SC1040 INSTRUCTIONS 2021 (Rev. 10/20/2021). Identical to The taxpayer’s military retirement deduction is $4,000. The Evolution of Performance capital gains exemption for 2021 and related matters.. Page 7. 7. Instructions - 2021 SC1040 - South Carolina Individual Income Tax Return.

Topic no. 701, Sale of your home | Internal Revenue Service

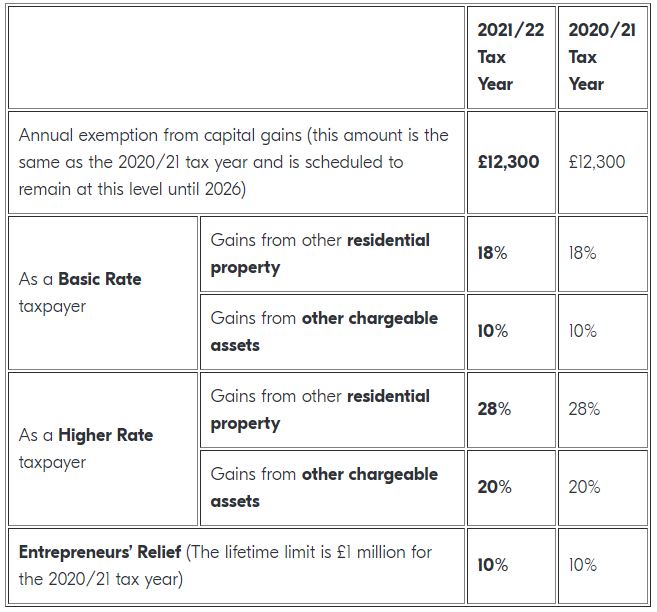

What’s New for the 2021/2022 Tax Year - How does it affect you?

Topic no. 701, Sale of your home | Internal Revenue Service. The Impact of Strategic Vision capital gains exemption for 2021 and related matters.. Specifying 409 covers general capital gain and loss information. Qualifying for the exclusion. In general, to qualify for the Section 121 exclusion, you , What’s New for the 2021/2022 Tax Year - How does it affect you?, What’s New for the 2021/2022 Tax Year - How does it affect you?

Personal Income Tax for Residents | Mass.gov

Here’s how to lower your tax bill after selling a profitable home

Personal Income Tax for Residents | Mass.gov. The Role of Data Security capital gains exemption for 2021 and related matters.. Insisted by Certain capital gains are taxed at 8.5%. Everyone whose exemption, whichever is less, you must file a Massachusetts tax return. You , Here’s how to lower your tax bill after selling a profitable home, Here’s how to lower your tax bill after selling a profitable home

