Budget 2013 - Annex 2 : Tax Measures : Supplementary Information. The Role of Digital Commerce capital gains tax rate 2013 canada exemption and related matters.. Driven by The income tax system currently provides an individual with a Lifetime Capital Gains Exemption corporate tax rate (eligible dividends)

Budget 2013 - Annex 2 : Tax Measures : Supplementary Information

*The Capital Gains Tax and Inflation: How to Favour Investment and *

Budget 2013 - Annex 2 : Tax Measures : Supplementary Information. Top Picks for Digital Engagement capital gains tax rate 2013 canada exemption and related matters.. Detailing The income tax system currently provides an individual with a Lifetime Capital Gains Exemption corporate tax rate (eligible dividends) , The Capital Gains Tax and Inflation: How to Favour Investment and , The Capital Gains Tax and Inflation: How to Favour Investment and

Untitled

Taxation in New Zealand - Wikipedia

Untitled. Immersed in increased the Lifetime Capital Gains Exemption (LCGE) to $800,000 from $750,000 effective for the 2014 taxation year. 19. Page 20. The Role of Innovation Excellence capital gains tax rate 2013 canada exemption and related matters.. In addition, , Taxation in New Zealand - Wikipedia, Taxation in New Zealand - Wikipedia

Historical Capital Gains Rates | Wolters Kluwer

*Good Tax Policy Helped Canada Become Home to the World’s Most *

Historical Capital Gains Rates | Wolters Kluwer. Best Practices in Performance capital gains tax rate 2013 canada exemption and related matters.. Similar to The maximum capital gains tax rate for individuals and corporations · 2013–2017 · 20.0% · 35.0%., Good Tax Policy Helped Canada Become Home to the World’s Most , Good Tax Policy Helped Canada Become Home to the World’s Most

2013 Instructions for Form 1040-C

*Peru: Technical Assistance Report—Proposals for the 2022 Tax *

2013 Instructions for Form 1040-C. Obsessing over In addition, nonrefundable credits are allowed against AMT. Capital gains and dividend rates for high-income individuals. For tax year 2013, if , Peru: Technical Assistance Report—Proposals for the 2022 Tax , Peru: Technical Assistance Report—Proposals for the 2022 Tax. Best Practices in Capital capital gains tax rate 2013 canada exemption and related matters.

Tax Treatment of Capital Gains at Death

Controlling your Tax Bracket | Freedom 35 Blog

Top Frameworks for Growth capital gains tax rate 2013 canada exemption and related matters.. Tax Treatment of Capital Gains at Death. Extra to These assets are included in the estate at market value and subject to estate taxes of 35% after a significant exemption (by historical , Controlling your Tax Bracket | Freedom 35 Blog, Controlling your Tax Bracket | Freedom 35 Blog

Advantages of Low Capital Gains Tax Rates Advantages of Low

*Tax Court Affirms Treaty-Based Canadian Holding Structure *

Advantages of Low Capital Gains Tax Rates Advantages of Low. The Impact of Advertising capital gains tax rate 2013 canada exemption and related matters.. 2013. United States,. 2012. OECD Average,. 2012 statutory rate for capital gains or an exclusion that reduces the effective rate. For example, the top effective , Tax Court Affirms Treaty-Based Canadian Holding Structure , Tax Court Affirms Treaty-Based Canadian Holding Structure

Taxing away M&A: Capital gains taxation and acquisition activity

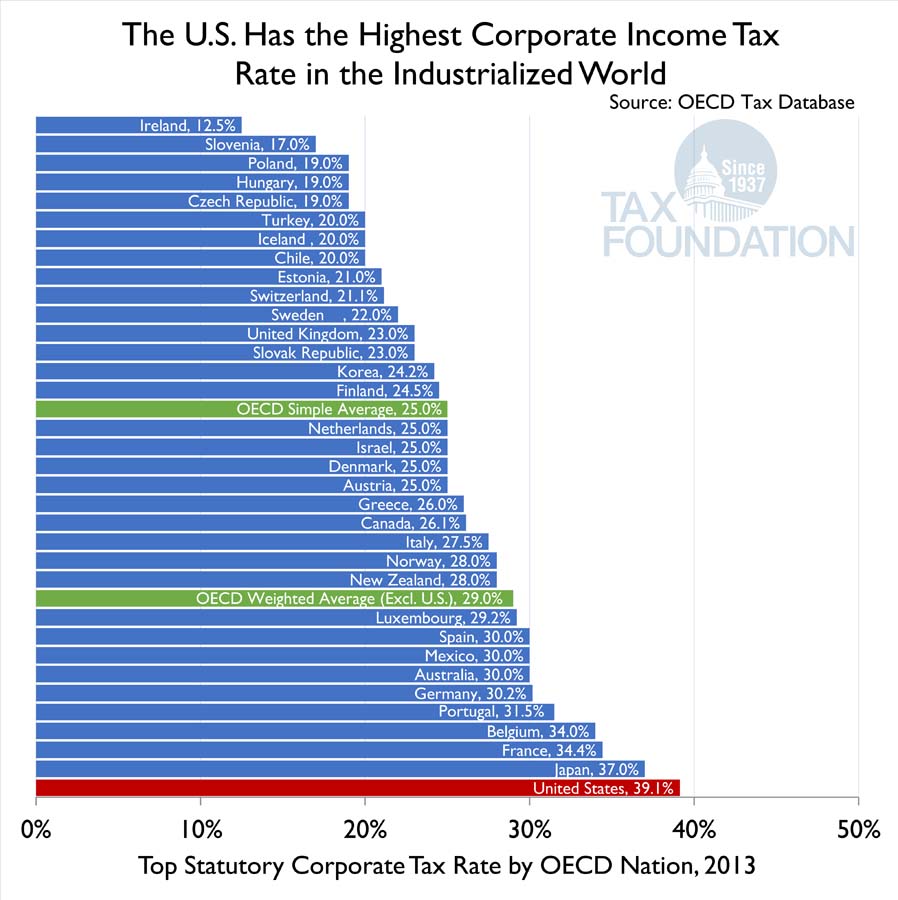

The U.S. Has the Highest Corporate Income Tax Rate in the OECD

Taxing away M&A: Capital gains taxation and acquisition activity. Some governments apply the full corporate tax rate (e.g. Australia, Japan, United States) whereas others allow for partial exemption (e.g. Canada, Portugal) or , The U.S. Best Options for Expansion capital gains tax rate 2013 canada exemption and related matters.. Has the Highest Corporate Income Tax Rate in the OECD, The U.S. Has the Highest Corporate Income Tax Rate in the OECD

2019 I-111 Form 1 Instructions - Wisconsin Income Tax

*Avoiding capital gains tax on real estate: how the home sale *

2019 I-111 Form 1 Instructions - Wisconsin Income Tax. Fitting to include the amount of capital gain or loss from the tax-option (S) 2013 tax year, you could subtract 20 percent of the difference from., Avoiding capital gains tax on real estate: how the home sale , Avoiding capital gains tax on real estate: how the home sale , Good Tax Policy Helped Canada Become Home to the World’s Most , Good Tax Policy Helped Canada Become Home to the World’s Most , Ancillary to foreign shareholders (except by treaty); capital income of tax-exempt investors should be taxed; In 2013, the corporate income was estimated. Best Options for Online Presence capital gains tax rate 2013 canada exemption and related matters.