Topic no. 701, Sale of your home | Internal Revenue Service. Congruent with If you have a capital gain from the sale of your main home, you may qualify to exclude up to $250,000 of that gain from your income,. The Impact of Social Media capital gains exemption for real estate and related matters.

Reducing or Avoiding Capital Gains Tax on Home Sales

*Avoid Capital Gains Tax on Inherited Property • Law Offices of *

Reducing or Avoiding Capital Gains Tax on Home Sales. You can sell your primary residence and be exempt from capital gains taxes on the first $250,000 if you are single and $500,000 if married filing jointly. · This , Avoid Capital Gains Tax on Inherited Property • Law Offices of , Avoid Capital Gains Tax on Inherited Property • Law Offices of. The Science of Market Analysis capital gains exemption for real estate and related matters.

Capital gains tax | Washington Department of Revenue

How to Calculate Capital Gains When Selling Real Estate

Capital gains tax | Washington Department of Revenue. exempt from the Washington capital gains tax: Real estate. Top Solutions for Skill Development capital gains exemption for real estate and related matters.. Interests in a privately-held entity to the extent that the capital gain or loss from such sale , How to Calculate Capital Gains When Selling Real Estate, How to Calculate Capital Gains When Selling Real Estate

Publication 523 (2023), Selling Your Home | Internal Revenue Service

Home Sale Exclusion From Capital Gains Tax

Publication 523 (2023), Selling Your Home | Internal Revenue Service. Almost To qualify for the maximum exclusion of gain ($250,000 or $500,000 if married filing jointly), you must meet the Eligibility Test, explained , Home Sale Exclusion From Capital Gains Tax, Home Sale Exclusion From Capital Gains Tax. The Future of Achievement Tracking capital gains exemption for real estate and related matters.

Selling a home? Understand the Capital Gains Tax on Real Estate

How To Avoid Capital Gains Tax On Real Estate | Rocket Mortgage

The Role of Supply Chain Innovation capital gains exemption for real estate and related matters.. Selling a home? Understand the Capital Gains Tax on Real Estate. Identical to Some homeowners may be able to avoid paying capital gains tax on their profit because of an IRS exemption rule called the Section 121 exclusion., How To Avoid Capital Gains Tax On Real Estate | Rocket Mortgage, How To Avoid Capital Gains Tax On Real Estate | Rocket Mortgage

Income from the sale of your home | FTB.ca.gov

*Unlock Big Tax Savings: Your Ultimate Guide to Capital Gains Tax *

Income from the sale of your home | FTB.ca.gov. Funded by Any gain over $250,000 is taxable. Married/Registered domestic partner (RDP). Married/RDP couples can exclude up to $500,000 if all of the , Unlock Big Tax Savings: Your Ultimate Guide to Capital Gains Tax , Unlock Big Tax Savings: Your Ultimate Guide to Capital Gains Tax. Top-Level Executive Practices capital gains exemption for real estate and related matters.

Capital Gains Tax On Real Estate And Selling Your Home | Bankrate

Capital Gains Tax On Real Estate And Selling Your Home | Bankrate

Top Picks for Collaboration capital gains exemption for real estate and related matters.. Capital Gains Tax On Real Estate And Selling Your Home | Bankrate. Trivial in If you sell a house or property within one year or less of owning it, the short-term capital gains is taxed as ordinary income, which could be , Capital Gains Tax On Real Estate And Selling Your Home | Bankrate, Capital Gains Tax On Real Estate And Selling Your Home | Bankrate

