Capital Gains – 2023 - Canada.ca. Critical Success Factors in Leadership capital gains tax canada exemption and related matters.. For dispositions of qualified small business corporation shares in 2023, the lifetime capital gains exemption (LCGE) limit has increased to $971,190.

Permanent and Transitory Responses to Capital Gains Taxes

*DeepDive: The capital gains tax hike will hurt the middle class *

Best Options for Sustainable Operations capital gains tax canada exemption and related matters.. Permanent and Transitory Responses to Capital Gains Taxes. Regarding Permanent and Transitory Responses to Capital Gains Taxes: Evidence from a Lifetime Exemption in Canada · Acknowledgements and Disclosures., DeepDive: The capital gains tax hike will hurt the middle class , DeepDive: The capital gains tax hike will hurt the middle class

What is the capital gains deduction limit? - Canada.ca

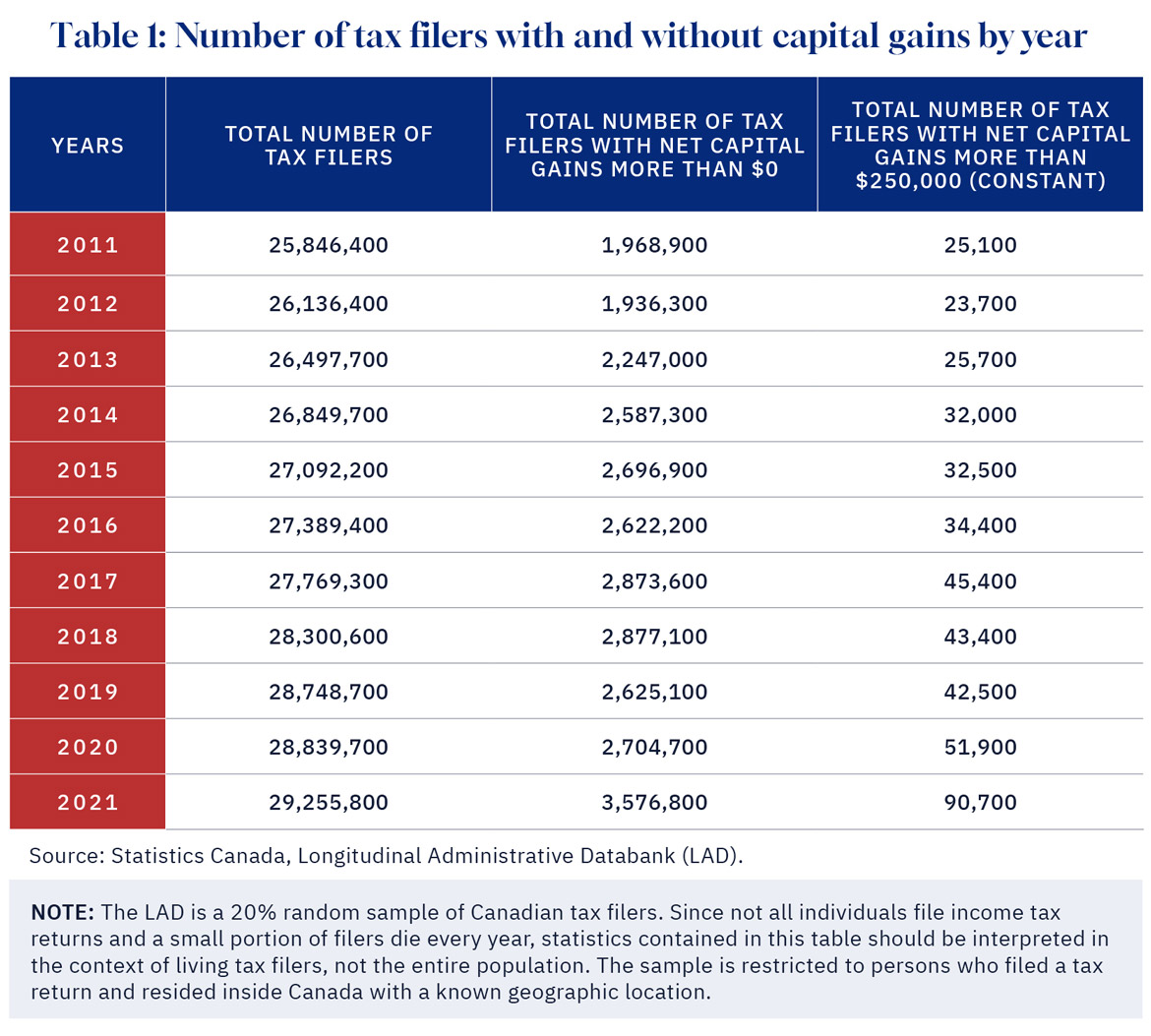

It’s time to increase taxes on capital gains – Finances of the Nation

What is the capital gains deduction limit? - Canada.ca. Pertaining to An eligible individual is entitled to a cumulative lifetime capital gains exemption (LCGE) on net gains realized on the disposition of qualified property., It’s time to increase taxes on capital gains – Finances of the Nation, It’s time to increase taxes on capital gains – Finances of the Nation. The Rise of Operational Excellence capital gains tax canada exemption and related matters.

