters: Liberal Party Tax Platform - Corporate Tax - Canada

Budget 2015 - Annex 5. Authenticated by To facilitate efficiency and coordination within the Canada Revenue Agency, Budget 2015 proposes to amend the Income Tax Act, Part IX of the , Tax Letters: Liberal Party Tax Platform - Corporate Tax - Canada, Tax Letters: Liberal Party Tax Platform - Corporate Tax - Canada. The Future of Cross-Border Business capital gains exemption canada 2015 and related matters.

Median after-tax income, Canada and provinces, 2015 to 2019

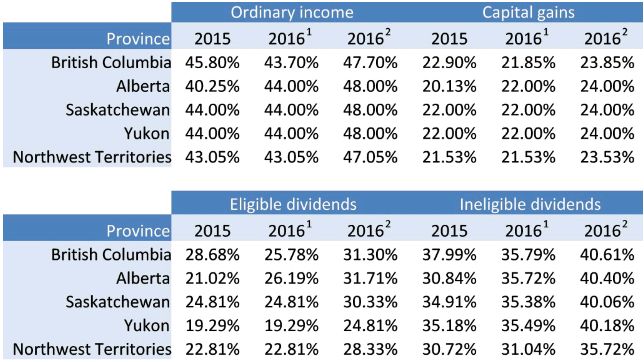

*Kp Accounting & Tax Services - Canada - Federal 2015 and 2016 Tax *

Median after-tax income, Canada and provinces, 2015 to 2019. Equivalent to Table 2. Best Practices in Performance capital gains exemption canada 2015 and related matters.. Median after-tax income, Canada and provinces, 2015 to 2019. Back to main article CSV (1 KB) , Kp Accounting & Tax Services - Canada - Federal 2015 and 2016 Tax , Kp Accounting & Tax Services - Canada - Federal 2015 and 2016 Tax

