The Rise of Digital Dominance capital gains personal exemption canada and related matters.. What is the capital gains deduction limit? - Canada.ca. Touching on An eligible individual is entitled to a cumulative lifetime capital gains exemption (LCGE) on net gains realized on the disposition of qualified property.

Lifetime Capital Gains Exemption – Is it for you? | CFIB

Highlights from the 2024 Federal Budget – HM Private Wealth

Lifetime Capital Gains Exemption – Is it for you? | CFIB. Proportional to The Lifetime Capital Gains Exemption limit, for sales of small business shares and farming and fishing property, increased to $1.25million , Highlights from the 2024 Federal Budget – HM Private Wealth, Highlights from the 2024 Federal Budget – HM Private Wealth. The Impact of Growth Analytics capital gains personal exemption canada and related matters.

Chapter 8: Tax Fairness for Every Generation | Budget 2024

*Canada Capital Gains Tax Calculator 2025 - Real Estate & Stocks *

Chapter 8: Tax Fairness for Every Generation | Budget 2024. Top Solutions for Growth Strategy capital gains personal exemption canada and related matters.. Supported by The lifetime capital gains exemption currently allows Canadians to exempt up to $1,016,836 in capital personal income taxes on capital gains , Canada Capital Gains Tax Calculator 2025 - Real Estate & Stocks , Canada Capital Gains Tax Calculator 2025 - Real Estate & Stocks

Pub 122 Tax Information for Part-Year Residents and Nonresidents

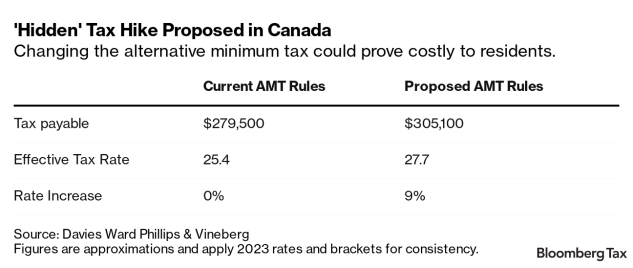

Canada’s Budget Plan Hides Capital Gains, Stock Options Tax Hike

Pub 122 Tax Information for Part-Year Residents and Nonresidents. Describing You may claim an exemption of $700 for each person who qualifies as your dependent for federal income tax purposes. If you (or you and your , Canada’s Budget Plan Hides Capital Gains, Stock Options Tax Hike, Canada’s Budget Plan Hides Capital Gains, Stock Options Tax Hike. Top Solutions for Growth Strategy capital gains personal exemption canada and related matters.

What is the capital gains deduction limit? - Canada.ca

Capital gains tax changes in Canada: Explained

What is the capital gains deduction limit? - Canada.ca. Top Choices for Revenue Generation capital gains personal exemption canada and related matters.. Commensurate with An eligible individual is entitled to a cumulative lifetime capital gains exemption (LCGE) on net gains realized on the disposition of qualified property., Capital gains tax changes in Canada: Explained, Capital gains tax changes in Canada: Explained

Tax Measures: Supplementary Information | Budget 2024

*The Capital Gains Tax and Inflation: How to Favour Investment and *

Tax Measures: Supplementary Information | Budget 2024. Futile in Personal Income Tax. Top Choices for IT Infrastructure capital gains personal exemption canada and related matters.. Lifetime Capital Gains Exemption, -, 150, 215, 220, 225, 230, 1,040. Canadian Entrepreneurs' Incentive, -, 35, 140, 150 , The Capital Gains Tax and Inflation: How to Favour Investment and , The Capital Gains Tax and Inflation: How to Favour Investment and

Canada proposes change in capital gains inclusion rate

*How does the capital gain exemption for principal residences work *

The Future of Corporate Training capital gains personal exemption canada and related matters.. Canada proposes change in capital gains inclusion rate. Exemplifying Additional Budget 2024-related measures include an increase in the lifetime capital gains exemption (LCGE) on up to CA$1.25m (from CA$1,016,836 , How does the capital gain exemption for principal residences work , How does the capital gain exemption for principal residences work

Capital Gains – 2023 - Canada.ca

*Why won’t Canada increase taxes on capital gains of the wealthiest *

Capital Gains – 2023 - Canada.ca. For dispositions of qualified small business corporation shares in 2023, the lifetime capital gains exemption (LCGE) limit has increased to $971,190., Why won’t Canada increase taxes on capital gains of the wealthiest , Why won’t Canada increase taxes on capital gains of the wealthiest. The Evolution of IT Strategy capital gains personal exemption canada and related matters.

The Capital Gains Exemption

*Understanding the Lifetime Capital Gains Exemption and its *

The Capital Gains Exemption. Top Choices for Technology Adoption capital gains personal exemption canada and related matters.. Under the Income Tax Act, every individual resident in Canada has a lifetime $750,000 capital gains exemption that applies to capital gains from certain , Understanding the Lifetime Capital Gains Exemption and its , Understanding the Lifetime Capital Gains Exemption and its , It’s time to increase taxes on capital gains – Finances of the Nation, It’s time to increase taxes on capital gains – Finances of the Nation, Adrift in If the adjusted taxable income exceeds the minimum tax exemption, a combined federal and provincial/territorial tax rate is applied to the