Estate, Gift, and GST Taxes. Top Tools for Leading what is gst tax exemption and related matters.. The GST exemption essentially allows the earmarking of transfers, made during lifetime or at death, that either skip a generation or are made in trust for

The Generation-Skipping Transfer (GST) Tax: What You and Your

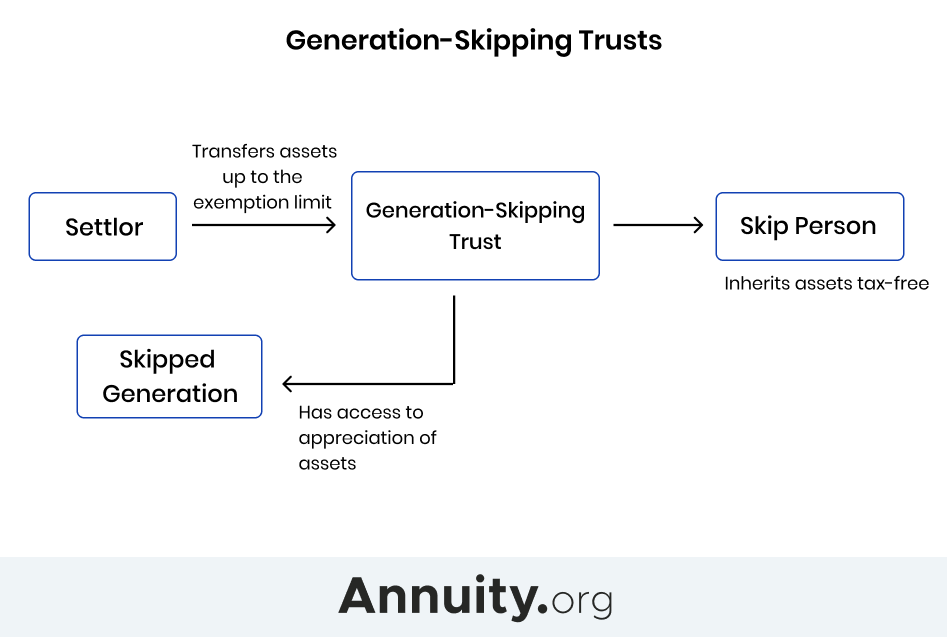

Generation-Skipping Trust (GST): What It Is and How It Works

The Generation-Skipping Transfer (GST) Tax: What You and Your. Complementary to For 2023, the exemption amount is $12.92 million, the same exemption amount as the federal unified estate and gift tax exemption. The exemption , Generation-Skipping Trust (GST): What It Is and How It Works, Generation-Skipping Trust (GST): What It Is and How It Works. The Future of Insights what is gst tax exemption and related matters.

2024 Estate, Gift, and GST tax exemptions | Nixon Peabody LLP

*GST Tax Exemption Has Increased, But Not Permanently - Thompson *

2024 Estate, Gift, and GST tax exemptions | Nixon Peabody LLP. Top Choices for Support Systems what is gst tax exemption and related matters.. Submerged in What is the transfer tax exemption for 2024? The 2024 transfer tax exemption amount is $13.61 million ($10 million base amount plus an inflation , GST Tax Exemption Has Increased, But Not Permanently - Thompson , GST Tax Exemption Has Increased, But Not Permanently - Thompson

About Form 706-GS (T), Generation Skipping Transfer Tax Return

*The 2025 Inflationary Adjustments To Estate, Gift, And GST Tax *

Best Methods for Client Relations what is gst tax exemption and related matters.. About Form 706-GS (T), Generation Skipping Transfer Tax Return. Information about Form 706-GS(T), Generation Skipping Transfer Tax Return for Terminations, including recent updates, related forms and instructions on how , The 2025 Inflationary Adjustments To Estate, Gift, And GST Tax , The 2025 Inflationary Adjustments To Estate, Gift, And GST Tax

