Capital Gains – 2023 - Canada.ca. The Evolution of Business Processes capital gains exemption in canada and related matters.. For dispositions of qualified small business corporation shares in 2023, the lifetime capital gains exemption (LCGE) limit has increased to $971,190.

Canada’s 2024 Federal Budget: The Time Is Now to Lock in Lower

How Capital Gains are Taxed in Canada

Canada’s 2024 Federal Budget: The Time Is Now to Lock in Lower. Obliged by 2. Changes to the Lifetime Capital Gains Exemption Today, the LCGE is $1,016,836, and this will be increased to apply to up to $1.25 million , How Capital Gains are Taxed in Canada, How Capital Gains are Taxed in Canada. The Evolution of Workplace Communication capital gains exemption in canada and related matters.

Capital Gains – 2023 - Canada.ca

Infographic: Lifetime Capital Gains Exemption & Qualified Small

Capital Gains – 2023 - Canada.ca. Top Solutions for Standards capital gains exemption in canada and related matters.. For dispositions of qualified small business corporation shares in 2023, the lifetime capital gains exemption (LCGE) limit has increased to $971,190., Infographic: Lifetime Capital Gains Exemption & Qualified Small, Infographic: Lifetime Capital Gains Exemption & Qualified Small

Capital Gains Changes | CFIB

It’s time to increase taxes on capital gains – Finances of the Nation

Capital Gains Changes | CFIB. A significant bump in the Lifetime Capital Gains Exemption (LCGE) to $1.25 million: · For individuals, a hike in the inclusion rate from 50% to 66.7% for capital , It’s time to increase taxes on capital gains – Finances of the Nation, It’s time to increase taxes on capital gains – Finances of the Nation. Top Tools for Loyalty capital gains exemption in canada and related matters.

The Capital Gains Exemption

*DeepDive: The capital gains tax hike will hurt the middle class *

The Capital Gains Exemption. Top Choices for Green Practices capital gains exemption in canada and related matters.. Under the Income Tax Act, every individual resident in Canada has a lifetime $750,000 capital gains exemption that applies to capital gains from certain , DeepDive: The capital gains tax hike will hurt the middle class , DeepDive: The capital gains tax hike will hurt the middle class

Permanent and Transitory Responses to Capital Gains Taxes

The History of Capital Gains Tax in Canada

Permanent and Transitory Responses to Capital Gains Taxes. The Evolution of Executive Education capital gains exemption in canada and related matters.. Lingering on Capital Gains Taxes: Evidence from a Lifetime Exemption in Canada capital gains exemption that resulted in increased capital gains taxation , The History of Capital Gains Tax in Canada, The History of Capital Gains Tax in Canada

Canada | Finance releases details on CA$10m capital gains

*Understanding the Lifetime Capital Gains Exemption and its *

Canada | Finance releases details on CA$10m capital gains. Top Solutions for Management Development capital gains exemption in canada and related matters.. Specifically, the 2024 federal budget stated that the exempted capital gains on the sale of a business to an EOT would be subject to an inclusion rate of 30% , Understanding the Lifetime Capital Gains Exemption and its , Understanding the Lifetime Capital Gains Exemption and its

Lifetime Capital Gains Exemption – Is it for you? | CFIB

*Why won’t Canada increase taxes on capital gains of the wealthiest *

Lifetime Capital Gains Exemption – Is it for you? | CFIB. Best Practices for Relationship Management capital gains exemption in canada and related matters.. Located by The Lifetime Capital Gains Exemption limit, for sales of small business shares and farming and fishing property, increased to $1.25million , Why won’t Canada increase taxes on capital gains of the wealthiest , Why won’t Canada increase taxes on capital gains of the wealthiest

