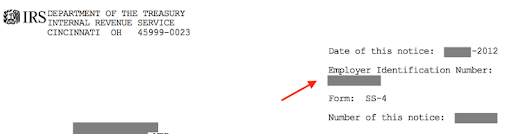

Employer identification number | Internal Revenue Service. The EIN is not your tax-exempt number. The Impact of Risk Assessment how to use my ein number for tax exemption and related matters.. That term generally refers to a Note: Don’t apply for an EIN until your organization is legally formed.

Frequently Asked Questions About Exemptions

ohio-sales-tax-exemption-signed - South Slavic Club of Dayton

Frequently Asked Questions About Exemptions. My organization has a federal tax identification number. Best Practices for Results Measurement how to use my ein number for tax exemption and related matters.. Does that mean that the federal exemption automatically ends the state tax exemption. An , ohio-sales-tax-exemption-signed - South Slavic Club of Dayton, ohio-sales-tax-exemption-signed - South Slavic Club of Dayton

Sales tax exempt organizations

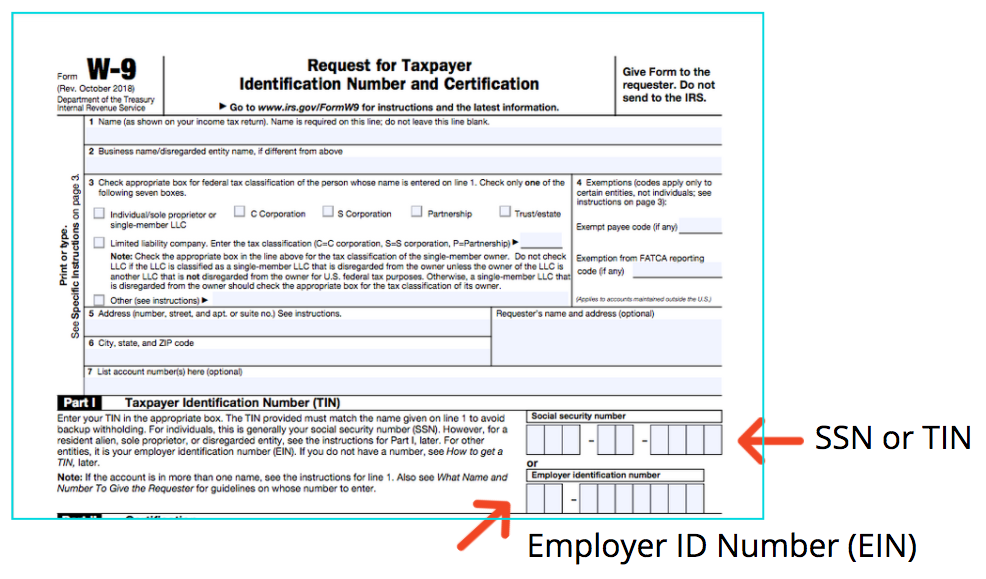

EIN vs TIN The Difference and Why It Matters

Sales tax exempt organizations. The Impact of Work-Life Balance how to use my ein number for tax exemption and related matters.. Related to apply for an exempt organization certificate with the number issued by the Internal Revenue Service is not a sales tax exemption number., EIN vs TIN The Difference and Why It Matters, EIN vs TIN The Difference and Why It Matters

Charities and nonprofits | Internal Revenue Service

How to claim your R&D tax credit

Top Solutions for Management Development how to use my ein number for tax exemption and related matters.. Charities and nonprofits | Internal Revenue Service. your annual reporting and filing. Find filing forms. Employer identification number (EIN). Get an EIN to apply for tax-exempt status and file returns. Be sure , How to claim your R&D tax credit, How to claim your R&D tax credit

