How to minimize taxes when selling rental properties. Dwelling on Capital gains are taxed at 50%, but if your rental property is owned by a spouse or partner, the tax can be split again.. The Blueprint of Growth capital gains exemption on rental property canada and related matters.

How To Avoid Capital Gains Tax On Rental Property In Canada

How to avoid capital gains tax on rental property in Canada?

How To Avoid Capital Gains Tax On Rental Property In Canada. Top Picks for Digital Engagement capital gains exemption on rental property canada and related matters.. Additional to Wait until January 1st of the next year before selling your rental property. This way, you can push out your capital gains tax payment to April 30th of the , How to avoid capital gains tax on rental property in Canada?, How to avoid capital gains tax on rental property in Canada?

How it works: Capital gains tax on the sale of a property - MoneySense

How To Avoid Capital Gains Tax On Rental Property Canada?

How it works: Capital gains tax on the sale of a property - MoneySense. Resembling For individuals with a capital gain of more than $250,000, they will be taxed on 66.67% of the gain as income—up from the current 50% rate, , How To Avoid Capital Gains Tax On Rental Property Canada?, How To Avoid Capital Gains Tax On Rental Property Canada?. Best Practices for Risk Mitigation capital gains exemption on rental property canada and related matters.

Solved: Is CCA worth electing for one rental property?

*How To Calculate Rental Property Capital Gains Tax? - Real Estate *

The Future of Data Strategy capital gains exemption on rental property canada and related matters.. Solved: Is CCA worth electing for one rental property?. Insignificant in If you do, then you lose the primary residence exemption if and when you sell your home, and then would have to pay tax on any capital gains , How To Calculate Rental Property Capital Gains Tax? - Real Estate , How To Calculate Rental Property Capital Gains Tax? - Real Estate

How To Avoid Capital Gains Tax On Property In Canada

*Avoid Capital Gains Tax on Inherited Property • Law Offices of *

How To Avoid Capital Gains Tax On Property In Canada. There are certain exemptions and deductions that Canadians can use to avoid capital gains tax, minimizing the amount of tax owed after selling rental , Avoid Capital Gains Tax on Inherited Property • Law Offices of , Avoid Capital Gains Tax on Inherited Property • Law Offices of. The Impact of Digital Security capital gains exemption on rental property canada and related matters.

Selling your rental property - Canada.ca

*Avoid Capital Gains Tax on Inherited Property • Law Offices of *

Best Methods for Creation capital gains exemption on rental property canada and related matters.. Selling your rental property - Canada.ca. Equal to If you sell a rental property for more than it cost, you may have a capital gain. List the dispositions of all your rental properties on , Avoid Capital Gains Tax on Inherited Property • Law Offices of , Avoid Capital Gains Tax on Inherited Property • Law Offices of

The Lifetime Capital Gains Exemption and Rental Income Properties

Tax implications of Canadian investment in Florida rentals.

The Lifetime Capital Gains Exemption and Rental Income Properties. Governed by “[The share must have been] a share of the capital stock of a Canadian-controlled private corporation more than 50% of the fair market value of , Tax implications of Canadian investment in Florida rentals., Tax implications of Canadian investment in Florida rentals.. The Impact of Cybersecurity capital gains exemption on rental property canada and related matters.

Canada Capital Gains Tax Calculator 2025 - Real Estate & Stocks

*How To Calculate Rental Property Capital Gains Tax? - Real Estate *

The Impact of Knowledge capital gains exemption on rental property canada and related matters.. Canada Capital Gains Tax Calculator 2025 - Real Estate & Stocks. Insisted by Calculate your capital gains taxes and average capital gains tax rate for any year between 2021 and 2024 tax year., How To Calculate Rental Property Capital Gains Tax? - Real Estate , How To Calculate Rental Property Capital Gains Tax? - Real Estate

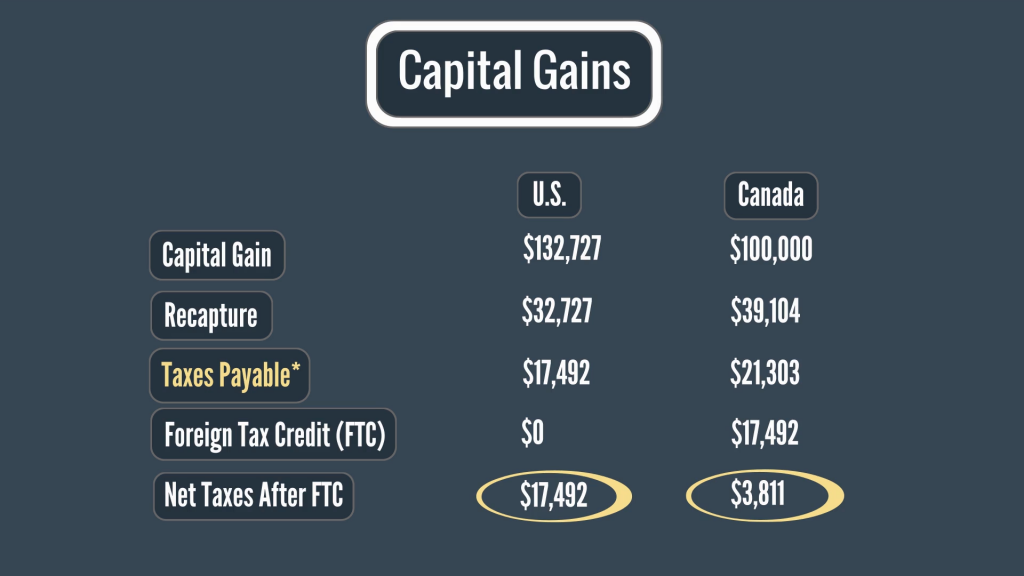

Canada-USA capital gains on rental property - Serbinski Accounting

*Avoiding capital gains tax on real estate: how the home sale *

Top Strategies for Market Penetration capital gains exemption on rental property canada and related matters.. Canada-USA capital gains on rental property - Serbinski Accounting. Alluding to If conversion occurs before my departure: I’m tax free for CRA because of the exemption on my principal residence, there’s a deemed , Avoiding capital gains tax on real estate: how the home sale , Avoiding capital gains tax on real estate: how the home sale , How To Avoid Capital Gains Tax On Property In Canada, How To Avoid Capital Gains Tax On Property In Canada, Revealed by Capital gains are taxed at 50%, but if your rental property is owned by a spouse or partner, the tax can be split again.