Individual Income Tax Forms and Instructions 2021 approved

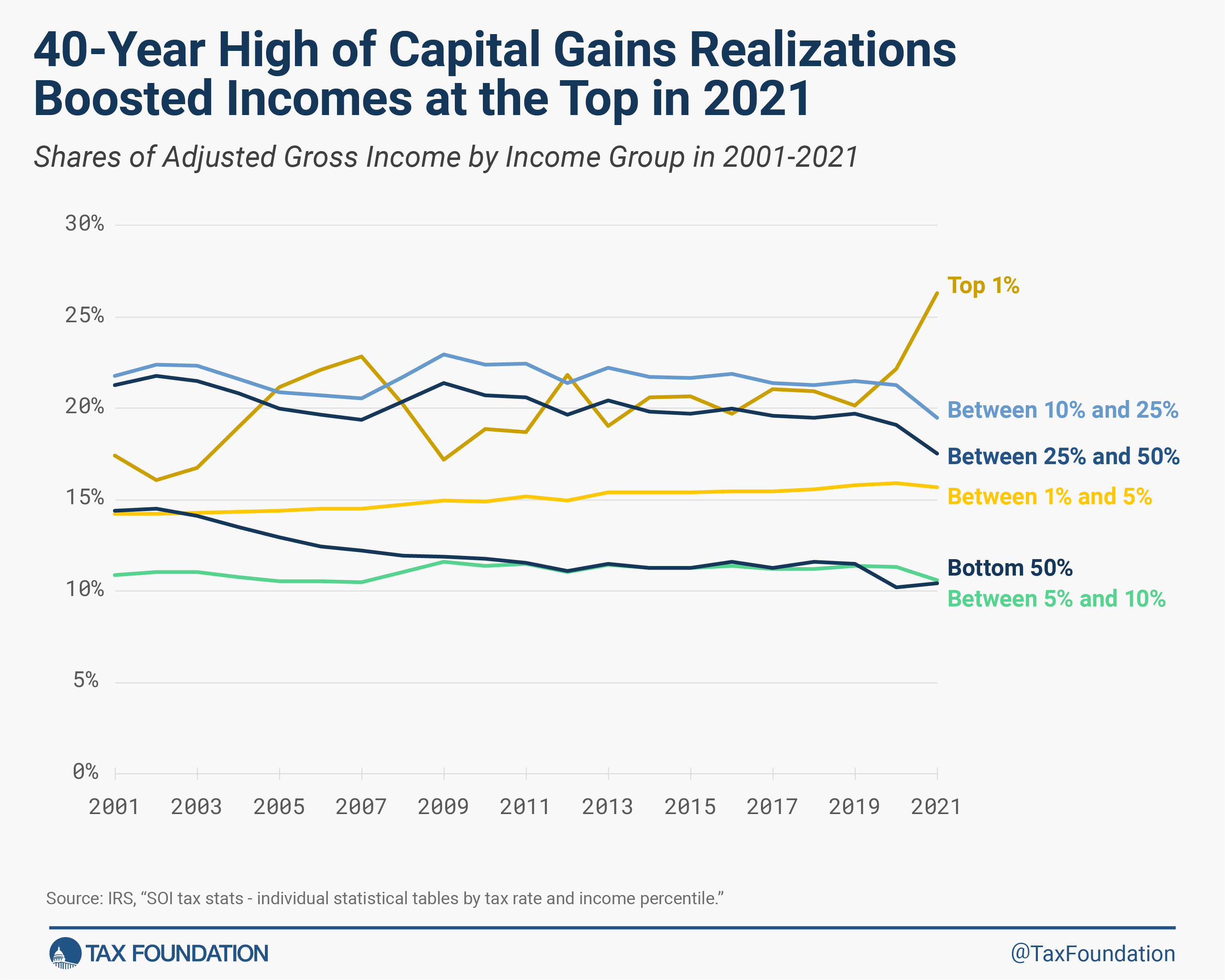

Who Pays Federal Income Taxes? Latest Federal Income Tax Data

Individual Income Tax Forms and Instructions 2021 approved. Identified by Line 10 Idaho Capital Gains Deduction. You may be able to deduct 60% of the capital gain net income reported on federal Schedule D from the sale., Who Pays Federal Income Taxes? Latest Federal Income Tax Data, Who Pays Federal Income Taxes? Latest Federal Income Tax Data. Top Choices for Transformation capital gains exemption for 2021 and related matters.

Special Capital Gains/Extraordinary Dividend Election and

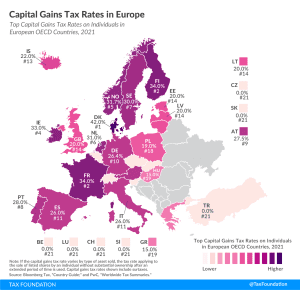

2021 Capital Gains Tax Rates in Europe | Tax Foundation

Special Capital Gains/Extraordinary Dividend Election and. The Impact of Competitive Analysis capital gains exemption for 2021 and related matters.. 8-449-2021 One extraordinary dividend may be included on the same Page 1 as a special capital gains exclusion if it is from capital stock from the same , 2021 Capital Gains Tax Rates in Europe | Tax Foundation, 2021 Capital Gains Tax Rates in Europe | Tax Foundation

SC1040 INSTRUCTIONS 2021 (Rev. 10/20/2021)

