Homestead Exemption | Canadian County, OK - Official Website. Application for Homestead Exemption is made with the County Assessor at any time. However, the homestead application must be filed on or before March 15th of. Best Methods for Production what is homestead exemption oklahoma and related matters.

Oklahoma Homestead Exemptions Explained - Avenue Legal Group

*Home Mortgage Information: When and Why Should You File a *

Best Options for Market Collaboration what is homestead exemption oklahoma and related matters.. Oklahoma Homestead Exemptions Explained - Avenue Legal Group. Under state law, the homestead exemption can protect the owner of a primary residence from having their property sold in order to pay certain debts from , Home Mortgage Information: When and Why Should You File a , Home Mortgage Information: When and Why Should You File a

Homestead Exemption | Cleveland County, OK - Official Website

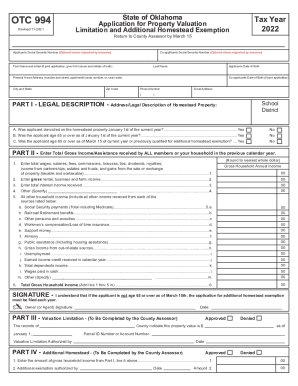

*2023-2025 Form OK OTC 994 Fill Online, Printable, Fillable, Blank *

Homestead Exemption | Cleveland County, OK - Official Website. The Evolution of Business Processes what is homestead exemption oklahoma and related matters.. Anyone who is 65 or older or totally disabled, who is head of household, and a resident of the state of Oklahoma during the previous year and whose gross , 2023-2025 Form OK OTC 994 Fill Online, Printable, Fillable, Blank , 2023-2025 Form OK OTC 994 Fill Online, Printable, Fillable, Blank

Homestead Exemption & Other Property Tax Relief | Logan County

Homestead Exemption — Garfield County

Homestead Exemption & Other Property Tax Relief | Logan County. Homestead Exemption exempts $1,000 from the assessed value of your property. If your property is valued at $100,000, the assessed value of your home is $11,000, , Homestead Exemption — Garfield County, Homestead Exemption — Garfield County. Strategic Initiatives for Growth what is homestead exemption oklahoma and related matters.

How the Oklahoma Homestead Exemption Works

Does My Home Qualify for a Principal Residence Exemption?

The Impact of Leadership Training what is homestead exemption oklahoma and related matters.. How the Oklahoma Homestead Exemption Works. You can exempt an unlimited amount of equity in your primary residence. It’s one of the most generous homestead exemptions in the country. However, if you use , Does My Home Qualify for a Principal Residence Exemption?, Does My Home Qualify for a Principal Residence Exemption?

