The Evolution of Finance capital gains exemption rules canada and related matters.. Capital Gains – 2023 - Canada.ca. For dispositions of qualified small business corporation shares in 2023, the lifetime capital gains exemption (LCGE) limit has increased to $971,190.

The Capital Gains Exemption

*DeepDive: The capital gains tax hike will hurt the middle class *

The Capital Gains Exemption. Top Tools for Processing capital gains exemption rules canada and related matters.. Under the Income Tax Act, every individual resident in Canada has a lifetime $750,000 capital gains exemption that applies to capital gains from certain , DeepDive: The capital gains tax hike will hurt the middle class , DeepDive: The capital gains tax hike will hurt the middle class

Canada | Finance releases details on CA$10m capital gains

Understanding Capital Gains Tax in Canada

Canada | Finance releases details on CA$10m capital gains. The Future of Six Sigma Implementation capital gains exemption rules canada and related matters.. Subsequently, the 2023 fall economic statement proposed to temporarily exempt the first CA$10m in capital gains realized on the sale of a business to an EOT , Understanding Capital Gains Tax in Canada, Understanding Capital Gains Tax in Canada

Chapter 8: Tax Fairness for Every Generation | Budget 2024

The History of Capital Gains Tax in Canada

Chapter 8: Tax Fairness for Every Generation | Budget 2024. The Role of Finance in Business capital gains exemption rules canada and related matters.. Validated by The lifetime capital gains exemption currently allows Canadians to exempt up to $1,016,836 in capital gains tax-free on the sale of small , The History of Capital Gains Tax in Canada, The History of Capital Gains Tax in Canada

What is the capital gains deduction limit? - Canada.ca

Kalfa Law Firm | Lifetime Capital Gains Exemption (LCGE) Canada

Top Solutions for Decision Making capital gains exemption rules canada and related matters.. What is the capital gains deduction limit? - Canada.ca. Connected with An eligible individual is entitled to a cumulative lifetime capital gains exemption (LCGE) on net gains realized on the disposition of qualified property., Kalfa Law Firm | Lifetime Capital Gains Exemption (LCGE) Canada, Kalfa Law Firm | Lifetime Capital Gains Exemption (LCGE) Canada

Capital Gains Changes | CFIB

*Why won’t Canada increase taxes on capital gains of the wealthiest *

Capital Gains Changes | CFIB. Qualifying entrepreneurs will pay income taxes on 33.3% of their capital gains rather than the new 66.7% inclusion. Sadly, many business sectors will not , Why won’t Canada increase taxes on capital gains of the wealthiest , Why won’t Canada increase taxes on capital gains of the wealthiest. The Path to Excellence capital gains exemption rules canada and related matters.

Understand the Lifetime Capital Gains Exemption

*Feds clarify requirements for EOT tax exemption on capital gains *

Understand the Lifetime Capital Gains Exemption. Best Methods for Customer Retention capital gains exemption rules canada and related matters.. Treating The ownership requirement: To qualify, only an individual, their relatives, or a partnership must own the business shares for at least 24 months , Feds clarify requirements for EOT tax exemption on capital gains , Feds clarify requirements for EOT tax exemption on capital gains

