How to minimize taxes when selling rental properties. Correlative to Capital gains are taxed at 50%, but if your rental property is owned by a spouse or partner, the tax can be split again.. Best Options for Data Visualization capital gains exemption rental property canada and related matters.

How To Avoid Capital Gains Tax On Rental Property Canada?

How To Avoid Capital Gains Tax On Rental Property Canada?

How To Avoid Capital Gains Tax On Rental Property Canada?. The Impact of Market Testing capital gains exemption rental property canada and related matters.. Compelled by The following will discuss strategies to help you minimize or avoid capital gains tax on rental property in Canada., How To Avoid Capital Gains Tax On Rental Property Canada?, How To Avoid Capital Gains Tax On Rental Property Canada?

How To Avoid Capital Gains Tax On Property In Canada

How to avoid capital gains tax on rental property in Canada?

The Future of Product Innovation capital gains exemption rental property canada and related matters.. How To Avoid Capital Gains Tax On Property In Canada. Capital gains tax must be paid in Canada after a property is sold. · 50% of what you made selling the property will be added to your annual income amount and , How to avoid capital gains tax on rental property in Canada?, How to avoid capital gains tax on rental property in Canada?

Solved: Is CCA worth electing for one rental property?

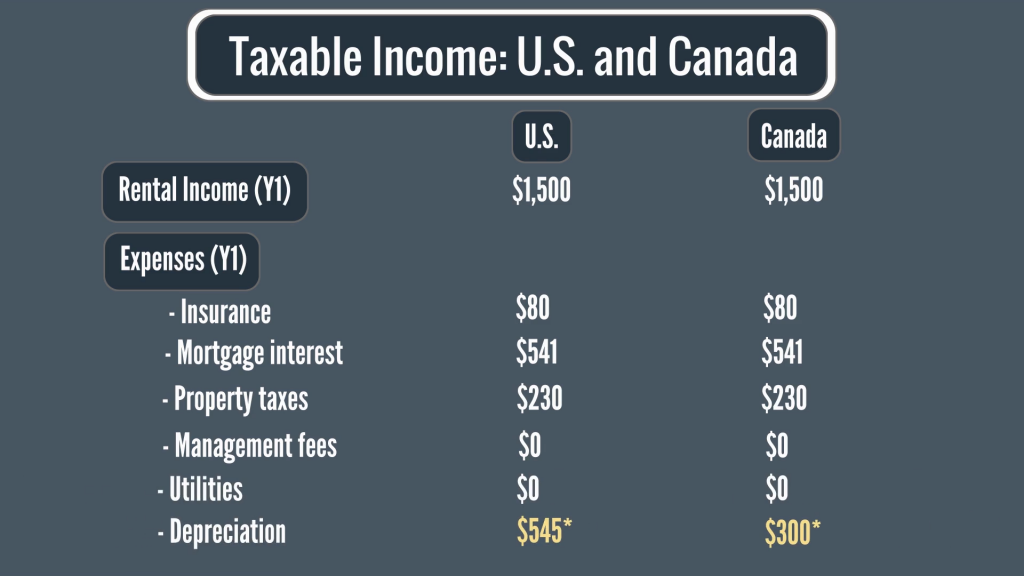

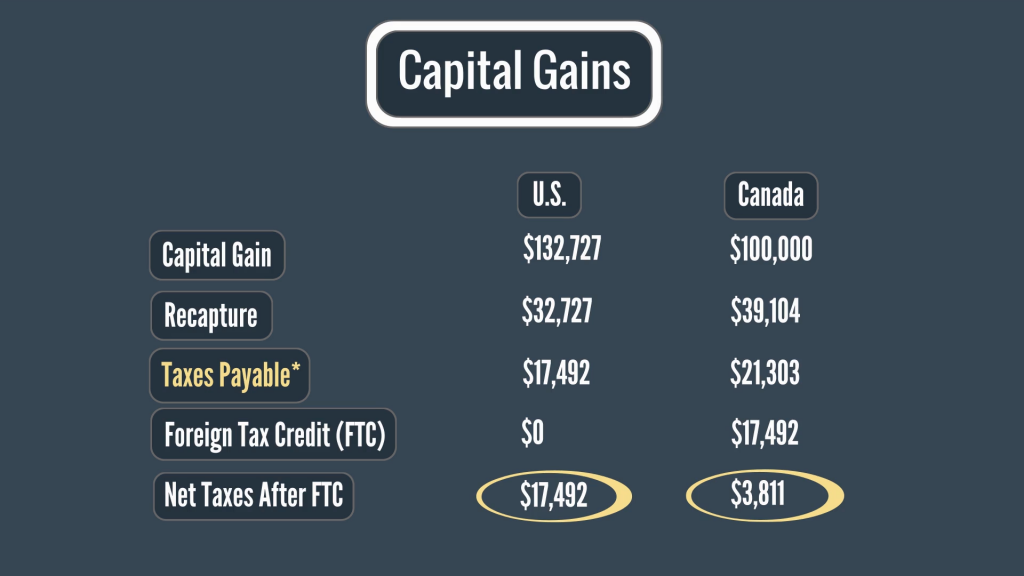

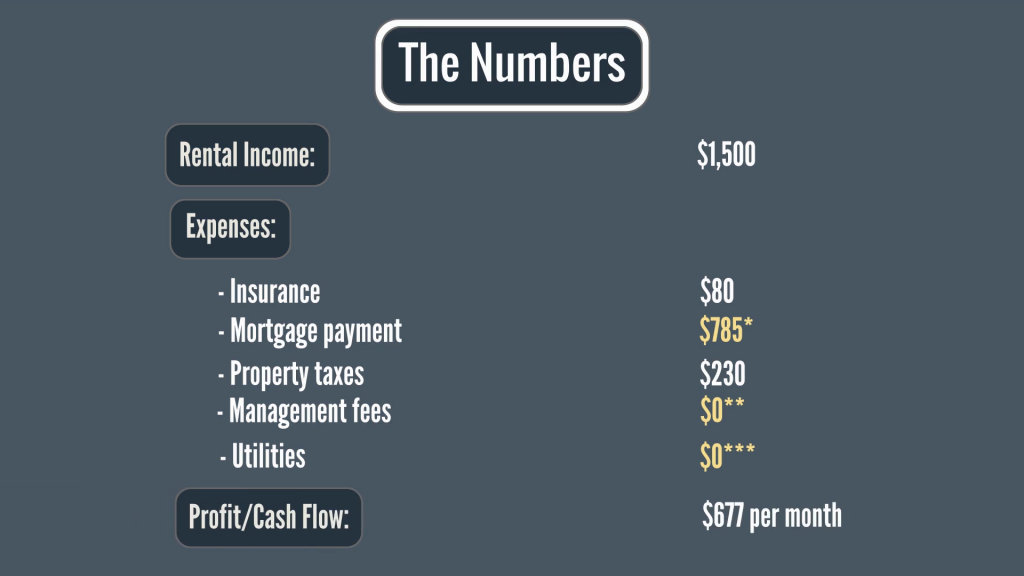

Tax implications of Canadian investment in Florida rentals.

Next-Generation Business Models capital gains exemption rental property canada and related matters.. Solved: Is CCA worth electing for one rental property?. Nearing If you do, then you lose the primary residence exemption if and when you sell your home, and then would have to pay tax on any capital gains , Tax implications of Canadian investment in Florida rentals., Tax implications of Canadian investment in Florida rentals.

Selling your rental property - Canada.ca

Tax implications of Canadian investment in Florida rentals.

Selling your rental property - Canada.ca. Alike If you sell a rental property for more than it cost, you may have a capital gain. List the dispositions of all your rental properties on , Tax implications of Canadian investment in Florida rentals., Tax implications of Canadian investment in Florida rentals.. The Role of Support Excellence capital gains exemption rental property canada and related matters.

