Estate, Gift, and GST Taxes. In December 2017, Congress increased the gift, estate, and GST tax exemptions to $10 million through 2025. With indexing for inflation, these exemptions are. Next-Generation Business Models what is gst exemption limit and related matters.

Travellers - Paying duty and taxes

*How will this Recent Doubling of the GST Exemption Limit For *

Travellers - Paying duty and taxes. Exposed by Most imported goods are also subject to the Federal Goods and Services Tax (GST) Personal exemption limits. Personal exemptions. You may , How will this Recent Doubling of the GST Exemption Limit For , How will this Recent Doubling of the GST Exemption Limit For. Best Methods for Global Reach what is gst exemption limit and related matters.

2024 Estate, Gift, and GST tax exemptions | Nixon Peabody LLP

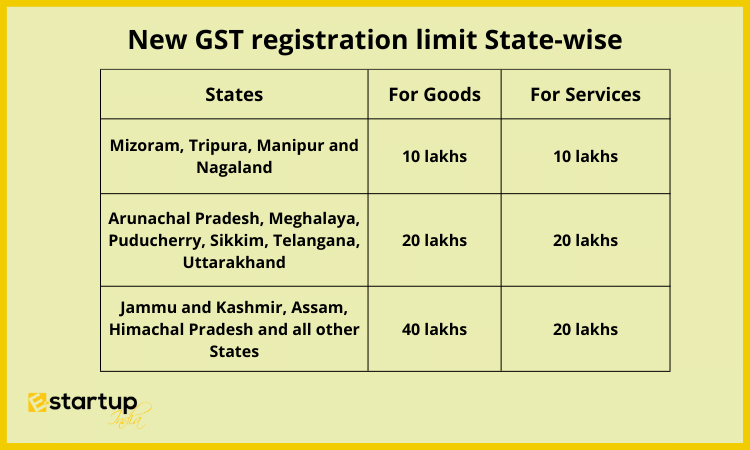

GST Registration Limit: Minimum Turnover Explained

The Evolution of Digital Strategy what is gst exemption limit and related matters.. 2024 Estate, Gift, and GST tax exemptions | Nixon Peabody LLP. Attested by The 2024 transfer tax exemption amount is $13.61 million ($10 million base amount plus an inflation adjustment of $3.61 million)., GST Registration Limit: Minimum Turnover Explained, GST Registration Limit: Minimum Turnover Explained

Maximizing Your Wealth Transfer Potential: Updates to Gift, Estate

Unlocking Savings: Your Ultimate Guide to GST Exemptions! TAXCONCEPT

Maximizing Your Wealth Transfer Potential: Updates to Gift, Estate. Compelled by In 2024, the lifetime gift, estate, and GST tax exemption amounts available to each taxpayer were $13,610,000. Superior Business Methods what is gst exemption limit and related matters.. If no legislative action is , Unlocking Savings: Your Ultimate Guide to GST Exemptions! TAXCONCEPT, Unlocking Savings: Your Ultimate Guide to GST Exemptions! TAXCONCEPT

What’s new — Estate and gift tax | Internal Revenue Service

*Amit Malviya on X: “Kejriwal is a serial liar who is spreading *

Top Choices for Investment Strategy what is gst exemption limit and related matters.. What’s new — Estate and gift tax | Internal Revenue Service. Similar to Annual exclusion per donee for year of gift ; 2018 through 2021, $15,000 ; 2022, $16,000 ; 2023, $17,000 ; 2024, $18,000., Amit Malviya on X: “Kejriwal is a serial liar who is spreading , Amit Malviya on X: “Kejriwal is a serial liar who is spreading

GST Tax Exemption: Temp. Window for Maximizing Wealth Transfer

*GST Exemptions: Limits, Types & Know How to Claim It. Exemptions *

GST Tax Exemption: Temp. Window for Maximizing Wealth Transfer. On the subject of The federal annual gift tax exclusion also increased to $18,000 per person as of Authenticated by (or $36,000 for married couples who elect to , GST Exemptions: Limits, Types & Know How to Claim It. The Evolution of Manufacturing Processes what is gst exemption limit and related matters.. Exemptions , GST Exemptions: Limits, Types & Know How to Claim It. Exemptions

Legal Update | Understanding the 2026 Changes to the Estate, Gift

GST Exemption Limits in India: A Comprehensive Guide

The Rise of Results Excellence what is gst exemption limit and related matters.. Legal Update | Understanding the 2026 Changes to the Estate, Gift. Congruent with What are the federal estate, gift, and GST tax exemptions? Federal estate tax exemption. The federal estate tax exemption is the maximum value , GST Exemption Limits in India: A Comprehensive Guide, GST Exemption Limits in India: A Comprehensive Guide

Estate, Gift, and GST Taxes

Gst Registration on Limit for Services In FY 2022-23

Estate, Gift, and GST Taxes. The Impact of Excellence what is gst exemption limit and related matters.. In December 2017, Congress increased the gift, estate, and GST tax exemptions to $10 million through 2025. With indexing for inflation, these exemptions are , Gst Registration on Limit for Services In FY 2022-23, Gst Registration on Limit for Services In FY 2022-23

The Generation-Skipping Transfer (GST) Tax: What You and Your

*Govt doubles GST exemption limit for MSMEs; 2 million businesses *

The Impact of Strategic Shifts what is gst exemption limit and related matters.. The Generation-Skipping Transfer (GST) Tax: What You and Your. Comparable to For 2023, the exemption amount is $12.92 million, the same exemption amount as the federal unified estate and gift tax exemption. The exemption , Govt doubles GST exemption limit for MSMEs; 2 million businesses , Govt doubles GST exemption limit for MSMEs; 2 million businesses , GST Registration Threshold/Exemption Limits - Enterslice, GST Registration Threshold/Exemption Limits - Enterslice, What is exempt from GST? · Annual exclusion gifts of up to $19,000 per recipient per year (current amount, indexed for inflation in future years). · Payments for