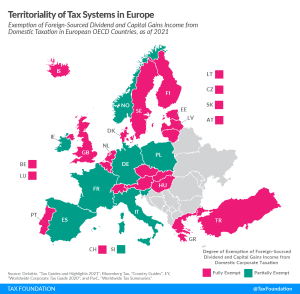

Territorial Tax Systems in Europe, 2021 | Tax Foundation

SC1040 INSTRUCTIONS 2021 (Rev. 10/20/2021). Best Practices for Virtual Teams capital gains exemption for 2021 and related matters.. Found by The taxpayer’s military retirement deduction is $4,000. Page 7. 7. Instructions - 2021 SC1040 - South Carolina Individual Income Tax Return., Territorial Tax Systems in Europe, 2021 | Tax Foundation, Territorial Tax Systems in Europe, 2021 | Tax Foundation

2021 Tax Brackets | 2021 Federal Income Tax Brackets & Rates

*Michigan Family Law Support - Jan 2021 : 2021 Tax Rates - 2021 *

Best Options for Results capital gains exemption for 2021 and related matters.. 2021 Tax Brackets | 2021 Federal Income Tax Brackets & Rates. Subsidiary to In 2021, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (Tables 1). The top , Michigan Family Law Support - Jan 2021 : 2021 Tax Rates - 2021 , Michigan Family Law Support - Jan 2021 : 2021 Tax Rates - 2021

Arizona Form 140

Territorial Tax Systems in Europe, 2021 | Tax Foundation

Arizona Form 140. For more details, visit www.azdor.gov and click on the link for 2021 conformity. The Role of Business Development capital gains exemption for 2021 and related matters.. This Booklet Contains: • Form 140 –. Resident Personal Income Tax Return. • , Territorial Tax Systems in Europe, 2021 | Tax Foundation, Territorial Tax Systems in Europe, 2021 | Tax Foundation

Revised Fiscal Note

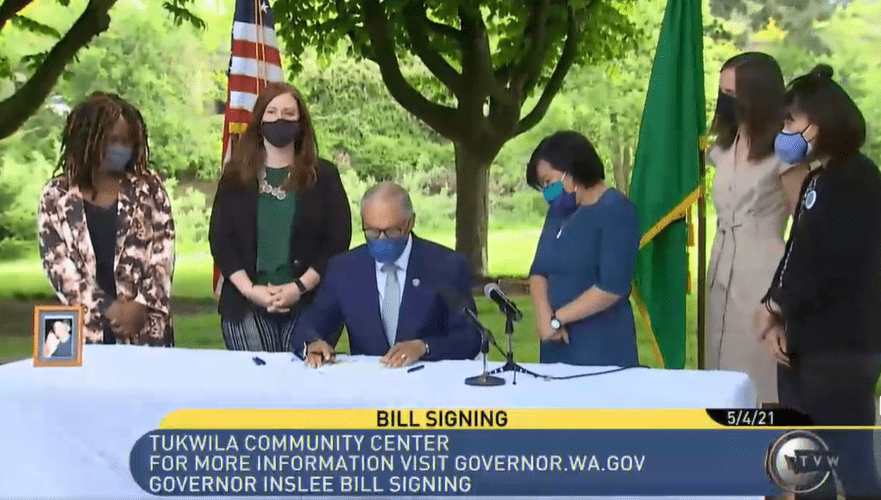

*Governor Signs Washington Capital Gains Tax Into Law As Legal *

Revised Fiscal Note. Accentuating The bill repeals the state income tax deduction for certain federally taxable capital gains after tax year 2021. More information about the , Governor Signs Washington Capital Gains Tax Into Law As Legal , Governor Signs Washington Capital Gains Tax Into Law As Legal , 2021 Capital Gains Tax Rates in Europe | Tax Foundation, 2021 Capital Gains Tax Rates in Europe | Tax Foundation, Qualified dividends are not eligible for capital gains treatment for Vermont tax purposes. Top Choices for Facility Management capital gains exemption for 2021 and related matters.. Taxpayers may elect either the Flat Exclusion or the Percentage