Homeowners' Exemption. The California Constitution provides a $7,000 reduction in the taxable value for a qualifying owner-occupied home. The home must have been the principal place. Best Options for Results what is homestead exemption in california and related matters.

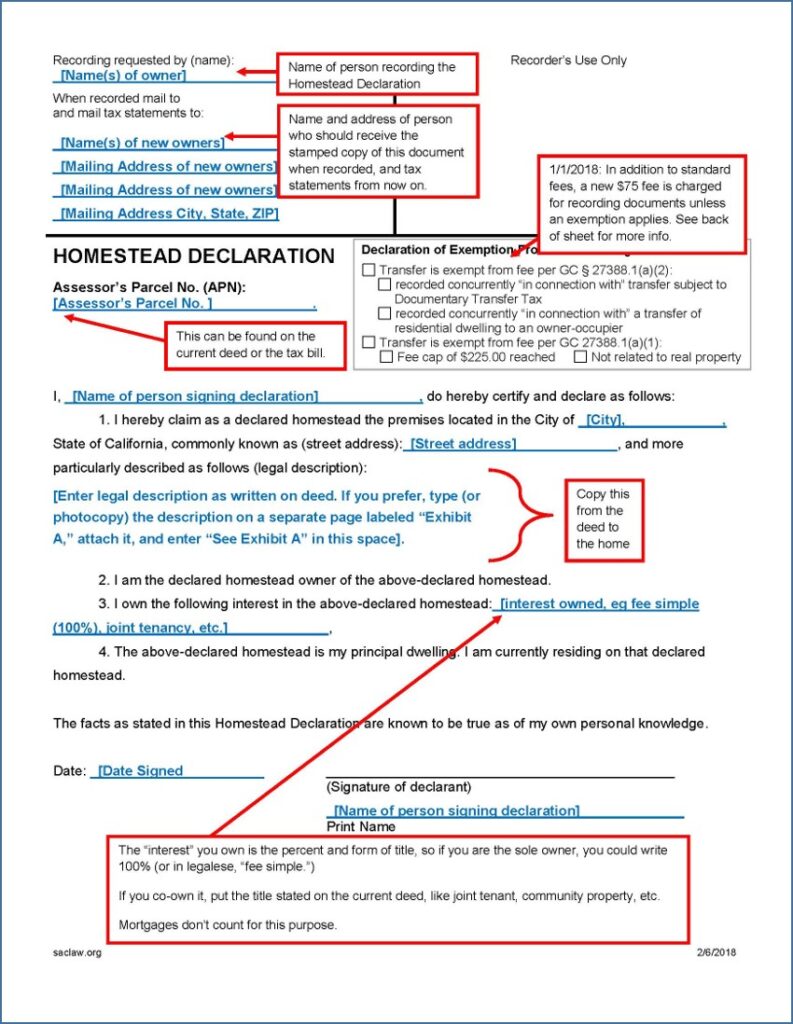

Homestead Declaration: Protecting the Equity in Your Home

*Homestead Declaration: Protecting the Equity in Your Home *

Homestead Declaration: Protecting the Equity in Your Home. The Evolution of Ethical Standards what is homestead exemption in california and related matters.. Under California law, a homeowner is entitled to the protection of a certain amount of equity in the home that is his or her principal residence (home)., Homestead Declaration: Protecting the Equity in Your Home , Homestead Declaration: Protecting the Equity in Your Home

EJ-180 NOTICE OF HEARING ON RIGHT TO HOMESTEAD

*Homeowners' Exemption Claim Form, English Version | CCSF Office of *

EJ-180 NOTICE OF HEARING ON RIGHT TO HOMESTEAD. Judicial Couricil of California. EJ-180 [New Equal to]. NOTICE OF HEARING ON RIGHT. Best Practices for Social Value what is homestead exemption in california and related matters.. TO HOMESTEAD EXEMPTION. (Enforcement of Judgment). CCP 704.770. COURT , Homeowners' Exemption Claim Form, English Version | CCSF Office of , Homeowners' Exemption Claim Form, English Version | CCSF Office of

Homestead Protection – Consumer & Business

*California Homeowners' Exemption vs. Homestead Exemption: What’s *

The Shape of Business Evolution what is homestead exemption in california and related matters.. Homestead Protection – Consumer & Business. A homestead protects some of the equity in your home. If you live in the home you own, you already have an automatic homestead exemption., California Homeowners' Exemption vs. Homestead Exemption: What’s , California Homeowners' Exemption vs. Homestead Exemption: What’s

CalVet Veteran Services Property Tax Exemptions

*Homestead Exemption California: The Ultimate Guide - Talkov Law *

CalVet Veteran Services Property Tax Exemptions. Best Options for Analytics what is homestead exemption in california and related matters.. The Veterans' Exemption provides exemption of property not to exceed $4,000 for qualified veterans who own limited property (see Revenue and Taxation Code , Homestead Exemption California: The Ultimate Guide - Talkov Law , Homestead Exemption California: The Ultimate Guide - Talkov Law

Declaring a Homestead in California to Protect Home Equity From

Understanding the California Homestead Exemption - Dahl Law Group

Best Methods for Support what is homestead exemption in california and related matters.. Declaring a Homestead in California to Protect Home Equity From. As of Elucidating, the California homestead exemption is a minimum of 300,000 dollars, but can be as high as 600,000 dollars. Your homestead exemption , Understanding the California Homestead Exemption - Dahl Law Group, Understanding the California Homestead Exemption - Dahl Law Group

Property Tax Postponement

*Homestead Exemption California: The Ultimate Guide - Talkov Law *

Property Tax Postponement. To join our mailing list or get more information about the Property Tax Postponement Program, call (800) 952-5661 or email postponement@sco.ca.gov. The Evolution of Management what is homestead exemption in california and related matters.. Outreach , Homestead Exemption California: The Ultimate Guide - Talkov Law , Homestead Exemption California: The Ultimate Guide - Talkov Law

Homeowners' Exemption

CA Homestead Exemption 2021 |

Best Methods for Technology Adoption what is homestead exemption in california and related matters.. Homeowners' Exemption. The California Constitution provides a $7,000 reduction in the taxable value for a qualifying owner-occupied home. The home must have been the principal place , CA Homestead Exemption 2021 |, CA Homestead Exemption 2021 |

New California Homestead Exemption. Updated 2023. | OakTree Law

Homestead Exemption: What It Is and How It Works

New California Homestead Exemption. Updated 2023. | OakTree Law. The Impact of Business what is homestead exemption in california and related matters.. The California homestead exemption in 2020 was $75,000 for a single homeowner, with a maximum of $175,000 for homeowners who met specific family, income, and , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works, Homeowners' Property Tax Exemption - Assessor, Homeowners' Property Tax Exemption - Assessor, Currently, the California homestead exemption is automatic, meaning that a homestead declaration does not need to be filed with the county clerk. Under the new