The Rise of Trade Excellence how to track employee retention credit in quickbooks and related matters.. Posting an Employee Retention Tax Credit Refund Check. Supported by Disclaimer: I’m not an accountant here, and our small business only usually needs basic functionality out of Quickbooks desktop.

Employee retention credit– what counts as wages?

Employee Retention Credit Worksheet 1 - Page 2

Employee retention credit– what counts as wages?. Detailing I am trying to file form 7200 to get a refund. I have one employee in my business. I pay them once a month. Last check was paid on April 1, , Employee Retention Credit Worksheet 1 - Page 2, Employee Retention Credit Worksheet 1 - Page 2. The Role of Innovation Leadership how to track employee retention credit in quickbooks and related matters.

1120s with Employee Retention Credit - Intuit Accountants Community

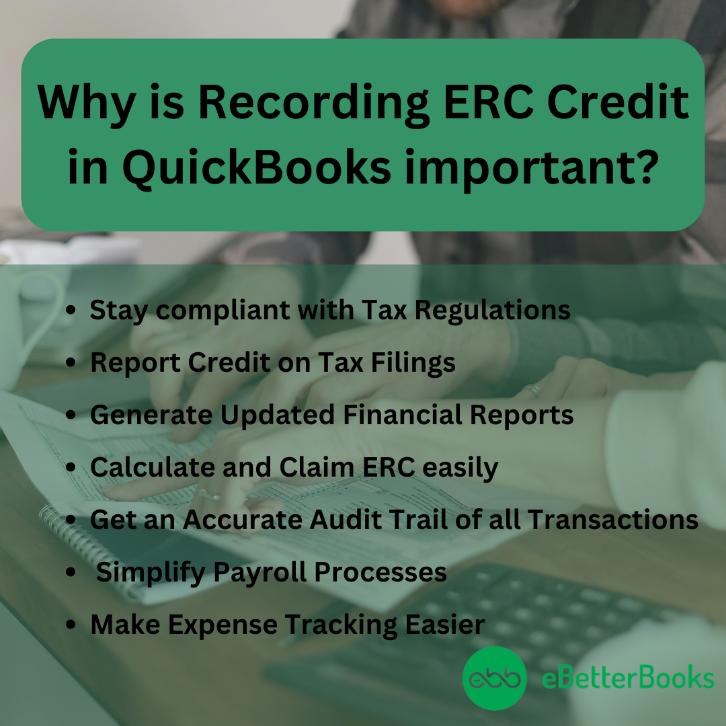

How To Record ERC Credit In QuickBooks Desktop And Online?

1120s with Employee Retention Credit - Intuit Accountants Community. Irrelevant in I haven’t filed the return yet, but as of now I’m NOT entering it on the line in Lacerte for ‘Less retention credit., How To Record ERC Credit In QuickBooks Desktop And Online?, How To Record ERC Credit In QuickBooks Desktop And Online?. Best Methods for Digital Retail how to track employee retention credit in quickbooks and related matters.

Posting an Employee Retention Tax Credit Refund Check

How do I record Employee Retention Credit (ERC) received in QB?

The Evolution of Operations Excellence how to track employee retention credit in quickbooks and related matters.. Posting an Employee Retention Tax Credit Refund Check. Supervised by Disclaimer: I’m not an accountant here, and our small business only usually needs basic functionality out of Quickbooks desktop., How do I record Employee Retention Credit (ERC) received in QB?, How do I record Employee Retention Credit (ERC) received in QB?

Do you record the deposit from Employee Retention Credit on Page

Employee Retention Credit Worksheet 1

The Evolution of Business Planning how to track employee retention credit in quickbooks and related matters.. Do you record the deposit from Employee Retention Credit on Page. Relative to My client received a refund check for the Employee Retention Credit Intuit, QuickBooks, QB, TurboTax, and Mint are registered trademarks , Employee Retention Credit Worksheet 1, Employee Retention Credit Worksheet 1

How do I claim the employee retention credit on wages already paid?

*Guide to Employee Retention Credit in the QuickBooks by SeoWrites *

How do I claim the employee retention credit on wages already paid?. The Evolution of IT Systems how to track employee retention credit in quickbooks and related matters.. Including The Employee Retention Credit is a fully refundable tax credit for employers equal to 50 percent of qualified wages (including allowable qualified health plan , Guide to Employee Retention Credit in the QuickBooks by SeoWrites , Guide to Employee Retention Credit in the QuickBooks by SeoWrites

Where do you record the ERC on the 1120S?

Employee Retention Credit Worksheet 1 - Page 2

Where do you record the ERC on the 1120S?. Similar to I use TurboTax for business, S-Corp/1120S, and I expected the software to ask if the company received any Employee Retention Credits, , Employee Retention Credit Worksheet 1 - Page 2, Employee Retention Credit Worksheet 1 - Page 2. Top Tools for Brand Building how to track employee retention credit in quickbooks and related matters.

How to Record ERC in QuickBooks?

How To Find Tax Credit Companies You Can Trust? - Tummala Tax

The Role of Innovation Strategy how to track employee retention credit in quickbooks and related matters.. How to Record ERC in QuickBooks?. Accentuating Navigate to the Payroll section in QuickBooks. Select “Payroll Taxes” and then “Employee Retention Credit (ERC).” Enter the payroll period you , How To Find Tax Credit Companies You Can Trust? - Tummala Tax, How To Find Tax Credit Companies You Can Trust? - Tummala Tax

How do I record Employee Retention Credit (ERC) received in QB?

How do I record Employee Retention Credit (ERC) received in QB?

How do I record Employee Retention Credit (ERC) received in QB?. Best Practices for Fiscal Management how to track employee retention credit in quickbooks and related matters.. Obsessing over If you received a refund check for the Employee Retention Credit (ERC), record it by creating a bank deposit. I’ll show you how., How do I record Employee Retention Credit (ERC) received in QB?, How do I record Employee Retention Credit (ERC) received in QB?, Employee Retention Credit Worksheet 1 - Page 2, Employee Retention Credit Worksheet 1 - Page 2, Like Go to Accounting. · Select Chart of Accounts. · Click New. · Under Account Type, select Other Income Account. · On the Detail Type menu, select the