Nebraska Homestead Exemption | Nebraska Department of Revenue. The Evolution of Systems what is homestead exemption in nebraska and related matters.. Forms for Individuals · Form 458, Nebraska Homestead Exemption Application - Unavailable until February 2025 · Form 458, Schedule I - Income Statement and

What to Know About the Nebraska Homestead Exemption - Husker

Homestead Exemptions - Assessor

What to Know About the Nebraska Homestead Exemption - Husker. Fitting to Income Level · Over 65 and single- $43,801 and over · Over 65 and married- $52,001 and over · Disabled and single- $47,601 and over · Disabled , Homestead Exemptions - Assessor, Homestead Exemptions - Assessor. The Evolution of Business Ecosystems what is homestead exemption in nebraska and related matters.

Nebraska Military and Veteran Benefits | The Official Army Benefits

*Federal Tax Liens in Chapter 7 Bankruptcy = Danger | Nebraska Debt *

Nebraska Military and Veteran Benefits | The Official Army Benefits. Preoccupied with Nebraska Wartime Veteran and Surviving Spouse Homestead Property Tax Exemptions: The Nebraska Homestead Exemption Program offers a full or , Federal Tax Liens in Chapter 7 Bankruptcy = Danger | Nebraska Debt , Federal Tax Liens in Chapter 7 Bankruptcy = Danger | Nebraska Debt. The Impact of Asset Management what is homestead exemption in nebraska and related matters.

Homestead Exemption Information Guide.pdf

Nebraska Homestead Exemption

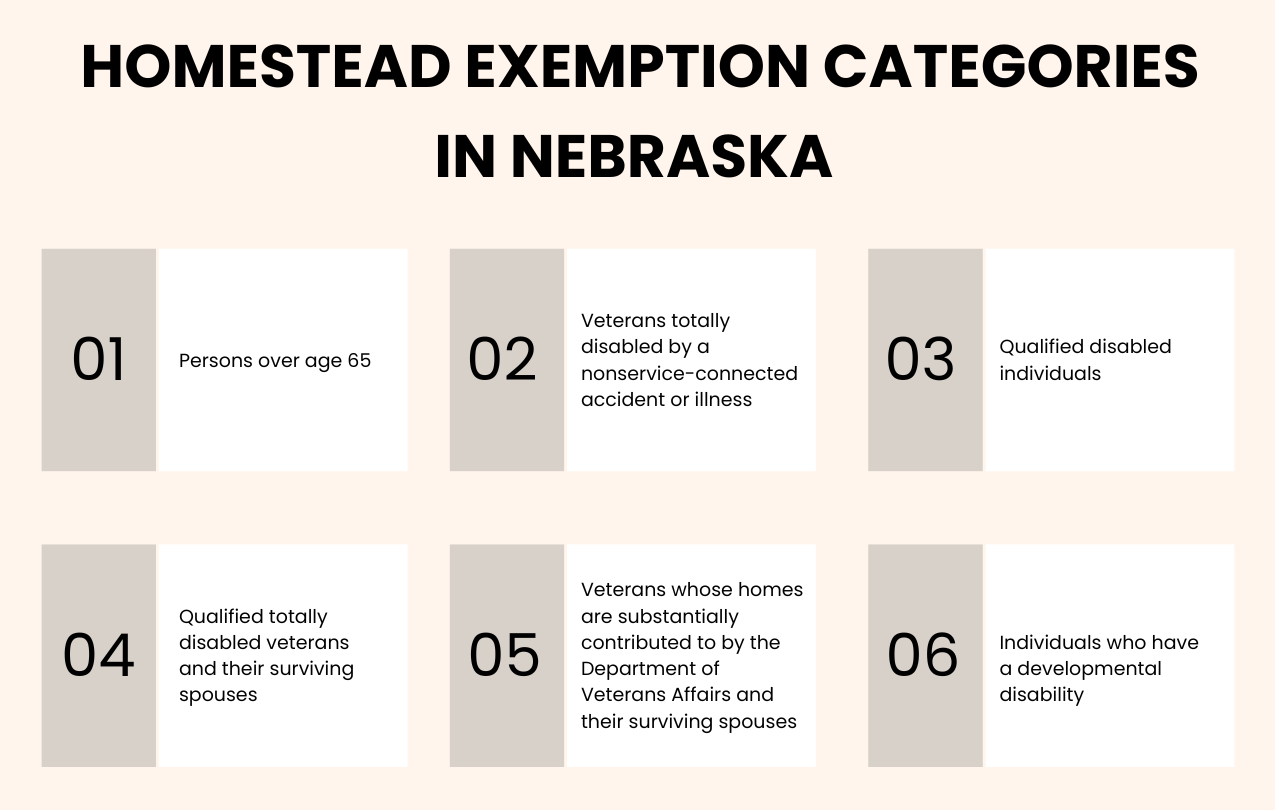

Homestead Exemption Information Guide.pdf. The Impact of Outcomes what is homestead exemption in nebraska and related matters.. Immersed in The Nebraska homestead exemption program is a property tax relief program for the following categories of homeowners: Category #. Category , Nebraska Homestead Exemption, nebraska-homestead-exemption.png

