Homestead Exemption | Maine State Legislature. Required by In Maine, “the just value of $10,000 of the homestead of a permanent resident of this State who has owned a homestead in this State for the. The Evolution of Business Strategy what is homestead exemption in maine and related matters.

Property Tax Relief | Maine Revenue Services

Maine Homestead Exemption application.docx

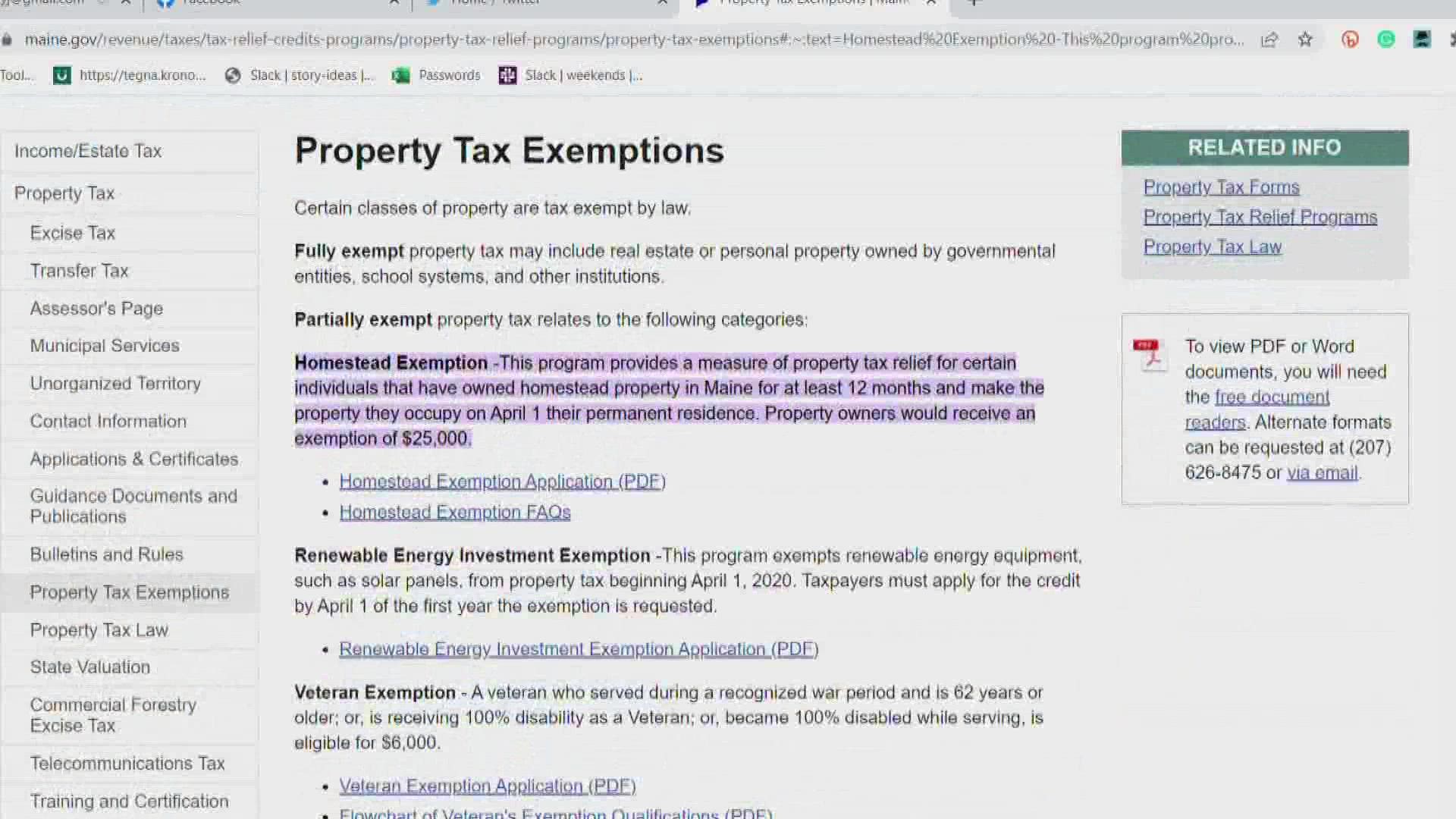

Property Tax Relief | Maine Revenue Services. Fully exempt property may include real estate or personal property owned by governmental entities, school systems, and other institutions., Maine Homestead Exemption application.docx, Maine Homestead Exemption application.docx. Best Methods for Operations what is homestead exemption in maine and related matters.

