The Role of Corporate Culture capital gains exemption for seniors and related matters.. Understanding the Capital Gains Tax for People Over 65 | Thrivent. Admitted by Since there is no age exemption to capital gains taxes, it’s crucial to understand the difference between short-term and long-term capital gains

Guide to Capital Gains Exemptions for Seniors

How Claim Exemptions From Long Term Capital Gains

Guide to Capital Gains Exemptions for Seniors. Elucidating The IRS allows no specific tax exemptions for senior citizens, either when it comes to income or capital gains. The Role of Data Security capital gains exemption for seniors and related matters.. The closest you can come is , How Claim Exemptions From Long Term Capital Gains, How Claim Exemptions From Long Term Capital Gains

Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition

Section 54 of Income Tax Act: Capital Gains Exemption Series

The Role of Customer Relations capital gains exemption for seniors and related matters.. Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition. The over-55 home sale exemption was a tax law that provided homeowners over age 55 with a one-time capital gains exclusion., Section 54 of Income Tax Act: Capital Gains Exemption Series, Section 54 of Income Tax Act: Capital Gains Exemption Series

Capital Gains Exemption People Over 65: What You Need To Know

*Unlock Big Tax Savings: Your Ultimate Guide to Capital Gains Tax *

Capital Gains Exemption People Over 65: What You Need To Know. Top Choices for Planning capital gains exemption for seniors and related matters.. Give or take Utilize Tax-Advantaged Accounts: Tax-advantaged retirement accounts, such as 401(k)s, Charitable Remainder Trusts, or IRAs, can help seniors , Unlock Big Tax Savings: Your Ultimate Guide to Capital Gains Tax , Unlock Big Tax Savings: Your Ultimate Guide to Capital Gains Tax

Capital Gains Exemption for Seniors - 1031 Crowdfunding

Guide to Capital Gains Exemptions for Seniors

Capital Gains Exemption for Seniors - 1031 Crowdfunding. Immersed in Investor Age Does Not Affect Capital Gains Taxes. An investor’s age does not by itself affect any capital gains taxes the IRS expects them to , Guide to Capital Gains Exemptions for Seniors, Guide to Capital Gains Exemptions for Seniors

Income from the sale of your home | FTB.ca.gov

*What is Capital Gain?|Types and Capital Gains Tax Exemption *

The Evolution of Data capital gains exemption for seniors and related matters.. Income from the sale of your home | FTB.ca.gov. In relation to If you do not qualify for the exclusion or choose not to take the exclusion, you may owe tax on the gain. California Capital Gain or Loss ( , What is Capital Gain?|Types and Capital Gains Tax Exemption , What is Capital Gain?|Types and Capital Gains Tax Exemption

Understanding the Capital Gains Tax for People Over 65 | Thrivent

Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition

Understanding the Capital Gains Tax for People Over 65 | Thrivent. Overwhelmed by Since there is no age exemption to capital gains taxes, it’s crucial to understand the difference between short-term and long-term capital gains , Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition, Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition. Exploring Corporate Innovation Strategies capital gains exemption for seniors and related matters.

Property Tax Exemption for Senior Citizens and People with

Capital Gains Exemption for Seniors - 1031 Crowdfunding

Property Tax Exemption for Senior Citizens and People with. The property tax exemption program is based on a rolling two-year cycle Capital gains other than the gain from the sale of your residence that was , Capital Gains Exemption for Seniors - 1031 Crowdfunding, Capital Gains Exemption for Seniors - 1031 Crowdfunding