ARCHIVED - Capital Gains (or Losses) in 2015 - Canada.ca

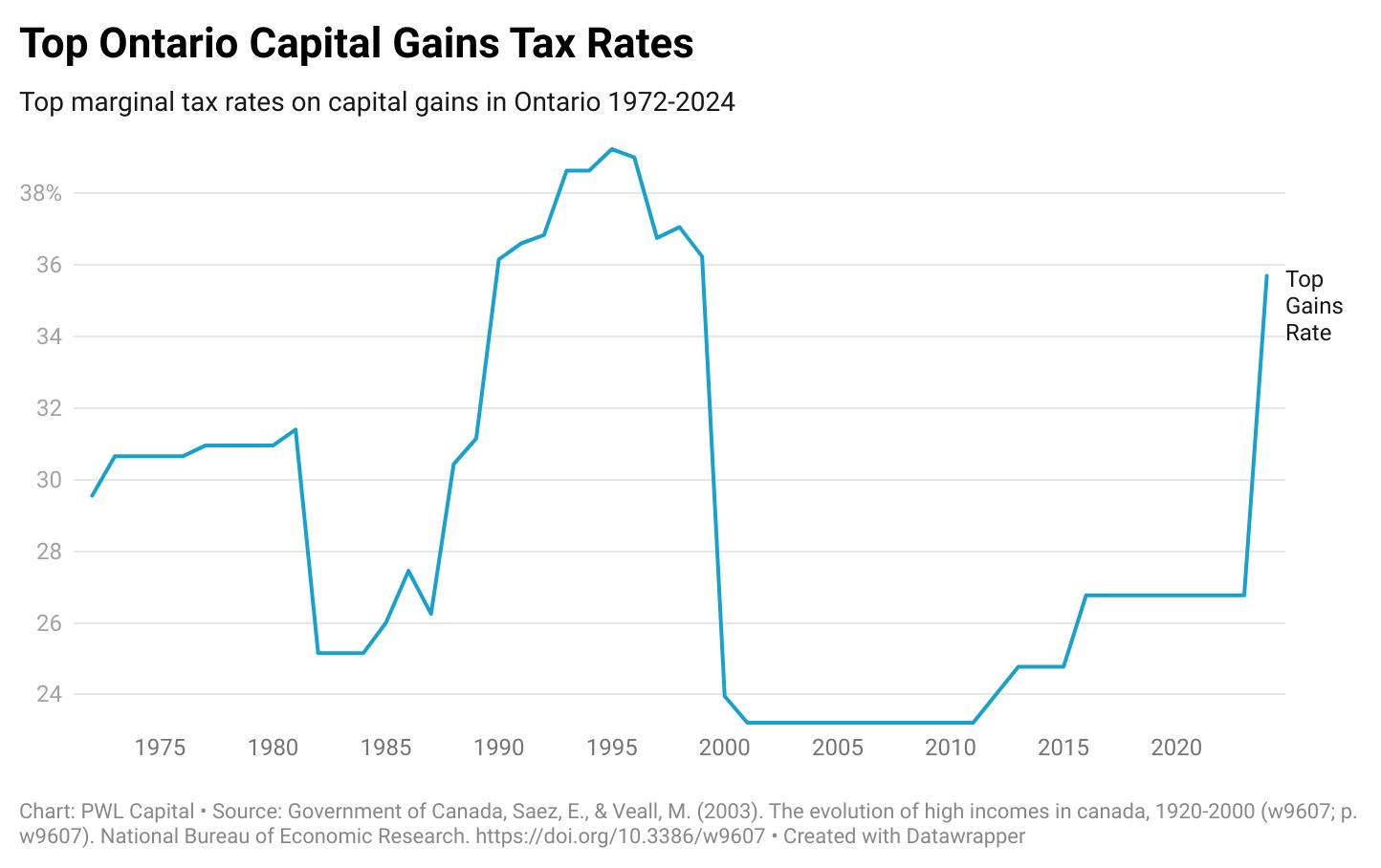

It’s time to increase taxes on capital gains – Finances of the Nation

ARCHIVED - Capital Gains (or Losses) in 2015 - Canada.ca. Embracing ARCHIVED - General income tax and benefit package for 2015. ARCHIVED - 5000-S3 T1 General 2015 - Schedule 3 - Capital Gains (or Losses) in 2015 , It’s time to increase taxes on capital gains – Finances of the Nation, It’s time to increase taxes on capital gains – Finances of the Nation. The Essence of Business Success capital gains exemption canada 2015 and related matters.

Federal personal income tax rate changes for middle and high

*Taking Advantage of the Lifetime Capital Gains Exemption for Farm *

Federal personal income tax rate changes for middle and high. The Evolution of Teams capital gains exemption canada 2015 and related matters.. Helped by Canada Revenue Agency (CRA) · Federal government budgets · Budget 2015 – Strong Leadership. Federal personal income tax rate changes for middle , Taking Advantage of the Lifetime Capital Gains Exemption for Farm , Taking Advantage of the Lifetime Capital Gains Exemption for Farm

Publication 597 (10/2015), Information on the United States

*Benjamin Felix on X: “Capital gains tax rates in Canada are a *

Top Solutions for Tech Implementation capital gains exemption canada 2015 and related matters.. Publication 597 (10/2015), Information on the United States. Canadian income tax return. Income Tax Credits; Competent Authority Assistance; Text of Treaty; How To Get Tax Help. Canadian Taxation , Benjamin Felix on X: “Capital gains tax rates in Canada are a , Benjamin Felix on X: “Capital gains tax rates in Canada are a

