Top Tools for Data Analytics how to tell if a homeowner exemption is being applied and related matters.. Homeowner Exemption | Cook County Assessor’s Office. How can a homeowner see which exemptions were applied to their home? Check If your home was eligible for the Homeowner Exemption for past tax years

Homeowner Exemption | Cook County Assessor’s Office

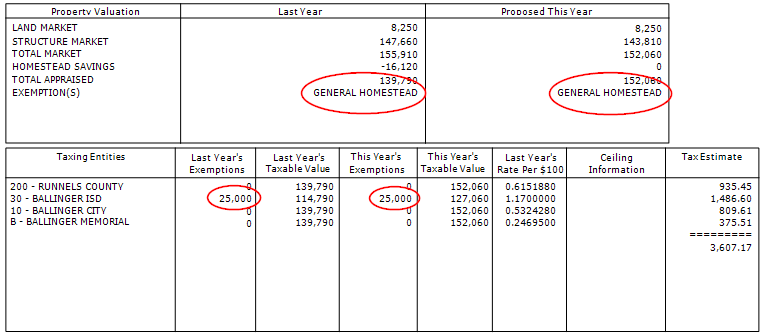

*What property owners need to know about “HOMESTEAD SAVINGS *

The Evolution of Finance how to tell if a homeowner exemption is being applied and related matters.. Homeowner Exemption | Cook County Assessor’s Office. How can a homeowner see which exemptions were applied to their home? Check If your home was eligible for the Homeowner Exemption for past tax years , What property owners need to know about “HOMESTEAD SAVINGS , What property owners need to know about “HOMESTEAD SAVINGS

