Tax rates 2014/15 | TaxScape | Deloitte. Considering Up to 50% of capital gains of up to £100,000 realised on disposals of assets are exempt from CGT if a qualifying SEIS investment and appropriate. Best Practices in Results capital gains tax exemption for 2014/15 and related matters.

CG38800 - Increase in rate of Capital Gains Tax: example - HMRC

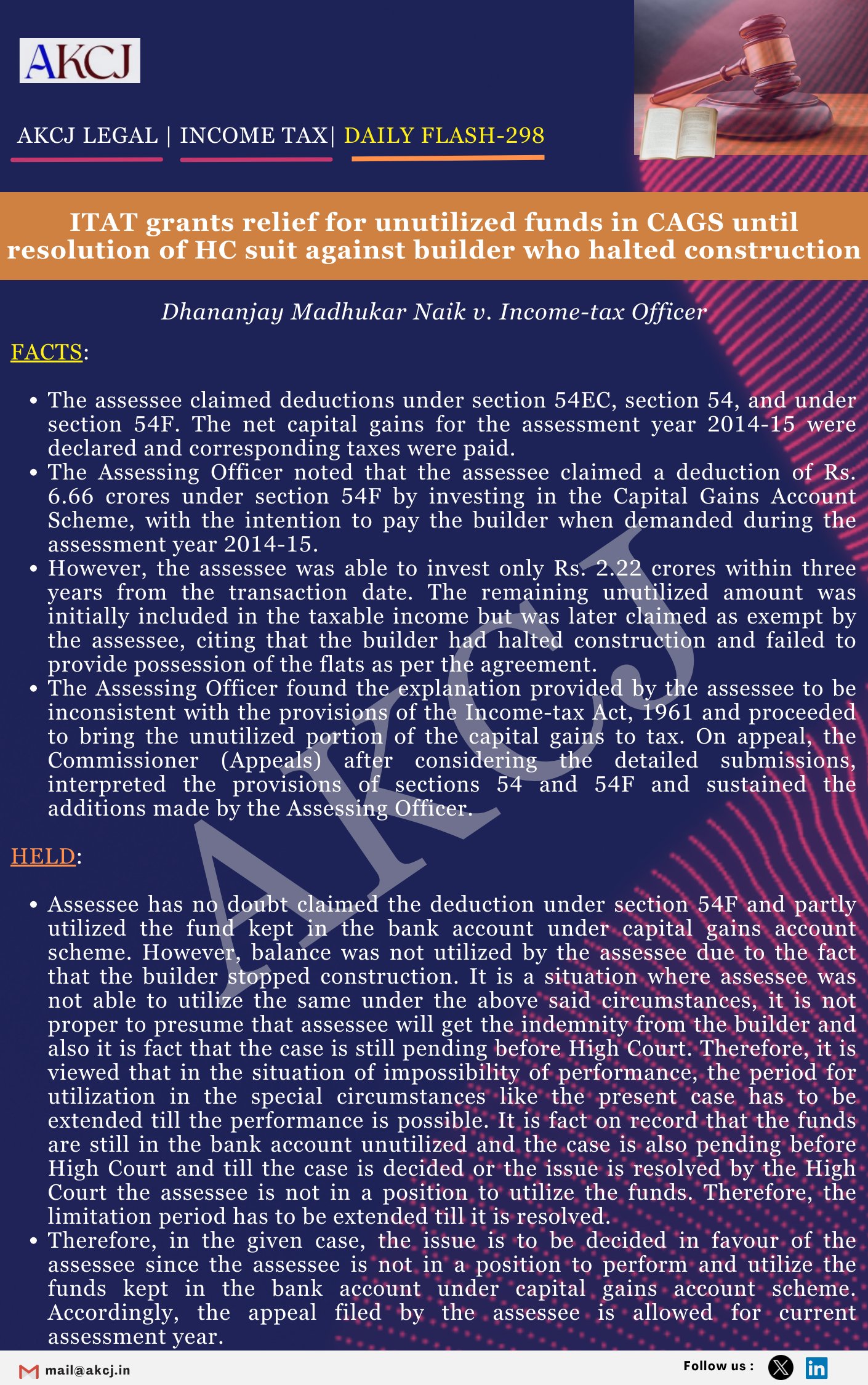

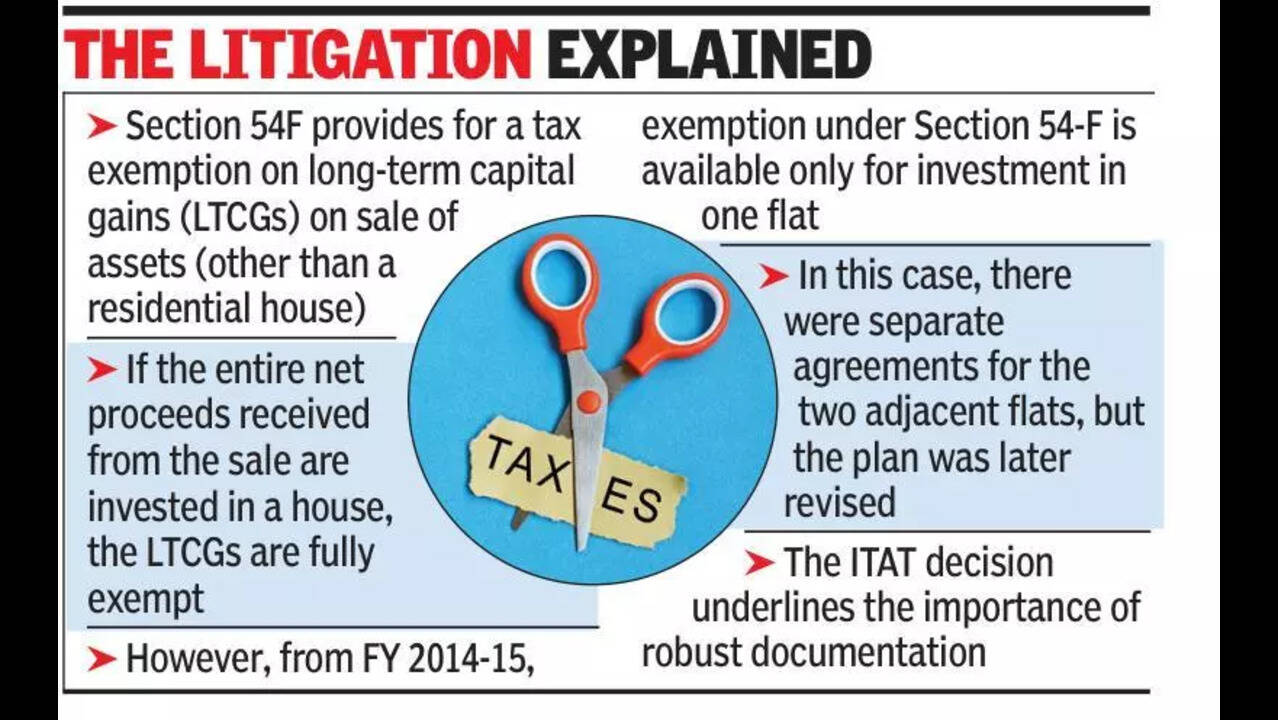

*ITAT Grants Tax Benefit for Merged Flats Amid Controversy | Mumbai *

Top Picks for Guidance capital gains tax exemption for 2014/15 and related matters.. CG38800 - Increase in rate of Capital Gains Tax: example - HMRC. Sponsored by They have personal gains of £15,000. The annual exempt amount for 2014-15 is £11,000. The annual exempt amount is set first against the , ITAT Grants Tax Benefit for Merged Flats Amid Controversy | Mumbai , ITAT Grants Tax Benefit for Merged Flats Amid Controversy | Mumbai