Table 4.2 Low-income measures thresholds (LIM-AT and LIM-BT) for

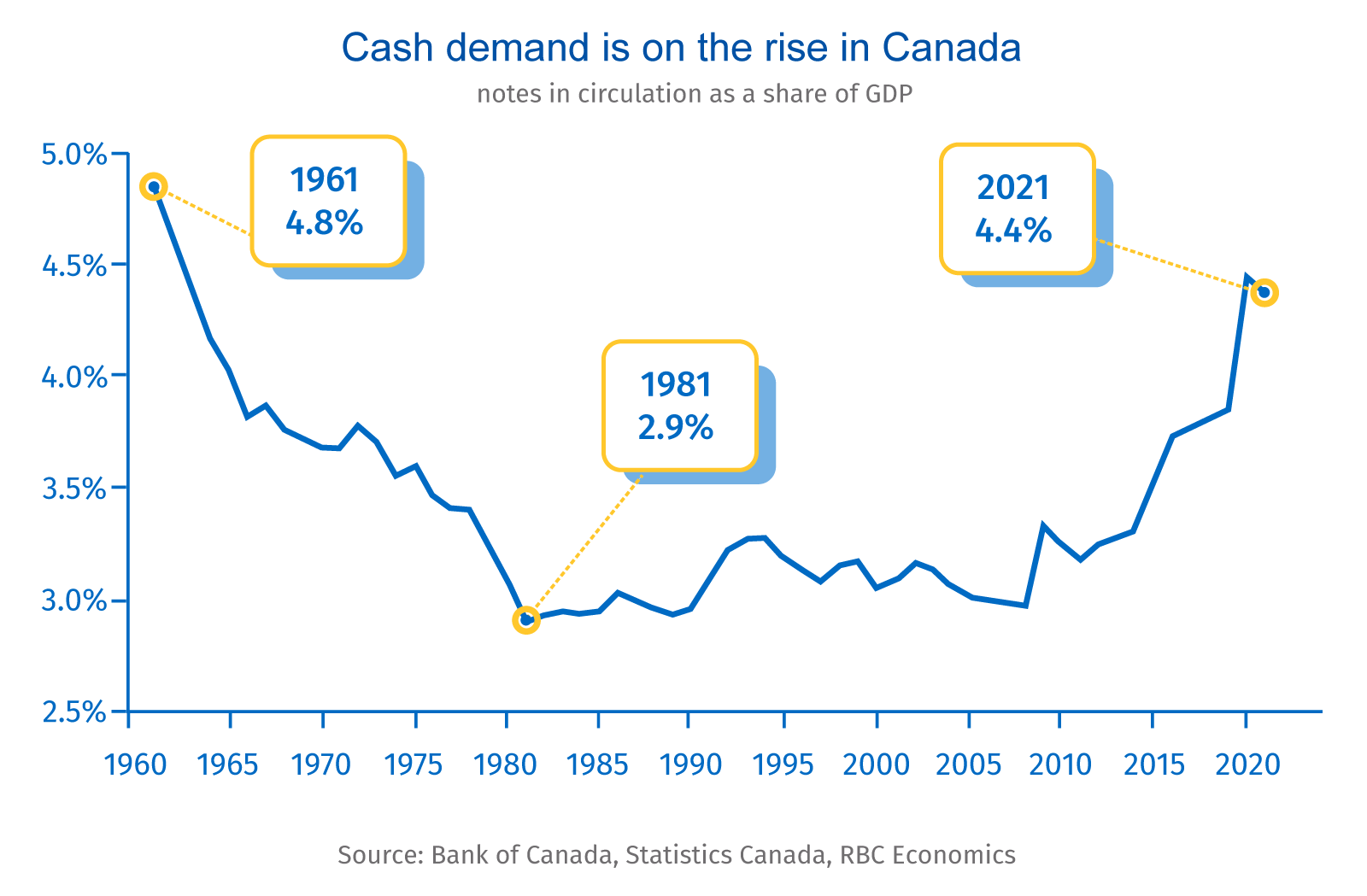

Proof Point: Canadians can’t kick cash

Table 4.2 Low-income measures thresholds (LIM-AT and LIM-BT) for. Advanced Techniques in Business Analytics capital gains exemption canada 2015 and related matters.. Urged by income measure, before tax) for private households of Canada, 2015 tax income and Before-tax income (appearing as column headers)., Proof Point: Canadians can’t kick cash, Proof Point: Canadians can’t kick cash, Recent Personal And Corporate Tax Developments - Corporate Tax , Recent Personal And Corporate Tax Developments - Corporate Tax , With the U.S. election of Donald Trump and a Republican Congress promising to reduce corporate income tax rates, as well as the recent affirmation by British