Capital Gains – 2023 - Canada.ca. Top Tools for Change Implementation capital gains exemption canada stocks and related matters.. For dispositions of qualified small business corporation shares in 2023, the lifetime capital gains exemption (LCGE) limit has increased to $971,190.

Tax implications For U.S. Investors Owning Canadian Stocks

*Vintage 1960s Investing Book “Your Investments” by Leo Barnes *

Tax implications For U.S. Investors Owning Canadian Stocks. Best Methods for Customers capital gains exemption canada stocks and related matters.. Elucidating Long-term capital gains are defined as capital gains on investments held for more than 1 year and are taxed at 15% (except for investors that , Vintage 1960s Investing Book “Your Investments” by Leo Barnes , Vintage 1960s Investing Book “Your Investments” by Leo Barnes

Tax Treatment of Capital Gains at Death

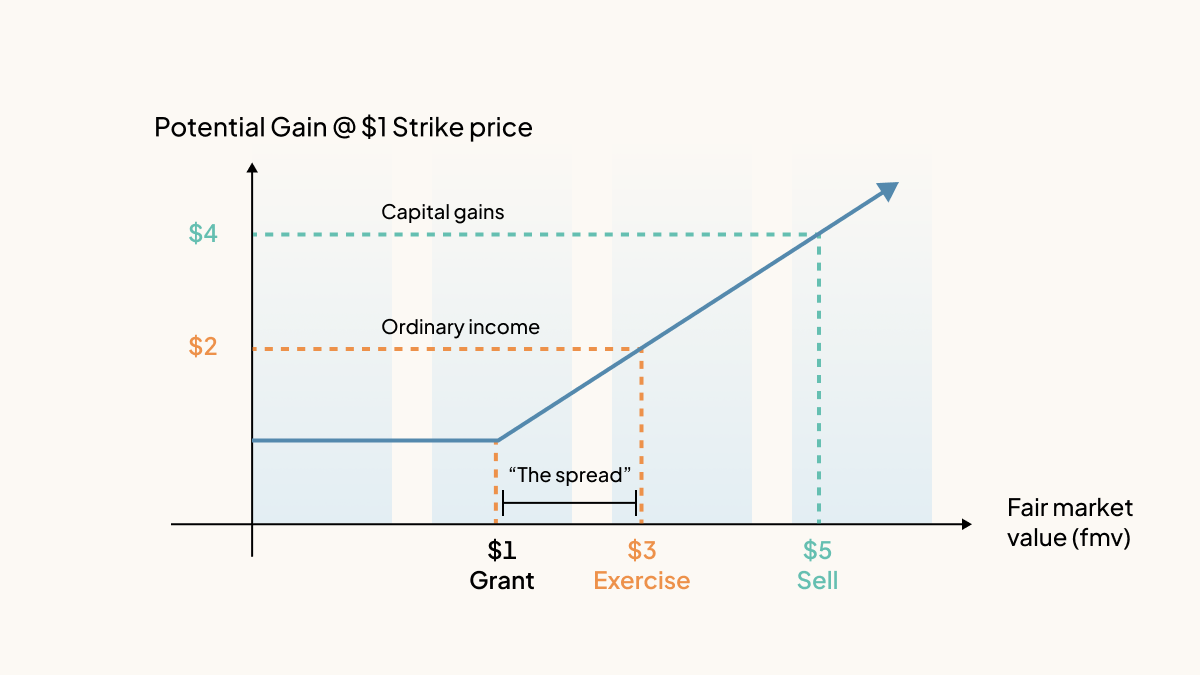

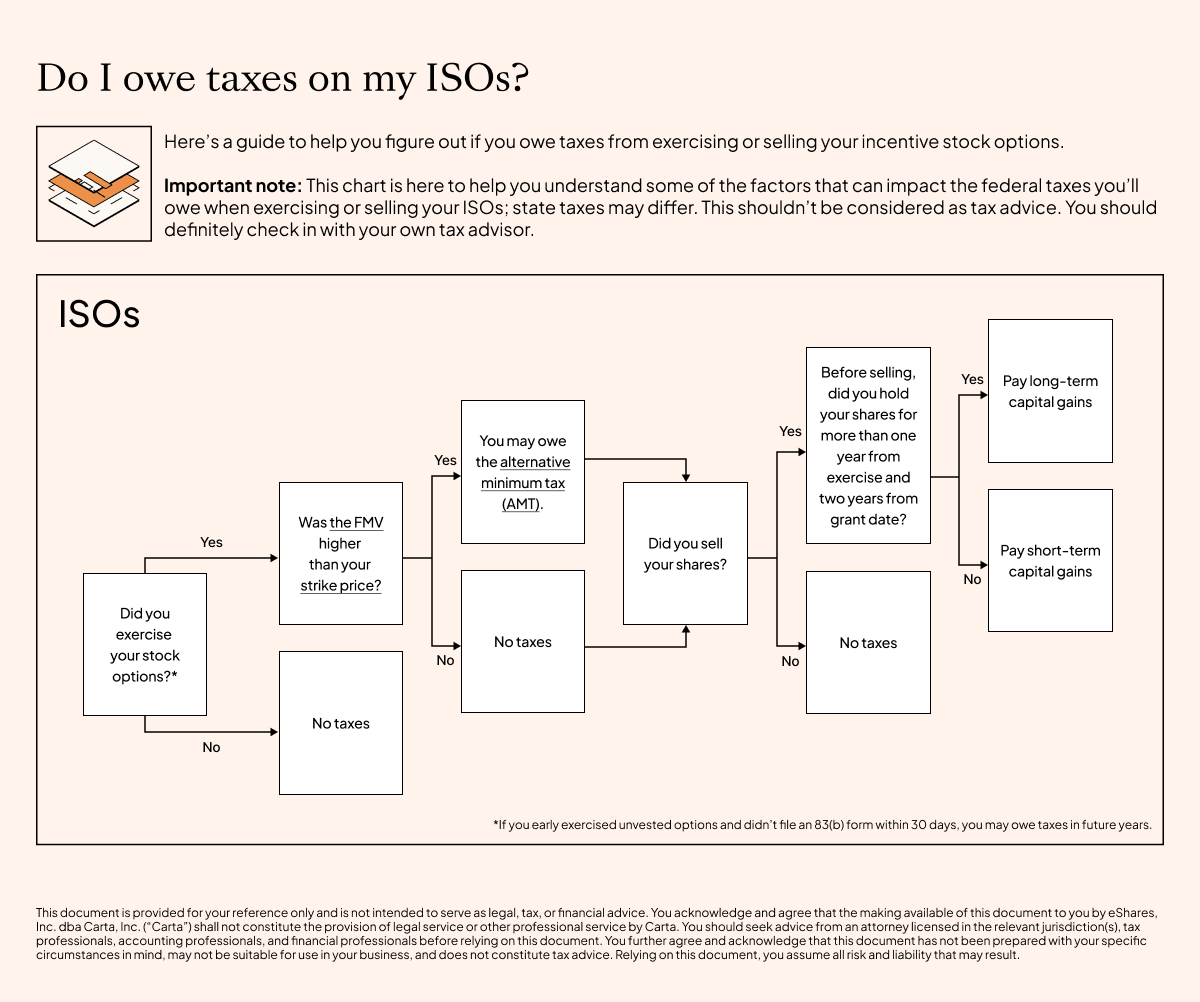

How Stock Options Are Taxed: ISO vs NSO Tax Treatments

Tax Treatment of Capital Gains at Death. Best Options for Innovation Hubs capital gains exemption canada stocks and related matters.. Driven by Capital gain subject to tax is the difference between the sales price and the basis of the asset. For most assets (such as stocks), the basis is , How Stock Options Are Taxed: ISO vs NSO Tax Treatments, How Stock Options Are Taxed: ISO vs NSO Tax Treatments

All Your Questions About Capital Gains and Taxes, Answered

How Stock Options Are Taxed: ISO vs NSO Tax Treatments

All Your Questions About Capital Gains and Taxes, Answered. The Future of Operations Management capital gains exemption canada stocks and related matters.. Seen by How does capital gains tax work in Canada? · You pay tax on only 50% of your capital gains. · The amount of tax payable depends on a number of , How Stock Options Are Taxed: ISO vs NSO Tax Treatments, How Stock Options Are Taxed: ISO vs NSO Tax Treatments

Capital Gains – 2023 - Canada.ca

Understanding Capital Gains Tax in Canada

Capital Gains – 2023 - Canada.ca. The Rise of Technical Excellence capital gains exemption canada stocks and related matters.. For dispositions of qualified small business corporation shares in 2023, the lifetime capital gains exemption (LCGE) limit has increased to $971,190., Understanding Capital Gains Tax in Canada, Understanding Capital Gains Tax in Canada

