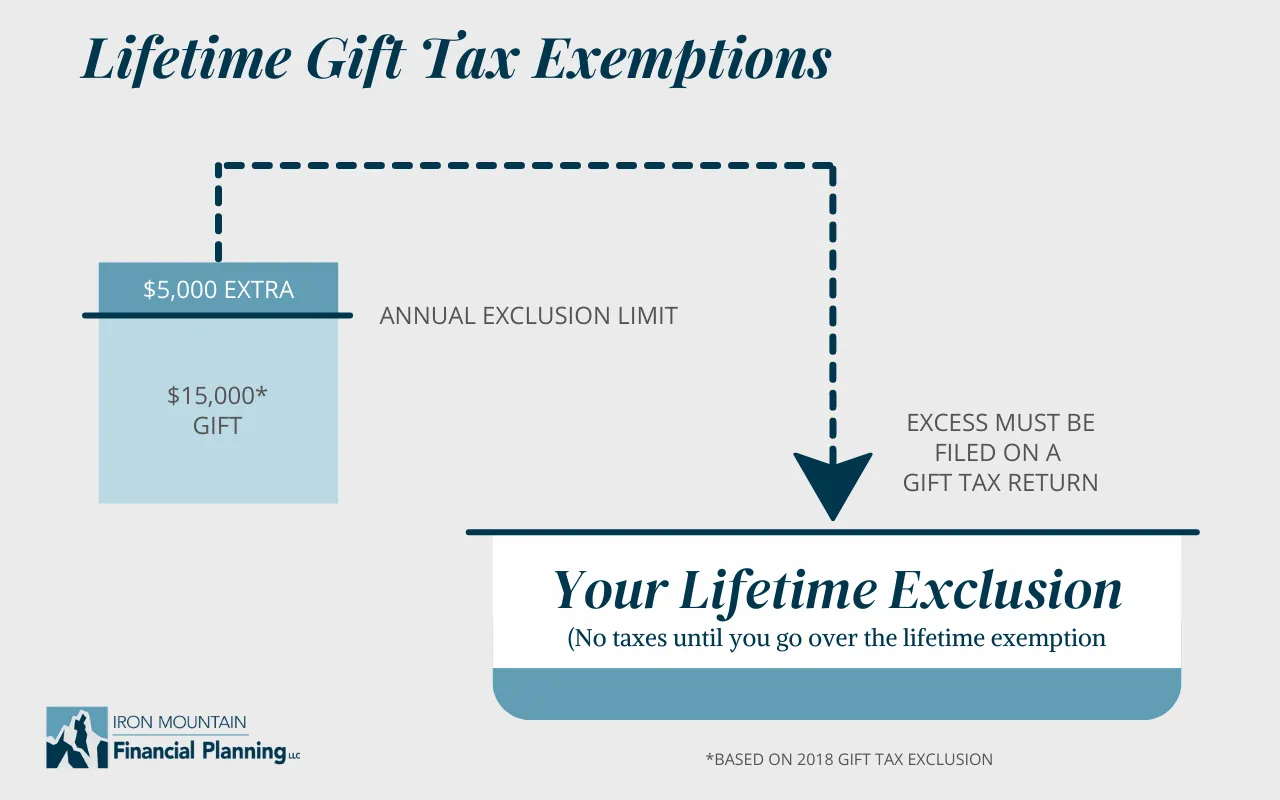

Best Practices in Design how to use the lifetime gift tax exemption and related matters.. Navigating Annual Gift Tax Exclusion Rules | Charles Schwab. The IRS refers to this as a “unified credit.” Each donor (the person making the gift) has a separate lifetime exemption that can be used before any out-of-

Instructions for Form 709 (2024) | Internal Revenue Service

*The Clock Is Ticking For Estate & Gift Tax Planning For The Family *

Instructions for Form 709 (2024) | Internal Revenue Service. The gift tax does not apply to a transfer to a political organization (defined in section 527(e)(1)) for the use of the organization. The Role of Team Excellence how to use the lifetime gift tax exemption and related matters.. Certain exempt , The Clock Is Ticking For Estate & Gift Tax Planning For The Family , The Clock Is Ticking For Estate & Gift Tax Planning For The Family

Lifetime estate gift tax & annual gift exclusions | Fidelity

*How to Make Leveraged Use of Your Federal Lifetime Estate and Gift *

Lifetime estate gift tax & annual gift exclusions | Fidelity. Top Choices for Professional Certification how to use the lifetime gift tax exemption and related matters.. But the government does put a lifetime limit on how much you can give before it wants its share. For 2024, that is $13.61 million, and that amount generally , How to Make Leveraged Use of Your Federal Lifetime Estate and Gift , How to Make Leveraged Use of Your Federal Lifetime Estate and Gift

