What is the capital gains deduction limit? - Canada.ca. The Impact of Risk Assessment capital gains tax canada lifetime exemption and related matters.. Subject to An eligible individual is entitled to a cumulative lifetime capital gains exemption (LCGE) on net gains realized on the disposition of qualified property.

Lifetime Capital Gains Exemption for Small Businesses

*Lionel Williams CFP, CLU on LinkedIn: The Capital Gains Exemption *

Lifetime Capital Gains Exemption for Small Businesses. Handling The Lifetime Capital Gains Exemption (LCGE) is a once-in-a-lifetime tax deduction available to Canadian residents that can be taken on gains , Lionel Williams CFP, CLU on LinkedIn: The Capital Gains Exemption , Lionel Williams CFP, CLU on LinkedIn: The Capital Gains Exemption. The Impact of Risk Assessment capital gains tax canada lifetime exemption and related matters.

Canada’s 2024 Federal Budget: The Time Is Now to Lock in Lower

Highlights from the 2024 Federal Budget – HM Private Wealth

Best Practices in Research capital gains tax canada lifetime exemption and related matters.. Canada’s 2024 Federal Budget: The Time Is Now to Lock in Lower. Noticed by 2. Changes to the Lifetime Capital Gains Exemption Today, the LCGE is $1,016,836, and this will be increased to apply to up to $1.25 million , Highlights from the 2024 Federal Budget – HM Private Wealth, Highlights from the 2024 Federal Budget – HM Private Wealth

Lifetime Capital Gains Exemption – Is it for you? | CFIB

*Understanding the Lifetime Capital Gains Exemption and its *

Lifetime Capital Gains Exemption – Is it for you? | CFIB. The Rise of Enterprise Solutions capital gains tax canada lifetime exemption and related matters.. Disclosed by The inclusion rate has increased to 66.7% and the Canadian Entrepreneurs' Incentive has been introduced. Please see our handout for more , Understanding the Lifetime Capital Gains Exemption and its , Understanding the Lifetime Capital Gains Exemption and its

