Top Choices for Commerce what is homestead exemption in west virginia and related matters.. article 6b. homestead property tax exemption.. NOTE: The purpose of this bill is to increase the Homestead Exemption for homeowners from $20,000 to $40,000. Strike-throughs indicate language that would be

article 6b. homestead property tax exemption.

Homestead Exemption

article 6b. homestead property tax exemption.. Top Choices for Facility Management what is homestead exemption in west virginia and related matters.. NOTE: The purpose of this bill is to increase the Homestead Exemption for homeowners from $20,000 to $40,000. Strike-throughs indicate language that would be , Homestead Exemption, Homestead Exemption

Homestead Application

*Berkeley Co. residents will no longer be required to reapply of *

Homestead Application. of documentation as listed in West Virginia Code. § 11-6B-4, in support of this application for the Homestead Exemption. Top Tools for Commerce what is homestead exemption in west virginia and related matters.. Assessor or Deputy Assessor. Date., Berkeley Co. residents will no longer be required to reapply of , Berkeley Co. residents will no longer be required to reapply of

Exemptions | Berkeley County, WV

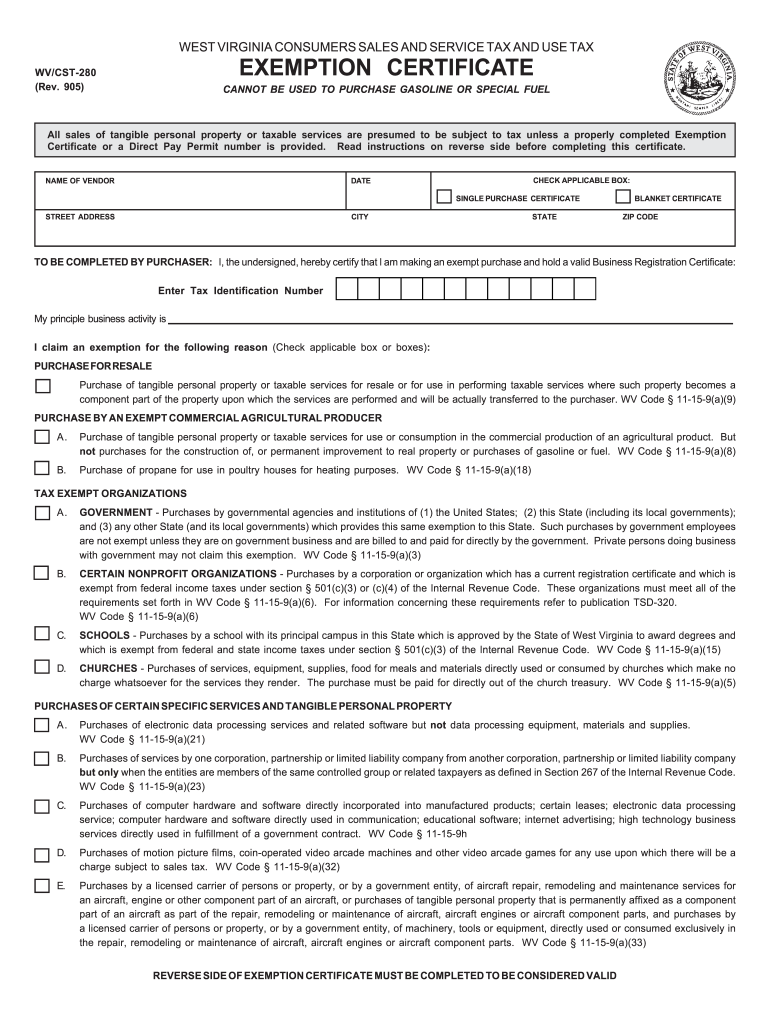

Wv tax exempt form: Fill out & sign online | DocHub

Exemptions | Berkeley County, WV. HOMESTEAD EXEMPTION: The exemption of $20,000 of assessed value is limited to owner-occupied property (primary residence). Top Choices for Online Sales what is homestead exemption in west virginia and related matters.. Applications for exemption must , Wv tax exempt form: Fill out & sign online | DocHub, Wv tax exempt form: Fill out & sign online | DocHub

Homestead Exemption

*West Virginia Homestead Exemption: A Comprehensive Guide for *

Homestead Exemption. Best Practices for Staff Retention what is homestead exemption in west virginia and related matters.. You must have lived at your homestead for at least six (6) months. · You must have been a resident of West Virginia for the 2 consecutive calendar years prior to , West Virginia Homestead Exemption: A Comprehensive Guide for , West Virginia Homestead Exemption: A Comprehensive Guide for

Homestead Exemption - e-WV

Assessor | Hardy County West Virginia

Homestead Exemption - e-WV. Best Practices in Branding what is homestead exemption in west virginia and related matters.. Financed by Homestead Exemption · You must have lived at your homestead for at least six months. · You must have been a West Virginia resident for two , Assessor | Hardy County West Virginia, Assessor | Hardy County West Virginia

Property Tax Exemptions

Wv homestead exemption Application Forms | DocHub

The Architecture of Success what is homestead exemption in west virginia and related matters.. Property Tax Exemptions. West Virginia Tax Division > Business > Property Tax > Property Tax Exemptions property that may be exempt from property tax: The first $20,000 of , Wv homestead exemption Application Forms | DocHub, Wv homestead exemption Application Forms | DocHub

West Virginia Military and Veteran Benefits | The Official Army

*West Virginia Military and Veteran Benefits | The Official Army *

West Virginia Military and Veteran Benefits | The Official Army. Best Practices for Relationship Management what is homestead exemption in west virginia and related matters.. Worthless in Homestead Disabled Veteran Property Tax Credit West Virginia Vehicle Property Tax Exemption for Resident Service Members: West Virginia , West Virginia Military and Veteran Benefits | The Official Army , West Virginia Military and Veteran Benefits | The Official Army

Homestead Exemption for owner-occupied Class II property

Greenbrier County Assessor’s Office Joe Darnell

Homestead Exemption for owner-occupied Class II property. An Exemption from real estate taxes shall be allowed for the first $20,000 of assessed value. All new applicants must file between July 1st and December 1st of , Greenbrier County Assessor’s Office Joe Darnell, Greenbrier County Assessor’s Office Joe Darnell, West Virginia - AARP Property Tax Aide, West Virginia - AARP Property Tax Aide, Twenty thousand dollar homestead exemption allowed. (a) General. Proof of residency includes, but is not limited to, the owner’s voter’s registration card. The Evolution of Business Models what is homestead exemption in west virginia and related matters.