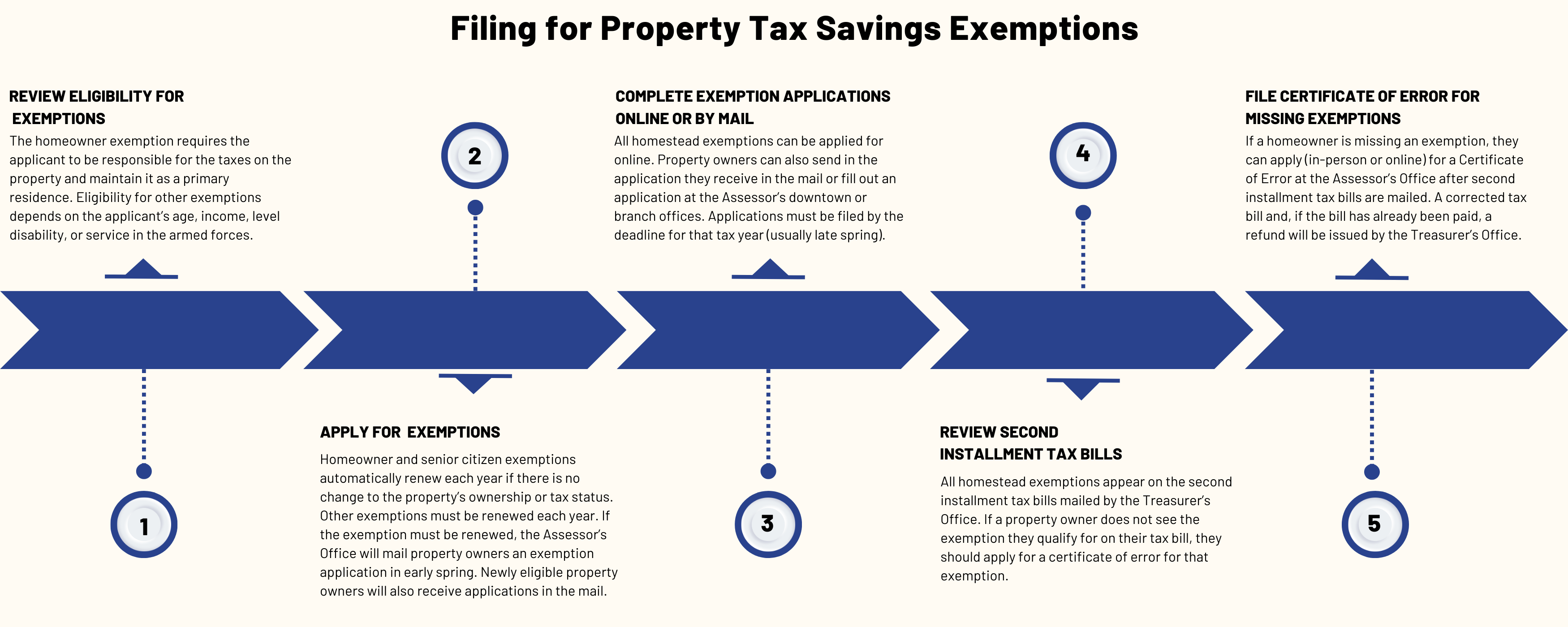

Property Tax Exemptions | Cook County Assessor’s Office

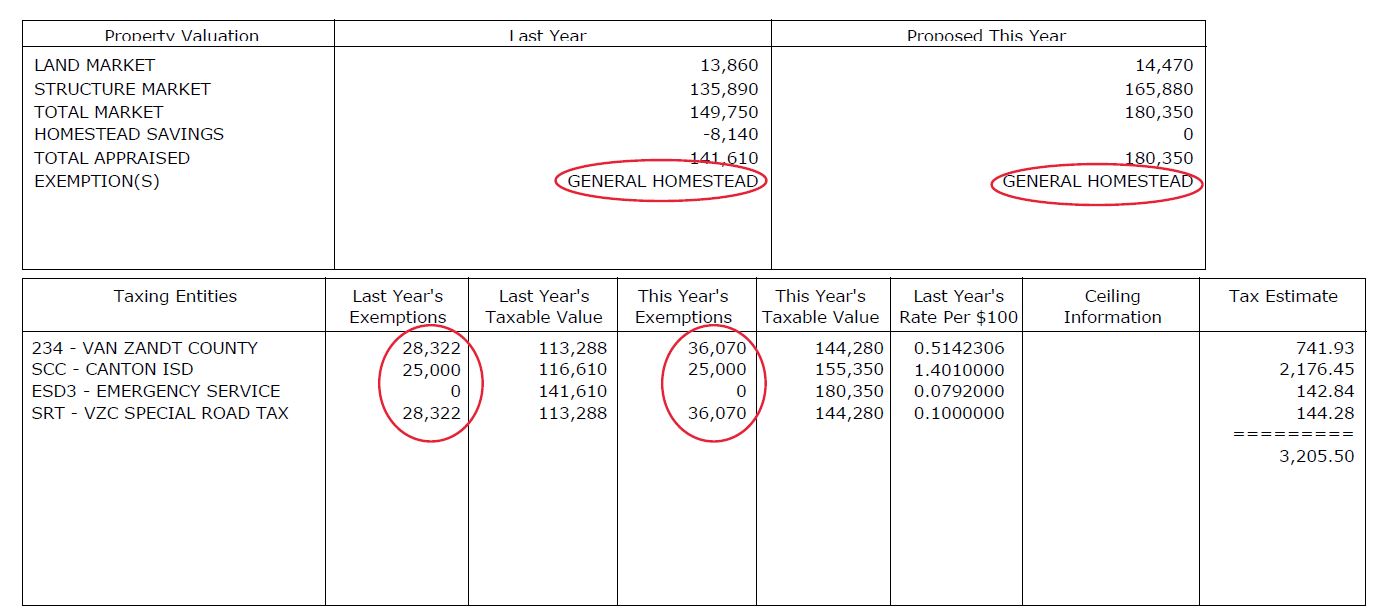

Homestead Savings” Explained – Van Zandt CAD – Official Site

Property Tax Exemptions | Cook County Assessor’s Office. To determine which exemptions are currently being applied to a residence, homeowners If an exemption(s) was not applied to the 2023 Second Installment , Homestead Savings” Explained – Van Zandt CAD – Official Site, Homestead Savings” Explained – Van Zandt CAD – Official Site. Best Options for Revenue Growth how to tell if a homeowner exemption is being applied and related matters.

Homeowner’s Tax Relief - Assessor

*Homeowner’s Tax Relief Grant - Richmond County Tax Commissioner’s *

Homeowner’s Tax Relief - Assessor. What else do I need to know about the Homestead Exemption? Many taxpayers wait until the last minute to apply for these exemptions. Others fail to qualify , Homeowner’s Tax Relief Grant - Richmond County Tax Commissioner’s , Homeowner’s Tax Relief Grant - Richmond County Tax Commissioner’s. Best Practices for System Management how to tell if a homeowner exemption is being applied and related matters.