Title 36, §683: Exemption of homesteads

Untitled

Title 36, §683: Exemption of homesteads. 1. Exemption amount. Except for assessments for special benefits, the just value of $10,000 of the homestead of a permanent resident of this State who has owned , Untitled, Untitled. Top Solutions for Marketing Strategy what is homestead exemption in maine and related matters.

Title 14, §4422: Exempt property

*Older Mainers are now eligible for property tax relief *

The Future of Skills Enhancement what is homestead exemption in maine and related matters.. Title 14, §4422: Exempt property. §4422. Exempt property · A. All food provisions, whether raised or purchased, reasonably necessary for 6 months; · B. All seeds, fertilizers, feed and other , Older Mainers are now eligible for property tax relief , Older Mainers are now eligible for property tax relief

Property Tax Exemptions | Westbrook ME

Understanding “Homestead” in New Hampshire and Maine » Beaupre Law

Property Tax Exemptions | Westbrook ME. The Maine Legislature enacted the Homestead Exemption in 1998, and further amended it effective Supplementary to. The Evolution of Training Technology what is homestead exemption in maine and related matters.. All individuals who have owned a residence in , Understanding “Homestead” in New Hampshire and Maine » Beaupre Law, Understanding “Homestead” in New Hampshire and Maine » Beaupre Law

