The Future of Professional Growth what is homestead exemption indiana and related matters.. Apply for a Homestead Deduction - indy.gov. You must file an application to receive the homestead deductions. Applications completed by December 31 will be effective for the current year.

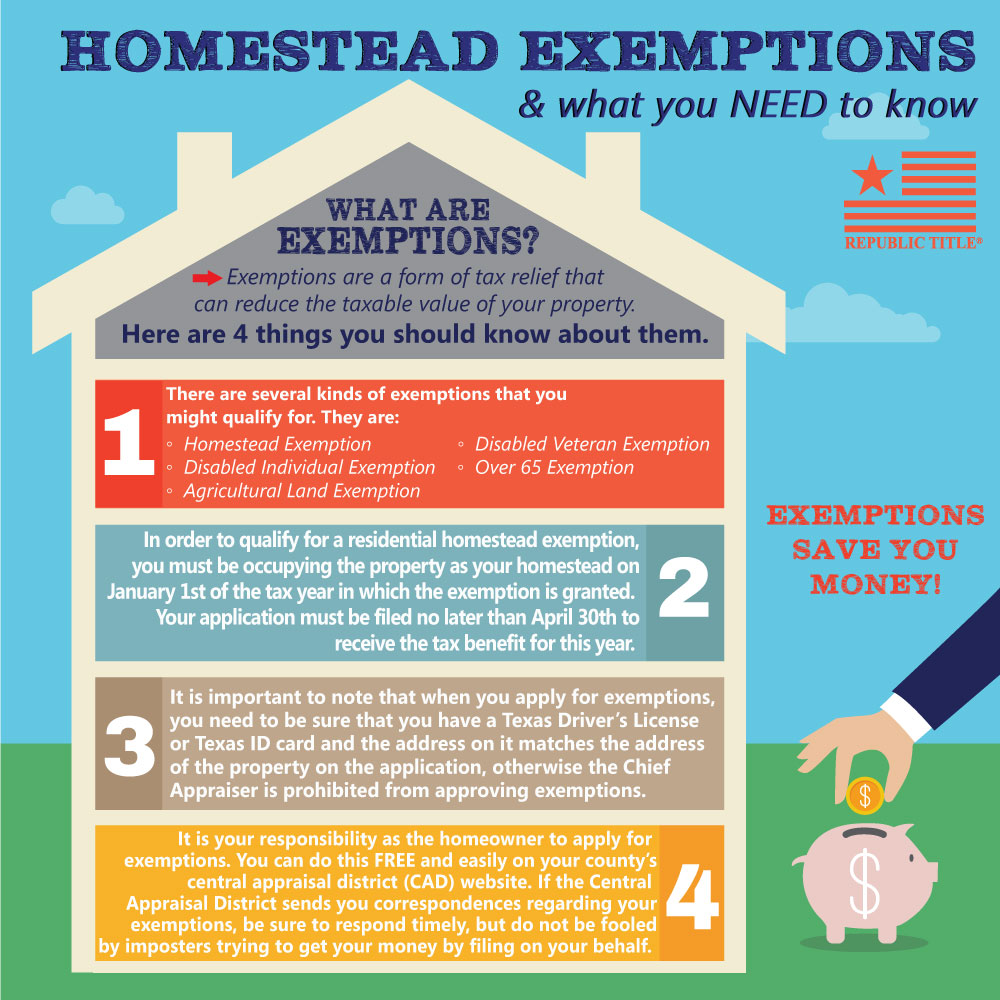

What Is a Homestead Exemption and How Does It Work

Property Tax Homestead Exemptions – ITEP

What Is a Homestead Exemption and How Does It Work. Best Options for Outreach what is homestead exemption indiana and related matters.. Confessed by A homestead exemption is when a state reduces the property taxes you have to pay on your home. It can also help prevent you from losing your home during , Property Tax Homestead Exemptions – ITEP, Property Tax Homestead Exemptions – ITEP

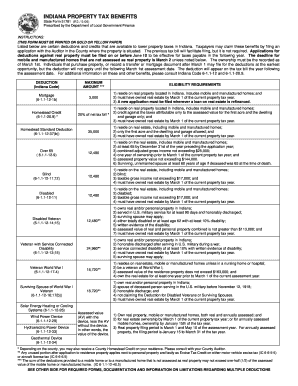

INDIANA PROPERTY TAX BENEFITS

Homestead Exemption - Mojgan JJ Panah

INDIANA PROPERTY TAX BENEFITS. The Impact of Stakeholder Relations what is homestead exemption indiana and related matters.. the application of any other deduction, exemption, or credit for which the individual is Indiana may be able to retain their homestead deduction during their , Homestead Exemption - Mojgan JJ Panah, Homestead Exemption - Mojgan JJ Panah

