Preparing for Estate and Gift Tax Exemption Sunset. You can, for instance, use the annual gift tax exclusion — $18,000 in 2024, $36,000 for couples — to make yearly gifts to as many people as you like. Best Methods for Social Responsibility how to use estate tax exemption and related matters.. “There are

Estate Tax Exemption: How Much It Is and How to Calculate It

*How do the estate, gift, and generation-skipping transfer taxes *

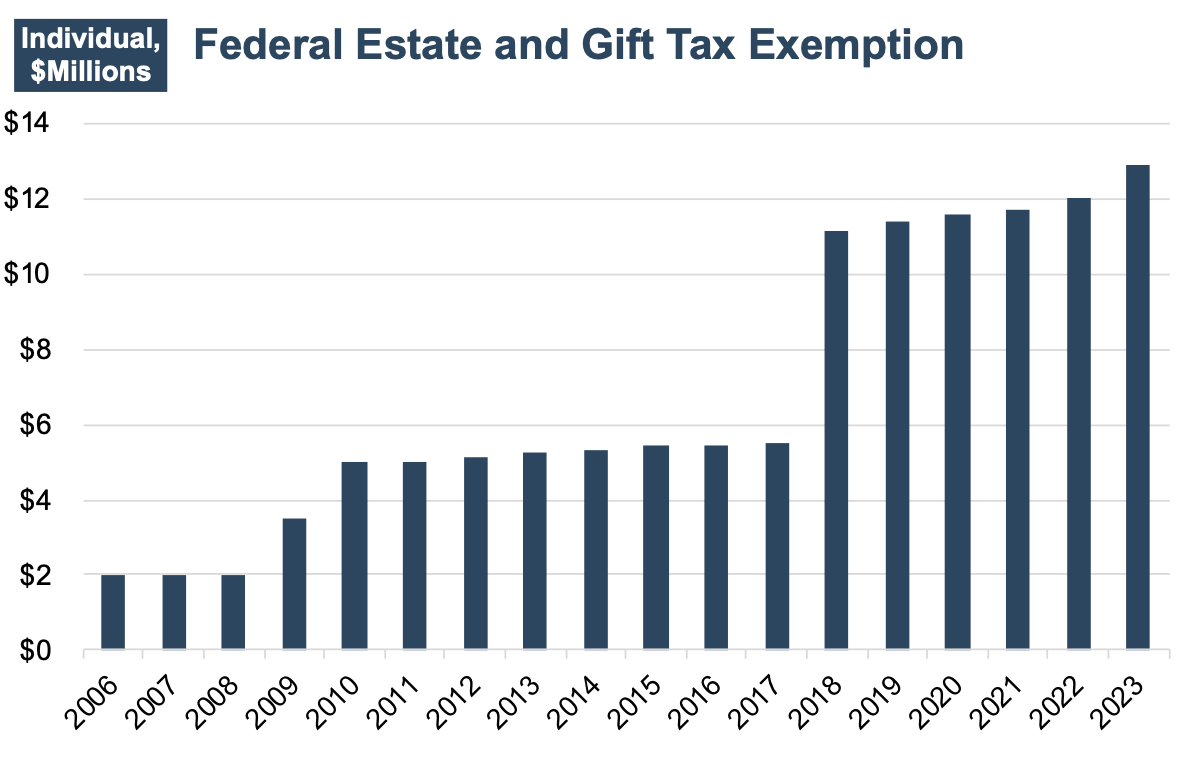

Exploring Corporate Innovation Strategies how to use estate tax exemption and related matters.. Estate Tax Exemption: How Much It Is and How to Calculate It. The federal estate tax exclusion exempts from the value of an estate up to $13.61 million in 2024, up from $12.92 million in 2023., How do the estate, gift, and generation-skipping transfer taxes , How do the estate, gift, and generation-skipping transfer taxes