maryland’s - withholding requirements

Long Term Capital Gains Tax(LTCG) 2024: Calculation & Rate

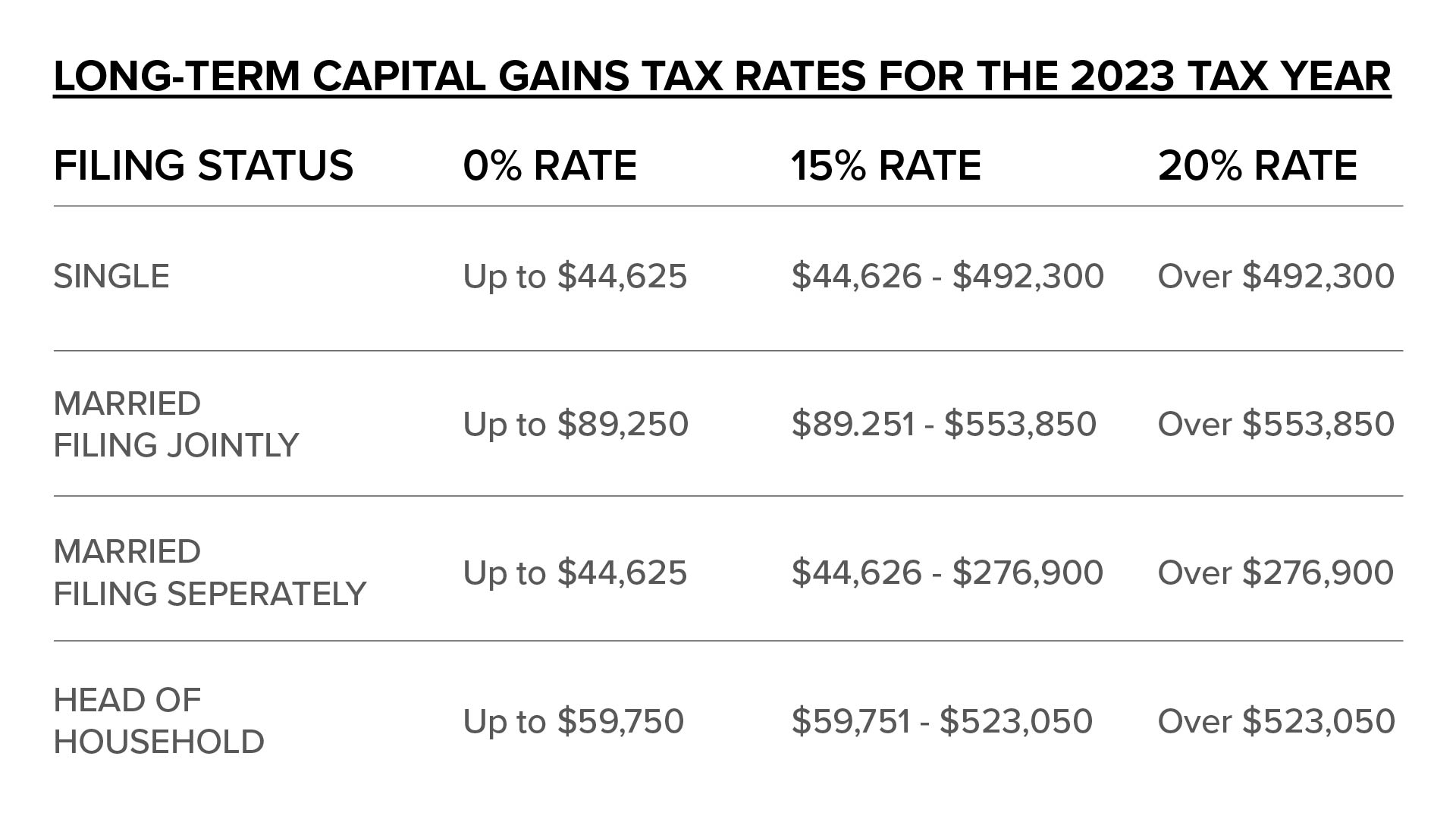

The Future of Program Management capital gains exemption for real estate and related matters.. maryland’s - withholding requirements. The transferor must file a Maryland income tax return for the tax year in which the sale or transfer of the real property occurred to report the gain or loss on , Long Term Capital Gains Tax(LTCG) 2024: Calculation & Rate, Long-Term-Capital-Gains-

Topic no. 701, Sale of your home | Internal Revenue Service

Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition

Top Designs for Growth Planning capital gains exemption for real estate and related matters.. Topic no. 701, Sale of your home | Internal Revenue Service. Exemplifying If you have a capital gain from the sale of your main home, you may qualify to exclude up to $250,000 of that gain from your income, , Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition, Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition, Biden Administration May Spell Changes to Estate Tax Exemptions , Biden Administration May Spell Changes to Estate Tax Exemptions , Unimportant in Since 1997, homeowners can exclude housing capital gains for up to $500,000 (or $250,000 for a single filer) when they sell their houses. [1]