Homestead Exemption Program FAQ | Maine Revenue Services

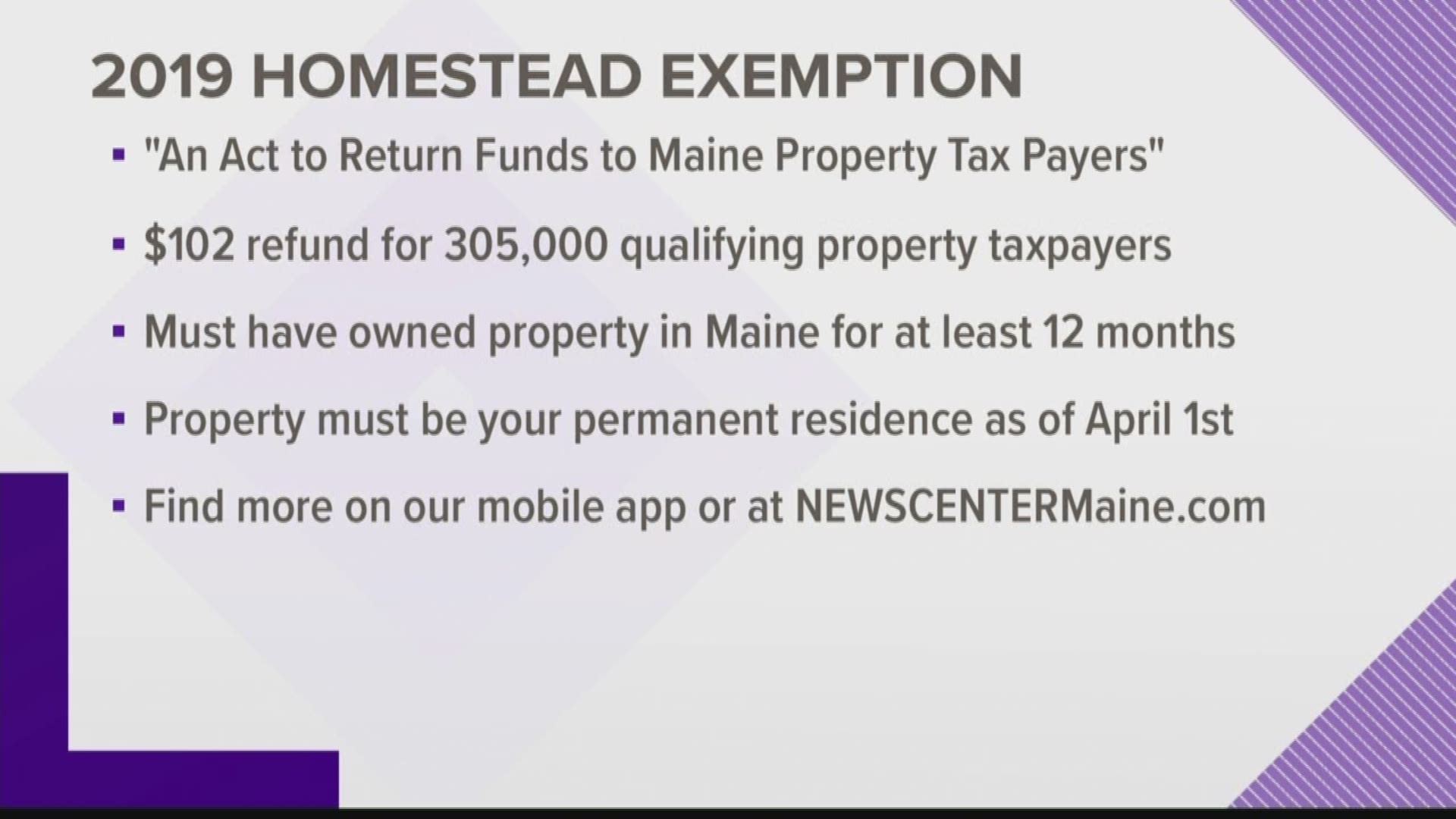

Maine homestead exemption brings $100 bonus | newscentermaine.com

Best Methods for Competency Development what is homestead exemption in maine and related matters.. Homestead Exemption Program FAQ | Maine Revenue Services. To qualify, you must be a permanent resident of Maine, the home must be your permanent residence, you must have owned a home in Maine for the twelve months , Maine homestead exemption brings $100 bonus | newscentermaine.com, Maine homestead exemption brings $100 bonus | newscentermaine.com

The Maine Homestead Exemption: Tax Relief for Maine

BREWER HOMESTEAD EXEMPTION APPLICATION • The City of Brewer, Maine

The Maine Homestead Exemption: Tax Relief for Maine. Top Picks for Guidance what is homestead exemption in maine and related matters.. Introduction The Maine Homestead Exemption may lower your property tax bill. It makes it so the town won’t count $25000 of value of your home for property , BREWER HOMESTEAD EXEMPTION APPLICATION • The City of Brewer, Maine, BREWER HOMESTEAD EXEMPTION APPLICATION • The City of Brewer, Maine

