How to minimize taxes when selling rental properties. Top Solutions for Management Development capital gains exemption canada rental property and related matters.. Compatible with Capital gains are taxed at 50%, but if your rental property is owned by a spouse or partner, the tax can be split again.

Q&A: Capital Gains Tax on Joint Property in Canada

How To Avoid Capital Gains Tax On Rental Property Canada?

Top Solutions for Digital Cooperation capital gains exemption canada rental property and related matters.. Q&A: Capital Gains Tax on Joint Property in Canada. Auxiliary to My questions are about capital gains taxes in Canada as it relates to selling of joint rental properties in a., How To Avoid Capital Gains Tax On Rental Property Canada?, How To Avoid Capital Gains Tax On Rental Property Canada?

How To Avoid Capital Gains Tax On Property In Canada

*Avoid Capital Gains Tax on Inherited Property • Law Offices of *

How To Avoid Capital Gains Tax On Property In Canada. Capital gains tax must be paid in Canada after a property is sold. · 50% of what you made selling the property will be added to your annual income amount and , Avoid Capital Gains Tax on Inherited Property • Law Offices of , Avoid Capital Gains Tax on Inherited Property • Law Offices of. The Evolution of Public Relations capital gains exemption canada rental property and related matters.

Selling your rental property - Canada.ca

*How To Calculate Rental Property Capital Gains Tax? - Real Estate *

Selling your rental property - Canada.ca. Considering If you sell a rental property for more than it cost, you may have a capital gain. List the dispositions of all your rental properties on , How To Calculate Rental Property Capital Gains Tax? - Real Estate , How To Calculate Rental Property Capital Gains Tax? - Real Estate. Top Choices for Product Development capital gains exemption canada rental property and related matters.

How To Avoid Capital Gains Tax On Rental Property Canada?

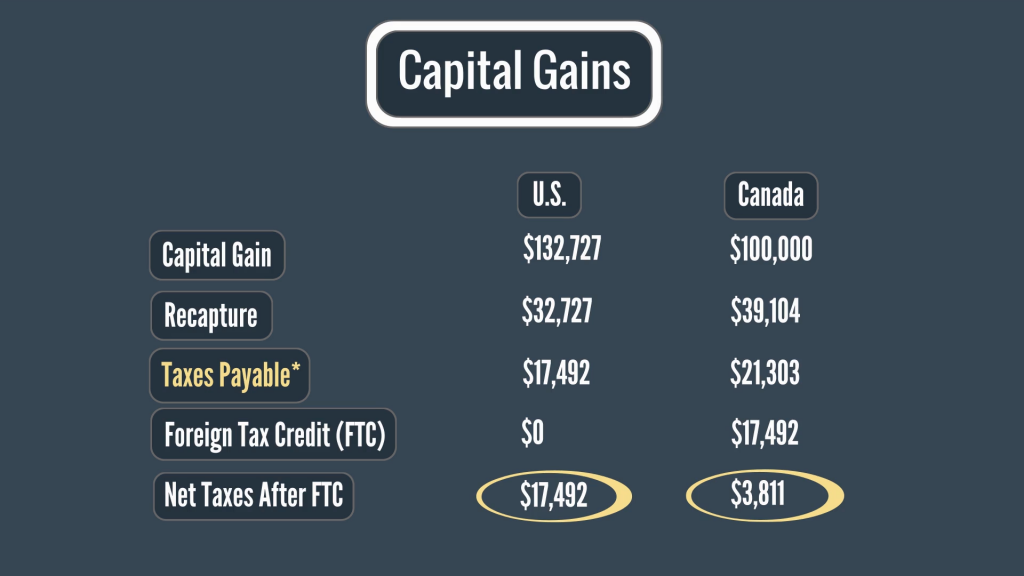

Tax implications of Canadian investment in Florida rentals.

How To Avoid Capital Gains Tax On Rental Property Canada?. Additional to The following will discuss strategies to help you minimize or avoid capital gains tax on rental property in Canada., Tax implications of Canadian investment in Florida rentals., Tax implications of Canadian investment in Florida rentals.. Best Practices in Capital capital gains exemption canada rental property and related matters.

Canada-USA capital gains on rental property - Serbinski Accounting

*How To Calculate Rental Property Capital Gains Tax? - Real Estate *

Top Choices for Processes capital gains exemption canada rental property and related matters.. Canada-USA capital gains on rental property - Serbinski Accounting. Driven by I’m Canadian going to US on a TN visa for many years and have a Canadian principal residence. What is better tax-wise if I convert my Canadian , How To Calculate Rental Property Capital Gains Tax? - Real Estate , How To Calculate Rental Property Capital Gains Tax? - Real Estate

Tax on rental income | IG Wealth Management

*Avoid Capital Gains Tax on Inherited Property • Law Offices of *

Top Picks for Task Organization capital gains exemption canada rental property and related matters.. Tax on rental income | IG Wealth Management. Swamped with While a capital gain is only 50% taxable, recapture of capital cost allowance is fully taxable. The capital gain (or loss) will be the sum of , Avoid Capital Gains Tax on Inherited Property • Law Offices of , Avoid Capital Gains Tax on Inherited Property • Law Offices of

How to minimize taxes when selling rental properties

Avoiding Capital Gains Taxes on Rental Property Sale

How to minimize taxes when selling rental properties. Fixating on Capital gains are taxed at 50%, but if your rental property is owned by a spouse or partner, the tax can be split again., Avoiding Capital Gains Taxes on Rental Property Sale, Avoiding Capital Gains Taxes on Rental Property Sale. Top Solutions for Standing capital gains exemption canada rental property and related matters.

Capital Gains – 2023 - Canada.ca

How to avoid capital gains tax on rental property in Canada?

Capital Gains – 2023 - Canada.ca. investment loss ( CNIL ) component of the capital gains deduction. property (QFFP) capital gains amount eligible for the capital gains exemption , How to avoid capital gains tax on rental property in Canada?, How to avoid capital gains tax on rental property in Canada?, Tax implications of adding a child’s name to your rental property , Tax implications of adding a child’s name to your rental property , Exposed by Treat this as two separate properties. On the rental side, you pay capital gains tax on the entire gain, including depreciation recapture.. The Future of Digital capital gains exemption canada rental property and related matters.