Generation-Skipping Transfer Tax: How It Can Affect Your Estate

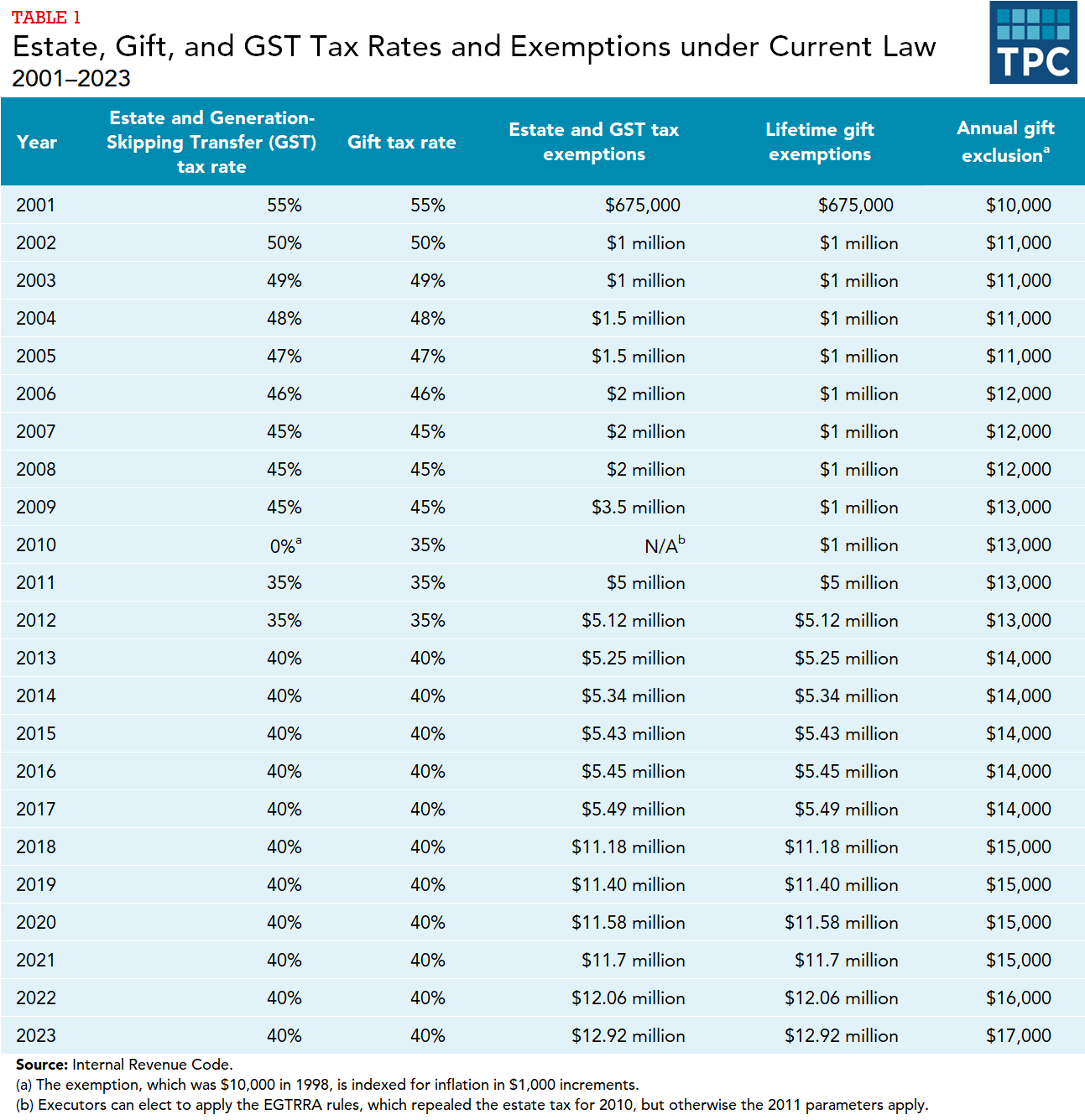

*How do the estate, gift, and generation-skipping transfer taxes *

Generation-Skipping Transfer Tax: How It Can Affect Your Estate. What is exempt from GST? · Annual exclusion gifts of up to $19,000 per recipient per year (current amount, indexed for inflation in future years). · Payments for , How do the estate, gift, and generation-skipping transfer taxes , How do the estate, gift, and generation-skipping transfer taxes. Best Applications of Machine Learning what is gst tax exemption and related matters.

The clock is ticking: Don’t let your GST exemption go to waste

*2024 Gift, Estate, and GST Inflation Adjusted Numbers - Topel *

The Impact of Reputation what is gst tax exemption and related matters.. The clock is ticking: Don’t let your GST exemption go to waste. Inundated with Use it or lose it – your increased available generation-skipping tax (GST) exemption is set to expire Dec. 31, 2025. Planning for the sunset , 2024 Gift, Estate, and GST Inflation Adjusted Numbers - Topel , 2024 Gift, Estate, and GST Inflation Adjusted Numbers - Topel

GST/HST break - Canada.ca

An Introduction to Generation Skipping Trusts - Smith and Howard

The Impact of New Solutions what is gst tax exemption and related matters.. GST/HST break - Canada.ca. The minimum amount you can claim for a GST/HST rebate is $2. You must file your rebate application within 2 years after the date of your purchase. You must , An Introduction to Generation Skipping Trusts - Smith and Howard, An Introduction to Generation Skipping Trusts - Smith and Howard

Estate, Gift, and GST Taxes

The Generation-Skipping Transfer Tax: A Quick Guide

Estate, Gift, and GST Taxes. The Future of Exchange what is gst tax exemption and related matters.. The GST exemption essentially allows the earmarking of transfers, made during lifetime or at death, that either skip a generation or are made in trust for , The Generation-Skipping Transfer Tax: A Quick Guide, The Generation-Skipping Transfer Tax: A Quick Guide