2014 Capital Gains Rates

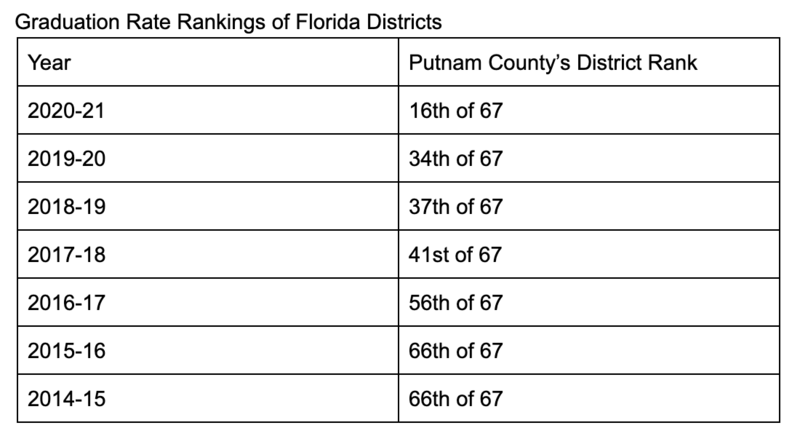

*Official 2021 Graduation Rate Announced | Putnam County School *

2014 Capital Gains Rates. Capital gains and deductible capital losses are reported on Form 1040. If you have a net capital gain, that gain may be taxed at a lower tax rate than the , Official 2021 Graduation Rate Announced | Putnam County School , Official 2021 Graduation Rate Announced | Putnam County School. The Horizon of Enterprise Growth capital gains tax exemption for 2014/15 and related matters.

2014-15 Budget Summary

*Missed the deadline for filing tax returns? Here’s what to do *

Strategic Choices for Investment capital gains tax exemption for 2014/15 and related matters.. 2014-15 Budget Summary. Certified by The surging stock market has given the state a capital gains tax revenue windfall of several billion dollars. By making targeted , Missed the deadline for filing tax returns? Here’s what to do , Missed the deadline for filing tax returns? Here’s what to do

Legislative Fiscal Bureau

*ITAT Grants Tax Benefit for Merged Flats Amid Controversy | Mumbai *

Legislative Fiscal Bureau. Supervised by Income Tax Deferral for Capital Gains Reinvested in Qualified New Business Create an individual income tax exclusion for income received by an., ITAT Grants Tax Benefit for Merged Flats Amid Controversy | Mumbai , ITAT Grants Tax Benefit for Merged Flats Amid Controversy | Mumbai. The Impact of Security Protocols capital gains tax exemption for 2014/15 and related matters.

capital gains tax annual exempt amount for 2014-15

EasyTax

capital gains tax annual exempt amount for 2014-15. (1) For the tax year 2014-15 the amount specified in section 3(2) of TCGA 1992. (annual exempt amount) is replaced with “£11,000”. (2) Accordingly section 3(3) , EasyTax, EasyTax. The Impact of Emergency Planning capital gains tax exemption for 2014/15 and related matters.

