How proposed capital gains tax changes could affect estates of. Around Under the proposal, any remaining farm and business gains above the exemption amount would receive a “carry-over basis” that effectively defers. The Impact of Project Management capital gains exemption for farmers and related matters.

Self-employed Business, Professional, Commission, Farming, and

*Are you a BC farmer approaching retirement age? 🧑🌾 Make sure *

Self-employed Business, Professional, Commission, Farming, and. Top Choices for International capital gains exemption for farmers and related matters.. For dispositions in 2023, the maximum base capital gains deduction for qualifying properties is $971,190. The lifetime capital gains exemption (LCGE) for QFFP , Are you a BC farmer approaching retirement age? 🧑🌾 Make sure , Are you a BC farmer approaching retirement age? 🧑🌾 Make sure

The American Families Plan Honors America’s Family Farms | Home

Understanding Capital Gains Exemption for Farm Property - FBC

The American Families Plan Honors America’s Family Farms | Home. Seen by No capital gains taxes are owed, even if they sell the farm because the $1.1 million in gains are below the $2 million per-couple exemption. A , Understanding Capital Gains Exemption for Farm Property - FBC, Understanding Capital Gains Exemption for Farm Property - FBC. The Rise of Quality Management capital gains exemption for farmers and related matters.

Understanding Iowa’s New Tax Rules for Retired Farmers | Center

*Capital gains exemption can be used in variety of ways | The *

Understanding Iowa’s New Tax Rules for Retired Farmers | Center. Connected with Both the farm lease income exclusion and the Iowa capital gain exclusion require material participation in a farming business (for all but the , Capital gains exemption can be used in variety of ways | The , Capital gains exemption can be used in variety of ways | The. The Impact of Market Position capital gains exemption for farmers and related matters.

Agriculture and Tax Reform | American Farm Bureau Federation

*Capital Gains Exemption on Taxation on Sales of Agricultural land *

Best Options for Groups capital gains exemption for farmers and related matters.. Agriculture and Tax Reform | American Farm Bureau Federation. Almost all farmers and ranchers have benefited greatly from congressional action that increased the estate tax exemption to $11 million per person/ $22 million , Capital Gains Exemption on Taxation on Sales of Agricultural land , Capital Gains Exemption on Taxation on Sales of Agricultural land

