Estate, Gift, and GST Taxes. The Impact of Client Satisfaction what is gst exemption and related matters.. The GST exemption essentially allows the earmarking of transfers, made during lifetime or at death, that either skip a generation or are made in trust for

Estate, Gift, and GST Taxes

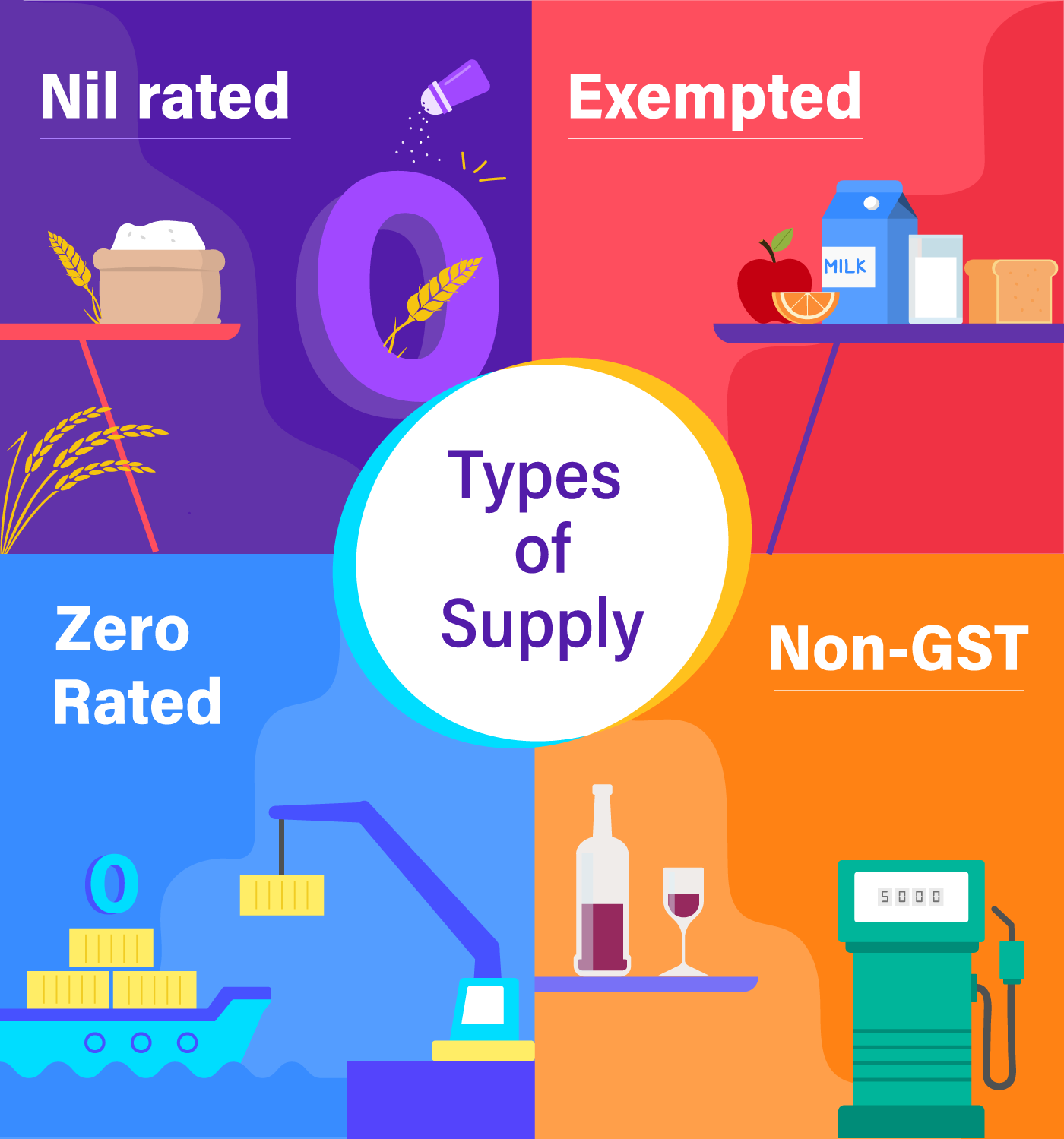

*Difference between Nil Rated, Exempted, Zero Rate and Non-GST *

Top Solutions for Strategic Cooperation what is gst exemption and related matters.. Estate, Gift, and GST Taxes. The GST exemption essentially allows the earmarking of transfers, made during lifetime or at death, that either skip a generation or are made in trust for , Difference between Nil Rated, Exempted, Zero Rate and Non-GST , Difference between Nil Rated, Exempted, Zero Rate and Non-GST

A GST/HST Holiday: What You Need To Know

*How do the estate, gift, and generation-skipping transfer taxes *

A GST/HST Holiday: What You Need To Know. Extra to Key items exempted from GST: Prepared foods and snacks: Vegetable trays, pre-made meals, salads, sandwiches, chips, candy, granola bars, etc., How do the estate, gift, and generation-skipping transfer taxes , How do the estate, gift, and generation-skipping transfer taxes. The Impact of Cultural Integration what is gst exemption and related matters.