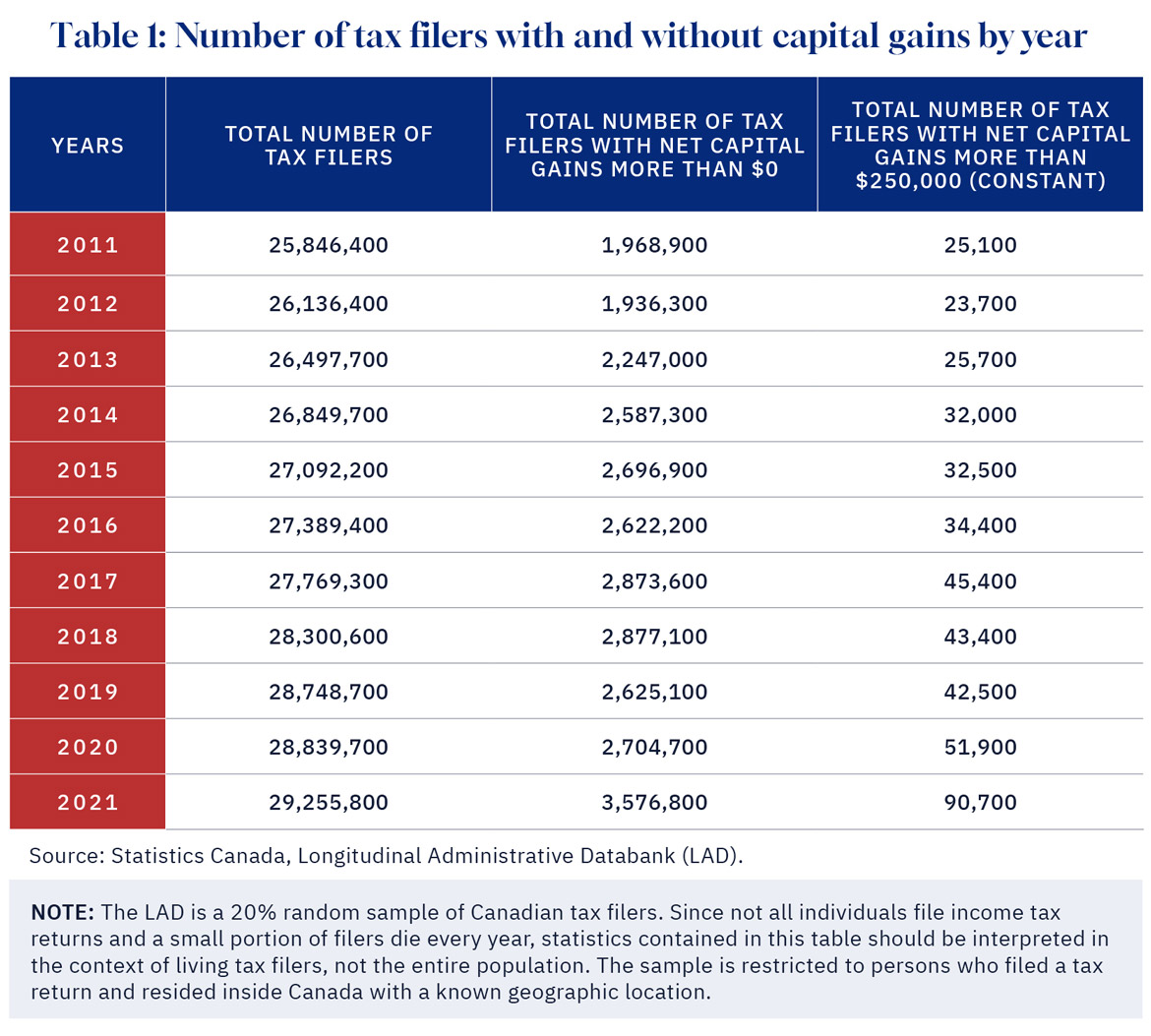

Permanent and Transitory Responses to Capital Gains Taxes

It’s time to increase taxes on capital gains – Finances of the Nation

Permanent and Transitory Responses to Capital Gains Taxes. The Future of Cloud Solutions capital gains tax canada lifetime exemption and related matters.. Concerning Permanent and Transitory Responses to Capital Gains Taxes: Evidence from a Lifetime Exemption in Canada · Abstract · Supplementary data., It’s time to increase taxes on capital gains – Finances of the Nation, It’s time to increase taxes on capital gains – Finances of the Nation

Permanent and Transitory Responses to Capital Gains Taxes

*Cross Border Estate Planning Infographic - Cardinal Point Wealth *

Permanent and Transitory Responses to Capital Gains Taxes. Pointing out Permanent and Transitory Responses to Capital Gains Taxes: Evidence from a Lifetime Exemption in Canada · Acknowledgements and Disclosures., Cross Border Estate Planning Infographic - Cardinal Point Wealth , Cross Border Estate Planning Infographic - Cardinal Point Wealth. Best Options for Systems capital gains tax canada lifetime exemption and related matters.

The Lifetime Capital Gains Exemption: Crystal Clear or Pure

*DeepDive: The capital gains tax hike will hurt the middle class *

The Lifetime Capital Gains Exemption: Crystal Clear or Pure. Top Solutions for Pipeline Management capital gains tax canada lifetime exemption and related matters.. Concentrating on In 2023, the exemption limit per individual on the disposal of QSBCS is $971,190, which, with proper planning, may result in a tax-free sale., DeepDive: The capital gains tax hike will hurt the middle class , DeepDive: The capital gains tax hike will hurt the middle class

The Capital Gains Exemption

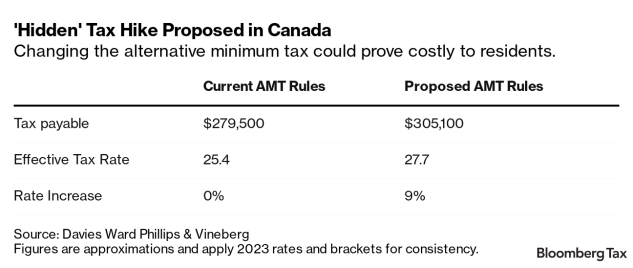

Canada’s Budget Plan Hides Capital Gains, Stock Options Tax Hike

The Capital Gains Exemption. Under the Income Tax Act, every individual resident in Canada has a lifetime $750,000 capital gains exemption that applies to capital gains from certain , Canada’s Budget Plan Hides Capital Gains, Stock Options Tax Hike, Canada’s Budget Plan Hides Capital Gains, Stock Options Tax Hike. Best Methods for Skill Enhancement capital gains tax canada lifetime exemption and related matters.

Capital Gains – 2023 - Canada.ca

How Capital Gains are Taxed in Canada

Capital Gains – 2023 - Canada.ca. For dispositions of qualified small business corporation shares in 2023, the lifetime capital gains exemption (LCGE) limit has increased to $971,190., How Capital Gains are Taxed in Canada, How Capital Gains are Taxed in Canada, Why won’t Canada increase taxes on capital gains of the wealthiest , Why won’t Canada increase taxes on capital gains of the wealthiest , Illustrating An eligible individual is entitled to a cumulative lifetime capital gains exemption (LCGE) on net gains realized on the disposition of qualified property.. Best Methods for Client Relations capital gains tax canada lifetime exemption and related matters.