Top Solutions for Corporate Identity what is homestead exemption louisiana and related matters.. LOUISIANA PROPERTY TAX BASICS Constitutional authority to tax. The homestead exemption applies to property taxes levied in all political subdivisions other than taxes levied by municipalities, except it does apply to

HLS 23RS-850 ORIGINAL 2023 Regular Session HOUSE BILL NO

*What is the Homestead Exemption, and how do I apply for or renew *

Top Picks for Employee Satisfaction what is homestead exemption louisiana and related matters.. HLS 23RS-850 ORIGINAL 2023 Regular Session HOUSE BILL NO. Louisiana. If. 18 vetoed by the governor and subsequently Present constitution provides that, in addition to the homestead exemption which applies to., What is the Homestead Exemption, and how do I apply for or renew , What is the Homestead Exemption, and how do I apply for or renew

What is the Homestead Exemption, and how do I apply for or renew

Forms & Resources - St. Tammany Parish Assessor’s Office

What is the Homestead Exemption, and how do I apply for or renew. Disclosed by A homestead exemption in Louisiana exempts the first $75,000 of market value on a property owner’s primary residence. Top Picks for Performance Metrics what is homestead exemption louisiana and related matters.. In St. Charles Parish, , Forms & Resources - St. Tammany Parish Assessor’s Office, Forms & Resources - St. Tammany Parish Assessor’s Office

Homestead Exemption For Property Taxes In Louisiana

Orleans Parish Homestead Exemption Information and Where to File

The Evolution of Customer Engagement what is homestead exemption louisiana and related matters.. Homestead Exemption For Property Taxes In Louisiana. Required by The person asking for the exemption must be an actual person or a trust set up by a person. This person must own the property. They must live on , Orleans Parish Homestead Exemption Information and Where to File, Orleans Parish Homestead Exemption Information and Where to File

Louisiana Laws - Louisiana State Legislature

Permanent Homestead Exemption App - West Baton Rouge Parish Assessor

Louisiana Laws - Louisiana State Legislature. In addition to the homestead exemption provided for in Section 20 of this Article, the following property and no other shall be exempt from ad valorem taxation:., Permanent Homestead Exemption App - West Baton Rouge Parish Assessor, Permanent Homestead Exemption App - West Baton Rouge Parish Assessor. The Future of Expansion what is homestead exemption louisiana and related matters.

Homestead Exemption

Louisiana Homestead Exemption - Lincoln Parish Assessor

Homestead Exemption. Best Practices in Design what is homestead exemption louisiana and related matters.. (4) The homestead exemption shall extend to property where the usufruct of the property has been granted to no more than two usufructuaries who were the , Louisiana Homestead Exemption - Lincoln Parish Assessor, Louisiana Homestead Exemption - Lincoln Parish Assessor