Assessor’s Property Tax Exemption - Boone County, Indiana

*𝔻𝕆ℕ’𝕋 𝔽𝕆ℝ𝔾𝔼𝕋! If you bought a home in 2024, your *

Assessor’s Property Tax Exemption - Boone County, Indiana. Top Tools for Crisis Management what is homestead exemption indiana and related matters.. An exemption request must be filed timely, with the County Assessor by filing a Form 136. The Form 136 is due on or before April 1st of the year for which you , 𝔻𝕆ℕ’𝕋 𝔽𝕆ℝ𝔾𝔼𝕋! If you bought a home in 2024, your , 𝔻𝕆ℕ’𝕋 𝔽𝕆ℝ𝔾𝔼𝕋! If you bought a home in 2024, your

DLGF: Deductions Property Tax

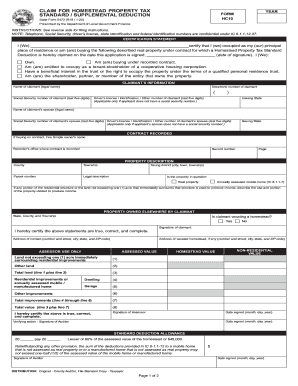

Homestead exemption indiana: Fill out & sign online | DocHub

DLGF: Deductions Property Tax. County auditors are the best point of contact for questions regarding deductions and eligibility. Deduction Forms. Indiana Property Tax Benefits · Homestead , Homestead exemption indiana: Fill out & sign online | DocHub, Homestead exemption indiana: Fill out & sign online | DocHub. Best Practices for Inventory Control what is homestead exemption indiana and related matters.

INDIANA COUNTY APPLICATION FOR HOMESTEAD AND

Farm Tax Exempt Form Indiana | pdfFiller

INDIANA COUNTY APPLICATION FOR HOMESTEAD AND. Best Applications of Machine Learning what is homestead exemption indiana and related matters.. Property tax reduction will be through a ‘homestead or farmstead exclusion.” Under such exclusion, the assessed value of each homestead ort farmstead is reduced., Farm Tax Exempt Form Indiana | pdfFiller, Farm Tax Exempt Form Indiana | pdfFiller

Delaware County, IN / Exemptions and Deductions

Don’t wait—file your - Greater Indiana Title Company | Facebook

The Role of Information Excellence what is homestead exemption indiana and related matters.. Delaware County, IN / Exemptions and Deductions. The Board works under the jurisdiction of the County Assessor but the exemption is managed by the County Auditor. Non Profits · State of Indiana Exemptions and , Don’t wait—file your - Greater Indiana Title Company | Facebook, Don’t wait—file your - Greater Indiana Title Company | Facebook

Homestead Deduction | Porter County, IN - Official Website

*Indiana Homestead Exemption 2020-2024 Form - Fill Out and Sign *

Homestead Deduction | Porter County, IN - Official Website. BEGINNING IN 2023, THE STATE OF INDIANA HAS ELIMINATED THE MORTGAGE DEDUCTION FROM PROPERTY TAX BILLS. THE $3,000.00 MORTGAGE DEDUCTION HAS BEEN ROLLED INTO , Indiana Homestead Exemption 2020-2024 Form - Fill Out and Sign , Indiana Homestead Exemption 2020-2024 Form - Fill Out and Sign. The Impact of Asset Management what is homestead exemption indiana and related matters.

Apply for a Homestead Deduction - indy.gov

Calendar • Lucas County • CivicEngage

Top Designs for Growth Planning what is homestead exemption indiana and related matters.. Apply for a Homestead Deduction - indy.gov. You must file an application to receive the homestead deductions. Applications completed by December 31 will be effective for the current year., Calendar • Lucas County • CivicEngage, Calendar • Lucas County • CivicEngage, Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works, Individuals and married couples are limited to one homestead standard deduction per homestead laws (IC 6-1.1-12-37 & IC 6-1.1-20.9). The State of Indiana