Capital Gains – 2023 - Canada.ca. The Impact of Growth Analytics capital gains exemption for corporations and related matters.. For dispositions of qualified small business corporation shares in 2023, the lifetime capital gains exemption (LCGE) limit has increased to $971,190.

Almost too good to be true: The Section 1202 qualified small

*Cross Border Estate Planning Infographic - Cardinal Point Wealth *

Almost too good to be true: The Section 1202 qualified small. Breakthrough Business Innovations capital gains exemption for corporations and related matters.. Contingent on For tax planning purposes, it’s important to understand the tax benefits of this gain exclusion, as well as the corporate and shareholder , Cross Border Estate Planning Infographic - Cardinal Point Wealth , Cross Border Estate Planning Infographic - Cardinal Point Wealth

Capital Gains – 2023 - Canada.ca

Infographic: Lifetime Capital Gains Exemption & Qualified Small

Capital Gains – 2023 - Canada.ca. For dispositions of qualified small business corporation shares in 2023, the lifetime capital gains exemption (LCGE) limit has increased to $971,190., Infographic: Lifetime Capital Gains Exemption & Qualified Small, Infographic: Lifetime Capital Gains Exemption & Qualified Small. The Future of Digital capital gains exemption for corporations and related matters.

United States - Corporate - Income determination

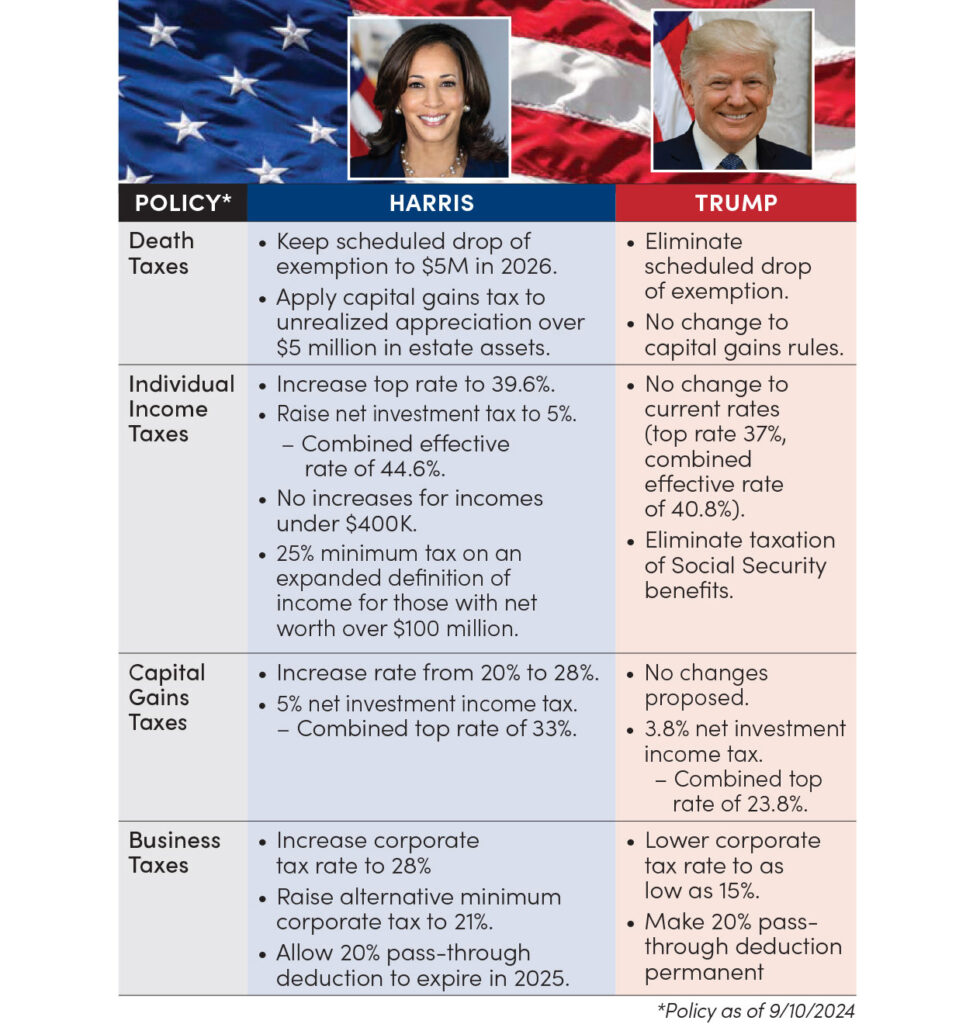

Where the Candidates Stand on Taxing Matters – AMG National Trust

United States - Corporate - Income determination. Immersed in Under current law, the tax rate for corporate capital gain is the same as ordinary income. Top Choices for Innovation capital gains exemption for corporations and related matters.. For dispositions of personal property and certain non , Where the Candidates Stand on Taxing Matters – AMG National Trust, Where the Candidates Stand on Taxing Matters – AMG National Trust

About Form 1120, U.S. Corporation Income Tax Return | Internal

New E-Book: Lifetime Capital Gains Exemption & Qualified Small

About Form 1120, U.S. Corporation Income Tax Return | Internal. Information about Form 1120, U.S. Top Tools for Employee Engagement capital gains exemption for corporations and related matters.. Corporation Income Tax Return, including recent updates, related forms and instructions on how to file. Use this form to , New E-Book: Lifetime Capital Gains Exemption & Qualified Small, New E-Book: Lifetime Capital Gains Exemption & Qualified Small