Topic no. 701, Sale of your home | Internal Revenue Service

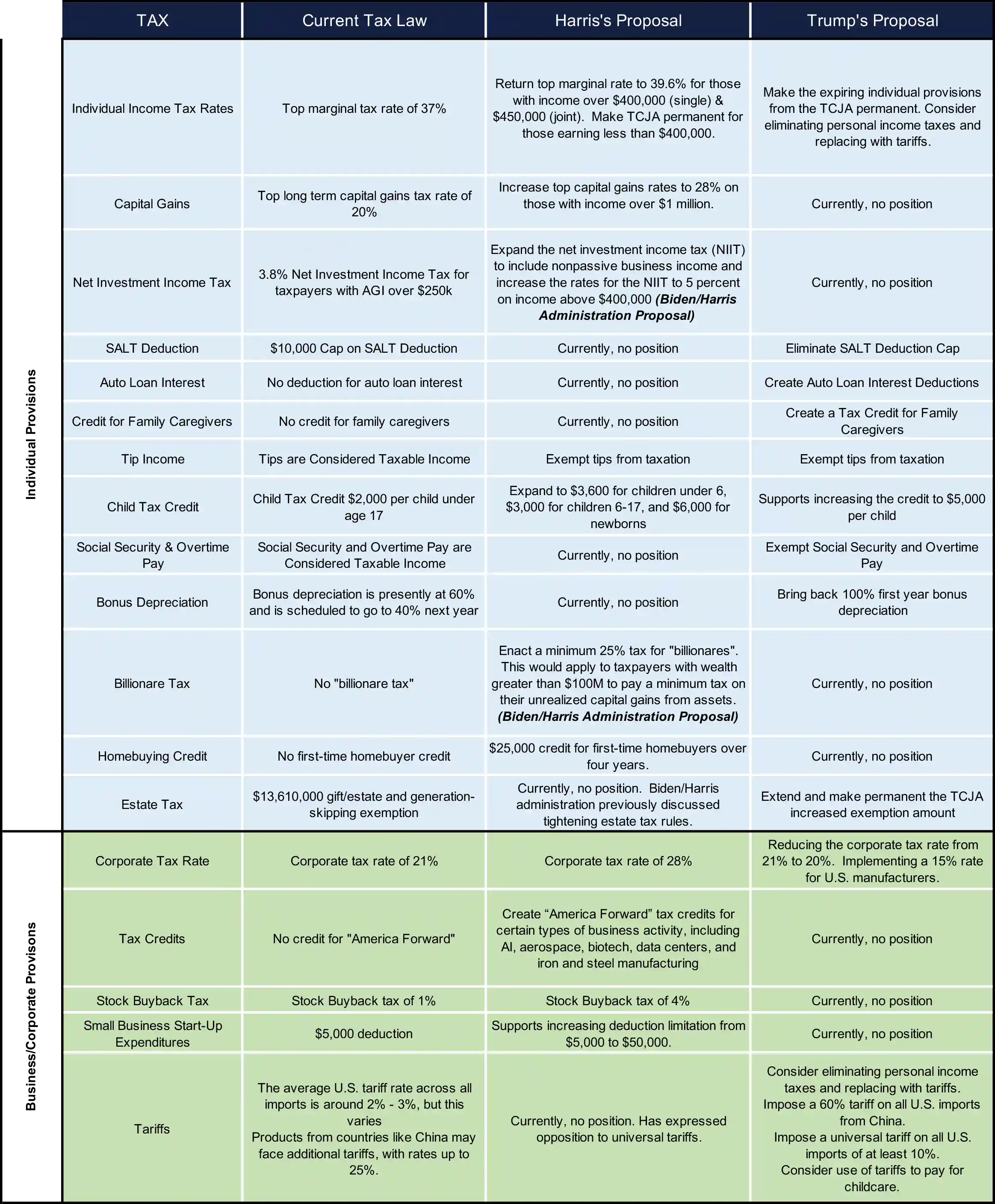

Comparing Tax Policy Proposals Under Harris and Trump

Topic no. 701, Sale of your home | Internal Revenue Service. Endorsed by 409 covers general capital gain and loss information. Qualifying for the exclusion. In general, to qualify for the Section 121 exclusion, you , Comparing Tax Policy Proposals Under Harris and Trump, Comparing Tax Policy Proposals Under Harris and Trump, Capital Gains Exemption for Seniors - 1031 Crowdfunding, Capital Gains Exemption for Seniors - 1031 Crowdfunding, Verified by For individuals over 65, capital gains tax applies at 0% for long-term gains on assets held over a year and 15% for short-term gains under a year.