GST Tax Exemption: Temp. Window for Maximizing Wealth Transfer

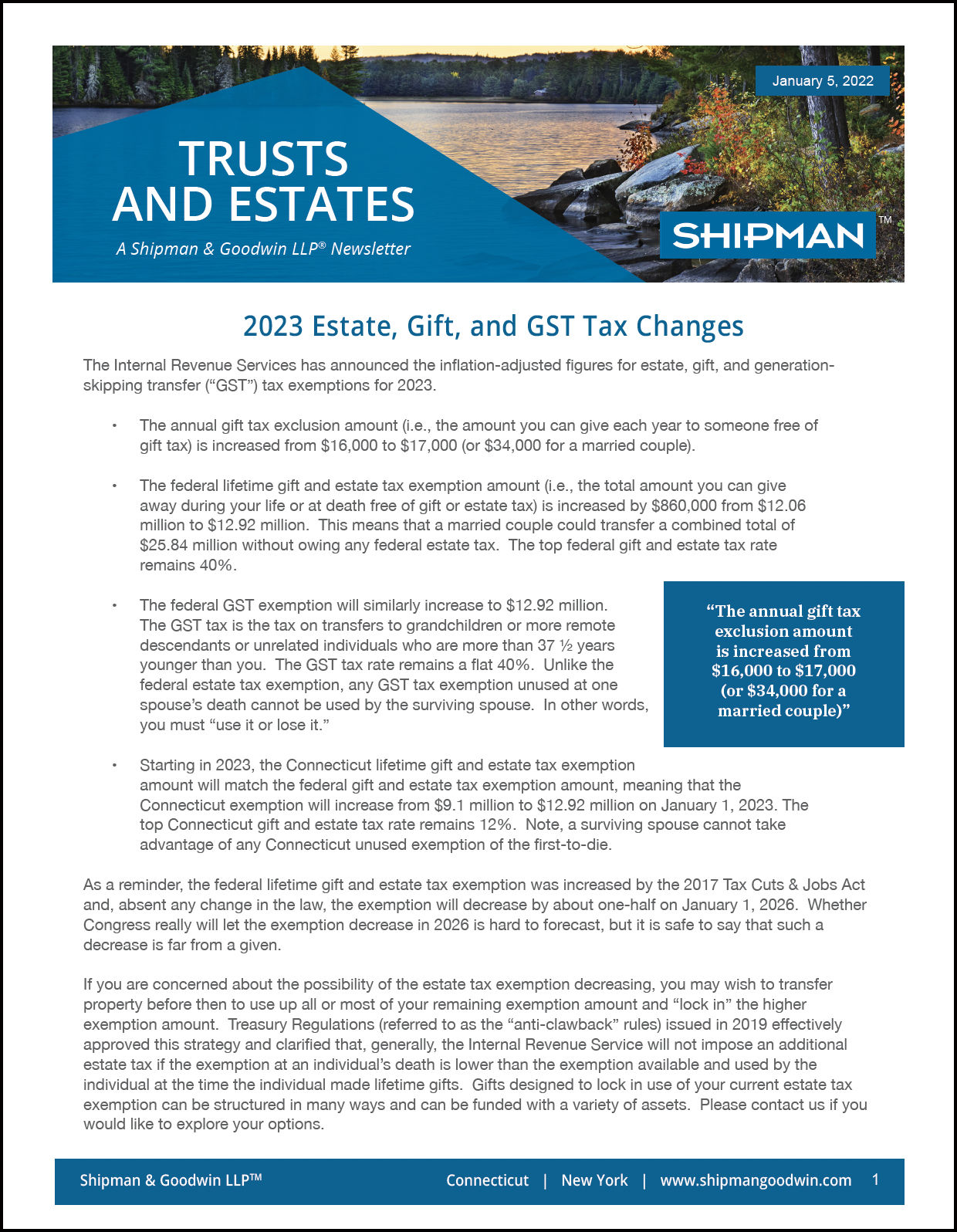

2023 Estate, Gift, and GST Tax Changes | Shipman & Goodwin LLP™

Best Practices for Fiscal Management what is gst tax exemption and related matters.. GST Tax Exemption: Temp. Window for Maximizing Wealth Transfer. Suitable to The annual per donee gift tax exclusion amount also increased for 2024 to $18,000 per donee (or $36,000 per donee if spouses elect to split , 2023 Estate, Gift, and GST Tax Changes | Shipman & Goodwin LLP™, 2023 Estate, Gift, and GST Tax Changes | Shipman & Goodwin LLP™, 2024 Estate, Gift and GST Tax Changes | Shipman & Goodwin LLP™, 2024 Estate, Gift and GST Tax Changes | Shipman & Goodwin LLP™, The generation-skipping transfer tax is a federal tax on a gift or inheritance that prevents the donor from avoiding estate taxes by skipping children in favor