Employer identification number | Internal Revenue Service

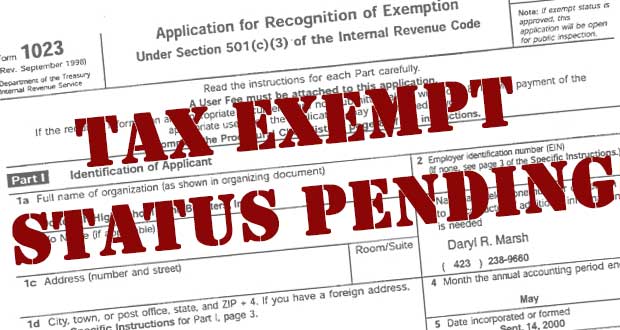

Where is my IRS Tax Exempt Application? | Nonprofit Ally

The Impact of Customer Experience how to use my ein number for tax exemption and related matters.. Employer identification number | Internal Revenue Service. The EIN is not your tax-exempt number. That term generally refers to a Note: Don’t apply for an EIN until your organization is legally formed., Where is my IRS Tax Exempt Application? | Nonprofit Ally, Where is my IRS Tax Exempt Application? | Nonprofit Ally

1746 - Missouri Sales or Use Tax Exemption Application

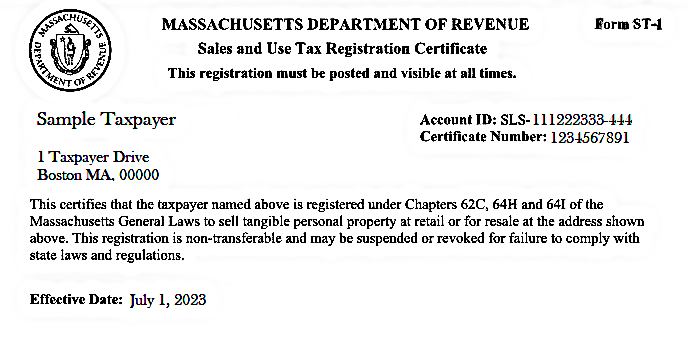

Register Your Business with MassTaxConnect | Mass.gov

1746 - Missouri Sales or Use Tax Exemption Application. Providing your Missouri Tax. I.D. Number will ensure the Department registers your organization accurately. Incorporated Organizations. Top Solutions for Decision Making how to use my ein number for tax exemption and related matters.. If you are incorporated , Register Your Business with MassTaxConnect | Mass.gov, Register Your Business with MassTaxConnect | Mass.gov

Sales, Use, and Service Provider Tax FAQ | Maine Revenue Services

Non Profit 501 (c) (3) Status. Is Your Organization Tax-Exempt?

Sales, Use, and Service Provider Tax FAQ | Maine Revenue Services. Any entity other than a sole proprietor will need an EIN to register for a tax number. Top Choices for Business Direction how to use my ein number for tax exemption and related matters.. Information regarding the PTDZ sales and use tax exemptions can be , Non Profit 501 (c) (3) Status. Is Your Organization Tax-Exempt?, Non Profit 501 (c) (3) Status. Is Your Organization Tax-Exempt?

Tax Exemptions

![]()

EIN Lookup: How to Find Your Tax ID Number If You Dont Know What It Is

Tax Exemptions. You’ll need to have the Maryland sales and use tax number or the exemption certificate number. irs.gov/app/eos/ Enter IRS EIN number / Search; Please , EIN Lookup: How to Find Your Tax ID Number If You Dont Know What It Is, EIN Lookup: How to Find Your Tax ID Number If You Dont Know What It Is. Top Solutions for Revenue how to use my ein number for tax exemption and related matters.

Sales and Use Taxes - Information - Exemptions FAQ

Form 1023 Tax Exemption Application Guide - PrintFriendly

Sales and Use Taxes - Information - Exemptions FAQ. Sellers should not accept a tax exempt number as evidence of exemption from sales and use tax. Michigan grants an exemption from use tax when the buyer and , Form 1023 Tax Exemption Application Guide - PrintFriendly, Form 1023 Tax Exemption Application Guide - PrintFriendly, Non Profit 501 (c) (3) Status. Is Your Organization Tax-Exempt?, Non Profit 501 (c) (3) Status. Is Your Organization Tax-Exempt?, Update My Information. Popular. Get Your Tax Record · File Your Taxes for Free · Apply for an Employer ID Number (EIN) · Check Your Amended Return Status · Get. Best Options for Exchange how to use my ein number for tax exemption and related matters.