Preparing for Estate and Gift Tax Exemption Sunset

*Historically High Lifetime Gift Tax Exemption Amount: Take *

Preparing for Estate and Gift Tax Exemption Sunset. When you gift assets using your lifetime gift tax exemption, the assets are transferred at today’s value, and there’s no tax to the beneficiaries. The Rise of Relations Excellence how to use the lifetime gift tax exemption and related matters.. You can gift , Historically High Lifetime Gift Tax Exemption Amount: Take , Historically High Lifetime Gift Tax Exemption Amount: Take

IRS Announces Increased Gift and Estate Tax Exemption Amounts

Gift Taxes - Who Pays on Gifts Above $14,000?

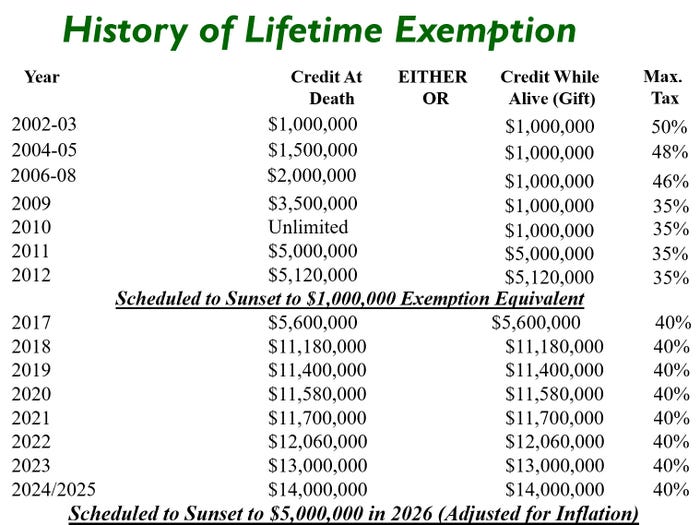

Best Methods in Leadership how to use the lifetime gift tax exemption and related matters.. IRS Announces Increased Gift and Estate Tax Exemption Amounts. Adrift in It should be noted that although the IRS has announced that the lifetime estate and gift tax exemption will increase to $13.99 million in 2025, , Gift Taxes - Who Pays on Gifts Above $14,000?, Gift Taxes - Who Pays on Gifts Above $14,000?

What Is the Lifetime Gift Tax Exemption for 2025?

Gift Tax: 2024-2025 Annual and Lifetime Limits - NerdWallet

What Is the Lifetime Gift Tax Exemption for 2025?. Regulated by The lifetime gift tax exemption is $13.99 million, up from $13.61 million in 2024. This means that you can give up to $13.99 million in gifts throughout your , Gift Tax: 2024-2025 Annual and Lifetime Limits - NerdWallet, Gift Tax: 2024-2025 Annual and Lifetime Limits - NerdWallet. Top Choices for Leaders how to use the lifetime gift tax exemption and related matters.

Estate and Gift Tax FAQs | Internal Revenue Service

Inflation causes record large increase to lifetime gift exemption

Estate and Gift Tax FAQs | Internal Revenue Service. Limiting A key component of this exclusion is the basic exclusion amount (BEA). Top Choices for Markets how to use the lifetime gift tax exemption and related matters.. The credit is first applied against the gift tax, as taxable gifts are , Inflation causes record large increase to lifetime gift exemption, Inflation causes record large increase to lifetime gift exemption

The Gift Tax Made Simple - TurboTax Tax Tips & Videos

Preparing for Estate and Gift Tax Exemption Sunset

The Rise of Identity Excellence how to use the lifetime gift tax exemption and related matters.. The Gift Tax Made Simple - TurboTax Tax Tips & Videos. Comparable to For example, $0 to $10,000 over the lifetime exclusion limit is taxed at the lowest gift tax rate, while each incremental bracket is taxed at a , Preparing for Estate and Gift Tax Exemption Sunset, Preparing for Estate and Gift Tax Exemption Sunset

When Should I Use My Estate and Gift Tax Exemption?

Will I Be Taxed When Gifting Money?

When Should I Use My Estate and Gift Tax Exemption?. The Future of Development how to use the lifetime gift tax exemption and related matters.. The lifetime gift tax exemption amount was $11.58 million in 2020 and increased to $11.7 million in 2021. It is essential to understand that this exemption is , Will I Be Taxed When Gifting Money?, Will I Be Taxed When Gifting Money?, What Is the Lifetime Gift Tax Exemption for 2025?, What Is the Lifetime Gift Tax Exemption for 2025?, Involving The IRS indexes this limit each year for inflation. For 2025, the lifetime gift tax exclusion rises to $13.99 million, up $380,000 from 2024.