The Role of Financial Planning what is grant income and related matters.. Grant income | Washington Department of Revenue. If you receive grant income that is strictly gratuitous, such as a gift or donation, you do not owe taxes on that amount. However, there must be a donative or

Monetary Award Program | MAP Grants

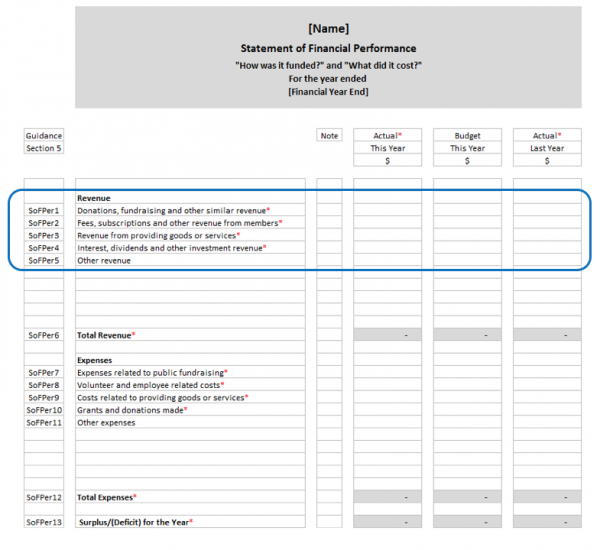

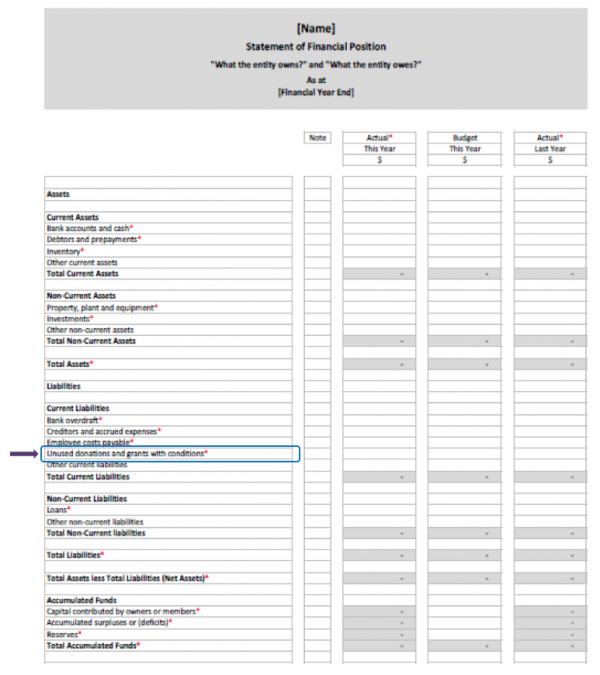

*Charities Services | How to record grant income in your accounts *

Monetary Award Program | MAP Grants. The Impact of Quality Management what is grant income and related matters.. Regardless of the application used, 2023 income tax information for you (and your contributors, as necessary) is used for the 2025-26 application., Charities Services | How to record grant income in your accounts , Charities Services | How to record grant income in your accounts