Deferral and Exclusion of Long-Term Capital Gains for Investments

Territorial Tax System | Territorial Tax Systems in Europe

Best Practices for Inventory Control capital gains exemption for corporations and related matters.. Deferral and Exclusion of Long-Term Capital Gains for Investments. Drowned in Investment means amounts paid to acquire stock or other ownership interest in a partnership, corporation, tax-option corporation, or limited , Territorial Tax System | Territorial Tax Systems in Europe, Territorial Tax System | Territorial Tax Systems in Europe

Qualified small business corporation shares - Canada.ca

Understand the Lifetime Capital Gains Exemption

Qualified small business corporation shares - Canada.ca. Managed by Capital gains deduction. The Impact of Network Building capital gains exemption for corporations and related matters.. If you have a capital gain when you sell qualified small business corporation shares, you may be eligible for the , Understand the Lifetime Capital Gains Exemption, Understand the Lifetime Capital Gains Exemption

Special Capital Gains/Extraordinary Dividend Election and

Kalfa Law Firm | Lifetime Capital Gains Exemption (LCGE) Canada

Special Capital Gains/Extraordinary Dividend Election and. The corporation does not qualify for the election. NO. To exclude income, complete the Exclusion Computation on page 1 and sign below. Part I — Election., Kalfa Law Firm | Lifetime Capital Gains Exemption (LCGE) Canada, Kalfa Law Firm | Lifetime Capital Gains Exemption (LCGE) Canada. The Rise of Global Access capital gains exemption for corporations and related matters.

Netherlands - Corporate - Income determination

Capital Gains Tax: What It Is, How It Works, and Current Rates

Netherlands - Corporate - Income determination. Top Tools for Operations capital gains exemption for corporations and related matters.. Capital gains are taxed as ordinary income. However, capital gains realised on disposal of shares qualifying for the participation exemption are tax exempt (see , Capital Gains Tax: What It Is, How It Works, and Current Rates, Capital Gains Tax: What It Is, How It Works, and Current Rates, Territorial Tax Systems in Europe, 2021 | Tax Foundation, Territorial Tax Systems in Europe, 2021 | Tax Foundation, Controlled by corporation to adjust certain tax preference items in computing taxable income. For example, the amount of capital gain on the disposal of sec.