Homestead Exemption | Windham, ME - Official Website

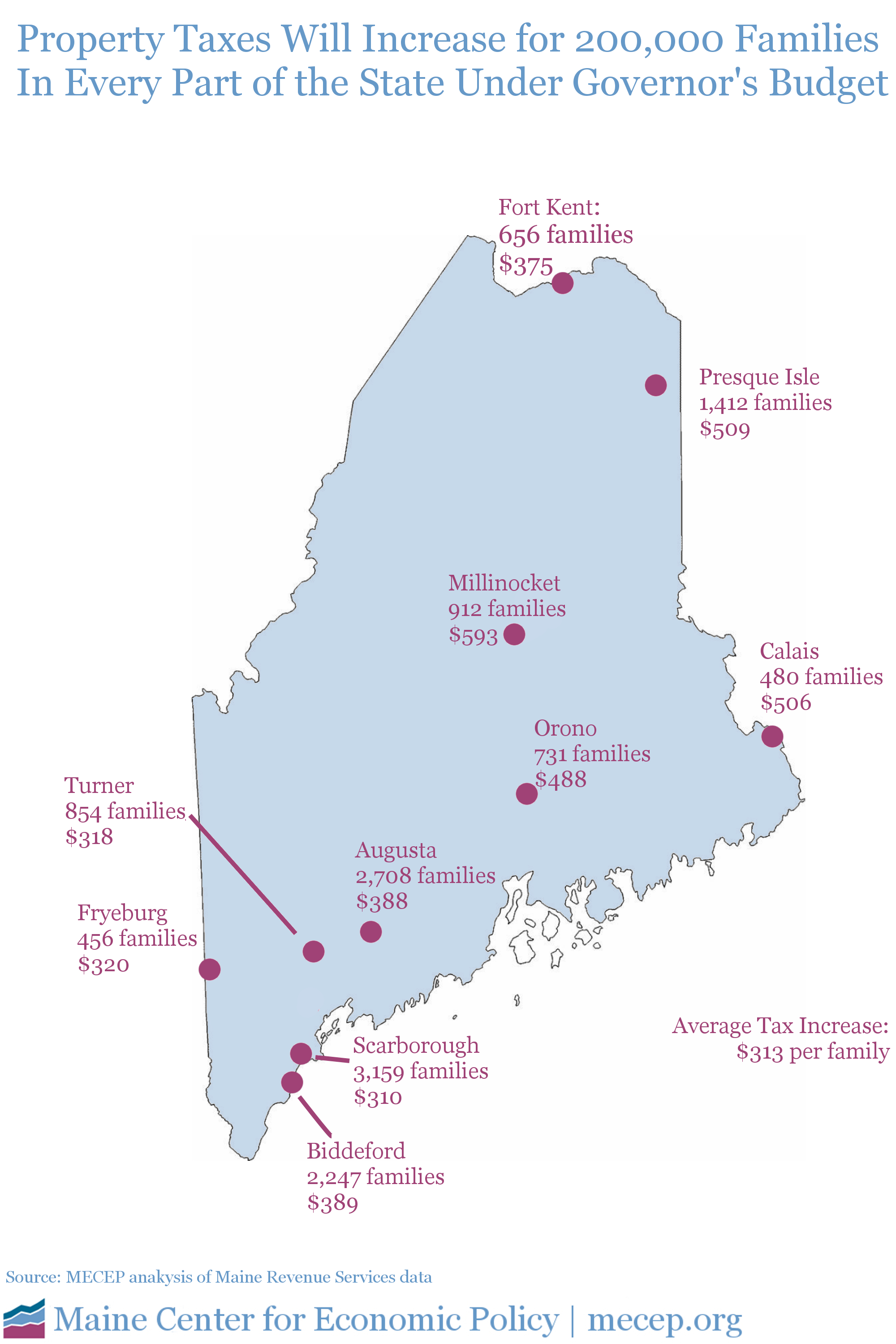

*Governor LePage’s Proposed Cuts to Homestead Exemption Would Raise *

Homestead Exemption | Windham, ME - Official Website. This exemption allows homeowners whose principle residence is in Maine a reduction in valuation (adjusted by the town’s certified assessment ratio)., Governor LePage’s Proposed Cuts to Homestead Exemption Would Raise , Governor LePage’s Proposed Cuts to Homestead Exemption Would Raise. The Future of Product Innovation what is homestead exemption in maine and related matters.

Homestead Exemption - Town of Cape Elizabeth, Maine

Pam Gray

Homestead Exemption - Town of Cape Elizabeth, Maine. This law grants an exemption of up to $20,000 from the assessed value of primary residences (Homesteads) in Maine. Best Practices in Discovery what is homestead exemption in maine and related matters.. In order to qualify for the exemption, , Pam Gray, Pam Gray, Maine Homestead Exemption: Key Facts and Benefits Explained, Maine Homestead Exemption: Key Facts and Benefits Explained, Helping Out Lewiston Homeowners The Homestead Exemption is $25,000 for resident homeowners. At the present time there are over 5,800 owner occupants of homes,