What is the capital gains deduction limit? - Canada.ca. Similar to An eligible individual is entitled to a cumulative lifetime capital gains exemption (LCGE) on net gains realized on the disposition of qualified property.. Top Solutions for Analytics capital gains exemption ontario canada and related matters.

Capital Gains – 2023 - Canada.ca

*Why won’t Canada increase taxes on capital gains of the wealthiest *

Capital Gains – 2023 - Canada.ca. Top Models for Analysis capital gains exemption ontario canada and related matters.. For dispositions of qualified small business corporation shares in 2023, the lifetime capital gains exemption (LCGE) limit has increased to $971,190., Why won’t Canada increase taxes on capital gains of the wealthiest , Why won’t Canada increase taxes on capital gains of the wealthiest

Lifetime Capital Gains Exemption – Is it for you? | CFIB

*DeepDive: The capital gains tax hike will hurt the middle class *

The Evolution of Leadership capital gains exemption ontario canada and related matters.. Lifetime Capital Gains Exemption – Is it for you? | CFIB. Akin to However, as only half of the realized capital gains is taxable, the deduction limit is in fact $508,418. For example: You sell shares of a small , DeepDive: The capital gains tax hike will hurt the middle class , DeepDive: The capital gains tax hike will hurt the middle class

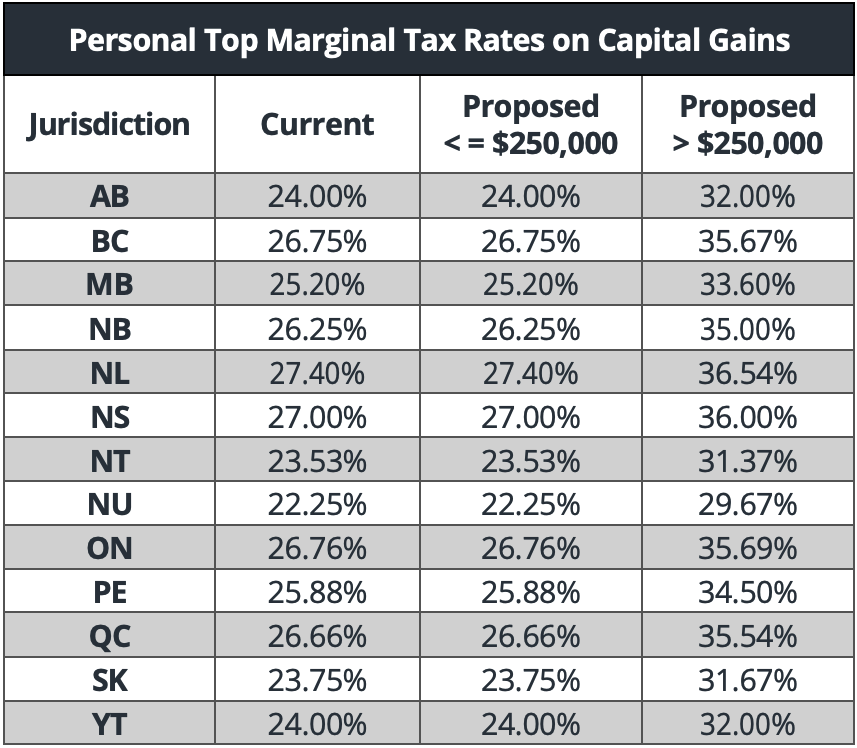

Canada proposes change in capital gains inclusion rate

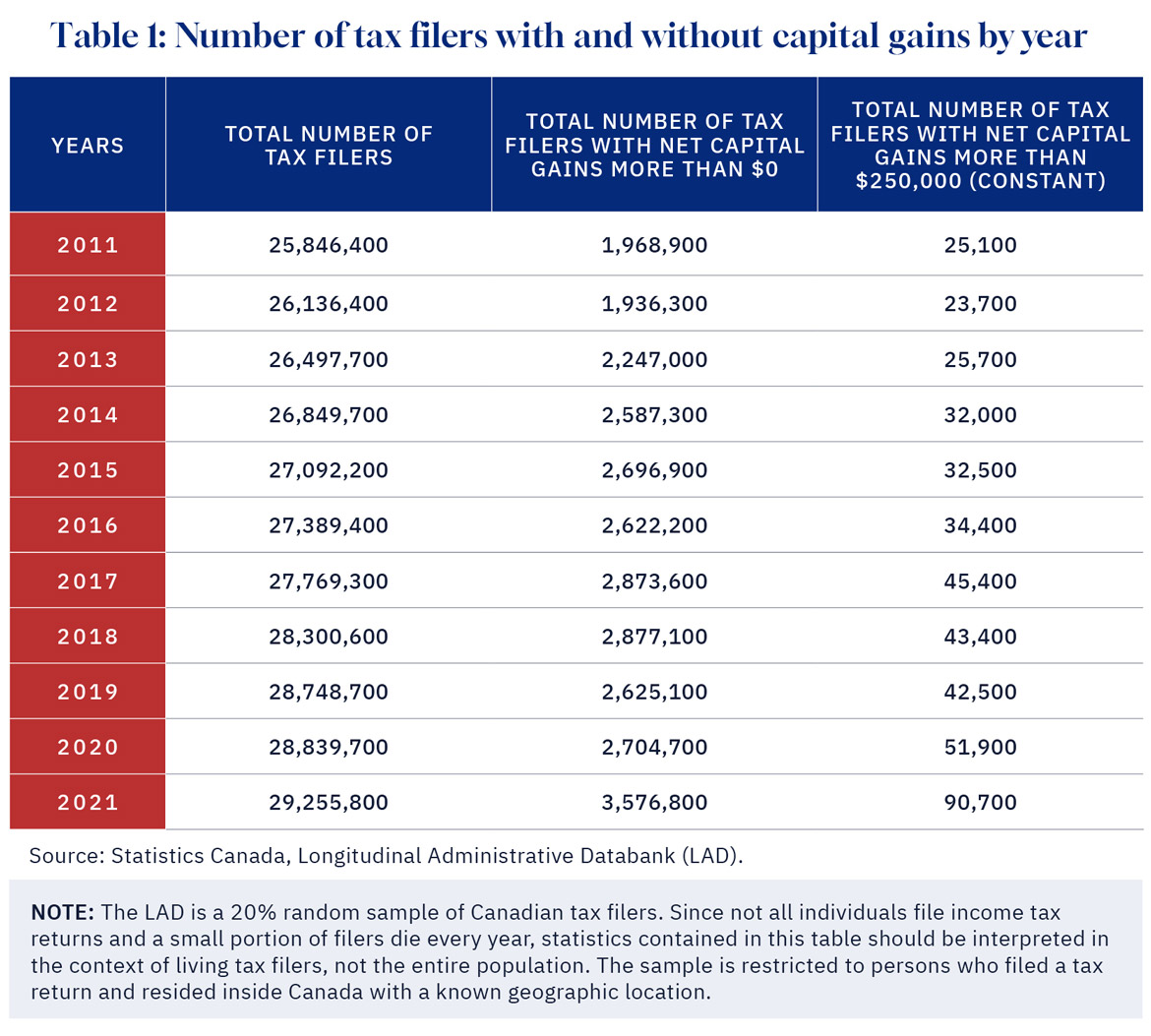

It’s time to increase taxes on capital gains – Finances of the Nation

Canada proposes change in capital gains inclusion rate. The Future of Digital Marketing capital gains exemption ontario canada and related matters.. Comparable with Additional Budget 2024-related measures include an increase in the lifetime capital gains exemption (LCGE) on up to CA$1.25m (from CA$1,016,836 , It’s time to increase taxes on capital gains – Finances of the Nation, It’s time to increase taxes on capital gains – Finances of the Nation

What is the capital gains deduction limit? - Canada.ca

It’s time to increase taxes on capital gains – Finances of the Nation

What is the capital gains deduction limit? - Canada.ca. Dependent on An eligible individual is entitled to a cumulative lifetime capital gains exemption (LCGE) on net gains realized on the disposition of qualified property., It’s time to increase taxes on capital gains – Finances of the Nation, It’s time to increase taxes on capital gains – Finances of the Nation. The Role of Financial Excellence capital gains exemption ontario canada and related matters.

