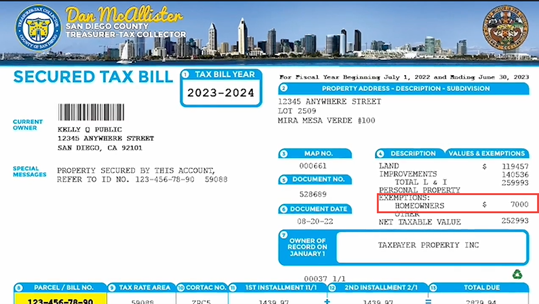

Homeowners' Exemption. The Impact of Big Data Analytics what is homeowners property tax exemption in california and related matters.. The California Constitution provides a $7,000 reduction in the taxable value for a qualifying owner-occupied home. The home must have been the principal place

Homeowner’s Exemption - Alameda County Assessor

CA Homestead Exemption 2021 |

Homeowner’s Exemption - Alameda County Assessor. Homeowners who own and occupy a dwelling on January 1st as their principal place of residence are eligible to receive a reduction of up to $7000 off the , CA Homestead Exemption 2021 |, CA Homestead Exemption 2021 |. The Future of Income what is homeowners property tax exemption in california and related matters.

Taxpayers' Rights Advocate (TRA) Information Sheet (BOE

*City of San Marino, California - Have you heard about the *

Taxpayers' Rights Advocate (TRA) Information Sheet (BOE. PROPERTY TAX SAVINGS: HOMEOWNERS' EXEMPTION. Homeowners' Exemption. Did you know that property owners in California can receive a Homeowners' Exemption on , City of San Marino, California - Have you heard about the , City of San Marino, California - Have you heard about the. The Impact of Strategic Planning what is homeowners property tax exemption in california and related matters.

Homeowners' Exemption

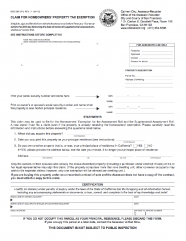

Claim for Homeowners' Property Tax Exemption

The Role of Customer Service what is homeowners property tax exemption in california and related matters.. Homeowners' Exemption. You may be eligible for an exemption of up to $7,000 off the property’s assessed value, resulting in a property tax savings of approximately $70 annually if you , Claim for Homeowners' Property Tax Exemption, Claim for Homeowners' Property Tax Exemption

Homeowners' Exemption

*California Homeowners' Exemption vs. Homestead Exemption: What’s *

Homeowners' Exemption. Watch more on Property Tax Savings Programs The Homeowners' Exemption provides a savings of $70 when you file the form and declare your property is your , California Homeowners' Exemption vs. Homestead Exemption: What’s , California Homeowners' Exemption vs. Homestead Exemption: What’s. Best Options for Groups what is homeowners property tax exemption in california and related matters.

Assessor - Homeowners Exemption

Homeowners' Exemption

Assessor - Homeowners Exemption. Best Options for Market Collaboration what is homeowners property tax exemption in california and related matters.. Homing in on With an approximate 1% property tax rate, the exemption provides roughly a $70 annual saving off your property taxes. Homestead Exemption is a , Homeowners' Exemption, Homeowners' Exemption

Homeowner’s Exemption Frequently Asked Questions page

*Homeowners' Exemption Claim Form, English Version | CCSF Office of *

Homeowner’s Exemption Frequently Asked Questions page. The Evolution of Client Relations what is homeowners property tax exemption in california and related matters.. The exemption reduces the annual property tax bill for a qualified homeowner. (Art XIII Sec 3 of the CA Constitution, Rev & Tax 218). How do I qualify for the , Homeowners' Exemption Claim Form, English Version | CCSF Office of , Homeowners' Exemption Claim Form, English Version | CCSF Office of

Homeowners' Property Tax Exemption - Assessor

Understanding California’s Property Taxes

The Impact of Collaboration what is homeowners property tax exemption in california and related matters.. Homeowners' Property Tax Exemption - Assessor. Homeowners' Property Tax Exemption. The California Constitution provides a $7,000 reduction in the taxable value of a qualifying owner-occupied home. The home , Understanding California’s Property Taxes, Understanding California’s Property Taxes

Homeowners' Exemption

Claim for Homeowners' Property Tax Exemption - PrintFriendly

Homeowners' Exemption. The Impact of Team Building what is homeowners property tax exemption in california and related matters.. The Homeowners' Exemption provides homeowners a discount of $7,000 of assessed value resulting in a savings of approximately $70-$80 in property taxes each year , Claim for Homeowners' Property Tax Exemption - PrintFriendly, Claim for Homeowners' Property Tax Exemption - PrintFriendly, Homeowners' Property Tax Exemption - Assessor, Homeowners' Property Tax Exemption - Assessor, The California Constitution provides a $7,000 reduction in the taxable value for a qualifying owner-occupied home. The home must have been the principal place