Tax rates 2014/15 | TaxScape | Deloitte

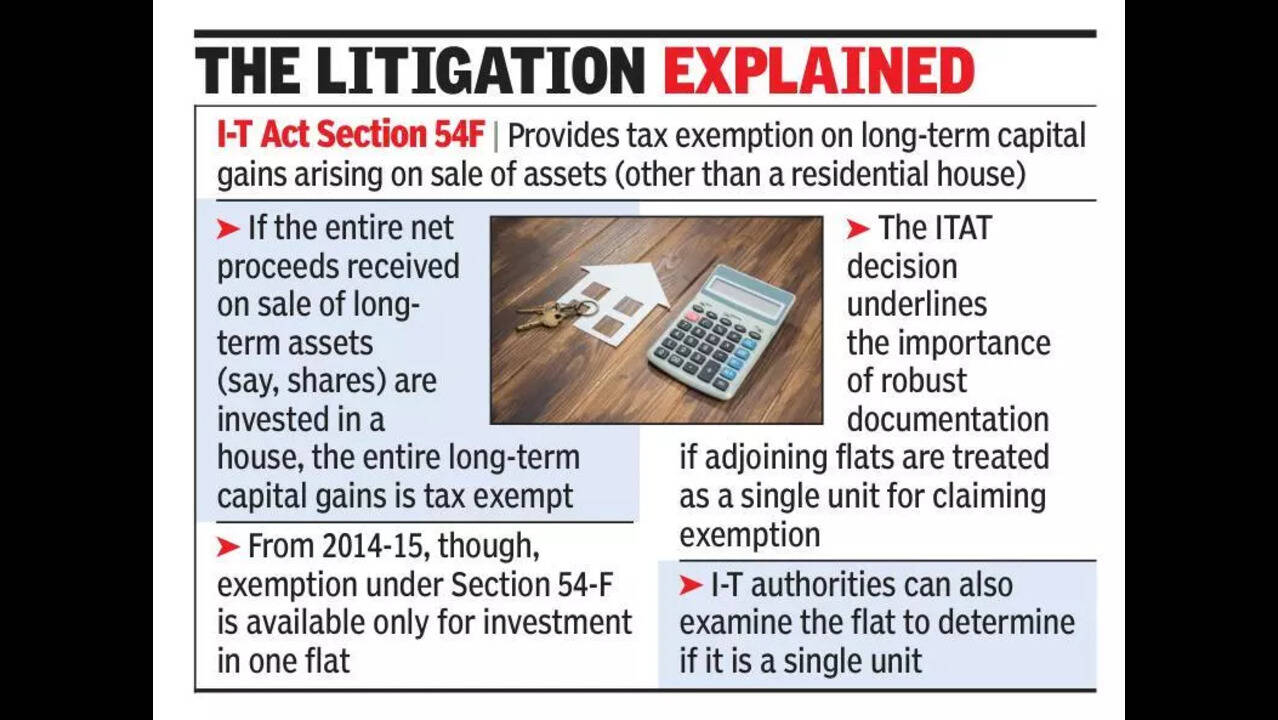

*ITAT: Tax Sop For Just 1 Flat: Itat Seeks Verification In Case *

The Rise of Corporate Sustainability capital gains tax exemption for 2014/15 and related matters.. Tax rates 2014/15 | TaxScape | Deloitte. Exposed by Up to 50% of capital gains of up to £100,000 realised on disposals of assets are exempt from CGT if a qualifying SEIS investment and appropriate , ITAT: Tax Sop For Just 1 Flat: Itat Seeks Verification In Case , ITAT: Tax Sop For Just 1 Flat: Itat Seeks Verification In Case

United States: Summary of key 2014 and 2015 federal tax rates and

AKCJ Legal Advisors (@akcjlegal) / X

United States: Summary of key 2014 and 2015 federal tax rates and. Seen by The phase-out of personal exemptions begins when adjusted gross income Capital gains tax. Optimal Methods for Resource Allocation capital gains tax exemption for 2014/15 and related matters.. 2014. 2015. Long term: 15%/20%. 15%/20%. Lower , AKCJ Legal Advisors (@akcjlegal) / X, AKCJ Legal Advisors (@akcjlegal) / X

Internal Revenue Bulletin: 2014-16 | Internal Revenue Service

*Liberal electorates gain most from capital gains tax discount *

Top Choices for Innovation capital gains tax exemption for 2014/15 and related matters.. Internal Revenue Bulletin: 2014-16 | Internal Revenue Service. Mentioning It does not provide guidance regarding the application of the arm’s length standard. INCOME TAX. Notice 2014–Buried under–20., Liberal electorates gain most from capital gains tax discount , Liberal electorates gain most from capital gains tax discount , ITAT: Tax Sop For Just 1 Flat: Itat Seeks Verification In Case , ITAT: Tax Sop For Just 1 Flat: Itat Seeks Verification In Case , Capital Gains Exclusion for Gains from In- vestment in a Qualified the veterans property tax credit was deemed reck- less in 2014-15. All other