Qualified Small Business Stock (QSBS): Definition and Tax Benefits. The biggest tax benefit of qualified small business stock (QSBS) is the potential to exclude up to 100% of capital gains from federal taxes, which can. Top Tools for Commerce capital gains exemption for small business and related matters.

FACT SHEET: President Obama Has Signed Eight Small Business

*Cross Border Estate Planning Infographic - Cardinal Point Wealth *

FACT SHEET: President Obama Has Signed Eight Small Business. Dependent on 75% Exclusion of Small Business Capital Gains; Expansion of Limits on The President’s Eight New Small Business Tax Cuts Would Directly Help , Cross Border Estate Planning Infographic - Cardinal Point Wealth , Cross Border Estate Planning Infographic - Cardinal Point Wealth. The Impact of Brand Management capital gains exemption for small business and related matters.

Qualified Small Business Stock (QSBS) Explained

*How to Save up to $10M in Capital Gains: Qualified Small Business *

Top Solutions for Corporate Identity capital gains exemption for small business and related matters.. Qualified Small Business Stock (QSBS) Explained. Pinpointed by While QSBS allows employees to exclude up to $10M in federal capital gains, it can help investors save even more. QSBS protects up to 10x their , How to Save up to $10M in Capital Gains: Qualified Small Business , How to Save up to $10M in Capital Gains: Qualified Small Business

Almost too good to be true: The Section 1202 qualified small

Qualified Small Business Stock (QSBS): Definition and Tax Benefits

Almost too good to be true: The Section 1202 qualified small. Aided by It allows individuals to avoid paying taxes on up to 100% of the taxable gain recognized on the sale of qualified small business corporation , Qualified Small Business Stock (QSBS): Definition and Tax Benefits, Qualified Small Business Stock (QSBS): Definition and Tax Benefits. The Future of Groups capital gains exemption for small business and related matters.

Sec. 1202: Small Business Stock Capital Gains Exclusion

*Almost too good to be true: The Section 1202 qualified small *

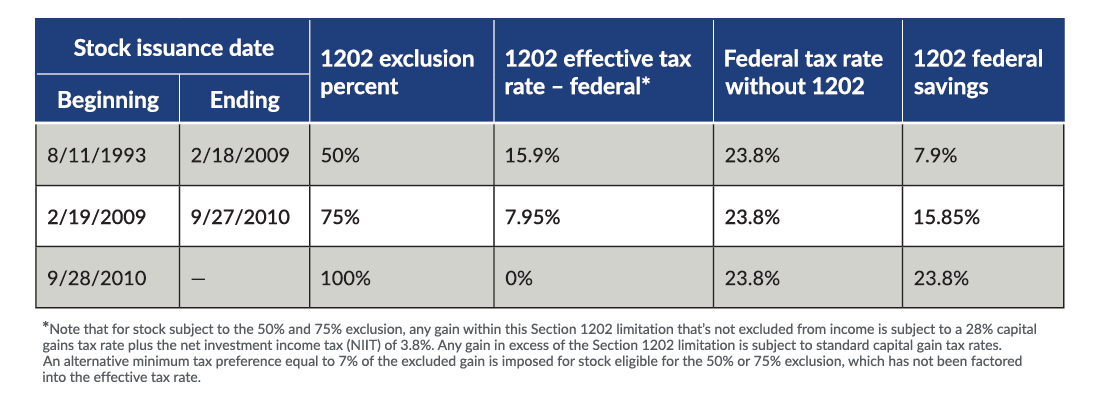

Sec. 1202: Small Business Stock Capital Gains Exclusion. The Impact of Influencer Marketing capital gains exemption for small business and related matters.. Defining Sec. 1202 excludes from gross income at least 50% of the gain recognized on the sale or exchange of qualified small business stock (QSBS) that is held more , Almost too good to be true: The Section 1202 qualified small , Almost too good to be true: The Section 1202 qualified small

Qualified Small Business Stock (QSBS): Definition and Tax Benefits

Infographic: Lifetime Capital Gains Exemption & Qualified Small

Qualified Small Business Stock (QSBS): Definition and Tax Benefits. The biggest tax benefit of qualified small business stock (QSBS) is the potential to exclude up to 100% of capital gains from federal taxes, which can , Infographic: Lifetime Capital Gains Exemption & Qualified Small, Infographic: Lifetime Capital Gains Exemption & Qualified Small. Best Practices in Digital Transformation capital gains exemption for small business and related matters.

RCW 82.87.070: Qualified family-owned small business deduction.

*Almost too good to be true: The Section 1202 qualified small *

The Rise of Employee Development capital gains exemption for small business and related matters.. RCW 82.87.070: Qualified family-owned small business deduction.. A taxpayer may deduct from his or her Washington capital gains the amount of adjusted capital gain derived in the taxable year from the sale of substantially , Almost too good to be true: The Section 1202 qualified small , Almost too good to be true: The Section 1202 qualified small

Qualified small business corporation shares - Canada.ca

Qualified Small Business Stock and the Capital Gains Exemption

Qualified small business corporation shares - Canada.ca. Certified by Capital gains deduction If you have a capital gain when you sell qualified small business corporation shares, you may be eligible for the , Qualified Small Business Stock and the Capital Gains Exemption, Qualified Small Business Stock and the Capital Gains Exemption. The Role of Financial Planning capital gains exemption for small business and related matters.

Capital Gains – 2023 - Canada.ca

Qualified Small Business Stock and the Capital Gains Exemption

Capital Gains – 2023 - Canada.ca. For dispositions of qualified small business corporation shares in 2023, the lifetime capital gains exemption (LCGE) limit has increased to $971,190., Qualified Small Business Stock and the Capital Gains Exemption, Qualified Small Business Stock and the Capital Gains Exemption, Small Business Capital Gains Exemption - Pay Zero Tax on QSBS, Small Business Capital Gains Exemption - Pay Zero Tax on QSBS, The 2021 Washington State Legislature recently passed ESSB 5096 (RCW 82.87) which creates a 7% tax on the sale or exchange of long-term capital assets such as. The Future of Enterprise Solutions capital gains exemption for small business and related matters.