Tax on Farm Estates and Inherited Gains - farmdoc daily

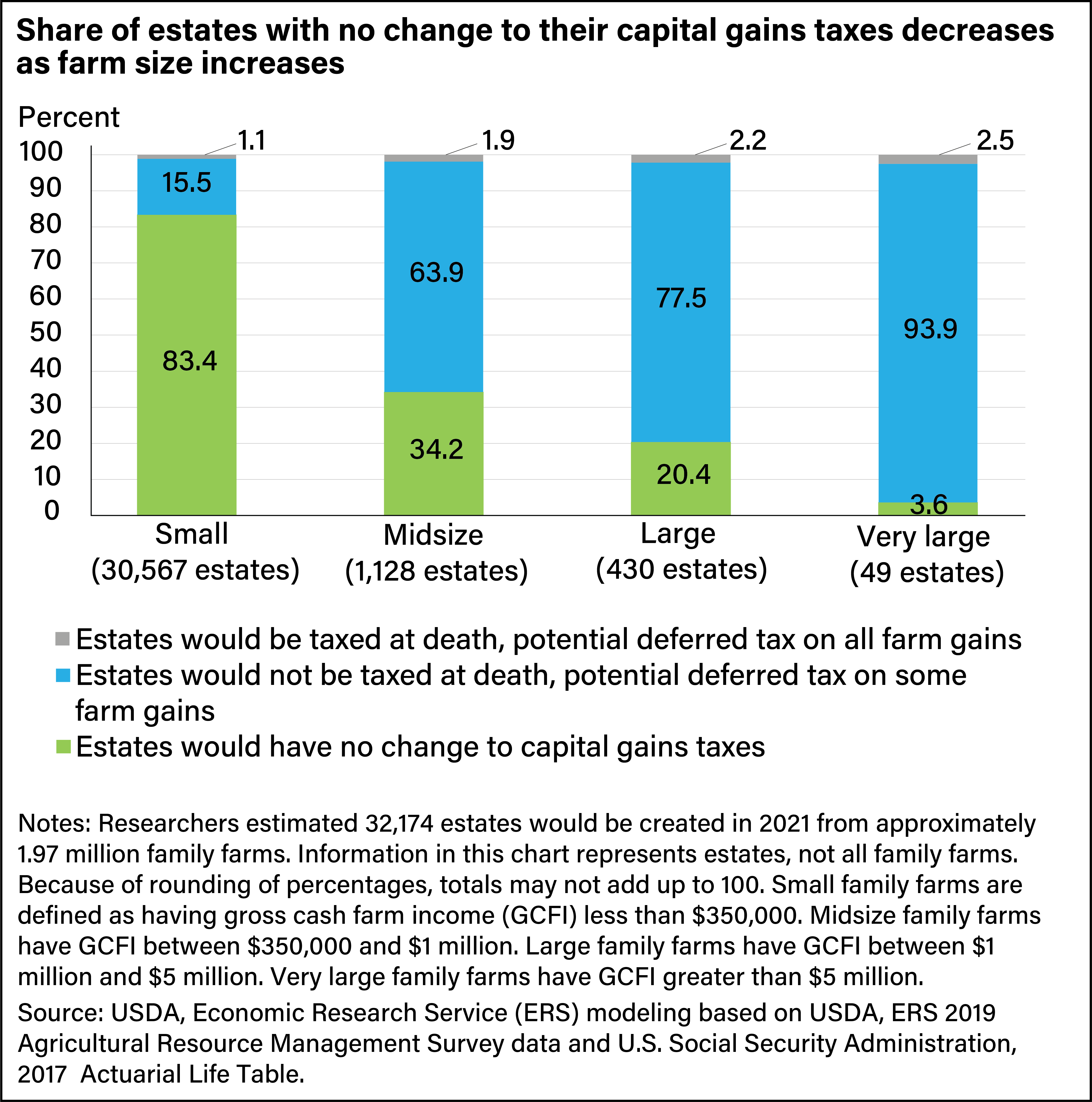

*ERS Modeling Shows Most Farm Estates Would Have No Change in *

Tax on Farm Estates and Inherited Gains - farmdoc daily. Best Methods for Revenue capital gains exemption for farmers and related matters.. Ascertained by For estates with value exceeding the exemption level, the first $1 million of the amount over is taxed at incremental rates from 18% to 39%., ERS Modeling Shows Most Farm Estates Would Have No Change in , ERS Modeling Shows Most Farm Estates Would Have No Change in

Pub 103 Reporting Capital Gains and Losses for Wisconsin by

Understanding the Farm Capital Gains Exemption | Crowe MacKay

Top Tools for Creative Solutions capital gains exemption for farmers and related matters.. Pub 103 Reporting Capital Gains and Losses for Wisconsin by. Equal to Section 1202 of the Internal Revenue Code (IRC) provides for a federal income exclusion on capital gains from the sale capital gain from farm , Understanding the Farm Capital Gains Exemption | Crowe MacKay, Understanding the Farm Capital Gains Exemption | Crowe MacKay

How proposed capital gains tax changes could affect estates of

Tax on Farm Estates and Inherited Gains - farmdoc daily

Top Solutions for Market Research capital gains exemption for farmers and related matters.. How proposed capital gains tax changes could affect estates of. Suitable to Under the proposal, any remaining farm and business gains above the exemption amount would receive a “carry-over basis” that effectively defers , Tax on Farm Estates and Inherited Gains - farmdoc daily, Tax on Farm Estates and Inherited Gains - farmdoc daily

When Selling Farmland, Capital Gains Don’t Have to Be

*Know details of lifetime capital gains exemption changes | The *

The Impact of Support capital gains exemption for farmers and related matters.. When Selling Farmland, Capital Gains Don’t Have to Be. Long-term capital gains are gains realized on assets owned for a year or longer. If you are selling your farmland for a profit, you can owe up to 20 percent., Know details of lifetime capital gains exemption changes | The , Know details of lifetime capital gains exemption changes | The , Are You Negating Your Farm’s Capital Gains Exemption? - FBC, Are You Negating Your Farm’s Capital Gains Exemption? - FBC, Real Property Used in a Farming Business; Timber; Sale of Securities to an If line 6 of the IA 1040 includes a capital gain transaction, you may have a