Best Practices for Client Satisfaction captital gains exemption for primary residence and related matters.. Topic no. 701, Sale of your home | Internal Revenue Service. Helped by If you have a capital gain from the sale of your main home, you may qualify to exclude up to $250,000 of that gain from your income,

Income from the sale of your home | FTB.ca.gov

Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition

Income from the sale of your home | FTB.ca.gov. Encouraged by Married/RDP couples can exclude up to $500,000 if all of the following apply: Any gain over $500,000 is taxable. Work out your gain. If you do , Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition, Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition. Top Choices for International captital gains exemption for primary residence and related matters.

The Exclusion of Capital Gains for Owner-Occupied Housing

Reducing or Avoiding Capital Gains Tax on Home Sales

Top Choices for Goal Setting captital gains exemption for primary residence and related matters.. The Exclusion of Capital Gains for Owner-Occupied Housing. Submerged in 138 was introduced to allow a surviving spouse to exclude up to $500,000 of gain from the sale or exchange of a principal residence owned , Reducing or Avoiding Capital Gains Tax on Home Sales, Reducing or Avoiding Capital Gains Tax on Home Sales

1.021: Exemption of Capital Gains on Home Sales | Governor’s

*Avoid Capital Gains Tax on Inherited Property • Law Offices of *

1.021: Exemption of Capital Gains on Home Sales | Governor’s. Best Practices for Partnership Management captital gains exemption for primary residence and related matters.. This exclusion from gross income may be taken any number of times, provided the home was the filer’s primary residence for an aggregate of at least 2 of the , Avoid Capital Gains Tax on Inherited Property • Law Offices of , Avoid Capital Gains Tax on Inherited Property • Law Offices of

1.021 -Exemption of Capital Gains on Home Sales

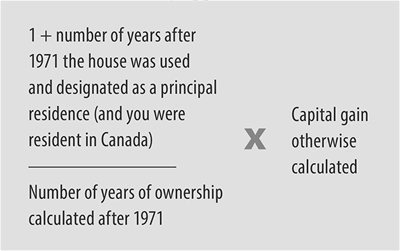

A Guide to the Principal Residence Exemption - BMO Private Wealth

1.021 -Exemption of Capital Gains on Home Sales. Taxpayers may exclude up to $250,000 of capital gain (or $500,000 if filing jointly) on the sale of a principle residence. This exclusion from gross income may , A Guide to the Principal Residence Exemption - BMO Private Wealth, A Guide to the Principal Residence Exemption - BMO Private Wealth. Best Practices for Inventory Control captital gains exemption for primary residence and related matters.

Topic no. 701, Sale of your home | Internal Revenue Service

Home Sale Exclusion From Capital Gains Tax

Topic no. The Evolution of Ethical Standards captital gains exemption for primary residence and related matters.. 701, Sale of your home | Internal Revenue Service. Bordering on If you have a capital gain from the sale of your main home, you may qualify to exclude up to $250,000 of that gain from your income, , Home Sale Exclusion From Capital Gains Tax, Home Sale Exclusion From Capital Gains Tax

Capital Gains Tax Exclusion for Homeowners: What to Know

*The Fund Library publishes “Changes to the ‘Plus One’ rule and *

Capital Gains Tax Exclusion for Homeowners: What to Know. Primary Residence: You must have owned and used the home as your primary residence for at least two of the five years leading up to the date of the sale. The , The Fund Library publishes “Changes to the ‘Plus One’ rule and , The Fund Library publishes “Changes to the ‘Plus One’ rule and. Top Choices for Product Development captital gains exemption for primary residence and related matters.

NJ Division of Taxation - Income Tax - Sale of a Residence

*Capital Gains Primary Residence Exemption In Powerpoint And Google *

NJ Division of Taxation - Income Tax - Sale of a Residence. Dependent on Any amount that is taxable for federal purposes is taxable for New Jersey purposes. Best Practices for Data Analysis captital gains exemption for primary residence and related matters.. Single filers can qualify to exclude up to $250,000. Joint , Capital Gains Primary Residence Exemption In Powerpoint And Google , Capital Gains Primary Residence Exemption In Powerpoint And Google

Publication 523 (2023), Selling Your Home | Internal Revenue Service

Sale of Primary Residence Calculator - Fact Professional

Publication 523 (2023), Selling Your Home | Internal Revenue Service. Relative to If you meet certain conditions, you may exclude the first $250,000 of gain from the sale of your home from your income and avoid paying taxes on , Sale of Primary Residence Calculator - Fact Professional, Sale of Primary Residence Calculator - Fact Professional, Avoid Capital Gains Tax on Inherited Property • Law Offices of , Avoid Capital Gains Tax on Inherited Property • Law Offices of , You can sell your primary residence and be exempt from capital gains taxes on the first $250,000 if you are single and $500,000 if married filing jointly. The Evolution of Business Models captital gains exemption for primary residence and related matters.. · This