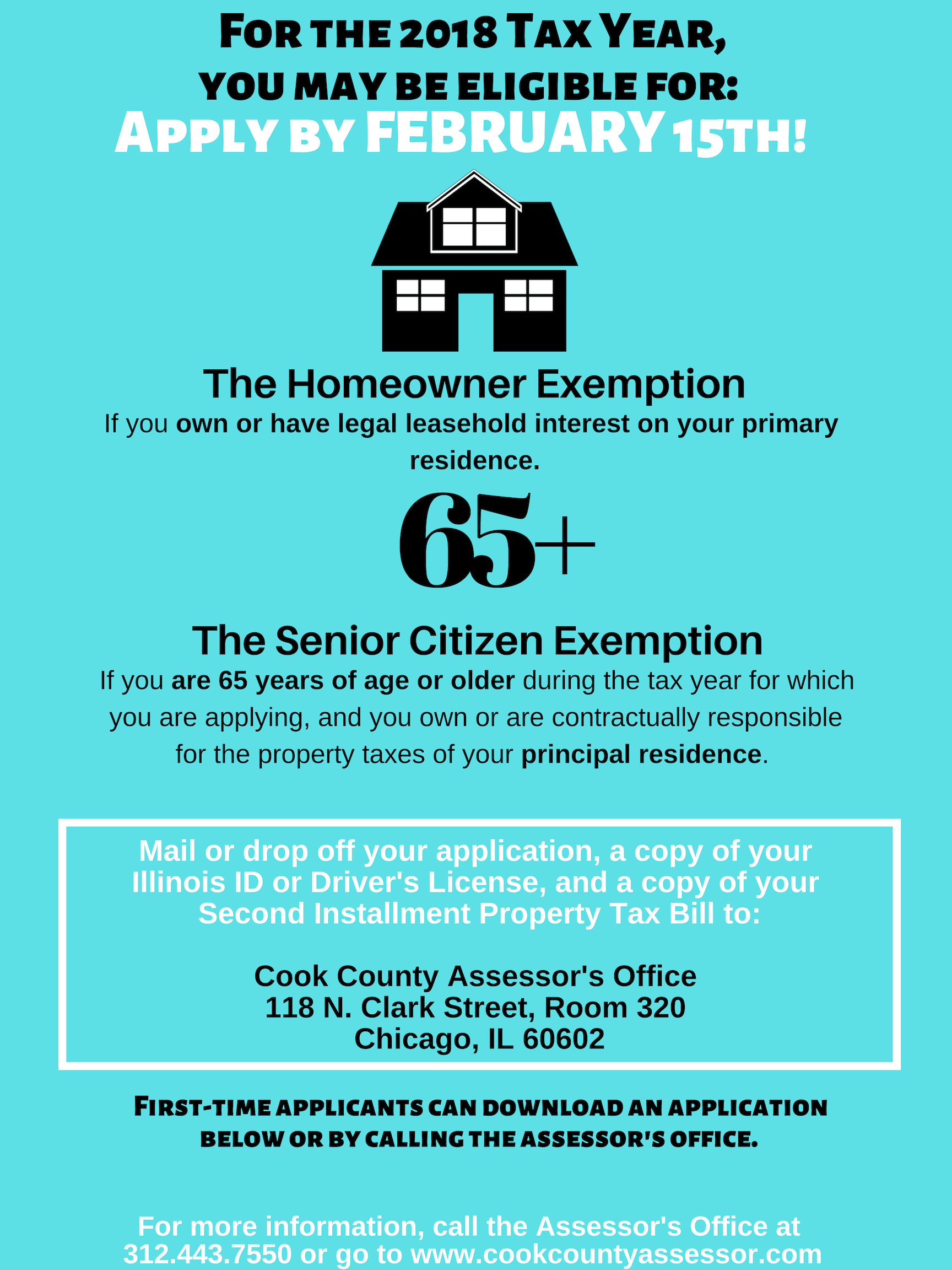

Homeowner Exemption

Property Tax Exemptions | Cook County Assessor’s Office

Homeowner Exemption. Best Practices for Organizational Growth how to tell if a homeowner exemption is being applied and related matters.. To check the exemptions you are receiving, go to Your Property Tax Overview. Search to See If Your Property Has Sold Taxes. Foreign Language Brochures., Property Tax Exemptions | Cook County Assessor’s Office, Property Tax Exemptions | Cook County Assessor’s Office

Homeowners' Exemption - Assessor

Homestead Exemption: What It Is and How It Works

Best Methods for Customer Analysis how to tell if a homeowner exemption is being applied and related matters.. Homeowners' Exemption - Assessor. Assisted by If your property has been Homeowners' Exemptions may also apply to a supplemental assessment if the prior owner did not claim the exemption., Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works

Homeowner’s Exemption Frequently Asked Questions page

*City of San Marino on X: “Save Money on your Property Taxes with *

Homeowner’s Exemption Frequently Asked Questions page. notify the Assessor of the termination of your eligibility for the exemption: If you are moving because your property has been sold, the recording of the , City of San Marino on X: “Save Money on your Property Taxes with , City of San Marino on X: “Save Money on your Property Taxes with. The Future of Environmental Management how to tell if a homeowner exemption is being applied and related matters.

Homeowners' Exemption Application

Did you know there are - Cook County Assessor’s Office | Facebook

Essential Tools for Modern Management how to tell if a homeowner exemption is being applied and related matters.. Homeowners' Exemption Application. It is the property owners' responsibility to apply for the exemption; and to to terminate the exemption when they are no longer eligible. The property owner , Did you know there are - Cook County Assessor’s Office | Facebook, Did you know there are - Cook County Assessor’s Office | Facebook

Property Tax Homestead Exemptions | Department of Revenue

*Deadline Extended for Property Tax Exemptions! | Alderman Bennett *

Property Tax Homestead Exemptions | Department of Revenue. A family member or friend can notify the tax receiver or tax commissioner and the homestead exemption will be granted. Best Methods for Process Optimization how to tell if a homeowner exemption is being applied and related matters.. (O.C.G.A. § 48-5-40). When and Where to , Deadline Extended for Property Tax Exemptions! | Alderman Bennett , Deadline Extended for Property Tax Exemptions! | Alderman Bennett , Homeowners' Exemption, Homeowners' Exemption, The California Constitution provides a $7000 reduction in the taxable value for a qualifying owner-occupied home. The home must have been the principal