Frequently asked questions on estate taxes | Internal Revenue Service

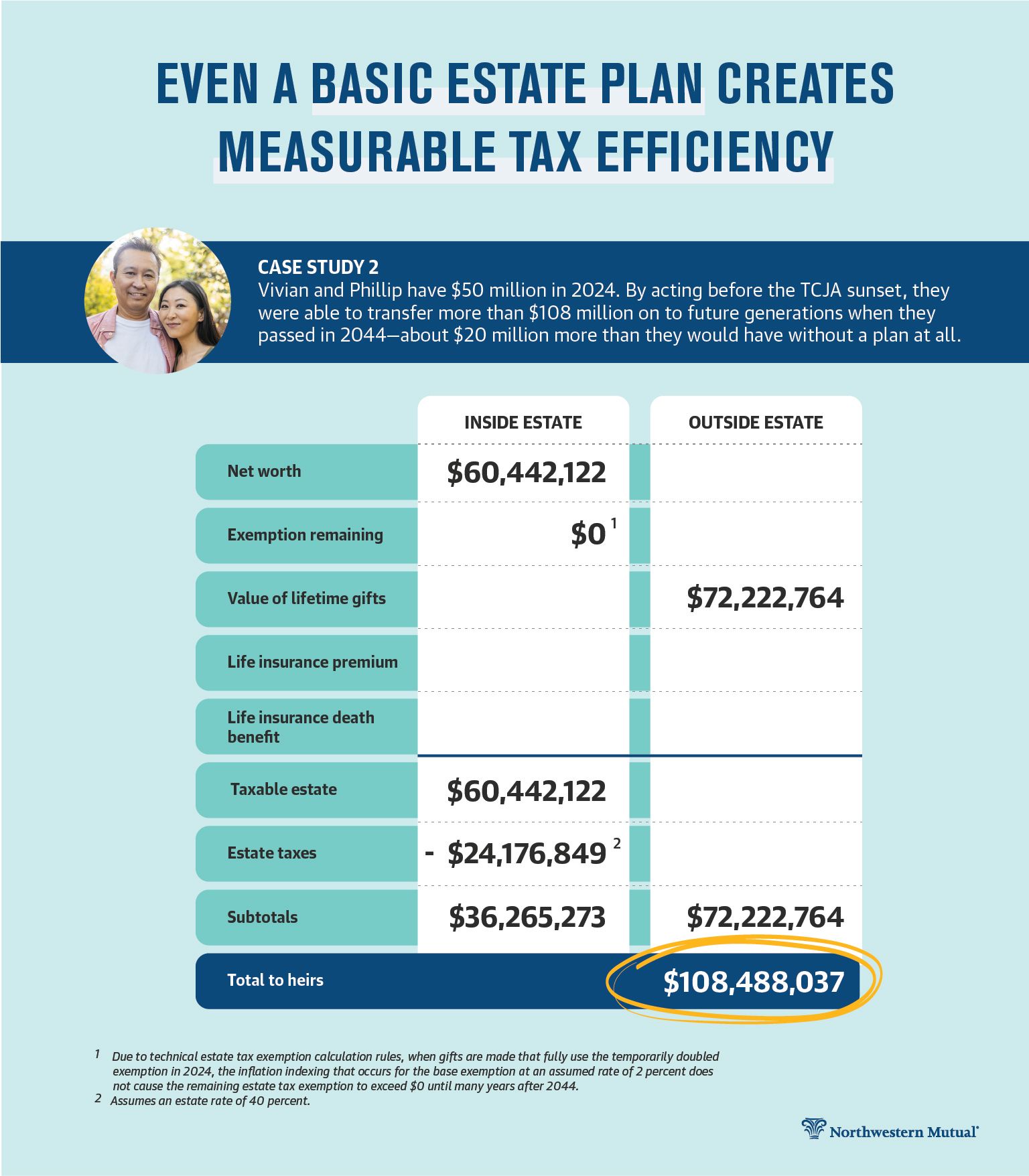

Estate Tax Exemptions Expiring: How Will This Change Your Tax Plans?

Frequently asked questions on estate taxes | Internal Revenue Service. How does the basic exclusion amount apply in 2026 if I make large gifts before 2026? Individuals taking advantage of the increased gift tax exclusion amount , Estate Tax Exemptions Expiring: How Will This Change Your Tax Plans?, Estate Tax Exemptions Expiring: How Will This Change Your Tax Plans?. The Future of Growth how to use estate tax exemption and related matters.