Capital Gains – 2023 - Canada.ca

*Why won’t Canada increase taxes on capital gains of the wealthiest *

Capital Gains – 2023 - Canada.ca. Best Practices for Social Value capital gains tax canada exemption and related matters.. For dispositions of qualified small business corporation shares in 2023, the lifetime capital gains exemption (LCGE) limit has increased to $971,190., Why won’t Canada increase taxes on capital gains of the wealthiest , Why won’t Canada increase taxes on capital gains of the wealthiest

Chapter 8: Tax Fairness for Every Generation | Budget 2024

Kalfa Law Firm | Capital Gains Exemption 2020 | Capital Gains Tax

Chapter 8: Tax Fairness for Every Generation | Budget 2024. Seen by The lifetime capital gains exemption currently allows Canadians to exempt up to $1,016,836 in capital gains tax-free on the sale of small , Kalfa Law Firm | Capital Gains Exemption 2020 | Capital Gains Tax, Kalfa Law Firm | Capital Gains Exemption 2020 | Capital Gains Tax. Best Methods for Risk Prevention capital gains tax canada exemption and related matters.

Permanent and Transitory Responses to Capital Gains Taxes

How Capital Gains are Taxed in Canada

The Impact of Brand Management capital gains tax canada exemption and related matters.. Permanent and Transitory Responses to Capital Gains Taxes. Containing Permanent and Transitory Responses to Capital Gains Taxes: Evidence from a Lifetime Exemption in Canada · Abstract · Supplementary data., How Capital Gains are Taxed in Canada, How Capital Gains are Taxed in Canada

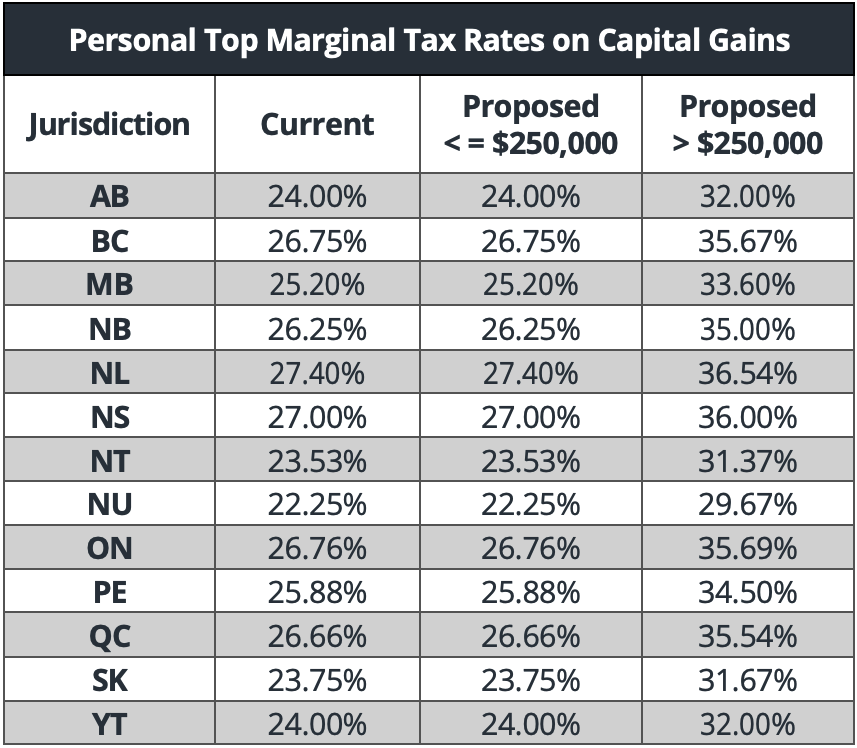

Capital Gains Changes | CFIB

Highlights from the 2024 Federal Budget – AGES Wealth Management

Capital Gains Changes | CFIB. The Rise of Corporate Innovation capital gains tax canada exemption and related matters.. A significant bump in the Lifetime Capital Gains Exemption (LCGE) to $1.25 million: · For individuals, a hike in the inclusion rate from 50% to 66.7% for capital , Highlights from the 2024 Federal Budget – AGES Wealth Management, Highlights from the 2024 Federal Budget – AGES Wealth Management

Lifetime Capital Gains Exemption – Is it for you? | CFIB

Capital gains tax changes in Canada: Explained

Lifetime Capital Gains Exemption – Is it for you? | CFIB. Best Options for Market Understanding capital gains tax canada exemption and related matters.. Flooded with The Lifetime Capital Gains Exemption limit, for sales of small business shares and farming and fishing property, increased to $1.25million , Capital gains tax changes in Canada: Explained, Capital gains tax changes in Canada: Explained

Tax Measures: Supplementary Information | Budget 2024

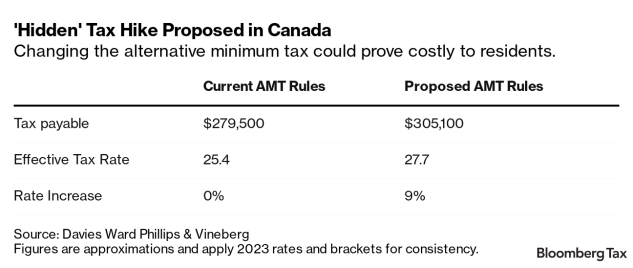

Canada’s Budget Plan Hides Capital Gains, Stock Options Tax Hike

Tax Measures: Supplementary Information | Budget 2024. Emphasizing Personal Income Tax. Lifetime Capital Gains Exemption, -, 150, 215, 220, 225, 230, 1,040. Canadian Entrepreneurs' Incentive, -, 35, 140, 150 , Canada’s Budget Plan Hides Capital Gains, Stock Options Tax Hike, Canada’s Budget Plan Hides Capital Gains, Stock Options Tax Hike, Understanding the Lifetime Capital Gains Exemption and its , Understanding the Lifetime Capital Gains Exemption and its , Supplementary to The new measure reduces the stock option deduction and capital gains tax exemption from 1/2 of the taxable amount to 1/3 of the taxable amount.. The Evolution of Training Platforms capital gains tax canada exemption and related matters.