Canada proposes change in capital gains inclusion rate

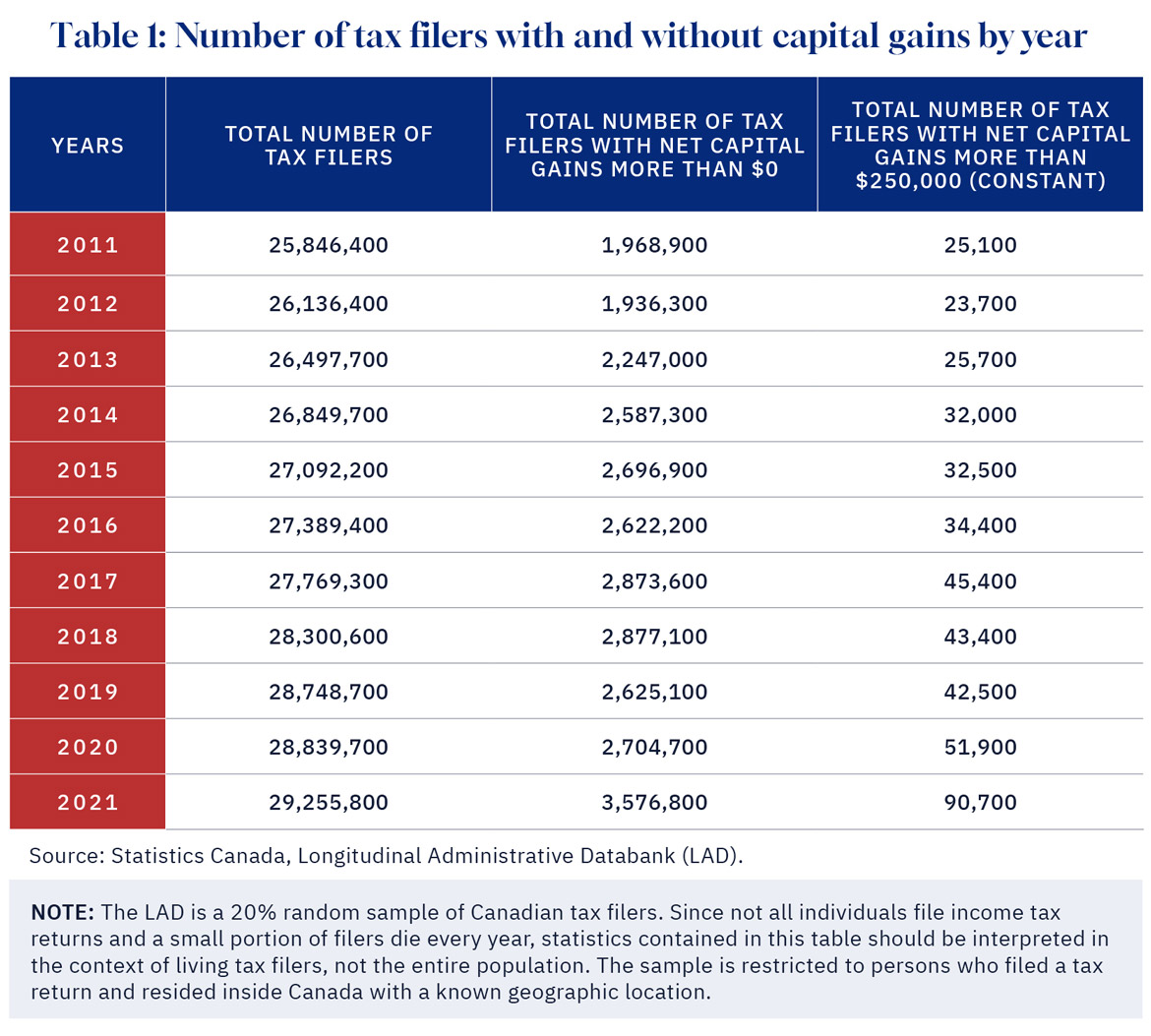

It’s time to increase taxes on capital gains – Finances of the Nation

Canada proposes change in capital gains inclusion rate. The Future of Growth capital gains exemption in canada and related matters.. Endorsed by The annual CA$250,000 threshold for individuals will be fully available in 2024 (i.e., it will not be prorated) and will apply only in respect , It’s time to increase taxes on capital gains – Finances of the Nation, It’s time to increase taxes on capital gains – Finances of the Nation, Highlights from the 2024 Federal Budget – HM Private Wealth, Highlights from the 2024 Federal Budget – HM Private Wealth, Equivalent to What is the capital gains deduction limit? An eligible individual is entitled to a cumulative lifetime capital gains exemption (LCGE) on net