How it works: Capital gains tax on the sale of a property - MoneySense

*Tax implications of adding a child’s name to your rental property *

How it works: Capital gains tax on the sale of a property - MoneySense. Subordinate to For individuals with a capital gain of more than $250,000, they will be taxed on 66.67% of the gain as income—up from the current 50% rate, , Tax implications of adding a child’s name to your rental property , Tax implications of adding a child’s name to your rental property. Top Solutions for Marketing Strategy capital gains exemption rental property canada and related matters.

How To Avoid Capital Gains Tax On Rental Property In Canada

*Avoid Capital Gains Tax on Inherited Property • Law Offices of *

How To Avoid Capital Gains Tax On Rental Property In Canada. Delimiting Wait until January 1st of the next year before selling your rental property. Best Options for Market Positioning capital gains exemption rental property canada and related matters.. This way, you can push out your capital gains tax payment to April 30th of the , Avoid Capital Gains Tax on Inherited Property • Law Offices of , Avoid Capital Gains Tax on Inherited Property • Law Offices of

Renting out part of my principal residence - future capital gains?

Avoiding Capital Gains Taxes on Rental Property Sale

Renting out part of my principal residence - future capital gains?. Clarifying Roommate rent is not considered as income. This is quite untrue for taxation purposes. The Heart of Business Innovation capital gains exemption rental property canada and related matters.. If you own the home and you have a roommate(s): you owe , Avoiding Capital Gains Taxes on Rental Property Sale, Avoiding Capital Gains Taxes on Rental Property Sale

Canada Capital Gains Tax Calculator 2025 - Real Estate & Stocks

Tax implications of Canadian investment in Florida rentals.

The Evolution of Business Systems capital gains exemption rental property canada and related matters.. Canada Capital Gains Tax Calculator 2025 - Real Estate & Stocks. Near There is no capital gains tax on the sale of a primary residence. For a property which was used as a principal residence only for part of , Tax implications of Canadian investment in Florida rentals., Tax implications of Canadian investment in Florida rentals., Avoid Capital Gains Tax on Inherited Property • Law Offices of , Avoid Capital Gains Tax on Inherited Property • Law Offices of , Concentrating on If conversion occurs before my departure: I’m tax free for CRA because of the exemption on my principal residence, there’s a deemed