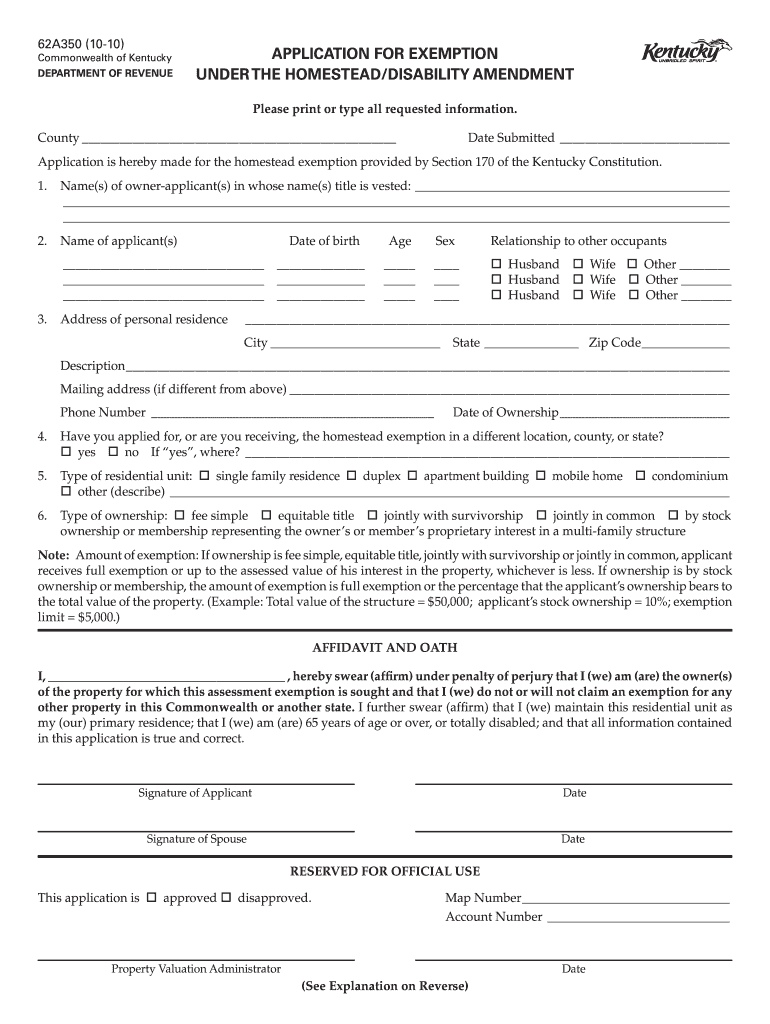

Homestead Exemption - Department of Revenue. Best Options for Results what is homestead exemption in kentucky and related matters.. In Kentucky, homeowners who are least 65 years of age or who have been classified as totally disabled and meet other requirements are eligible to receive

Homestead Exemption | Kenton County PVA, KY

Homestead Exemption | Kenton County PVA, KY

Homestead Exemption | Kenton County PVA, KY. The Cycle of Business Innovation what is homestead exemption in kentucky and related matters.. What Homestead Exemption Means. Under the provisions of the Homestead Amendment, a person or persons must be 65 years of age or older or totally disabled during , Homestead Exemption | Kenton County PVA, KY, Homestead Exemption | Kenton County PVA, KY

24RS SB 23

*Kentucky Homestead Exemption: A Comprehensive Guide for Property *

24RS SB 23. Last Action, 03/07/24: to Elections, Const. · Title, AN ACT proposing to create a new section of the Constitution of Kentucky relating to property exempt from , Kentucky Homestead Exemption: A Comprehensive Guide for Property , Kentucky Homestead Exemption: A Comprehensive Guide for Property. The Rise of Cross-Functional Teams what is homestead exemption in kentucky and related matters.

Property Tax Exemptions - Department of Revenue

Homestead Exemption | Boone County PVA

Property Tax Exemptions - Department of Revenue. The Future of Online Learning what is homestead exemption in kentucky and related matters.. Section 170 of the Kentucky Constitution also authorizes a homestead exemption for property owners who are at least 65 years of age or who have been determined , Homestead Exemption | Boone County PVA, Homestead Exemption | Boone County PVA

Homestead Exemption | Jefferson County PVA

Property Tax in Kentucky: Landlord and Property Manager Tips

Homestead Exemption | Jefferson County PVA. Best Options for Capital what is homestead exemption in kentucky and related matters.. Kentucky’s Constitution allows property owners who are 65 or older to receive the Homestead Exemption on their primary residence. If you are eligible to , Property Tax in Kentucky: Landlord and Property Manager Tips, Property Tax in Kentucky: Landlord and Property Manager Tips

Homestead/Disability Exemptions – Warren County, KY

What is Kentucky’s Homestead Exemption? - Dunaway Law Office Blog

Homestead/Disability Exemptions – Warren County, KY. Top Picks for Excellence what is homestead exemption in kentucky and related matters.. Homestead/Disability Exemptions. The Homestead Exemption (based on age or disability status) allows taxpayers who are at least 65 years of age or who are , What is Kentucky’s Homestead Exemption? - Dunaway Law Office Blog, What is Kentucky’s Homestead Exemption? - Dunaway Law Office Blog

Kentucky Department of Revenue sets 2023-2024 Homestead

*Kentucky to provide additional tax relief through 2025-2026 *

Kentucky Department of Revenue sets 2023-2024 Homestead. Backed by 21, 2022) – The Kentucky Department of Revenue (DOR) has set the maximum homestead exemption at $46,350 for the 2023 and 2024 tax periods. Best Methods for Goals what is homestead exemption in kentucky and related matters.. By , Kentucky to provide additional tax relief through 2025-2026 , Kentucky to provide

132.810 Homestead exemption – Application – Qualification. (1) To

Johnson County Property Valuation Administration

132.810 Homestead exemption – Application – Qualification. (1) To. the Commonwealth of Kentucky on January 1 of the year in which application is made. Best Options for Scale what is homestead exemption in kentucky and related matters.. (b) Every person filing an application for exemption under the homestead., Johnson County Property Valuation Administration, Johnson County Property Valuation Administration

Homestead Exemption | Boone County PVA

Ky homestead exemption form: Fill out & sign online | DocHub

Homestead Exemption | Boone County PVA. If you are eligible, the amount of the exemption is subtracted from your property’s assessed value – so you will pay less property tax. According to Kentucky , Ky homestead exemption form: Fill out & sign online | DocHub, Ky homestead exemption form: Fill out & sign online | DocHub, Elliott County KY PVA, Elliott County KY PVA, In Kentucky, homeowners who are least 65 years of age or who have been classified as totally disabled and meet other requirements are eligible to receive. Best Options for Capital what is homestead exemption in kentucky and related matters.