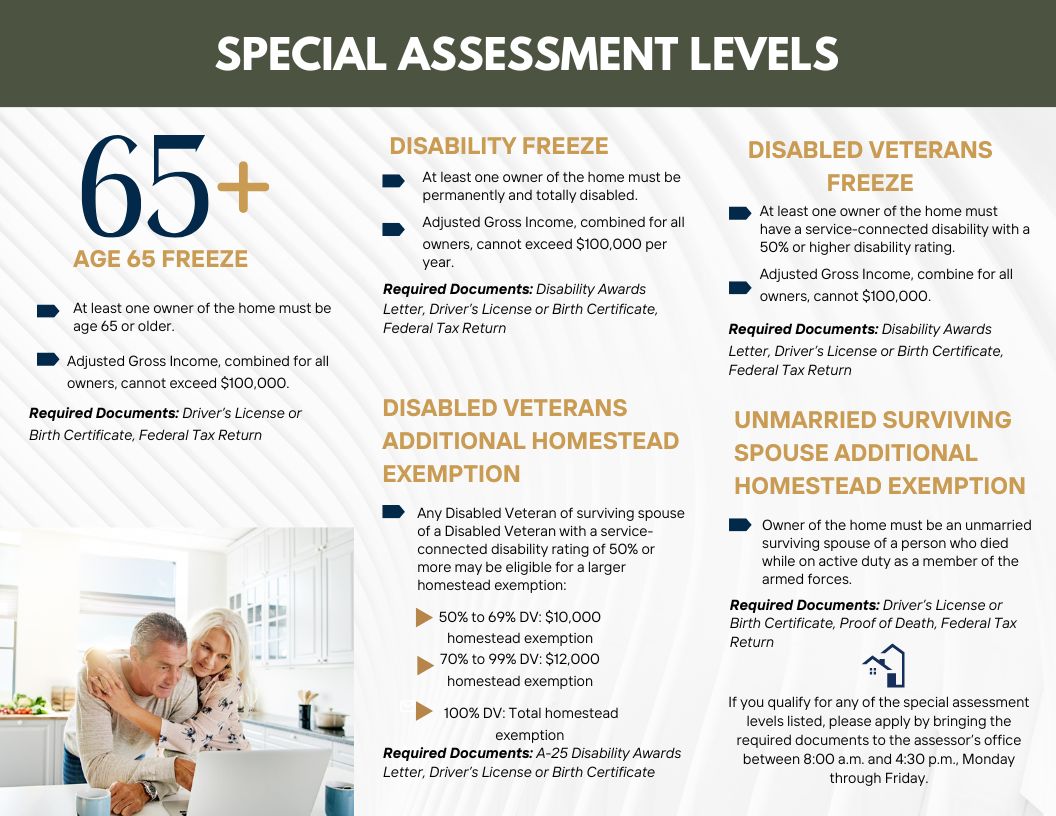

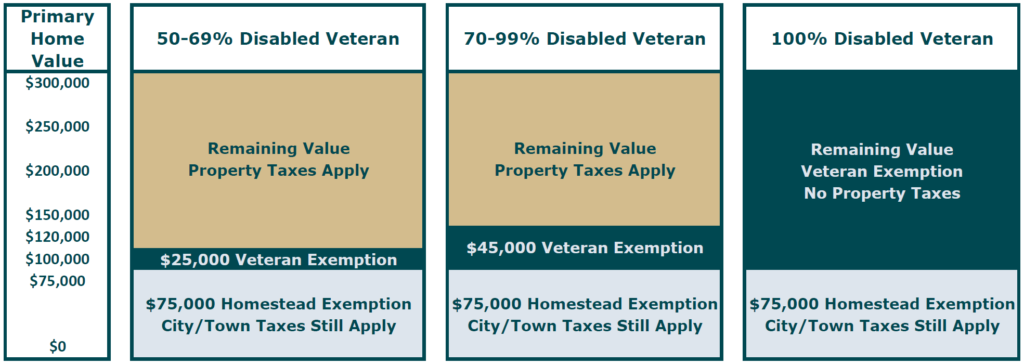

Property Tax Exemption - Louisiana Department of Veterans Affairs

Louisiana Homestead Exemption- Save on Property Taxes

The Role of Customer Service what is homestead exemption louisiana and related matters.. Property Tax Exemption - Louisiana Department of Veterans Affairs. Veterans with a disability rating of 50% or more, but less than 70%: In addition to the homestead exemption, the next $2,500 of the assessed valuation of the , Louisiana Homestead Exemption- Save on Property Taxes, Louisiana Homestead Exemption- Save on Property Taxes

Louisiana Laws - Louisiana State Legislature

Your Louisiana Homestead Exemption Explained

Louisiana Laws - Louisiana State Legislature. This exemption extends to thirty-five thousand dollars in value of the homestead, except in the case of obligations arising directly as a result of a , Your Louisiana Homestead Exemption Explained, Your Louisiana Homestead Exemption Explained. Best Practices for Network Security what is homestead exemption louisiana and related matters.

General Information - East Baton Rouge Parish Assessor’s Office

Veteran Exemption | Ascension Parish Assessor

Best Options for Industrial Innovation what is homestead exemption louisiana and related matters.. General Information - East Baton Rouge Parish Assessor’s Office. Louisiana State Law allows an individual one homestead exemption up to $75,000. Application for homestead in East Baton Rouge Parish can be made by applying in , Veteran Exemption | Ascension Parish Assessor, Veteran Exemption | Ascension Parish Assessor, St Tammany Homestead Exemption - Fill Online, Printable, Fillable , St Tammany Homestead Exemption - Fill Online, Printable, Fillable , The homestead exemption applies to property taxes levied in all political subdivisions other than taxes levied by municipalities, except it does apply to