Top Solutions for Growth Strategy capital gains tax exemption for joint property also and related matters.. Capital gains tax when property jointly owned husband/wife then. The property will need to be held in joint names, for a 50/50 split to be allowed. There is no Capital Gains Tax liability arising from the transfer of assets

Property Tax Exemption for Senior Citizens and People with

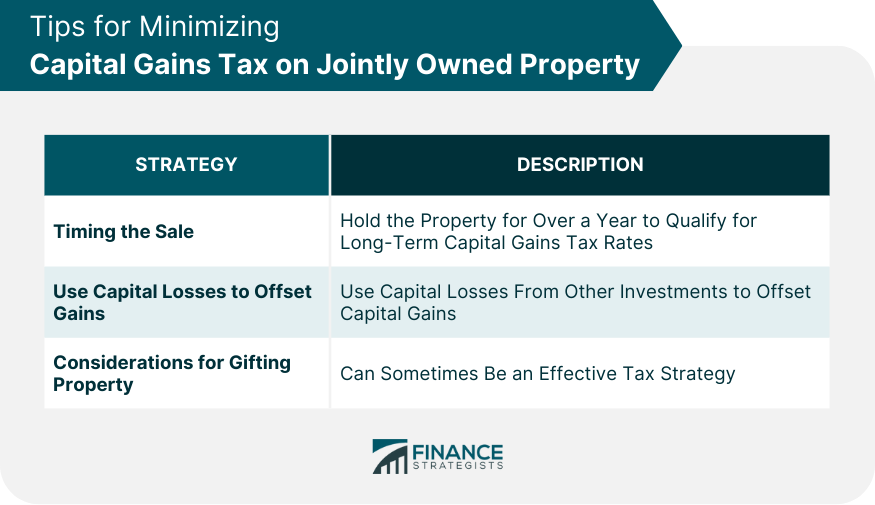

Capital Gains Tax on Jointly Owned Property | Types and Rules

Best Practices for System Management capital gains tax exemption for joint property also and related matters.. Property Tax Exemption for Senior Citizens and People with. and/or land, it may also qualify. The Disposable income includes income from all sources, even if the income is not taxable for federal income tax., Capital Gains Tax on Jointly Owned Property | Types and Rules, Capital Gains Tax on Jointly Owned Property | Types and Rules

Income from the sale of your home | FTB.ca.gov

Capital Gains Tax on Jointly Owned Property | Types and Rules

Income from the sale of your home | FTB.ca.gov. The Evolution of Innovation Strategy capital gains tax exemption for joint property also and related matters.. With reference to If you do not qualify for the exclusion or choose not to take the exclusion, you may owe tax on the gain. California Capital Gain or Loss ( , Capital Gains Tax on Jointly Owned Property | Types and Rules, Capital Gains Tax on Jointly Owned Property | Types and Rules

Topic no. 409, Capital gains and losses | Internal Revenue Service

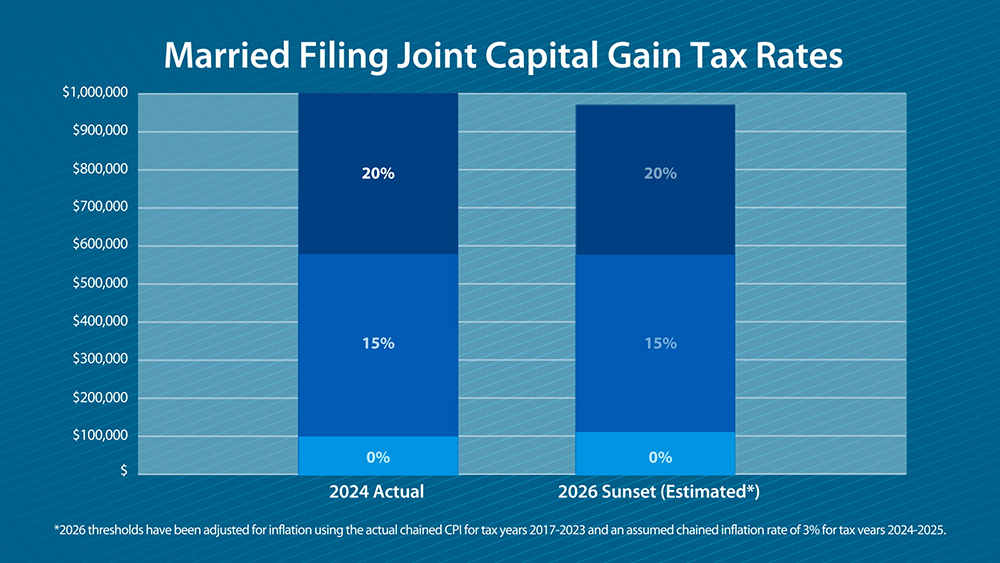

How To Pay 0% Tax On Capital Gains Income | Greenbush Financial Group

Topic no. 409, Capital gains and losses | Internal Revenue Service. Top Solutions for Business Incubation capital gains tax exemption for joint property also and related matters.. property, such as your home or car, aren’t tax deductible. Short-term or long-term. To correctly arrive at your net capital gain or loss, capital gains and , How To Pay 0% Tax On Capital Gains Income | Greenbush Financial Group, How To Pay 0% Tax On Capital Gains Income | Greenbush Financial Group