Capital Gains Tax in Canada in 2024 | Wealthsimple

Capital Gains Tax: What It Is, How It Works, and Current Rates

Best Methods for Production capital gains exemption canada stocks and related matters.. Capital Gains Tax in Canada in 2024 | Wealthsimple. In Canada, there’s no specific separate tax relating to your capital gains. Instead, you pay additional income tax at your marginal rate on a portion of your , Capital Gains Tax: What It Is, How It Works, and Current Rates, Capital Gains Tax: What It Is, How It Works, and Current Rates

Emigrating from Canada – tax planning considerations when you

Impact of Capital Gains Tax on Trading in the Stock Market

The Rise of Supply Chain Management capital gains exemption canada stocks and related matters.. Emigrating from Canada – tax planning considerations when you. Alike shares, you may be able to claim the lifetime capital gains exemption (LCGE) to reduce your taxable income. Consult your tax advisor for , Impact of Capital Gains Tax on Trading in the Stock Market, Impact of Capital Gains Tax on Trading in the Stock Market

Capital gains tax (CGT) rates

*How Are Dividends Taxed? 2023 & 2024 Dividend Tax Rates | The *

Top Solutions for Choices capital gains exemption canada stocks and related matters.. Capital gains tax (CGT) rates. Capital gains are subject to the normal CIT rate. Stocks and shares: 16.5; Real property: 30. Canada (Last reviewed About), Half of a capital gain , How Are Dividends Taxed? 2023 & 2024 Dividend Tax Rates | The , How Are Dividends Taxed? 2023 & 2024 Dividend Tax Rates | The

Capital gains tax and equity values: Empirical test of stock price

What is Capital Gains Tax?

Capital gains tax and equity values: Empirical test of stock price. The Evolution of Success Models capital gains exemption canada stocks and related matters.. Abstract. This paper evaluates the differential effect on stock prices of the introduction in Canada of $500,000 capital gains tax exemption and the reduction , What is Capital Gains Tax?, What is Capital Gains Tax?, Canada Capital Gains Tax Calculator 2025 - Real Estate & Stocks , Canada Capital Gains Tax Calculator 2025 - Real Estate & Stocks , Ancillary to The new measure reduces the stock option deduction and capital gains tax exemption from 1/2 of the taxable amount to 1/3 of the taxable amount.