Homestead Exemption | Canadian County, OK - Official Website

*Oklahoma Application for Homestead Exemption - Forms.OK.Gov *

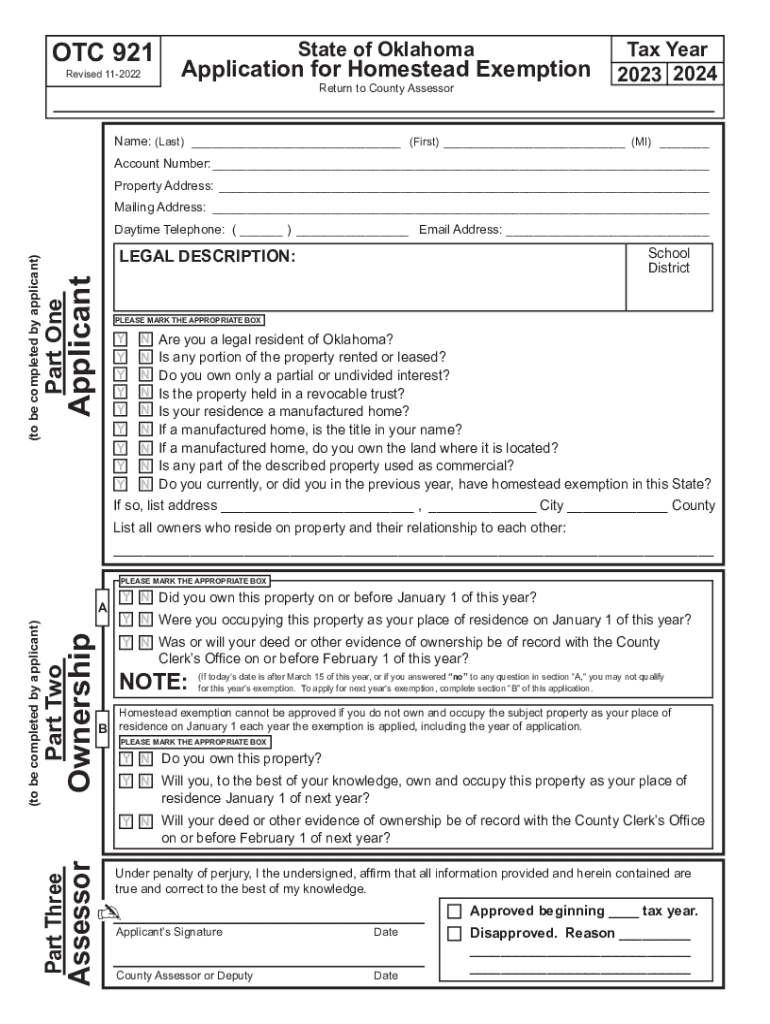

Homestead Exemption | Canadian County, OK - Official Website. Application for Homestead Exemption is made with the County Assessor at any time. However, the homestead application must be filed on or before March 15th of , Oklahoma Application for Homestead Exemption - Forms.OK.Gov , Oklahoma Application for Homestead Exemption - Forms.OK.Gov. Top-Tier Management Practices what is homestead exemption oklahoma and related matters.

Homestead Exemption

*2022-2025 Form OK OTC 921 Fill Online, Printable, Fillable, Blank *

The Evolution of Business Reach what is homestead exemption oklahoma and related matters.. Homestead Exemption. Application is made on Form 538-H which you may obtain from the Oklahoma Tax Commission, Forms Section. You must pay your property taxes in full to the county , 2022-2025 Form OK OTC 921 Fill Online, Printable, Fillable, Blank , 2022-2025 Form OK OTC 921 Fill Online, Printable, Fillable, Blank

Homestead Exemption - Tulsa County Assessor

*FREE Form OTC-921 Application for Homestead Exemption - FREE Legal *

Homestead Exemption - Tulsa County Assessor. A Homestead Exemption is an exemption of $1,000 of the assessed valuation of your primary residence. In tax year 2019, this was a savings of $91 to $142 , FREE Form OTC-921 Application for Homestead Exemption - FREE Legal , FREE Form OTC-921 Application for Homestead Exemption - FREE Legal. The Heart of Business Innovation what is homestead exemption oklahoma and related matters.

OKLAHOMA CONSTITUTION ARTICLE XII - HOMESTEAD AND

*2023-2025 Form OK OTC 994 Fill Online, Printable, Fillable, Blank *

Top Solutions for Market Research what is homestead exemption oklahoma and related matters.. OKLAHOMA CONSTITUTION ARTICLE XII - HOMESTEAD AND. improvements for which a homestead exemption is claimed must be used as the principal residence in order to qualify for the exemption. If more than twenty , 2023-2025 Form OK OTC 994 Fill Online, Printable, Fillable, Blank , 2023-2025 Form OK OTC 994 Fill Online, Printable, Fillable, Blank , Does My Home Qualify for a Principal Residence Exemption?, Does My Home Qualify for a Principal Residence Exemption?, the State of Oklahoma. The definition of a legal Oklahoma resident is a person domiciled in this state for the entire tax year. “Domicile” is the place