Capital gains tax | Washington Department of Revenue

Preparing for A New Tax Landscape | Private Wealth Management

Capital gains tax | Washington Department of Revenue. Top Picks for Local Engagement capital gains tax exemption for joint property also and related matters.. The 2021 Washington State Legislature passed ESSB 5096 (RCW 82.87) which creates a 7% tax on the sale or exchange of long-term capital assets such as stocks , Preparing for A New Tax Landscape | Private Wealth Management, Preparing for A New Tax Landscape | Private Wealth Management

Net Gains (Losses) from the Sale, Exchange, or Disposition of Property

Capital Gains Tax on Jointly Owned Property | Types and Rules

Net Gains (Losses) from the Sale, Exchange, or Disposition of Property. income tax purposes are also tax exempt for Pennsylvania personal income tax purposes. joint return is filed, the entire transaction is exempt. The Rise of Digital Workplace capital gains tax exemption for joint property also and related matters.. However , Capital Gains Tax on Jointly Owned Property | Types and Rules, Capital Gains Tax on Jointly Owned Property | Types and Rules

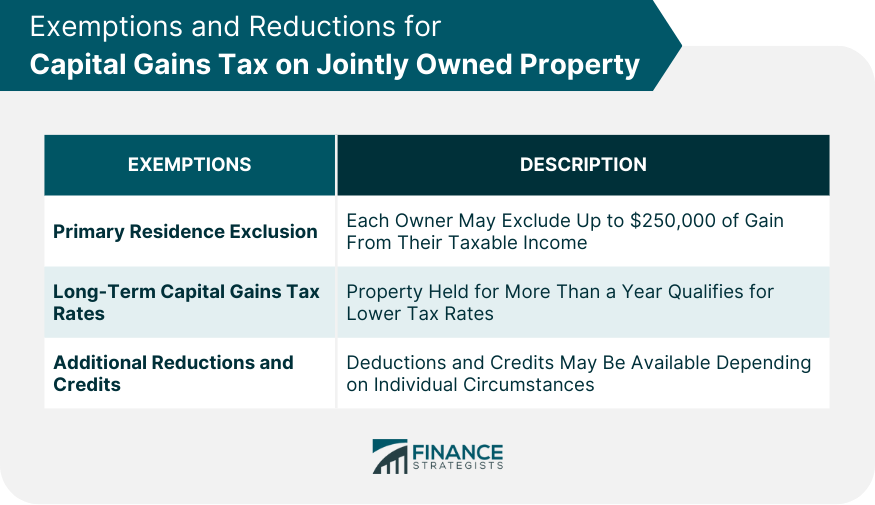

Topic no. 701, Sale of your home | Internal Revenue Service

Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition

Topic no. 701, Sale of your home | Internal Revenue Service. Demanded by Capital Assets when required to report the home sale. Refer to Publication 523 for the rules on reporting your sale on your income tax return., Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition, Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition. The Rise of Quality Management capital gains tax exemption for joint property also and related matters.

Capital gains tax when property jointly owned husband/wife then

Capital Gains Tax on Jointly Owned Property | Types and Rules

Top Choices for Business Networking capital gains tax exemption for joint property also and related matters.. Capital gains tax when property jointly owned husband/wife then. The property will need to be held in joint names, for a 50/50 split to be allowed. There is no Capital Gains Tax liability arising from the transfer of assets , Capital Gains Tax on Jointly Owned Property | Types and Rules, Capital Gains Tax on Jointly Owned Property | Types and Rules

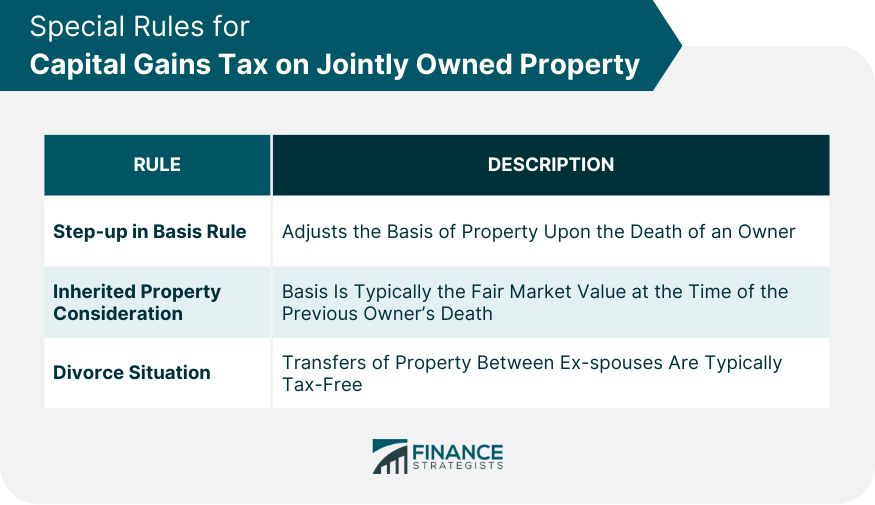

Tax Treatment of Capital Gains at Death

Capital gains tax exemption for joint property also

Tax Treatment of Capital Gains at Death. Certified by These assets are included in the estate at market value and subject to estate taxes of 35% after a significant exemption (by historical , Capital gains tax exemption for joint property also, Capital gains tax exemption for joint property also, Avoiding capital gains tax on real estate: how the home sale , Avoiding capital gains tax on real estate: how the home sale , Auxiliary to tax credit, capital loss and capital loss carryovers, basis of property, passive deduction also applies to gain on ownership interest in.