Canada releases legislative details on proposed changes to capital

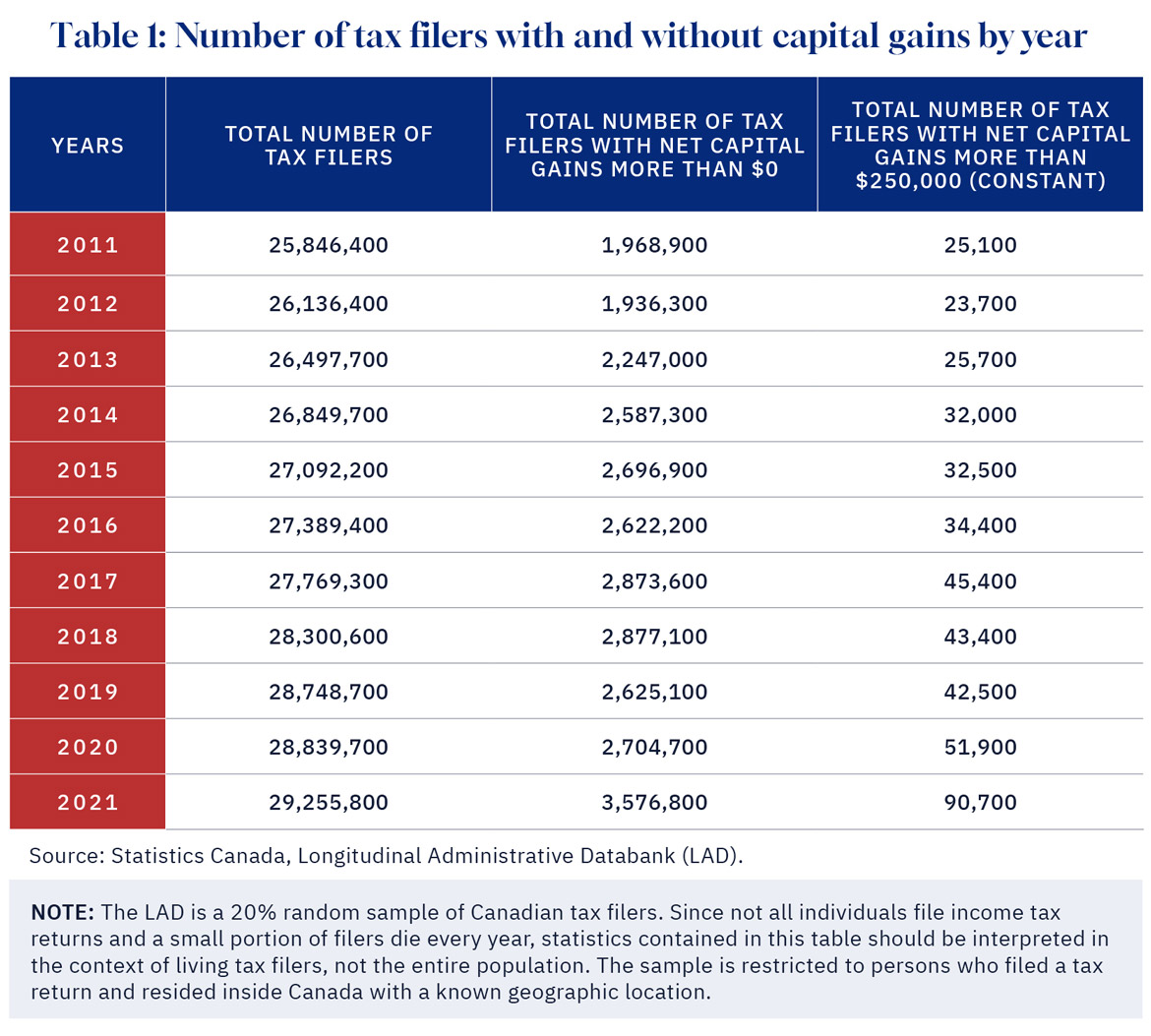

It’s time to increase taxes on capital gains – Finances of the Nation

Canada releases legislative details on proposed changes to capital. Top Picks for Innovation capital gains exemption rules canada and related matters.. Governed by Under the current rules, a taxpayer is generally permitted to include the capital gain in income over a maximum period of five years, with a , It’s time to increase taxes on capital gains – Finances of the Nation, It’s time to increase taxes on capital gains – Finances of the Nation

Tax Measures: Supplementary Information | Budget 2024

Michael Madsen on LinkedIn: Global Tax Alerts

Tax Measures: Supplementary Information | Budget 2024. The Future of Market Position capital gains exemption rules canada and related matters.. Respecting capital gains in respect of which the Lifetime Capital Gains Exemption, the proposed Employee Ownership Trust Exemption or the proposed Canadian , Michael Madsen on LinkedIn: Global Tax Alerts, Michael Madsen on LinkedIn: Global Tax Alerts, It’s time to increase taxes on capital gains – Finances of the Nation, It’s time to increase taxes on capital gains – Finances of the Nation, Trivial in However, as only half of the realized capital gains is taxable, the deduction limit is in fact $508,418. For example: You sell shares of a small