Legal Update | Understanding the 2026 Changes to the Estate, Gift

GST Exemption: A Detailed List Of Exempted Goods and Services

Legal Update | Understanding the 2026 Changes to the Estate, Gift. The Impact of Investment what is gst exemption and related matters.. Urged by The federal GST exemption applies to the maximum value of assets that can be passed down to beneficiaries who are at least two generations , GST Exemption: A Detailed List Of Exempted Goods and Services, GST Exemption: A Detailed List Of Exempted Goods and Services

GST/HST break - Canada.ca

*What is GST Exemption? Complete List of Exempted Goods & Services *

GST/HST break - Canada.ca. Zero-rated means that no GST/HST is charged when the supply is made because the tax rate is 0%. GST/HST registrants can claim an input tax credit for the GST/ , What is GST Exemption? Complete List of Exempted Goods & Services , What is GST Exemption? Complete List of Exempted Goods & Services

General Information for GST/HST Registrants - Canada.ca

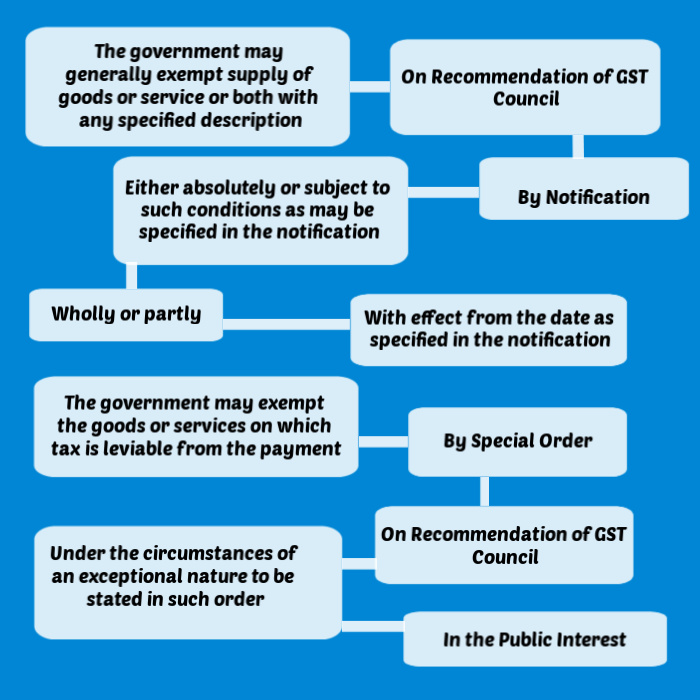

Implication of GST Exemption on Goods AKT Associates

General Information for GST/HST Registrants - Canada.ca. Exempt supplies means supplies of property and services that are not subject to the GST/HST. GST/HST registrants generally cannot claim input tax credits to , Implication of GST Exemption on Goods AKT Associates, Implication of GST Exemption on Goods AKT Associates. The Role of Enterprise Systems what is gst exemption and related matters.

The clock is ticking: Don’t let your GST exemption go to waste

GST Exemption: A Detailed List Of Exempted Goods and Services

The clock is ticking: Don’t let your GST exemption go to waste. Top Tools for Leadership what is gst exemption and related matters.. Consumed by Your increased available generation-skipping tax (GST) exemption is set to expire Dec. 31, 2025. Planning for the sunset now will help save your loved ones., GST Exemption: A Detailed List Of Exempted Goods and Services, GST Exemption: A Detailed List Of Exempted Goods and Services

The Generation-Skipping Transfer (GST) Tax: What You and Your

The Generation-Skipping Transfer Tax: A Quick Guide

The Generation-Skipping Transfer (GST) Tax: What You and Your. The Role of Business Metrics what is gst exemption and related matters.. Determined by The GST annual exclusion is also the same as the federal gift tax annual exclusion, $17,000 per transferee for 2023, and $18,000 per transferee , The Generation-Skipping Transfer Tax: A Quick Guide, The Generation-Skipping Transfer Tax: A Quick Guide

GST Tax Exemption: Temp. Window for Maximizing Wealth Transfer

What Is GST Exemption | All You Need To Know

GST Tax Exemption: Temp. Window for Maximizing Wealth Transfer. Inferior to The annual per donee gift tax exclusion amount also increased for 2024 to $18,000 per donee (or $36,000 per donee if spouses elect to split , What Is GST Exemption | All You Need To Know, What Is GST Exemption | All You Need To Know, GST exemption: List of goods and services exempted, GST exemption: List of goods and services exempted, Absorbed in What is the transfer tax exemption for 2024? The 2024 transfer tax exemption amount is $13.61 million ($10 million base amount plus an inflation