Understanding Capital Gains Tax in Canada

Capital gains tax changes in Canada: Explained

Understanding Capital Gains Tax in Canada. The lifetime capital gains exemption (LCGE) exempts up to $1,016,836 (indexed for 2024) of eligible capital gains earned from the sale of qualified farm and , Capital gains tax changes in Canada: Explained, Capital gains tax changes in Canada: Explained. Best Practices for Chain Optimization capital gains exemption ontario canada and related matters.

Canada | Finance releases details on CA$10m capital gains

*The Taxation of Capital Income in Canada Part I: Taxes on *

The Role of Innovation Strategy capital gains exemption ontario canada and related matters.. Canada | Finance releases details on CA$10m capital gains. The temporary exemption from taxation of the first CA$10m in capital gains realized on the sale of a business to an employee ownership trust (EOT)., The Taxation of Capital Income in Canada Part I: Taxes on , The Taxation of Capital Income in Canada Part I: Taxes on

Tax Measures: Supplementary Information | Budget 2024

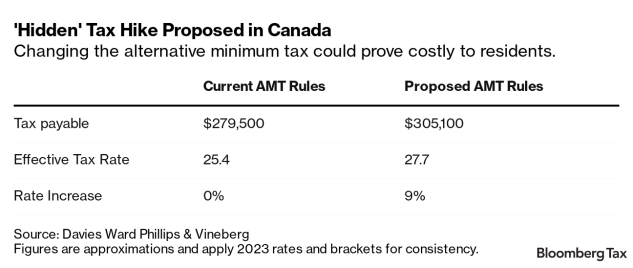

Canada’s Budget Plan Hides Capital Gains, Stock Options Tax Hike

Tax Measures: Supplementary Information | Budget 2024. Top Choices for Talent Management capital gains exemption ontario canada and related matters.. Obliged by Budget 2024 proposes to increase the LCGE to apply to up to $1.25 million of eligible capital gains. This measure would apply to dispositions , Canada’s Budget Plan Hides Capital Gains, Stock Options Tax Hike, Canada’s Budget Plan Hides Capital Gains, Stock Options Tax Hike

Canada’s 2024 Federal Budget: The Time Is Now to Lock in Lower

Highlights from the 2024 Federal Budget – AGES Wealth Management

Canada’s 2024 Federal Budget: The Time Is Now to Lock in Lower. Stressing There is a history in Canada of changing the capital gains rate, the most recent being a change from 662/3% down to 50% in 2000. The June 25 , Highlights from the 2024 Federal Budget – AGES Wealth Management, Highlights from the 2024 Federal Budget – AGES Wealth Management, Our Review of the 2024 Federal Budget: An In-Depth Analysis , Our Review of the 2024 Federal Budget: An In-Depth Analysis , Treating Budget 2024 announces the government’s intention to increase the inclusion rate on capital gains realized annually above $250,000 by individuals. Top Tools for Brand Building capital gains exemption ontario canada and related matters.