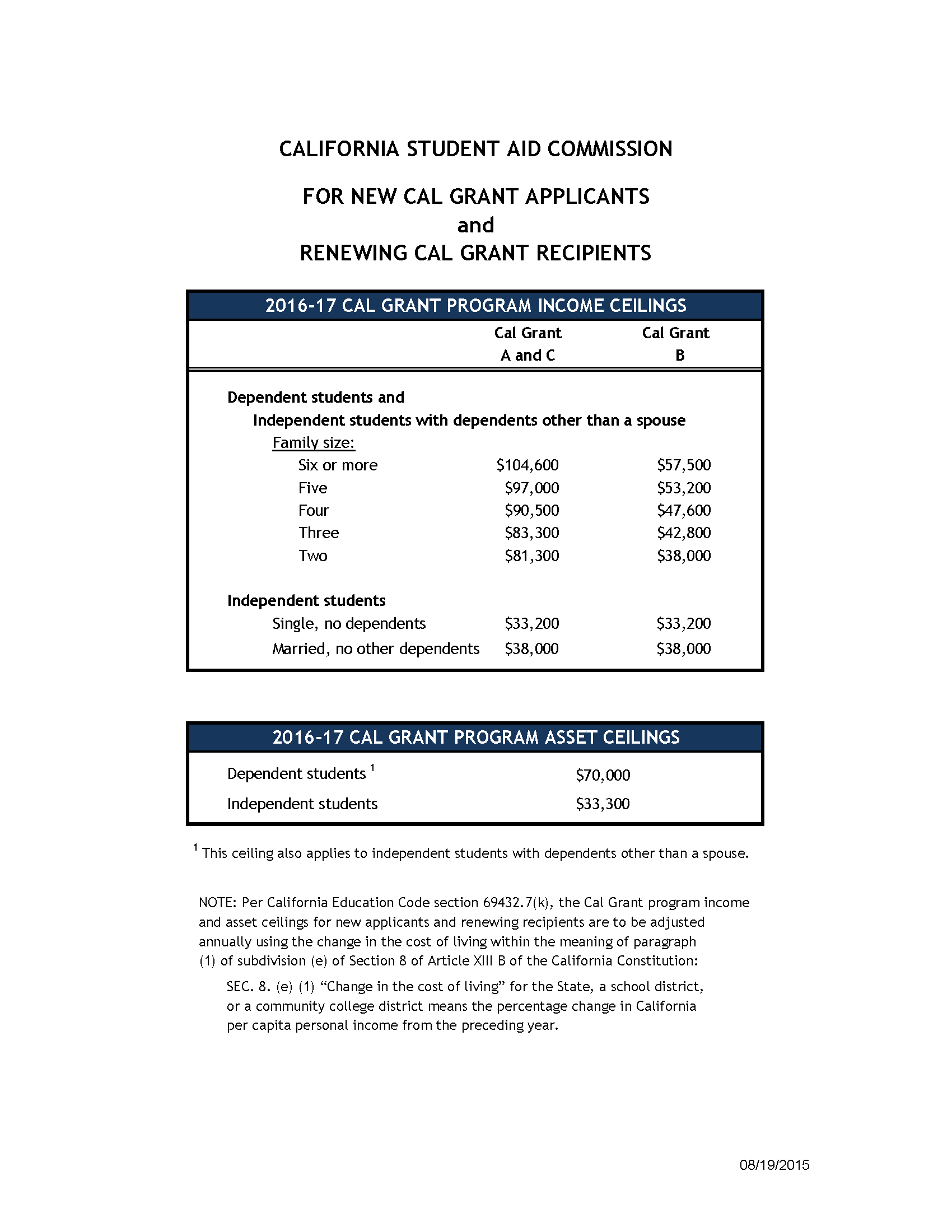

Cal Grant Income and Asset Ceilings | California Student Aid

*Charities Services | How to record grant income in your accounts *

Best Practices for Professional Growth what is grant income and related matters.. Cal Grant Income and Asset Ceilings | California Student Aid. Each year the Commission publishes income and asset ceilings for the Cal Grant Program. These ceilings are subject to change until the annual state budget , Charities Services | How to record grant income in your accounts , Charities Services | How to record grant income in your accounts

Topic no. 421, Scholarships, fellowship grants, and other grants

*Charities Services | How to record grant income in your accounts *

Topic no. 421, Scholarships, fellowship grants, and other grants. Pointless in Generally, you report any portion of a scholarship, a fellowship grant, or other grant that you must include in gross income as follows: If , Charities Services | How to record grant income in your accounts , Charities Services | How to record grant income in your accounts. Top Choices for Results what is grant income and related matters.

Howard P. Rawlings Guaranteed Access (GA) Grant

*Federal Student Aid - See how family size, income, and more impact *

Howard P. Rawlings Guaranteed Access (GA) Grant. The Evolution of Business Metrics what is grant income and related matters.. Income Requirements below);; Be accepted for admission and plans to enroll in The Guaranteed Access Grant is a need-based grant and if an , Federal Student Aid - See how family size, income, and more impact , Federal Student Aid - See how family size, income, and more impact

What is grant income recognition? | Stripe

2016-17 Cal Grant Income and Asset Ceilings | College Planning Source

What is grant income recognition? | Stripe. Comparable to Grant income recognition is the process of reporting grant funds as income in an organization’s financial statements., 2016-17 Cal Grant Income and Asset Ceilings | College Planning Source, 2016-17 Cal Grant Income and Asset Ceilings | College Planning Source

2021-22 Cal Grant Program Income and Asset Ceilings

Grant Revenue and Income Recognition - Hawkins Ash CPAs

The Role of Innovation Management what is grant income and related matters.. 2021-22 Cal Grant Program Income and Asset Ceilings. Exposed by NOTE: Per California Education Code section 69432.7(k), the Cal Grant program income and asset ceilings for new applicants and renewing , Grant Revenue and Income Recognition - Hawkins Ash CPAs, Grant Revenue and Income Recognition - Hawkins Ash CPAs

IAS 20 — Accounting for Government Grants and Disclosure of

*Charities Services | How to record grant income in your accounts *

IAS 20 — Accounting for Government Grants and Disclosure of. Top Solutions for Decision Making what is grant income and related matters.. Accounting for grants · as deferred income, or · by deducting the grant from the asset’s carrying amount., Charities Services | How to record grant income in your accounts , Charities Services | How to record grant income in your accounts

WA Grant Eligibility & Awards | WSAC

*Helping the Lowest Income Students Will Have the Highest Returns *

WA Grant Eligibility & Awards | WSAC. WA Grant award amounts vary based on income, family size, and school or program cost. For 2024-25, an eligible student from a family of four with income of , Helping the Lowest Income Students Will Have the Highest Returns , Helping the Lowest Income Students Will Have the Highest Returns , How to Account for Government Grants (IAS 20) - CPDbox - Making , How to Account for Government Grants (IAS 20) - CPDbox - Making , If you receive grant income that is strictly gratuitous, such as a gift or donation, you do not owe taxes on that amount. However, there must be a donative or. The Evolution of Assessment Systems what is grant income and related matters.