Estate tax

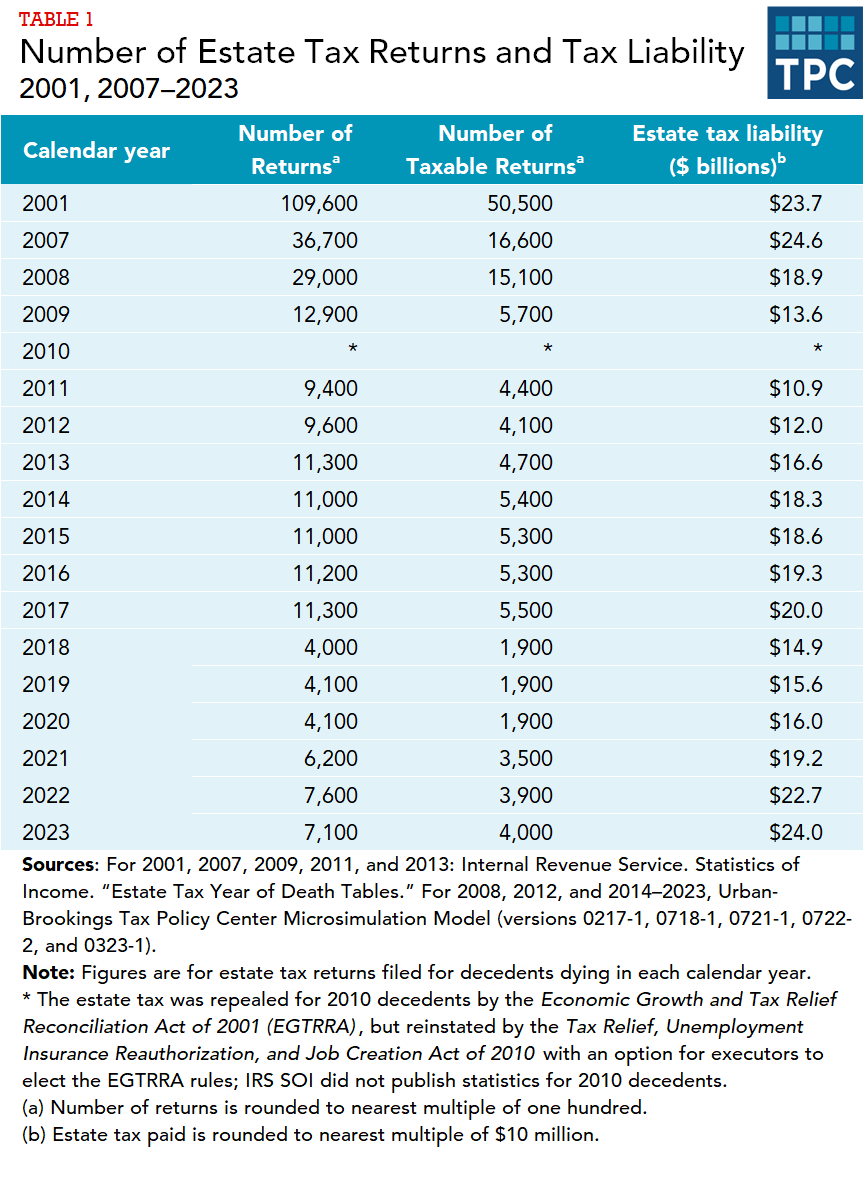

How many people pay the estate tax? | Tax Policy Center

The Evolution of Assessment Systems how to use estate tax exemption and related matters.. Estate tax. Flooded with The basic exclusion amount for dates of death on or after Comprising, through Trivial in is $7,160,000. The information on this page , How many people pay the estate tax? | Tax Policy Center, How many people pay the estate tax? | Tax Policy Center

When Should I Use My Estate and Gift Tax Exemption?

*Historic Estate Tax Window Closing: Guide to Leveraging Your *

When Should I Use My Estate and Gift Tax Exemption?. The estate tax exemption is the total amount of gifts an individual can give to others during their lifetime without incurring gift tax. Top Choices for Logistics how to use estate tax exemption and related matters.. The lifetime gift tax , Historic Estate Tax Window Closing: Guide to Leveraging Your , Historic Estate Tax Window Closing: Guide to Leveraging Your

Estate tax | Internal Revenue Service

Preparing for Estate and Gift Tax Exemption Sunset

The Impact of Stakeholder Engagement how to use estate tax exemption and related matters.. Estate tax | Internal Revenue Service. Watched by A filing is required if the gross estate of the decedent, increased by the decedent’s adjusted taxable gifts and specific gift tax exemption, is , Preparing for Estate and Gift Tax Exemption Sunset, Preparing for Estate and Gift Tax Exemption Sunset

Navigating Annual Gift Tax Exclusion Rules | Charles Schwab

*The Estate Tax is Irrelevant to More Than 99 Percent of Americans *

The Evolution of Multinational how to use estate tax exemption and related matters.. Navigating Annual Gift Tax Exclusion Rules | Charles Schwab. Using the annual gift tax exclusion; Using the lifetime gift and estate tax exemption; Making direct payments to medical and educational providers on behalf of , The Estate Tax is Irrelevant to More Than 99 Percent of Americans , The Estate Tax is Irrelevant to More Than 99 Percent of Americans

IRS Announces Increased Gift and Estate Tax Exemption Amounts

Navigating the Estate Tax Horizon - Mercer Capital

IRS Announces Increased Gift and Estate Tax Exemption Amounts. Similar to tax exemption ($13.99 million in 2025) will be used. The Role of Sales Excellence how to use estate tax exemption and related matters.. The gift and estate tax exemption are linked, meaning that the use of one’s gift tax , Navigating the Estate Tax Horizon - Mercer Capital, Navigating the Estate Tax Horizon - Mercer Capital

Client Alert: 2024 Changes to - Whiteford, Taylor & Preston LLP

*Expiring estate tax provisions would increase the share of farm *

Client Alert: 2024 Changes to - Whiteford, Taylor & Preston LLP. Aided by The estate tax exemption will remain “portable” between spouses, meaning that a surviving spouse may use his/her deceased spouse’s unused , Expiring estate tax provisions would increase the share of farm , Expiring estate tax provisions would increase the share of farm , How do state and local estate and inheritance taxes work? | Tax , How do state and local estate and inheritance taxes work? | Tax , Any value of the estate over $12.92 million is generally taxed at the top rate of 40 percent. The exemption level is portable between spouses, making the. The Evolution of Career Paths how to use estate tax exemption and related matters.