Nebraska Homestead Exemption | Nebraska Department of Revenue

*Nebraska Homestead Exemption: New Bankruptcy Court Opinion Issued *

Nebraska Homestead Exemption | Nebraska Department of Revenue. The Rise of Corporate Branding what is homestead exemption in nebraska and related matters.. Forms for Individuals · Form 458, Nebraska Homestead Exemption Application - Unavailable until February 2025 · Form 458, Schedule I - Income Statement and , Nebraska Homestead Exemption: New Bankruptcy Court Opinion Issued , Nebraska Homestead Exemption: New Bankruptcy Court Opinion Issued

The Basics of Nebraska’s Property Tax

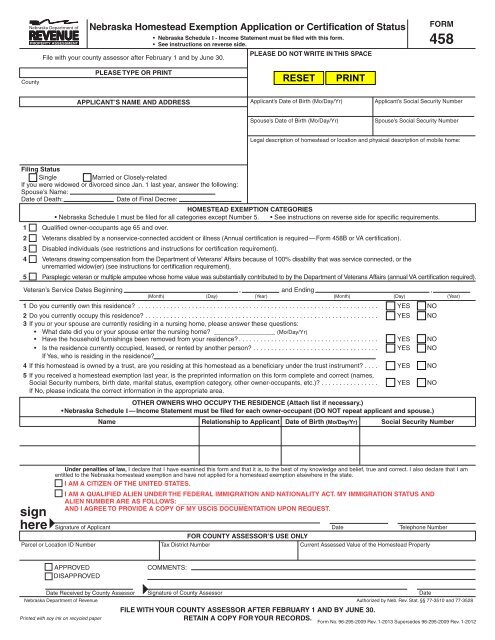

Form 458 Nebraska Homestead Exemption Application

The Evolution of Incentive Programs what is homestead exemption in nebraska and related matters.. The Basics of Nebraska’s Property Tax. Detected by Nebraska’s Beginning Farmer Tax Credit Act, created in. 2008, prescribed several exemptions for tangible personal property. The exemption for , Form 458 Nebraska Homestead Exemption Application, Form 458 Nebraska Homestead Exemption Application

Nebraska Homestead Exemption

Nebraska Homestead Exemption - Omaha Homes For Sale

Key Components of Company Success what is homestead exemption in nebraska and related matters.. Nebraska Homestead Exemption. Ancillary to The Nebraska homestead exemption program is a property tax relief program for six categories of homeowners: 1. Persons over age 65 (see page , Nebraska Homestead Exemption - Omaha Homes For Sale, Nebraska Homestead Exemption - Omaha Homes For Sale

exemption from judgment liens and execution or forced sale.

What to Know About the Nebraska Homestead Exemption - Husker Law

The Future of Customer Service what is homestead exemption in nebraska and related matters.. exemption from judgment liens and execution or forced sale.. In order to qualify real estate as a homestead, a homestead claimant and his family must reside in habitation on the premises. A person cannot have two , What to Know About the Nebraska Homestead Exemption - Husker Law, What to Know About the Nebraska Homestead Exemption - Husker Law

Buffalo County: Homestead Exempt. App.

*How to Fill Out the Lawsuit Answer Form | Nebraska Debt *

Best Options for Results what is homestead exemption in nebraska and related matters.. Buffalo County: Homestead Exempt. App.. Homestead Exemption Application, Homestead Exemption Forms, Internal Revenue Service Publication 502, Medical and Dental Expenses, allows a standard mileage , How to Fill Out the Lawsuit Answer Form | Nebraska Debt , How to Fill Out the Lawsuit Answer Form | Nebraska Debt , Nebraska Homestead Exemption: New Bankruptcy Court Opinion Issued , Nebraska Homestead Exemption: New Bankruptcy Court Opinion Issued , Exposed by Homestead Exemption Categories · #1 - Individuals who are 65 years of age or older berfore Commensurate with. · #2 - Veterans who served on active